Summary:

- Intel is scheduled to release its 2023 Q2 earnings on July 27.

- Implied volatility (“IV”) usually spikes shortly after the earnings release.

- However, its current IV is near the bottom level for options expiring on Aug 18, 2023.

- Such extreme IV creates an attractive setup for investors to buy options cheaply and hedge earnings surprises on July 27.

Leon Neal

Thesis

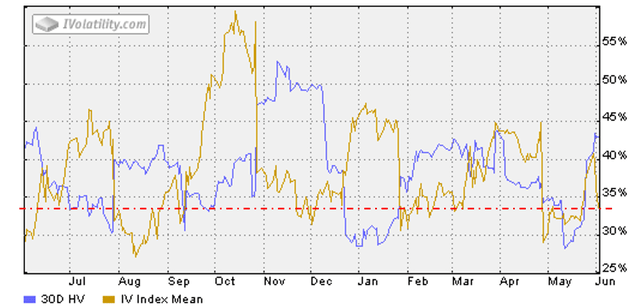

Intel Corporation (NASDAQ:INTC) is scheduled to release its next earnings report (“ER”) on July 27, 2023. The ER will be for its second fiscal quarter of the year. The company faces many uncertainties and challenges in the near term, and many of them have been discussed thoroughly by other SA authors in their ER preview articles. These uncertainties have caused large historical volatilities in its stock prices (see the chart below, blue line). Plus, the implied volatility (“IV”) in the optional market usually would show an extra spike shortly after earnings release as investors price in earnings surprises.

Despite these above factors, INTC’s current IV hovers near the bottom level for options expiring on Aug 18, 2023, as seen in the chart below (yellow line). To wit, the IV for INTC’s put option expires on Aug 18 and currently hovers around 37%. To contextualize such IV, it is among the lowest level observed in the past year. As seen, both its HV and IV have been in the 30% to 50% range most of the time, with a peak value of about 60% and a bottom value of around 30%. Thus, the current IV has not only diverged significantly from its historical average but is also far below its current historical volatility.

And next, I will further analyze the implications of such extreme IV for both short-term traders and long-term investors.

Near-term implications

Depending on the view you want to express (bullish or bearish), such an extremely low IV creates an attractive setup for investors to buy options (either put or call) cheaply and hedge earnings surprises on July 27. Since I hold a bullish view in the long term, I will anchor the rest of the analysis with the analysis of buying a call option expiring on Aug 18. Also, note that options are treated in units of 100 shares. But in the remainder of this article, I will be quoting all the parameters on a per-share basis.

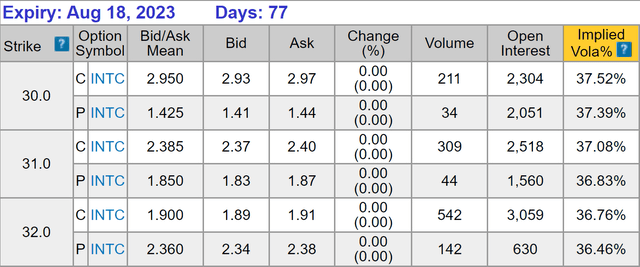

First, let me address the near-term implications of such a low IV. As shown in the following table, an Aug 18 call option with a $32.0 strike price (i.e., a near-the-money option) is currently trading at approximately $1.90. Estimating the true “value” of such a guarantee is a tough topic and has been debated among Nobel-prize level researchers. Regardless of the model you use to price options, thanks to the near-bottom level, the premium is pretty low in my view, only equivalent to about 6% of the $32.0 strike price. And 6% is the maximum of my loss in the case if the stock price ends up lower than $32.0 on Aug 18. In this case, I view it as a cost-effective hedge in the near term.

However, in the case that INTC’s stock price ends up higher than $32 on Aug 18, the call option would allow me to purchase the shares at a price of $32 no matter how high the market price is. In this case, you can choose to be either a short-term or long-term investor. As a short-term investor, your gain/loss would be whatever the option is worth on Aug 18 minus the $1.9 premium you paid upfront.

To be a long-term investor, you could choose to purchase the shares. Your effective purchase price would be ~$33.9 per share (which is obtained by adding the $1.9 premium paid upfront to the $32.0 strike price). And next, I will explain I view $33.9 as an attractive entry price for long-term holding too.

$32.9 is a good entry point for long-term holding

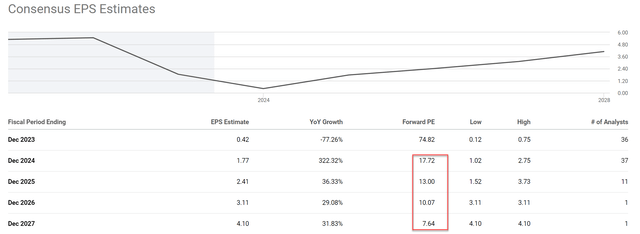

The market has a quite uncertain view for INTC in the next few years – for good reasons. As seen below, the EPS estimate for 2023 sits at $0.42. This represents a 77% YoY decline. However, note the variance of the estimate ($0.12 to $0.75) is almost 7x, which again signals the current low IV represents a mispricing.

For the fiscal period ending Dec 2024 and Dec 2025, the EPS estimates are $1.77 and $2.41, respectively. Such a significant improvement from the previous year suggests that the company is expected to rebound strongly. And with such a rebound, the forward P/E ratio for this period would be only 17.72x and 13.00x, respectively. With the 6% premium we’ve paid to purchase the option, our effective entry P/E would be about 6% higher (i.e., 18.8x for FY 2024 and 13.8x for FY 2025).

For readers familiar with our framework of thinking, the projection of long-term returns involves two key parts: A) the owners’ earning yield (“OEY”) when the purchase was made, and B) the growth rate of the company’s earnings. With an FWD P/E in the range of 18.8x to 13.8x, the corresponding earnings yield will be in the range of 5.3% to 7.2%. Then note that the OEY would be a bit higher than the accounting earnings yield just quoted (details are in our other articles if interested). All told, my estimate of its OEY is 7%, toward the upper end of this range, at an entry price of $32.9 as shown in the chart below.

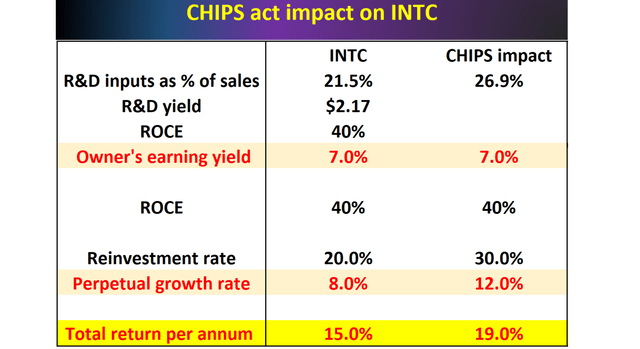

Earnings growth rates in the long term are governed by the return on capital employed (“ROCE”) and reinvestment rate (“RR”), which are estimated to be 40% and 20% respectively for INTC. As such, the growth rate would be around 8% in the long term (40% ROCE * 20% RR = 8%). Hence, the total return potential would be ~15% (7% OEY + 8% growth) at a price of $32.9. A very attractive entry point in my mind.

Finally, note that my above analysis was based on INTC’s financials without considering the impact of the CHIPS Act. It is a key piece of legislation that was signed into law in the United States recently, and INTC is expected to be a major beneficiary of this act. More specifically, the CHIPS Act could help Intel’s business in the next few years in a few ways:

- Effectively increasing its RR. The CHIPS Act provides funding for research and development of advanced semiconductor technologies, as well as grants and incentives for semiconductor manufacturing facilities. Such investment is expected to benefit INTC business so a good part of its R&D and also CAPEX expenditures are essentially subsidized, thus effectively boosting its RR.

- Mitigating investment risks. The CHIPS Act aims to increase domestic semiconductor manufacturing in the United States, which could help to reduce Intel’s dependence on foreign manufacturers for its supply chain. This could help to mitigate some of the risks associated with geopolitical tensions and disruptions to global supply chains.

- Other higher-order effects. If the CHIPS Act works as intended and leads to increased domestic semiconductor manufacturing, this could potentially create other higher-order benefits for INTC too. For example, it could lead to lower import costs and could reduce the company’s overall tax liabilities.

My estimates above show a conservative projection of the CHIPS act impact. It is conservative in the sense that I only considered the boost of reinvestment rates in the projection, from 20% to 30%. And as you can see, in this case, the total return potential could be in the upper teens (say around 19% per annum).

Risks and concluding thoughts

If you share my long-term bullish view and want to consider the above option strategy to be a long-term shareholder, note that INTC is facing numerous uncertainties in the near term, both externally and internally. The broader economy is still struggling with inflationary concerns and is facing a non-negligible chance of suffering a recession. Intel faces intense competition from companies such as AMD, NVIDIA, and Qualcomm, among others. All these companies are investing heavily in new technologies, such as artificial intelligence and 5G, and compete fiercely for key market segments against each other. Internally, Intel has faced and is still facing delays and quality issues with its latest chip manufacturing process, which has resulted in product delays and increased costs. The company is undertaking a major restructuring to preserve cash (it had to cut its dividends by 2/3 too) and improve efficiency. The progress of its restructuring adds another layer of uncertainty for the near term.

Finally, a word about the risk associated with buying options. Even though the $1.9 premium is a small fraction of the $32 strike price. But options buyers have a good chance of losing all $1.9 completely (i.e., a 100% loss) in the case INTC stock prices drop below $32 on the expiry date.

To conclude, the thesis of this article is INTC currently provides an attractive setup for option buyers. The low IV allows investors – whether you hold a bullish or bearish view on its Q2 earnings – to hedge potentials earnings surprises. The IV for INTC’s options currently hovers around 37%, the lowest level in about a year and also substantially lower than its recent historical volatility.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.