Summary:

- Intel reports top and bottom line beats for Q1.

- Q2 guidance was a bit mixed.

- Cash flow picture needs to improve quickly.

JHVEPhoto

A couple of weeks ago I detailed how chip giant Intel (NASDAQ:INTC) was looking to redeem itself after a terrible couple of quarters. The company has seen its revenues plunge and cash flow turn negative, with investors continuing to worry about competition in the space. On Thursday, Intel reported its Q1 results, and while there were some nice signs, the overall figures showed that the company isn’t out of the woods just yet.

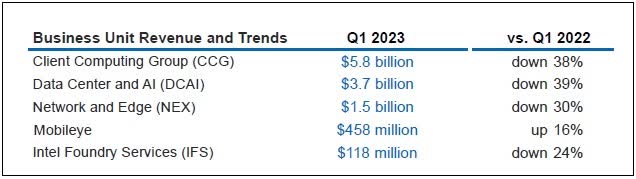

For the first quarter of 2023, Intel reported revenue of more than $11.7 billion. While this number was about $600 million above street estimates, we have to remember that Intel provided horrific guidance a few months back. In last year’s period, Intel reported over $18.3 billion in sales. As the graphic below shows, Mobileye was the only segment reporting a year over year increase, with the two most important divisions showing nearly 40% hits.

Q1 2023 Segment Revenue (Company Earnings Release)

Likewise, Intel reported a bottom line that wasn’t as bad as expected. A non-GAAP loss of 4 cents per share was delivered, beating the street by a dime. At the Q4 report, however, analysts were looking for a 25-cent profit, so expectations did swing wildly negative recently. The beat here was likely a function of the revenue beat flowing down the income statement, plus the company cutting key adjusted operating expenses by 13% year over year. The one area where Intel disappointed here was that non-GAAP gross margins came in at 38.4%, while management called for 39%.

When it came to Q2 guidance, we saw some similar trends. Management has guided to revenues of $11.5 billion to $12.5 billion, which is mostly better than the street at $11.77 billion after heavily reduced expectations. However, guidance calls for a four cent non-GAAP loss here, whereas the street was looking for either flat earnings or maybe a slight profit. The culprit here again seems to be gross margins, expected to be 37.5% on a non-GAAP basis, which is almost another full percentage point sequential decline.

The one area where Intel needs to improve quickly is the cash flow situation. In Q1, adjusted free cash flow was a negative $8.76 billion, which is a substantial number given the total revenue print. Hopefully, this is the worst figure we’ll see here, because the dividend already has been slashed, and we’re seeing a bit of debt taken on here to help with operations in the short term. With the margin picture already looking iffy and debt expenses on the rise, Intel’s profitability picture likely won’t rebound as quickly as it fell. Throw in the elimination of the buyback in recent years, and the earnings per share picture is an extra headwind on top when profitability does resume.

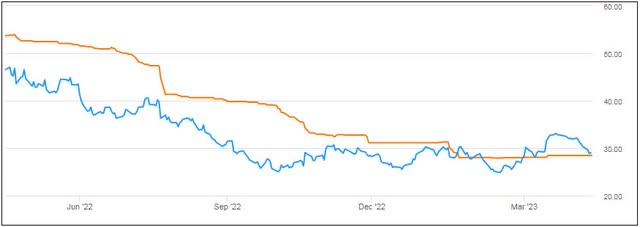

Intel shares ticked up a little in the after-hours session, breaking back above the $30 mark. As the graphic below shows, the stock had recently rallied above its average analyst price target, which at Thursday’s closing price represented about 4.7% of downside. I don’t see the Q1 report significantly changing any analyst opinions in the near term, as there was plenty for both the bulls and bears to like.

INTC Shares Vs. Price Target Average (Seeking Alpha)

In the end, Intel announced a better than feared Q1, but the overall report wasn’t enough to send shares significantly higher like we’ve seen with a number of other tech giants recently. First quarter figures beat heavily-reduced estimates on both the top and bottom lines, but gross margins still were a problem and cash burn was tremendous. Q2 guidance implies a revenue bottom may be in, but the margin picture and adjusted earnings forecast didn’t look great. While the worst of things for Intel might be behind us now, there’s still a lot of work left to do here. As a result, I don’t see significant upside for the stock until we start to see some more meaningful improvement, which hopefully will come later this year and into 2024.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.