Summary:

- Expectations ahead of the Intel Corporation Q1 earnings were so low that it was almost impossible for the company to miss meeting them.

- Management’s words on report and call hinted optimism, sparking the stock’s turnaround.

- The Intel Corporation 2023 outlook isn’t any better; 2024 may be too far ahead to predict yet.

JHVEPhoto/iStock Editorial via Getty Images

Intel Corporation (NASDAQ:INTC) reported its Q1 earnings results last night as Seeking Alpha has covered here. When I read most of the headlines like Intel reporting its largest quarterly loss ever and revenue plummeting 36%, I thought the “Good” section of this report was going to be impossible to fill in. But then, the stock went up about 5% after hours after initially going down 2%. As I am typing this out pre-market on April 28th, 2023, the stock is up more than 6%. Although this could change rapidly, something should be good in the report for this to happen?

Let’s find out in Intel’s edition of Good, Bad, and Ugly.

Good

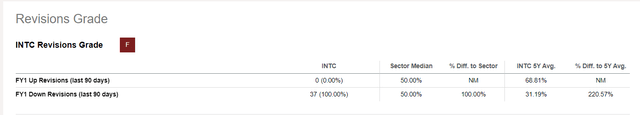

- Tone: That the management had the courage to show up for the conference call. Ha! Just kidding. Not really. Okay, partially. Alright, seriously now. Expectations from Intel were so low heading into this quarter as shown by Seeking Alpha’s earnings revision history below. 37/37 downward revisions conveys the mood ahead of the earnings call. In short, it was good that Intel beat these watered-down expectations on both top and bottom line, as it’d have been horrendous to miss after everyone had thrown in the towel. Management appeared more upbeat than anticipated and that clearly was the reason for the stock’s turnaround after the initial slump.

INTC Revisions (Seekingalpha.com)

- Cost: A dollar saved is worth more than a dollar earned. This applies to both corporations and individuals, thanks to Uncle Sam. This becomes paramount for companies in Intel’s situation, where the company is fighting the not so enviable combination of: (a) revenue decline; (b) cyclical demand; and (c) higher unit costs. Intel reiterated in the earnings report that it is well on its way to saving $3 Billion in 2023 with plans to slash as much as $10 Billion/yr by 2025. We need to take these cost savings with a pinch of salt, though, as they are primarily through layoffs and accounting trickery (within legal limits). For example, with its heavy exposure to manufacturing equipment, Intel can save money on the books by extending the useful time of its machineries. That said, it is still welcome from an investor’s perspective that while the company struggles to bring money in, it is at least mindful of not leaking too much.

- The Magic Words: While PCs were weak as expected, the hope is that the downturn maybe in its last legs. Intel’s report stated PC usage remains strong, despite the expected inventory correction. The earnings call reiterated that Intel in fact gained a bit of PC Client share while PC Server demand was flat. The report also highlights that the Server segment has a big tailwind, the magical two words that everyone seems to love these days: Artificial Intelligence.

Bad

- Revenue: That overall revenue was down shouldn’t surprise anyone but what concerns me is the consistency across the board: Client Computing Group down 38%, Data Center & AI Group down 39%, Network & Edge Group 30% and Intel Foundry Services down 24%. The only segment with revenue growth was, unsurprisingly, Mobileye and that has its own problems to deal with.

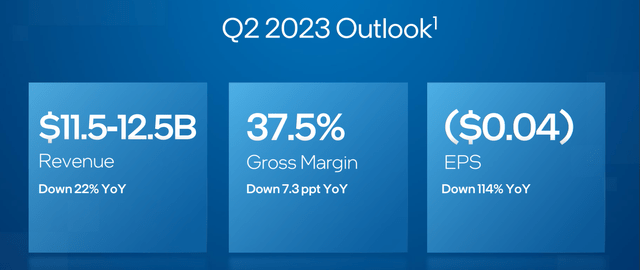

- Outlook: 2023’s outlook isn’t any better, despite optimistic hints from the company. Revenue, margin, and EPS are all expected to be down massively compared to what was already a bad year in 2022.

- Despite the company’s stated goals on cost cutting, inventory build-up was mentioned consistently as a reason for reduced operating income across various segments. This is a sure sign that the company is still adjusting for the previous cycle’s excesses.

Ugly

- Free Cash Flow (“FCF”): Ugh. Intel reported -$8.764 Billion in FCF and that handily beats the worst quarter (-$6.446 Billion June 2022) in the last 5 years by more than 30%. I don’t think there is any need to get deeper with that number, so let’s leave it right there while highlighting the number again. Almost $9 Billion dollars on the wrong side. There is only so far cost-savings will take you.

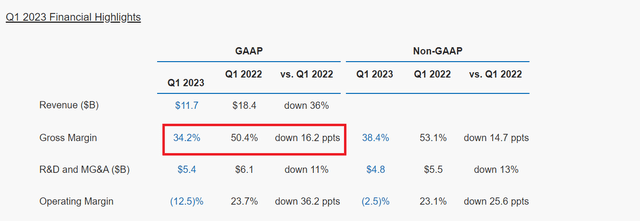

- Margin Erosion: Intel’s gross margin was already looking pale in comparison with peers and this quarter did that reputation no good with the margin going down 16.2 ppts. To conclude the main section of the article on a positive note, it appears like the margins will get better in the second half of the year.

Conclusion

As this headline on Seeking Alpha indicates, hope is likely why Intel’s stock is going up after the Q1 report. Things were looking so bad going into the call. The company not only beat the low estimates but also managed to present a better picture for the future than anticipated. I couldn’t help compare the Intel earnings call with Amazon.com, Inc.’s (AMZN) call. While Amazon blasted past estimates and the stock was trading higher ahead of the call, the management’s tone on the call sent the stock crashing back from post-market highs. Intel had the reverse happen.

I am not saying Intel management should present misleading rosy statements, but Intel’s subtle way of saying things like (I am paraphrasing here) “While PC Server demand was flat, don’t forget the massive AI tailwind” or “While PCs Client weakness continues, don’t forget we are at the end of bad times” helped the market sentiment.

Intel’s stock was already up 12% YTD before the earnings report and if the pre-market gains hold, that is about to become 18% at least. The stock may appear over-valued here based on current EPS (or lack of it), but if 2024 estimates hold and the company delivers, Intel stock is currently trading at a 2024 forward multiple of 16.40.

I am not invested in Intel Corporation stock for many reasons, like holding NVIDIA Corporation (NVDA) and Qualcomm, Inc. (QCOM) when it comes to semiconductors and holding International Business Machines Corporation (IBM) when it comes to betting on a turnaround. That said, if you have the appetite for bumpy rides, Intel Corporation stock does present an interesting case for betting on a veteran to turn things around.

Do you believe this is a case of darkest before dawn or darkest before pitch-black? Please leave your comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, NVDA, QCOM, IBM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.