Summary:

- Despite Intel’s historical underperformance and management issues, I’m upgrading my rating from hold to buy due to potential positive sentiment changes.

- Intel’s struggles stem from manufacturing challenges, competition, strategic missteps, and poor financial performance, all linked to poor management.

- Pat Gelsinger’s dismissal is a positive step, but Intel needs an outside CEO to reform its corporate culture and drive a sustainable turnaround.

- Intel has significant potential; with the right leadership, it could see improved profitability and a 25-33% stock price increase in the near term.

hapabapa

I’ve been skeptical regarding Intel (NASDAQ:INTC) in prior analyses, and despite the constructive news of Pat Gelsinger’s dismissal, I remain cautious about Intel’s future. Nonetheless, releasing Pat Gelsinger from the CEO spot is a solid step. Therefore, I’m becoming more conservative about Intel’s prospects, changing my hold rating to a buy, as Intel could soon benefit from a positive change in sentiment.

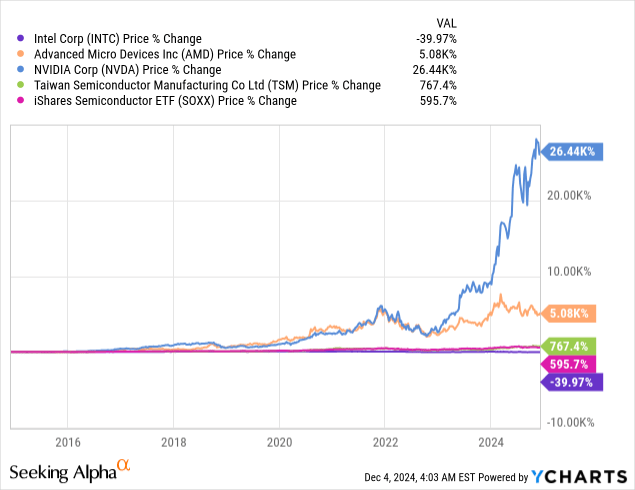

Intel’s stock has been in the dog house for years. While many chip companies like Nvidia (NVDA), AMD (AMD), TSMC (TSM), and other high-quality stocks have appreciated considerably, remarkably, Intel’s stock has declined by around 40% over the last decade. To illustrate how profound Intel’s underperformance has been, the iShares Semiconductor ETF (SOXX) has surged by around 600% in the same time frame.

Intel vs. Competition

So, what has been behind Intel’s massive underperformance?

Manufacturing challenges – not achieving mass production of its 10nm until 2019 (planned for 2016).

Competition pressures – TSMC, Nvidia, AMD, and other competitors have significantly outpaced Intel innovation-wise, taking the initiative and its leadership role away from Intel.

Strategic missteps – Intel missed out on massive opportunities by being stuck in the past. There has been very little forward-looking at Intel, as it missed out on substantial AI opportunities by investing too late or not investing in AI when it was preferable. Intel passed on a $1 billion investment in OpenAI in the late 2010s because the then-CEO didn’t believe the investment would have paid off.

Given that Open AI’s recent valuation was estimated at around $160 billion, the investment would have likely paid off big time for Intel, not only monetarily but also by significantly strengthening Intel’s presence in AI, which is essentially priceless. Intel also greatly underestimated the mobile market, limiting its presence in this profitable, high-growth space.

Poor financial performance – Due to all the mishaps, Intel’s financial performance has struggled for years. Intel’s earnings have essentially evaporated, dropping to just $0.40 in 2023, a decrease of nearly 80% from the previous year.

Disgracefully, Intel suspended its long-standing dividend, and after being a DJIA component for 25 years, it recently got booted from the DOW. This year’s EPS will likely be negative (-$0.15 consensus estimate), and next year, despite the projections for $1 in EPS, if Intel remains the “Old Intel,” its EPS results could be much less.

Fortunately for Intel and its shareholders, the times may finally be changing, and the prospects of a new outside CEO bring the potential for change, improved sentiment, and a higher stock price for Intel as we advance.

Most Of Intel’s Problems Stem From Poor Management

Due to poor leadership, Intel continues to lack a comprehensive global strategy. Management instability, poor corporate culture, and other leadership issues are to blame. The challenges, pressures, missteps, poor performance, etc., can all be traced back to a single common denominator: abysmal management at the top.

Intel has had six different CEOs in the last twenty years. More recently, as the company’s performance has continued to decline, the CEO tenures have become shorter, with the previous three CEOs serving an average of only about three years each.

While there are apparent differences, Intel reminds me of General Electric (GE) about seven years ago. Terrible management blunders, corporate greed, and massive missteps ran down General Electric, causing its stock to crater. I wrote extensively about GE in those days, and it wasn’t until Lawrence Culp (an outside CEO) took over that we began seeing positive and lasting change at GE.

Finally, Gelsinger is Out

Intel is in a similar position to GE in around 2018. It’s excellent that Pat Gelsinger is out because he was not a highly competent CEO (in my opinion). Here are some factors that highlight Mr. Gelsinger’s “leadership” at Intel:

- Unrealized turnaround goals – There was much talk about an ambitious grand turnaround, but few concrete actions equated to minimal turnaround progress for Intel.

- Execution issues – Numerous delays and challenges, leading Intel to fall further behind TSMS, AMD, and Nvidia.

- Financial underperformance – Pat presided over Intel’s worst sales and profitability decline. TTM revenue declined from around $80B when Pat took over in 2021 to only about $54B recently.

- Expensive investments – The company allocated billions to build new factories, boosting manufacturing capacity. Yet, these initiatives were costly and poorly timed in a weakening economy and questionable semiconductor market.

- Numerous leadership missteps – Misjudging market dynamics, implementing unnecessary high-risk strategies like vertical integration chip production, and more.

- Erosion of investor confidence – Poor stock performance, boardroom discontent, dividend suspension, exclusion from the DOW, and other factors have caused sentiment to decline considerably surrounding Intel.

- Organizational problems – A high turnover rate in key leadership positions, cultural resistance to Gelsinger’s proposed reforms, and other issues continue to plague Intel internally.

- Competitive issues – Missed opportunities in AI and continued slack in AI, GPU, and CPU markets highlight Mr. Gelsinger’s lack of leadership at Intel.

Only An Outsider Can Save Intel Now

Intel badly needs an outside CEO to reform the company’s archaic corporate culture, or we may never see a sustainable turnaround at Intel. Intel’s overly cautious, risk-averse culture hinders innovation and timely decision-making. This approach has contributed to Intel’s lag in adopting emerging technologies, such as artificial intelligence, allowing competitors to gain a technological advantage.

Like GE in its troubled time, Intel’s corporate structure has been criticized for being overly bureaucratic, leading to slow responses to changing market dynamics and internal inefficiencies. Leadership instability, ethical concerns, and other factors continue to plague the company from within, illustrating the need for an outside CEO and “radical change” at Intel.

Some analysts agree that an outside CEO may be the only answer. A highly capable outside CEO can reform Intel’s corporate culture, enabling it to execute better and compete with its adversaries instead of lagging behind the broader semiconductor space.

Selecting another inside CEO from the pool of candidates at Intel may not achieve the desired results and is unlikely to produce meaningful change at the company. However, I think the era of insider CEOs has passed, and Intel will likely look outside the company to achieve lasting change.

The Bottom Line: Intel Has Potential

In my view, David Zinsner and Michelle Johnston Holthaus (current co-CEOs) are not the right candidates for the top position at Intel. It’s better to go with Lip-Bu Tan or, better yet, Matthew Murphy, the current CEO of Marvell (MRVL), if he gets the top job at Intel. Despite being a market laggard for years, Intel has considerable potential. While 2026 consensus estimates call for about $1.76 in EPS, Intel could achieve $2-2.50 in a slightly more bullish case scenario.

This dynamic implies that in a favorable scenario, including an outside CEO, Intel could increase sales and substantially improve profitability. In such a case, Intel’s forward P/E ratio may be around ten here, which is relatively cheap considering the earnings growth prospects. Therefore, Intel could begin trading more favorably on the news of a potential for a new CEO, and a near-term price target range may be around $28-30, approximately 25-33% higher from here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return) and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Join The Financial Prophet And Become A Better Investor!

Join The Financial Prophet And Become A Better Investor!

Don’t Hesitate! Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!