Summary:

- Intel Corporation continued its streak of outperformance this year with stellar Q3 results.

- Yet we see signs of investors’ wariness over IDM 2.0 execution risks returning, given ongoing uncertainties to near-term PC outlook, elevated costs of capital, and intensifying competition.

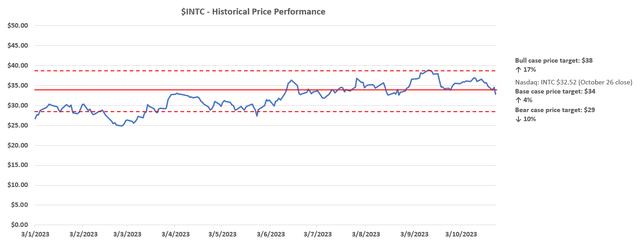

- This is corroborated by the stock’s underperformance in recent weeks, with the market’s response to Intel’s Q3 outperformance still rangebound in the mid-$30 range.

Leon Neal

The Philadelphia Semiconductor Index’s (SOX) performance has been blighted by amplified focus on lingering industry challenges. These include resurfacing concerns over geopolitical and regulatory headwinds, a mixed demand outlook amid broader macroeconomic uncertainties, and rising multiple compression risks due to the elevated rate environment. And Intel Corporation (NASDAQ:INTC) has only been dealt with an extra headache, which is intensifying competition that brings previous investors’ wariness over the company’s execution of its turnaround strategy back into focus.

However, the company’s robust Q3 outperformance and in-line guidance for the current period, highlighted by continued ramp of its capital-intensive foundry ambitions in the spotlight, has led to post-earnings gains of more than 7% in the stock in late trading. Yet these levels remain below the year-to-date highs observed earlier this month, likely highlighting the potential drag from industrywide and company-specific risks. Taken together, we believe fundamental support for the stock’s performance at current levels remains fragile in the face of a volatile demand environment and intensifying competition that could thwart Intel’s ambitions of eventually regaining market leadership.

The Near-Term PC Outlook is Still Mixed

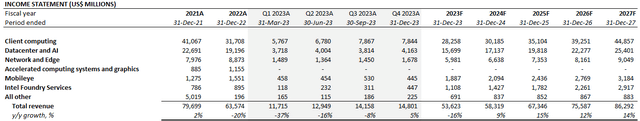

PC chip sales remain a core revenue driver at Intel. The company reported slowing declines of -3% y/y in client computing revenue to $7.9 billion during the third quarter. The results continue to represent sequential improvements, albeit tepid, to demand. Specifically, desktop and notebook sales represent more than 90% of client computing revenue, with both businesses posting robust sequential growth at 16%.

And management remains optimistic for further momentum heading into the fourth quarter, helped by the beginning of shipments of Meteor Lake to customers in Q3, with its impending launch scheduled for later this year. As discussed in our previous coverage on the stock, Meteor Lake represents one of Intel’s most advanced developments in recent years since announcing IDM 2.0. Integrated with “AI acceleration” capabilities. The next-generation CPU is likely to complement Intel’s share capture in the imminent upgrade cycle. As the advent of generative AI capabilities migrate from “data centers and into end-user devices,” the ensuing transformative changes to PCs – as highlighted by the increasingly pervasive use of conversational AI chatbots and the upcoming general availability of Microsoft’s (MSFT) 365 Copilot tools next month – is expected to be a tailwind to Meteor Lake demand.

However, the broader timeline to PC’s recovery remains uncertain, despite emerging signs of improvement in the demand environment in recent months. Specifically, the pickup in PC sales have remained tepid, despite market data that points to a “cycle trough” following the extended two-year slump. Specifically, Q3 global PC shipments have remained in decline (-9% y/y), albeit at a slower pace compared to preceding quarters. This comes despite a smaller PY comparison base after eight consecutive quarters of shipment volume reductions, most notably through 2022.

The lingering challenge is further corroborated by continued y/y declines in Intel’s Q3 client computing sale though, with lumpy, though improving, sequential growth over the same period, which tempers expectations from management’s optimism earlier in the year for stronger recovery tailwinds in the second half of the year. With cyclical headwinds still dynamic and challenging amid broader macroeconomic uncertainties, particularly as consumer spending remains soft in the face of persistent inflationary pressures and impending recession risks, Intel’s core client computing segment remains exposed to a mixed PC outlook.

Intensifying Competition

In addition to lingering, though troughing, cyclical headwinds facing its core client computing business, another imminent wave is crashing in on Intel’s turnaround roadmap. While the new chips based on Intel’s latest process nodes that will start shipping later this year and through 2024 are expected to help lead the recovery in broader market demand, emerging competition risks further challenging the company’s ambitions to reestablishing its industry leadership. In the latest development, some of Intel’s key competitors including Nvidia (NVDA) and Qualcomm (QCOM) have announced next-generation PC chips aimed at challenging Intel’s dominance in the space. This couples with headwinds stemming from Apple’s (AAPL) transition from Intel CPUs to in-house silicon for its Mac line-up, and ongoing market share gains at key rival Advanced Micro Devices, Inc. (AMD) that continue to threaten Intel’s efforts in regaining its grip on PC market demand.

Specifically, Nvidia has recently announced the development of an Arm-based (ARM) CPU that will hook into the Microsoft Windows operating system, with shipments slated to begin in 2025. AMD, which currently makes its PC processors based on Intel’s “x86 computing architecture,” also has plans to announce an Arm-based equivalent by mid-decade. The development comes on the back of speculated Microsoft ambitions to reinforce Windows’ PC dominance over Apple, which has doubled its market share after the Mac line-up’s transition to in-house silicon based on Arm’s technology. The majority of Windows PCs currently run on chips based on the x86 computing architecture, and Microsoft’s aims at diversifying to Arm-based technology risks further displacing Intel’s market leadership and disrupting CEO Pat Gelsinger’s aggressive turnaround plans for the company.

In addition to Nvidia, Qualcomm has also recently announced its latest and greatest “Snapdragon X” desktop CPU, which marks the advent of its foray in the PC market. The new PC chip, which is also based on Arm technology, touts as much as 68% better power efficiency over the most comparable 12-core Raptor Lake processors from Intel. The Snapdragon X is also capable of up to 50% better performance compared to Apple’s M2-series chips that currently run the most updated Macs available in the market today, which puts Intel on notice. In addition to putting “generative AI in [users] pockets” via its market-leading innovations in smartphone chips, Qualcomm will also be incorporating relevant capabilities into the Snapdragon X, effectively rivalling Intel’s upcoming Meteor Lake processor.

Taken together, Intel’s market share gain prospects remain at risk of disruption, especially as competitors step-up in their innovative efforts. This will likely continue to limit visibility on the timeline and viability of Intel’s execution on ambitions to reinforce its PC moat.

Lingering Geopolitical Risks

Recent updates to chip export restrictions imposed by the U.S. are also bringing geopolitical tensions with China – a key market for Intel and the broader semiconductor industry – back into focus, taking precedence over AI momentum. Building on the export restrictions levied on advanced semiconductor technology from the U.S. to China in late October of last year, Washington has recently provided clarification that the relevant regulations will also apply to the sale of chips that fall below, but are close, to the “controlled threshold” – pointing directly at accelerator chips critical to the developments in AI and high-performance computing. The rules will kick into effect “30 days after October 17.”

The latest development is likely to further hamper Intel’s transformational shift to accelerated computing. Specifically Intel’s Gaudi series accelerator chips developed by subsidiary Habana Labs, which are based on the 7nm process node, are likely to be impacted by the new rules, which will require U.S. regulatory approval for sales made to China.

The Gaudi 2, which started shipping to European and American markets in May 2022, had only recently entered the Chinese market in July. Despite boasting “twice the performance” compared to Nvidia’s “A100” accelerator chips, Intel’s Gaudi 2 still trails the capabilities of its rival’s latest “H100” chip, which is 6x more powerful than the predecessor. Intel still markets its Gaudi 2 accelerator as the “only viable alternative to H100 for training large language models,” nonetheless, aiming at capturing market share from Nvidia’s hard-to-come-by processor in the supply-constrained environment. Similar to Nvidia’s A800 and H800 chips, which are slower versions of the A100 and H100 tailored for the Chinese market to comply with U.S. export regulations, Intel’s Gaudi 2 also falls just slightly below the rules’ controlled threshold, which restricts the sale of “processors capable of greater than 600GB/sec of I/O bandwidth” to China.

Since the Gaudi 2’s entry to the Chinese market, it has been well received, bolstering Intel’s prominence in the region responsible for the bulk of global semiconductor demand. This largely differs from the lack of adoption momentum in Europe and the U.S., which has limited Intel’s foray in accelerated computing. Specifically, Chinese AI server market leaders spanning Inspur, New H3C and xFusion have endorsed Intel’s Gaudi 2, with plans to incorporate the accelerator chip into their next-generation products. Considering the three AI server market leaders’ combined share of about 50% in China, their endorsement of Gaudi 2 accordingly provides validation to the technology’s capabilities, as well as its capabilities against rivalling products such as Nvidia’s A800 and H800 accelerators.

Yet the latest update to U.S. chip export restrictions could thwart Intel’s growing monetization opportunities in China’s rapidly expanding accelerated computing and HPC market. This accordingly injects further uncertainties to the prospects of Intel’s data center and AI segment. The second-largest revenue contributor at Intel has been struggling to recapture market share from competitors Nvidia and AMD in recent quarters, as evidenced by its ongoing sales declines. Although upcoming shipments of the next-generation Emerald Rapids, Sierra Forest, and Graphite Rapids server processors are expected to drive a much-needed uplift to DCAI sales, ongoing transformations in computing infrastructure to facilitate next-generation AI developments are likely to increase focus on accelerated computing, adding urgency to Intel’s roadmap on ramping Gaudi.

In addition to China-related geopolitical risks, the intensified Israel-Hamas conflict in recent weeks also risks disrupting Intel’s fabrication and R&D footprint in Israel. Specifically, Israel represents an important base for Intel’s hardware and software developments related to AI, with Habana having a large operational footprint in the region. Intel has also been ramping up productions at its most-advanced fabrication plant in Kiryat Gat, with recently made investments into the facility’s capacity expansion plans. Ongoing uncertainties over the Israel-Hamas war could potentially be a near-term risk to Intel’s DCAI business, as well as its Mobileye (MBLY) subsidiary headquartered in Israel.

Foundry Spotlight

Meanwhile, the continued ramp of Intel Foundry Services remains a spotlight. The segment’s revenue grew 82% y/y to $311 million during the third quarter, paving the way for robust acceleration for full year 2023. Although IFS revenue remains a nominal share of Intel’s consolidated business with limited margin improvements, the segment’s acceleration indicates healthy market share gains and gradual scale.

However, elevated execution risks remain on this front, as management continues to warn of multi-year pressure on gross margins due to IFS start-up costs. Management has also provided limited detail pertaining to earlier news on the prepayment from a notable chipmaker aimed at speeding up the build-out of Intel 18A and Intel 3 foundry capacities, other than specifying the allocation of funds towards the “two new leading-edge chip factories at the Ocotillo campus in Chandler, Arizona,” which keeps IFS prospects at bay in the near-term.

Fundamental and Valuation Update

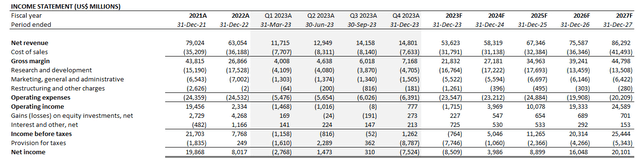

Adjusting our previous forecast for Intel’s actual Q3 performance and forward prospects as discussed in the foregoing analysis, we expect the company’s full year 2023 revenue to decline -16% to $53.6 billion. The slowing decline from 2022 is expected to be primarily helped by client computing sales in the current period, which is expected to benefit from an easier PY compare when PC market demand was near its weakest, as well as Intel’s shipment of Meteor Lake. DCAI sales are likely to see gradual benefit from the upcoming shipment of Emerald Rapids in Q4, with tailwinds expected to be more prominent as Sierra Forest and Granite Rapids rolls out heading into 2024.

Author

On the cost front, lingering growth headwinds as discussed in the foregoing analysis is likely to keep a lid on Intel’s margin expansion driven by scale. Instead, the ongoing implementation of annualized cost-savings initiatives will remain a key contributor to offsetting the elevated start-up costs coming out of Intel’s capital-intensive foundry business, as well as its ongoing R&D investments to keep up with industry’s innovative demands.

Author

Intel_-_Forecasted_Financial_Information.pdf.

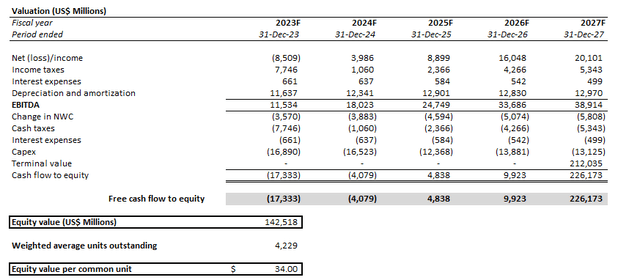

Our base case price target remains at $34, which is largely in line with the stock’s currently traded levels and likely reflective of tempered investors’ confidence following adverse industry- and company-specific developments in recent weeks.

Author

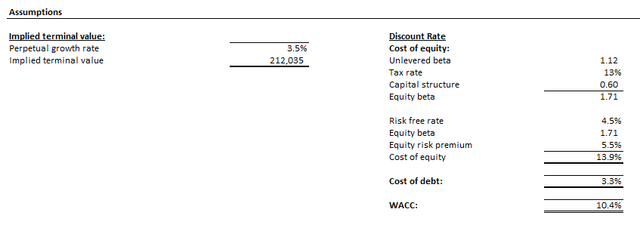

The price target is computed under the discounted cash flow method based on projections in conjunction with the fundamental analysis discussed in the earlier section. The analysis assumes a 10.4% WACC in line with Intel’s capital structure and risk profile relative to the elevated benchmark Treasury yield, alongside a perpetual growth rate of 3.5% to reflect the company’s longer-term prospects.

Author

Author

Final Thoughts

Admittedly, Intel Corporation’s string of in line-performance this year, despite the lowly set bar, is welcomed news indicative of on-track progress relative to the IDM 2.0 comeback plan. However, execution risks pertaining to the capital-intensive undertaking remain. And incremental challenges, such as returning geopolitical risks and intensifying competition, have re-emerged in recent months which could dampen the appeal of Intel’s recent fundamental strength further. Taken together with its volatile margin prospects amid elevated costs of capital, the stock is expected to face limited upside from current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!