Summary:

- For the first time since many quarters, Intel delivered a better than expected earnings report; but to be fair, estimates have provided a very low bar to top.

- Going into Q2, management sees tailwinds from an improving demand backdrop, and suggests that group revenue might have bottomed in Q1.

- Accordingly, with Intel’s fundamentals starting to improve slightly, I am cautiously raising my EPS targets through 2023.

- I continue to assign a ‘Hold/ equal weight’ rating on the backdrop of persisting competitive challenges.

JasonDoiy

Intel (NASDAQ:INTC) reported better than expected Q1 2023 results, beating analyst consensus estimates on both topline and earnings. Moreover, management guidance framed that the cyclical slowdown could be done by early Q3, suggesting that a topline recovery as well as a subsequent margin expansion could be likely in 2H 2023. However, while a cyclical upswing may somewhat restore confidence, it will do little to erase Intel’s structural problems, which anchor on lack of foundry scale and chip technology as compared to industry peers.

With Intel’s fundamentals starting to improve slightly, I am cautiously raising my EPS targets through 2023; but I continue to assign a ‘Hold/ equal weight’ rating.

For reference, Intel stock continues to underperform. For the trailing twelve months, INTC shares are down about 34%, as compared to the S&P 500 (SP500) being approximately flat.

Intel’s Q1 Results

Intel reported better than expected/ feared Q1 2023 results, beating analyst consensus estimates with regard to both revenue and earnings. During the period from January to end of March, Intel generated total revenues of $11.72 billion, versus $18.4 billion for the same period one year earlier (down 36% YoY – hard to believe that this is considered better than expected), topping analyst estimates by about $600 million, according to data collected by Refinitiv. With regard to profitability, Intel reported a 14.7 percentage point contraction in Non-GAAP gross margin, and non-GAAP operating margin fell by 23.1 percentage points, down to -12.5%. First-quarter adjusted net income was $-0.2 billion (-0.04/ share), down about 105% YoY, while analysts had expected a loss of about $300-$400 million (again, hard to believe that this is better than expected)

Notably, all of Intel’s operating segments in Q1 FY 2023 performed below the respective FY 2022 reference (down between 24-39% YoY), except for Mobileye.

Intel’s guidance for Q2 indicates that the company’s financials may have bottomed, and the cyclical headwind, including inventory rebalancing/ destocking may fade. With that frame of reference, investors should consider that Intel heavily relies on the PC and servers segment, cumulatively accounting for approximately 90% of Intel’s revenues. Consequently, a substantial global surge in PC purchases could lead to a significant upward adjustment of Intel’s earnings per share (EPS) estimates.

Intel also mentioned some positive demand trends coming from China. For the March period, management projects potential QoQ topline growth, with revenue in the range of $11.5-$12.5 billion. However, gross margin is estimated to remain depressed, likely falling again, to 37.5% versus 38.4% in Q1. Similar to Q4 2022, Intel management refrained from providing FY 2023 guidance.

Bottoming, But far from Booming

Even though Intel’s short/-midterm economics may start to improve again in Q2, investors should consider that Intel’s long-term fundamentals will likely remain pressured due to challenges relating to the company’s competitive positioning within the chip market. Specifically, I argue that Intel may continue to lose market share to AMD (AMD) and Nvidia (NVDA) in the data center and PC market; while continued competitive pressure from ARM in CPUs, and pressure from Samsung and TSMC in foundry service offering, will add to Intel’s upside limitation.

Now, for Intel to catch up on competition, the company needs to invest enormous sums of CAPEX, as well as R&D. In fact, Jefferies estimates that Intel will likely not generate any positive free cash flow until 2025, a timeline that may stretch investor’s patience–or trust, given that there is no guarantee/ little visibility for significant shareholder distributions even after 2025.

Jefferies

On a more positive note, investors should consider that Intel is the US’ key chip foundry player, and, if Asia tensions continue to increase, the government may provide a supportive tailwind to Intel’s investments and competitive ambitions. With that frame of reference, the ‘Chips and Science Act‘ has already provided attractive support. However, it’s important to consider that an increase in government support in the form of ‘non-economic’ subsidies could also introduce more competition, which could potentially have a negative effect on Intel.

Valuation Update: Raise TP

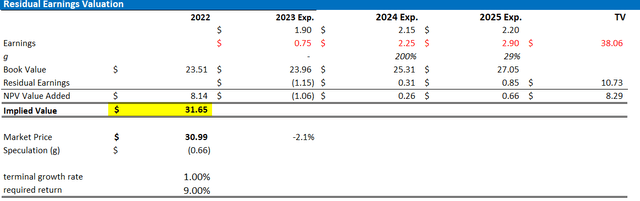

With Intel’s fundamentals starting to improve slightly, I am cautiously raising my EPS targets through 2023: I now estimate that INTC’s EPS in 2023 will likely fall somewhere between $0.5 and $1, while I raise my EPS expectations for 2024 and 2025, to $2.25 and 2.90, respectively.

In addition, I raise the terminal growth rate assumption to 1% terminal growth rate (still seeing Intel as a clear industry underperformer) and I maintain a 9% cost of equity requirement.

Given the EPS updates as highlighted below, I now calculate a fair implied share price for INTC of $31.51 as compared to $26.94 prior.

Author’s Estimates & Calculation

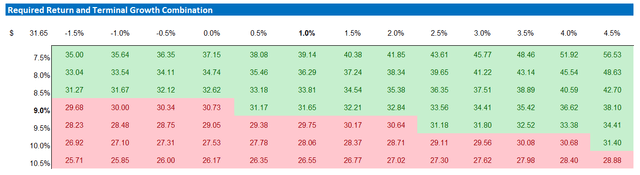

Below is also the updated sensitivity table.

Author’s Estimates & Calculation

Conclusion

For the first time since many quarters, Intel delivered a better than expected earnings report; but to be fair, estimates have provided a very low bar to top. Now, going into Q2, management sees tailwinds from an improving demand backdrop, and indirectly suggests that group revenue might have bottomed in the January quarter. Accordingly, with Intel’s fundamentals starting to improve slightly, I am cautiously raising my EPS targets through 2023; but I continue to assign a ‘Hold/ equal weight’ rating on the backdrop of persisting competitive challenges.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.