Summary:

- Intel’s H1 performance fell short, declining 27% from projected growth due to weakness in the PC and server markets.

- The CCG segment showed better growth than expected, supported by a recovery in the PC market.

- The DCAI and NEX segments underperformed, but there are expectations for a server market recovery in 2024.

Tomohiro Ohsumi/Getty Images News

In our prior analysis, we found Intel Corporation’s (NASDAQ:INTC) H1 performance fell short, declining 27% from our projected growth. The DCAI segment dropped by 28.3%, and Others revenue, particularly NEX, significantly underperformed as weakness in CCG and DCAI was influenced by PC and server market declines in H1 2023 due to economic uncertainty. Despite this, we anticipated improvements in H2, driven by increased consumer confidence and reduced PC market inventory. Intel’s management guidance indicated a better outlook for PC and server markets, as well as positive growth in PSG, IFS, and Mobileye segments in H2. We acknowledged our projections were smoothed and anticipate a more moderate decline in H1, aligning with the company’s expected growth in H2.

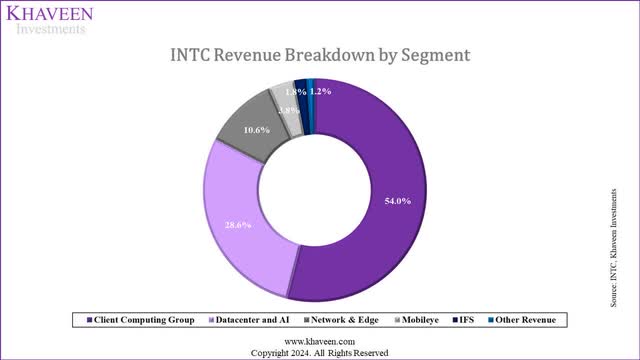

In this analysis, we covered the company again following the earnings release of its full-year 2023 results, which were in line with our expectations for overall revenue growth (-14%) as its performance improved throughout H2 2023 as we had anticipated. We determined whether Intel’s growth could continue to recover. Firstly, we examined its segment performance breakdown and updated our outlook of its key segments including CCG, DCAI, NEX and Others.

Company Data, Khaveen Investments

| Intel Revenue ($ bln) | 2020 | 2021 | 2022 | 2023 | Average | Our Previous 2023F |

| Client Computing Group | 40.535 | 41.067 | 31.708 | 29.258 | 23.47 | |

| Growth % | 6.8% | 1.3% | -22.8% | -7.7% | -5.6% | -26.0% |

| Datacenter and AI | 23.413 | 22.691 | 19.196 | 15.521 | 16.77 | |

| Growth % | 7.9% | -3.1% | -15.4% | -19.1% | -7.4% | -12.6% |

| Network & Edge | 7.132 | 7.976 | 8.873 | 5.774 | 9.58 | |

| Growth % | 4.4% | 11.8% | 11.2% | -34.9% | -1.9% | 8.0% |

| Mobileye | 0.967 | 1.386 | 1.869 | 2.079 | 2.45 | |

| Growth % | 10.0% | 43.3% | 34.8% | 11.2% | 24.9% | 31.3% |

| IFS | 0.715 | 0.786 | 0.895 | 0.952 | 1.00 | |

| Growth % | 55.1% | 9.9% | 13.9% | 6.4% | 21.3% | 11.9% |

| Others | 5.091 | 5.019 | 0.196 | 0.644 | 0.196 | |

| Growth % | 22.7% | -1.4% | -96.1% | 228.6% | 38.4% | 0.0% |

| Total | 77.87 | 79.02 | 63.05 | 54.23 | 53.92 | |

| Growth % | 8.2% | 1.5% | -20.2% | -14.0% | -6.1% | -14.5% |

Source: Company Data, Khaveen Investments

Intel’s full-year revenue growth in 2024 came within our expectations with a full-year decline of 14%, in line with our projections of a -14.5% growth. In 2024, we previously forecasted the company’s growth to continue a strong recovery with 20% growth. Though, management guidance for Q1 2023 has been disappointing, with a YoY growth guidance of 8% for Q1 2024. Thus, we further examine and update our outlook on Intel’s growth outlook in 2024 and beyond.

In terms of segment performance, the main difference in our projection is its CCG, DCAI and NEX segments. Its CCG segment growth was better than we forecasted (-7.7% vs -26%) while its DCAI and NEX were below our forecasts. Thus, we focused on these segments below.

CCG Growth Supported by PC Recovery

In 2024, Intel’s CCG segment declined by 7.7% but is better compared to its performance in 2022 which declined by 22%, as well as outperforming our previous forecasts for 2023. We examined the segment’s shipment and ASP growth in comparison with our past forecasts.

| CCG Segment | Desktop (Actual 2023) | Desktop (Forecast 2023) | Desktop (Actual H2 2023) | Desktop (Forecast H2 2023) | Laptop (Actual 2023) | Laptop (Forecast 2023) | Laptop (Actual H2 2023) | Laptop (Forecast H2 2023) |

| Shipments | -9% | -10.80% | 33.9% | 30.3% | -5% | -10.80% | 15.0% | 3.4% |

| ASP | 5% | -20.00% | -11.8% | -61.8% | -5% | -20.00% | 3.6% | -26.4% |

| Revenue Growth % | -4.60% | -28.60% | 4.6% | -43.4% | -9.50% | -28.60% | 12.8% | -25.4% |

| PC Market Shipments | -13.90% | -11.70% | -5.9% | -1.5% | -13.90% | -11.70% | -5.9% | -1.5% |

Source: Company Data, IDC, Khaveen Investments

Based on the table above of Intel’s CCG segment by Desktop and Laptop categories, its actual revenue growth in 2023 for both Desktop (-4.6%) and Laptop (-.9.5%) was better with a smaller decline than our previous 2023 forecasts (-28.6%). This is due to the company’s H2 2023 actual revenue growth performing much better than we had expected for both Desktop (4.6%) and Laptop (12.8%) in comparison with our forecasted declines (-43.4% for Desktop and -25.4% for Laptop). Its revenue growth recovered in H2 2023, buoyed by a recovery in shipment growth, which was fairly in line with our forecasts for Desktop but slightly below our forecasts for Laptop. The main difference was caused by ASP. Its ASP for Desktop declined by 11.8% but lower than our expectations (-61.8%) whereas its Laptop ASP growth was positive (3.6%) in H2 2023 compared to an expected decline (-26.4%).

Its H2 recovery for Desktop and Laptop was above our expectations for overall revenue growth. This is mainly due to its ASP not declining as much as we anticipated for Desktop and Laptop. As analyzed previously, we expected the company’s ASPs to decline based on reported price cuts by Intel by up to 20%. However, based on its annual report, which attributed its ASP change to a change in product mix, we believe this indicates the price cuts did not materialize. In our previous comparison analysis of Intel’s average CPU value (performance per price), we highlighted its superior value for its Alder Lake gen compared to AMD, thus we believe there was a lower incentive for Intel to cut prices due to its already stronger value competitiveness.

We forecast Intel’s CCG revenue based on shipments and pricing. Shipment projections are based on our proprietary PC/internet penetration model adjusted for our estimated absorption of excess shipments due to the pandemic, factoring in our factor competitive score for Intel. As mentioned, we had forecasted ASP growth in 2023 for both Desktop and Laptop on a conservative decline of 20% based on reported price cuts by Intel, which did not materialize. For 2024 on the other hand, we had based ASP growth on our analysis of its past 5 generation average pricing of 8.2%.

| Intel CCG ASP Growth | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | Average |

| Laptop ASP | -7.0% | 2.0% | 2.0% | 2.0% | 3.0% | 5.0% | -6.0% | 6.0% | 15.0% | -5.0% | 1.7% |

| Desktop ASP | 0.0% | 6.0% | 2.0% | 0.0% | 11.0% | 3.0% | 2.0% | 3.0% | 5.0% | 5.0% | 3.7% |

Source: Company Data, Khaveen Investments

We compiled CCG’s ASP growth in the table above in the past 10 years. Laptop ASP growth averaged 1.7% while Desktop ASP averaged 3.7%. In comparison, our previous analysis of the ASP growth of each next-generation CPU is higher at 8.2% on average. The difference in the ASP growth could be due to the effect of product mix, as customers may continue to purchase older generation products instead of switching to the new product generations, thus leading to the actual ASP growth below the average pricing growth of the past 5 generations. Furthermore, had we used Intel’s past 10-year average instead of the reported price cuts in 2023, our forecasts would have been more in line with the actual growth for Desktop (-7.4% vs -4.6%) and Laptop (-9.2% vs -7.4%). Given the historical ASP growth was more in line with the actual ASP growth in 2023, therefore, we believe that basing our assumption for its ASP growth going forward through 2027 on its historical average for both Laptop and Desktop is more appropriate.

Additionally, in terms of shipment growth, we updated our proprietary PC/internet penetration model adjusted for estimated absorption of excess shipments with full-year 2023 figures and derived our forecast growth rate of 11.5% in 2024 as we see the cumulative excess shipments of 28.3 mln remaining fully absorbed this year, pointing towards a recovery to our long-term projections. In comparison, Intel’s management guided their growth forecast for the PC market to be low-single digits. According to IDC, the PC market is forecasted to grow by 3.4% in 2024, in line with Intel’s guidance where it expects “low single digits year-on-year in 2024”.

However, we previously analyzed that IDC’s previous forecast in 2022 was off the mark significantly (2.4% vs -16.1% actual) whereas our backtested model was more in line with a smaller difference of 5%. Therefore, we continue to base our PC market shipment growth on our model and derive our projections for Intel’s shipment growth based on the same factor score of 1.08x from our previous analysis.

| Intel Desktop CCG Segment | 2023 | 2024F | 2025F | 2026F |

| Market Shipment Growth | -13.9% | 11.5% | 12.4% | 2.1% |

| Intel’s Share of Growth | 1.54 | 1.08 | 1.08 | 1.08 |

| Desktop Volume Growth | -9.0% | 12.4% | 13.5% | 2.2% |

| Desktop ASP Growth | 5.0% | 3.7% | 3.7% | 3.7% |

| Revenues ($ mln) | 10,166 | 11,850 | 13,943 | 14,781 |

| Growth % | -4.6% | 16.6% | 17.7% | 6.0% |

| Intel Laptop CCG Segment | 2023 | 2024F | 2025F | 2026F |

| Market Shipment Growth | -13.9% | 11.5% | 12.4% | 2.1% |

| Intel’s Share of Growth | 2.78 | 1.08 | 1.08 | 1.08 |

| Laptop Volume Growth | -5.0% | 12.4% | 13.5% | 2.2% |

| ASP Growth | -5.0% | 1.7% | 1.7% | 1.7% |

| Revenues ($ mln) | 16,990 | 19,423 | 22,413 | 23,301 |

| Growth % | -9.5% | 14.3% | 15.4% | 4.0% |

Source: Company Data, Khaveen Investments

Overall, we expect the CCG segment desktop and laptop revenue to rebound in 2024 supported by shipment growth mainly due to an expected recovery in the PC market which we forecast to rise by 11.5% in 2024 as we estimate excess shipments due to the pandemic boom to be fully absorbed and the market to recover towards its long-term shipment growth. Furthermore, given the expected launch of Intel’s upcoming next-gen Arrow Lake PC CPUs in 2024 with a more advanced 2nm process node, we expect this could bode well for its ASP growth as well, supporting its revenue growth.

DCAI To Benefit from Server Recovery

Furthermore, the company’s DCAI segment revenue growth underperformed our forecasts with a decline of 19% vs our previous -12.6% projection in 2023. We analyzed its shipments and ASP growth below.

| DCAI Segment | Actual 2023 | Forecast 2023 | Actual H2 2023 | Forecast H2 2023 |

| Shipments | -37% | 0.90% | -35.3% | 40.5% |

| ASP | 20% | -20% | 19.8% | -60.2% |

| Revenue Growth % | -19% | -12.60% | -9.7% | 3.1% |

| Server Market Shipments | -19% | 1.30% | -15.6% | 24.0% |

Source: Company Data, Omdia, Khaveen Investments

Based on the table above, its actual revenue growth for the full year was lower than our forecast (-19% vs -12.6%) due to its underperformance in H2 2023 with revenue growth of -9.7% compared to our previously expected recovery of 3.1%. The main reason for the difference in revenue growth compared to our expectations was due to contrasting ASP performance, with its H2 2023 ASP growth positive at 19.8% compared to our expectation of a -60% decline. Furthermore, while we expected a 40.5% growth recovery in shipment growth, its actual shipment growth in H2 2023 was -35.3%. Therefore, its full-year 2023 shipment growth was negative at -37% vs our expectations of 0.9%, weighing down its full-year revenue growth.

Thus, the company’s H2 2023 performance was below our expectations of recovery mainly due to weakness in shipment growth as the server market continued to decline by 15.6%, leading to a full-year estimated decline of 19% by Omdia. Previously, we expected top cloud service providers including AWS, Microsoft and Google to increase capex for scale infrastructure for their AI services which did materialize as H2 2023 total capex of these companies rose 9%. Despite that, the server market declined in H2 2023. We believe this could be due to weaker enterprise demand. According to Gartner, the IT spending on Devices (including servers) was initially forecasted to decline by only 4.6% in 2023 (April 2023) but Gartner had lowered its forecasts for IT spending on Devices to -10% for the full year in October 2023, indicating a deterioration in enterprise demand in H2 2023.

In terms of ASP, we also previously based it on the reported price cuts of Intel processors by 20% which did not materialize. Instead, the company highlighted its ASP grew due to a better product mix of “high core count products” as Intel released its next-gen Emerald Rapids Xeon CPUs in Aug 2023 which have higher core counts (up to 64 vs 60) than its previous gen. For example, the 60-core 8490H 5th Gen Xeon CPU is 124% more expensive than the 60-core 8581V 4th Gen Xeon CPU.

Previously, we derived our shipment forecast based on the server market forecast CAGR of 1.3%. Furthermore, we accounted for a factor score of 0.72x based on our previous performance-to-pricing analysis of its server CPUs, where it is disadvantaged compared to AMD. In 2024 and beyond, we had previously based the ASP forecast on our previous analysis of its past 4 server CPU generations average pricing growth of 5.6%.

| Server | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | Average |

| ASP | 10.0% | 3.0% | -1.0% | 4.0% | 7.0% | 5.0% | -3.0% | 2.0% | -5.0% | 20.0% | 4.2% |

Source: Company Data, Khaveen Investments

We compiled the company’s DCAI ASP growth in the past 10 years from its annual reports. As seen, it has an average of 4.2%. In 2023, its ASP growth was the highest in the past 10 years at 20%. Therefore, had we used its past pricing growth in our forecast, it would have been closer to the actual revenue growth in 2023 but not fully in line with the actual 20% growth. As such, we now base our assumption for DCAI ASP growth on its past 10-year average. Also, we based it on the past 10-year average instead of the past 5 generations’ pricing growth as explained above customers may continue to purchase older generation server CPUs affecting the product mix which is not accounted for based on only the past 5 generations pricing change as explained above.

| Intel DCAI Segment | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | Average |

| Server Market Shipment Growth | -7.1% | 5.4% | -1.5% | 6.8% | 15.4% | 0.0% | 3.6% | 11.4% | 5.1% | -19.0% | 2% |

| Intel Shipment Growth | 8.0% | 8.0% | 8.0% | 5.0% | 13.0% | -3.0% | 11.0% | 2.0% | -16.0% | -37.0% | -0.1% |

| ASP Growth | 10.0% | 3.0% | -1.0% | 4.0% | 7.0% | 5.0% | -3.0% | 2.0% | -5.0% | 20.0% | 4.2% |

| Revenue Growth | 19.1% | 11.1% | 7.0% | 9.7% | 21.3% | 1.4% | 9.2% | -3.1% | -20.2% | -24.4% | 3.1% |

| Cloud Market Growth | 46.2% | 47.4% | 50.0% | 52.4% | 45.3% | 48.4% | 39.1% | 34.9% | 37.5% | 27.5% | 42.9% |

Source: Company Data, Synergy Research, Khaveen Investments

Furthermore, we compared the company’s DCAI segment with the cloud market growth above. As seen, the cloud market growth had been significantly higher with above 40% average growth compared to its DCAI segment growth. The company’s average shipment growth was flattish (-0.1%) and more in line with the server market growth (2%) compared to the cloud market. Thus, we continue to forecast the DCAI segment growth based on shipment and ASP growth. For the server market shipment growth, we based it on the past 10-year average growth of 2%. This as the IT spending by enterprises for devices (including servers) is projected by Garner to rebound in 2024 at 4.8%. Additionally, we continued to use the same factor score of 0.72x to project Intel’s shipment growth.

| Intel DCAI Server Revenue Projections ($ mln) | 2024F | 2025F | 2026F |

| Server Market Shipment Growth | 2.0% | 2.0% | 2.0% |

| Intel’s Share of Growth | 0.72 | 0.72 | 0.72 |

| Volume Growth | 1.4% | 1.4% | 1.4% |

| ASP Growth | 4.2% | 4.2% | 4.2% |

| Revenues Growth | 12,499 | 13,211 | 13,963 |

| Growth % | 5.7% | 5.7% | 5.7% |

Source: Company Data, Khaveen Investments

Overall, we forecasted its DCAI server revenue growth at 5.7% in 2024 and beyond, recovering from its decline in 2023, which management expects to continue in Q1 2024. This is as we see the company benefitting from the server market which we expect could improve in 2024 to its historical average growth of 2% as IT spending by enterprises for Devices is expected to rebound to a positive growth of 4.6% in 2024 according to Gartner. Additionally, we believe the top cloud service providers to continue increasing capex for data centers to scale their AI investments. Our forecast is in line with management’s full-year outlook for the segment, where Intel sees its data center revenue “improving through the year” and “growth in CPU computer cores to return to more normal historical rates”. That said, we still expect the company to face tough competition from AMD (AMD) in server CPUs, which is also anticipated to release its next-gen Zen-4 architecture chips in 2024. That said, Intel is also expected to continue expanding its 5th gen Sierra Forest CPU product line in H1 2024, which could bode well for ASP growth.

Other Segments Growth Outlook

Finally, besides CCG and DCAI, we compiled the rest of Intel’s segments below, including Network & Edge (NEX), Mobileye and IFS.

| Intel Segment Revenue ($ bln) | 2020 | 2021 | 2022 | 2023 | Average |

| Network & Edge (NEX) | 7.132 | 7.976 | 8.873 | 5.774 | |

| Growth % | 4.4% | 11.8% | 11.2% | -34.9% | -1.9% |

| Mobileye | 0.967 | 1.386 | 1.869 | 2.079 | |

| Growth % | 10.0% | 43.3% | 34.8% | 11.2% | 24.9% |

| IFS | 0.715 | 0.786 | 0.895 | 0.952 | |

| Growth % | 55.1% | 9.9% | 13.9% | 6.4% | 21.3% |

| Other Revenue | 5.091 | 5.019 | 0.196 | 0.644 | |

| Total Others | 13.91 | 15.17 | 11.83 | 9.45 | |

| Growth % | 12.9% | 9.1% | -22.0% | -20.1% | -5.0% |

Source: Company Data, Khaveen Investments

Based on the table above, the NEX segment represents the largest segment, followed by Mobileye and IFS. We examined the NEX, Mobileye and IFS businesses further below.

NEX

The company’s NEX segment, which includes its processors for network and edge customers, declined significantly by 35%, compared to our forecast of positive growth of 8%. Previously, we forecasted its segment based on its product breakdown which includes Intel Xeon, Core and Atom processors (IOTG), ethernet, silicon photonics and other NEX.

We analyzed the NEX segment in terms of shipment and ASP growth below. We based the shipment growth on its DCAI segment’s actual server shipment growth, as the company does not disclose shipment growth for NEX. We believe the DCAI segment shipments are a suitable proxy, as it serves a common customer base of cloud and server makers as well as telecom network infrastructure providers including “Ericsson (ERIC), Nokia (NOK), Cisco (CSCO), Dell Technologies (DELL), HPE (HPE), Lenovo (OTCPK:LNVGY), Amazon (AMZN), Google (GOOG), and Microsoft (MSFT)”. Furthermore, NEX segment products also serve the server end market as mentioned in its annual report. We then derived its ASP growth based on its revenue and shipment growth.

| NEX Segment ($ mln) | 2020 | 2021 | 2022 | 2023 | Average |

| Shipments Growth | 11.0% | 2.0% | -16.0% | -37.0% | -10.0% |

| ASP Growth | -5.9% | 9.6% | 32.4% | 3.3% | 9.9% |

| NEX Revenue | 7,132 | 7,976 | 8,873 | 5,774 | |

| Growth % | 4.4% | 11.8% | 11.2% | -34.9% | 0.9% |

Source: Company Data, Khaveen Investments

Based on the table above, the shipment growth averaged -10% in the past 4 years. On the other hand, we calculated its ASP growth averaged 9.9% during the period. In 2023, Intel’s annual report highlighted that its customers adjusted their orders to cut their inventories, affecting shipment growth. In Q2 2023, Intel highlighted that NEX was impacted by “sluggish China recovery” and “telcos have delayed infrastructure investments due to macro uncertainty”. According to ResearchAndMarkets, the global telecom capex is forecasted to decline by 7% in 2023, indicating lower telecom equipment spending and affecting Intel’s customers such as Network infrastructure suppliers Ericsson and Nokia. Moreover, China Mobile’s (China’s telecom market leader) annualized Q1 to Q3 2023 capex spending declined by 18% YoY, following a decline of 11% in 2022.

On the other hand, its ASP growth was positive at 3.3% in 2023, below its average of 9.9%. However, in 2022, its ASP growth increased significantly. According to its annual report, one factor for its revenue growth was “driven by higher Ethernet ASPs”, which we believe contributed to its ASP growth. In our previous analysis, we analyzed the average ASP growth of its past 3 Ethernet generations at an average of 45%.

| NEX Revenue Projections ($ mln) | 2023 | 2024F | 2025F | 2026F |

| Shipments Growth | -37.0% | 2.0% | 2.0% | 2.0% |

| ASP Growth | 3.3% | 9.9% | 9.9% | 9.9% |

| NEX Revenue | 5,774 | 6,471 | 7,252 | 8,127 |

| Growth % | -34.9% | 12.1% | 12.1% | 12.1% |

Source: Company Data, Khaveen Investments

We updated our revenue projections for the NEX segment based on shipment and ASP growth above. For shipment growth, we based this on the past 10-year average server market shipment growth of 2%. Moreover, we based its ASP growth on our calculated average ASP growth of 9.9%. In total, we forecast its growth to recover to 12.1% in 2024.

Furthermore, a recovery in 2024 is in line with Intel’s expectations, as Intel guided in its latest briefing that its outlook for the NEX segment could recover with positive growth in all quarters throughout 2024. However, despite that, the company’s management anticipated the telecom market segment “to remain weak through the year” in its latest earnings. Therefore, we believe the shipment growth of 2% is conservative as the overall NEX business outlook apart from its telecom market segment is guided to grow positively.

Mobileye

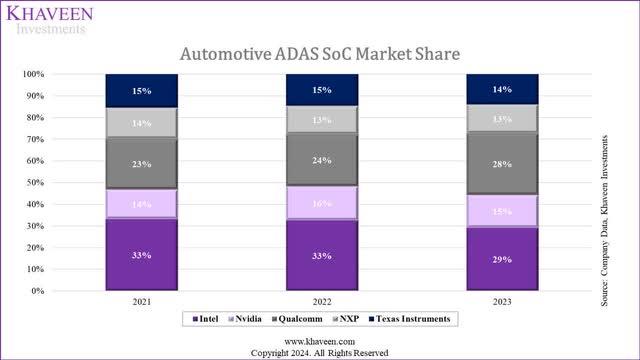

For its Mobileye segment, the company’s growth was below our forecast of 31.3% previously with its actual growth at 11.2%, which is below its average growth of 24.9%. Previously, we forecasted its growth based on the growth in the AV market, as covered in our analysis of Mobileye. We examined the company’s market share compared to key competitors such as Nvidia (NVDA), Qualcomm (QCOM), NXP (NXPI) and Texas Instruments (TXN) below.

Company Data, Khaveen Investments

Based on the chart of the market share of ADAS SoC revenue, Intel’s market share had contracted in 2023 to 29% compared to 33% in the previous year as Qualcomm gained market share while TI and Nvidia’s share decreased slightly by 1% whereas NXP’s share remained stable. In our previous analysis, we highlighted that Qualcomm’s roadmap indicates a performance advantage over Mobileye with a max TOPS of 700+, the highest among competitors.

According to Intel, the Mobileye business was impacted by customer inventory corrections in 2023 and is guided to continue in 2024. Notwithstanding, the company highlighted that its design win pipeline has reached $7 bln, 3.5x higher than 2023 Mobileye revenue.

| Intel Mobileye ($ bln) | 2020 | 2021 | 2022 | 2023 | 2024F | 2025F | 2026F |

| Mobileye Revenue | 0.967 | 1.386 | 1.869 | 2.079 | 2.596 | 3.241 | 4.047 |

| Growth % | 10.0% | 43.3% | 34.8% | 11.2% | 24.9% | 24.9% | 24.9% |

Source: Company Data, Khaveen Investments

Therefore, we forecast the company’s Mobileye revenue growth based on its historical average in the past 4-years at 24.9% which is below our derived AV market CAGR of 31% previously as we expect the company to continue facing challenges based on its guidance and also increasing competitive threats from Qualcomm and Nvidia. Moreover, Qualcomm has recently released its new Snapdragon Ride Flex which has integrations with its software stack Snapdragon Ride Vision stack.

IFS

Finally, in terms of Intel IFS, the smallest segment (10% of Others revenue), its revenue grew by 6.4% in 2023 which is slightly below our forecast of 11.9% which we previously forecasted by projecting the increase of its capacity based on our capex growth assumption.

According to TrendForce, Intel’s market share in Q3 2023 in the foundry only stood at 1%, a minor share in comparison to its competitors such as TSMC (TSM) which continues to dominate the market with a 57.9% market share, followed by Samsung (OTCPK:SSNLF) with a 12.4% share. Nonetheless, the company has aggressively expanded its foundry business over the past year. For example, it has entered into a partnership with UMC (UMC) to collaborate on mature process manufacturing, leveraging Intel’s capacity in the US and UMC’s expertise to serve customers. Furthermore, the company highlighted its ongoing expansion in New Mexico providing advanced packaging solutions as well as its pipeline more than doubling to $10 bln. Assuming a period of 10 years, this translates to over $1 bln per year in revenue.

| Intel IFS ($ bln) | 2021 | 2022 | 2023 | 2024F | 2025F | 2026F | Average |

| IFS Revenue | 0.786 | 0.895 | 0.952 | 1.048 | 1.153 | 1.269 | |

| Growth % | 9.9% | 13.9% | 6.4% | 10.1% | 10.1% | 10.1% | 10.1%. |

Source: Khaveen Investments

We forecasted its IFS segment based on its past 4-year average revenue growth of 10.1%. We believe the company’s deal pipeline that exceeds $10 bln supports its foundry growth in 2024 with a forecast of $1.048 bln.

Outlook

| Intel Revenue Projections ($ bln) | 2023 | 2024F | 2025F | 2026F |

| Network & Edge (NEX) | 5.8 | 6.5 | 7.3 | 8.1 |

| Mobileye | 2.1 | 2.6 | 3.2 | 4.0 |

| IFS | 1.0 | 1.0 | 1.2 | 1.3 |

| Other Revenue | 0.6 | 0.6 | 0.6 | 0.6 |

| Total Others | 9.45 | 10.76 | 12.29 | 14.09 |

| Growth % | -20.1% | 13.9% | 14.2% | 14.6% |

Source: Khaveen Investments

Overall, we expect Intel’s NEX, Mobileye and IFS segment revenue to also recover as a whole in 2024, with growth driven by its NEX and Mobileye segments which are its larger segments. For NEX, we see its growth recovering benefiting from the server market as we explained above as well as new Ethernet products such as E810 which could support continued ASP growth. For Mobileye, while we see the company capitalizing on the AV growth opportunity with a pipeline of $7 bln, we expect it to face tough competition from Qualcomm and Nvidia with a performance advantage over Mobileye, thus growing below the market CAGR (31%). Despite the positive outlook in its IFS segment, supported by its partnership with UMC as well as ongoing capacity expansions in New Mexico and Ohio, coupled with its pipeline that more than doubled to $10 bln, we see the segment still being only a minor portion of the company’s revenue (1.7% of total company revenue) by 2026.

Valuation

| Intel Revenue Projection ($ bln) | 2023 | 2024F | 2025F | 2026F |

| Client Computing Group | 29.26 | 33.69 | 39.17 | 41.03 |

| Growth % | -7.7% | 15.2% | 16.3% | 4.7% |

| Datacenter and AI | 15.52 | 16.76 | 18.12 | 19.62 |

| Growth % | -19.1% | 8.0% | 8.1% | 8.3% |

| Network & Edge | 5.77 | 6.47 | 7.25 | 8.13 |

| Growth % | -34.9% | 12.1% | 12.1% | 12.1% |

| Mobileye | 2.08 | 2.60 | 3.24 | 4.05 |

| Growth % | 11.2% | 24.9% | 24.9% | 24.9% |

| IFS | 0.95 | 1.05 | 1.15 | 1.27 |

| Growth % | 6.4% | 10.1% | 10.1% | 10.1% |

| Other Revenue | 0.64 | 0.64 | 0.64 | 0.64 |

| Total | 54.23 | 61.21 | 69.58 | 74.74 |

| Growth % | -14.0% | 12.9% | 13.7% | 7.4% |

Source: Khaveen Investments

Overall, we updated our revenue projections based on our analysis of its CCG, DCAI (including platform and adjacencies revenue) and Others (NEX, Mobileye and IFS) segments. We expect the company’s revenue growth is well positioned to recover in 2024 with a growth of 12.8%, though lower than our previous analysis (20%), as we see certain segments such as DCAI, NEX and Mobileye facing some market weakness challenges.

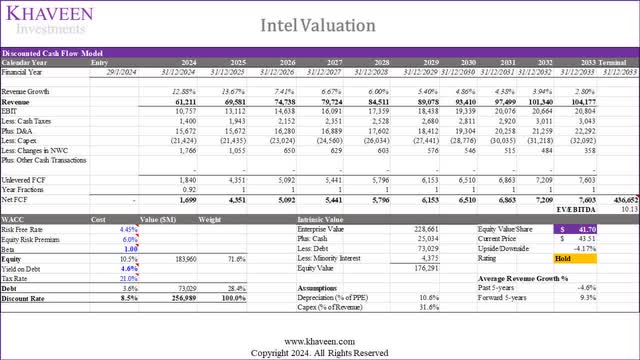

Khaveen Investments

Based on our updated DCF model, we obtained an upside of -4% with a discount rate of 8.5% (company’s WACC) and an average 5-year company EV/EBITDA of 10.13x, which is much lower than the industry average (22x). We believe this lower EV/EBITDA is more appropriate, as we believe it reflects the company’s poor revenue growth over the past 5 years. Moreover, the company’s profitability margins had deteriorated in the past 2 years, with a net margin of 3% in 2023 as its revenues slumped. We modeled its margins to gradually recover through 2025 (20.6%), leading to our higher FCF forecasts in 2025.

Verdict

In summary, we anticipate a rebound in the desktop and laptop revenue of the CCG segment in 2024. This is driven by an expected 11.5% growth in the PC market, absorbing excess shipments from the pandemic boom. We also see the launch of Intel’s Arrow Lake PC CPUs with a more advanced 2nm process node to contribute to ASP growth. Similarly, we project a 5.7% growth in server revenue for 2024 and beyond, recovering from the decline in 2023, with a positive IT spending trend in 2024 supporting our view for a server market recovery benefiting Intel. Additionally, we believe top cloud service providers will continue increasing data center capex for AI expansion. Despite tough competition from AMD, we believe Intel’s expansion of the Sierra Forest CPU product line to contribute to ASP growth upside.

Furthermore, we expect Intel’s NEX, Mobileye, and IFS segment revenue to recover in 2024. The NEX segment is anticipated to benefit from end-market recovery and the launch of new Ethernet products, while Mobileye could continue benefiting from ADAS growth drivers despite facing strong competition from Qualcomm and NVidia. Finally, ongoing capacity expansions and partnerships could support IFS segment growth, though we expect its contributions to remain minor (1.7% of total company revenue) by 2026. In total, we believe Intel is poised to benefit from a recovery year in 2024 with a growth forecast of 12.9% in total. However, our DCF valuation indicates limited upside as its stock has risen by 33% since our previous coverage, thus we downgrade the company as a Hold with a price target of $41.70.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No information in this publication is intended as investment, tax, accounting, or legal advice, or as an offer/solicitation to sell or buy. Material provided in this publication is for educational purposes only and was prepared from sources and data believed to be reliable, but we do not guarantee its accuracy or completeness.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.