Summary:

- Since I initiated a “Sell” rating on Intel Corporation in November 2023, the stock price has declined by more than 49%, compared to 26% positive return in the S&P 500.

- I think the near-term weakness is already reflected in their stock price, and Intel is making progress on its 18A process launch.

- Notably, beyond AWS, Intel added two 18A wafer design wins during the quarter from compute centric companies.

- Intel expects its first external customer to launch their 18A design in the first half of 2025 and enter high-volume production in the first half of 2026.

- I am upgrading to a “Buy” with a fair value of $28 per share.

hapabapa

Since I initiated a “Sell” rating on Intel Corporation (NASDAQ:INTC) in November 2023, the stock price has declined by more than 49%, compared to 26% positive return in the S&P 500 (SPX). I reiterated my “Sell” rating in August 2024, highlighting their $10 billion cost reduction plan.

Intel delivered a solid Q3 result, beating the market expectations. I think the near-term weakness is already reflected in their stock price and Intel is making progress on its 18A process launch; therefore, I am upgrading to a “Buy” with a fair value of $28 per share.

Launching 18A in 2025 & Cost Reduction

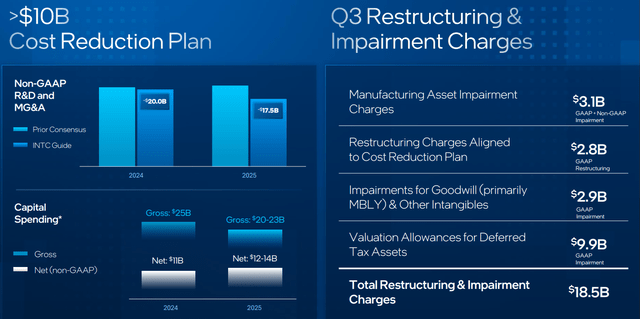

Intel is on track to reduce its workforce by 15% before the end of the year, as noted in the earnings call. In addition, the company reduced its capital expenditure by 20% compared to their initial plan. As discussed in my previous article, Intel is implementing its $10 billion cost reduction plan, aiming to become a leaner and faster company. As shown in the slide below, Intel recognized $2.8 billion in restructuring charges in Q3 FY24 and anticipates higher restructuring expenses in Q4 FY24. I think the cost reduction is mission-critical for Intel to transform the corporate culture and save capital to invest in high-growth areas like AI chips.

As noted in the earnings call, Intel is making solid progress on their 18A and 14A roadmap. Notably, beyond AWS, Intel added two 18A wafer design wins during the quarter from compute centric companies. Intel expects its first external customer to launch their 18A design in the first half of 2025 and enter high-volume production in the first half of 2026. While the timeline is 6 months behind TSMC’s (TSM) N2 2nm technology, which is scheduled to enter high-volume production in the second half of 2025, I am encouraged by Intel’s advancement in their 18A and 14A roadmap. I acknowledge that it will take some time for Intel to catch up with competitors including TSMC and Advanced Micro Devices (AMD).

Q3 Result and Outlook

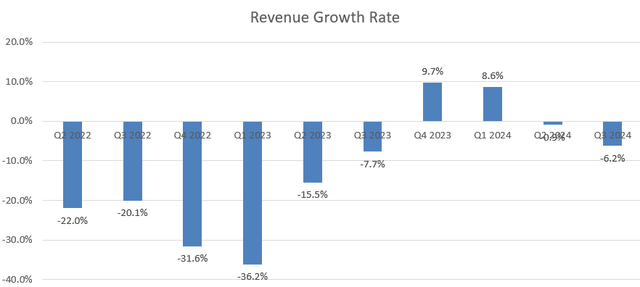

Intel announced its Q3 result on October 31st after the market close, reporting a 6.2% revenue decline, exceeding the market expectations.

Intel is guiding for $13.3-$14.3 billion in revenue for Q4, with a 9.3% decline in gross margins, as shown in the slide below. The company plans to continue working down the customer inventory level in Q4 and executing their cost reduction plans with higher restructuring charges for Q4. As noted in the earnings call, Intel aims to scale their business to support 3%-5% revenue growth, with the potential to accelerate to 7%-9% in the future.

For the near-term growth, I am considering the following:

- Client Computing Group (CCG): In the near term, CCG growth will be driven by AI PC demands and the potential launch of Panther Lake on Intel 18A in the second half of FY25. In September 2024, Intel launched their Core Ultra 200V series processor, the most efficient family of x86 processor for AI computers. Intel is on track to ship over 100 million AI PCs by the end of FY25. Considering these factors, I have raised the segment growth forecast to 5%, up from 4% in my previous DCF model.

- Data Center and AI: As I analyzed in the previous article, Intel is 6-12 months behind Nvidia (NVDA) and AMD in the data center accelerator market. While Intel launched its Gaudi 3 AI accelerator in Q3 FY24, the overall adoption speed has been impacted by the product transition from Gaudi 2 to Gaudi 3 and software, as disclosed over the earnings call. I forecast Intel will grow Data Center and AI business by 10% in the near future.

- Network and Edge: I forecast the segment will grow by 6%, aligned with the overall market growth.

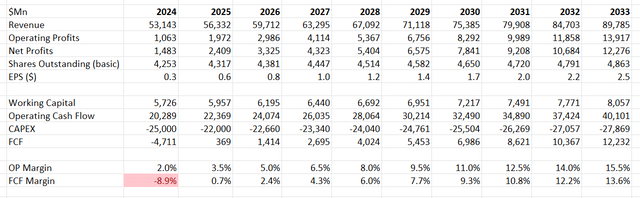

As such, I calculate that Intel will generate 6% organic revenue growth in the future. Given Intel’s massive cost reduction plan, I anticipate they will continue charging restructuring costs in the near term. Thanks to their cost reduction, I calculate their operating expenses will grow by 4.3%, and the operating margin will expand to 15.5% by FY33. I have revised the WACC to 10.5% assuming: Risk-free rate 3.6%; cost of debt 5%; equity risk premium 7%; beta 1.38; equity $105 billion; debt $50 billion; tax rate 13%. The DCF can be summarized as follows:

Discounting all the future FCF, the fair value is calculated to be $28 per share, as per my estimates.

Key Risk

Intel plans to spend $25 billion in CAPEX for FY24 and $20-$23 billion for FY25, investing in process technology and manufacturing capabilities. The massive CAPEX investment will constrain their free cash flow generation in the near term. Intel exited the quarter with almost $50 billion in debt, and the company has to continue deleveraging to achieve a robust balance sheet.

Conclusion

The potential launch of 18A wafer design in 2025 could become a near-term catalyst for Intel’s stock price. I think the near-term challenges have already priced in Intel’s stock price. As such, I am upgrading to a “Buy” with a fair value of $28 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.