Summary:

- Intel’s strong financials and recent earnings beat provide a catalyst to examine the stock and justify the move up this year.

- The company is meeting customer demand efficiently with new product launches and regaining process leadership through R&D and scaling efforts.

- Intel’s advantages in IDM manufacturing, packaging technology, and AI-driven products position it well for long-term growth in the semiconductor market.

- Recent efforts to diversify supply chains allow Intel to pull demand from TSMC as long as they can rise to the challenge with its 18A process.

Justin Sullivan

Investment Thesis

Intel (NASDAQ:INTC) represents an attractive opportunity given the company’s strong financials and dominance in the semiconductor industry. Intel is meeting customer demand efficiently with new product launches, regaining process leadership through R&D and scaling efforts, expanding production capacity globally with government funding, and delivering strong financial performance including revenue and earnings above expectations. Its recent quarterly earnings are an example of this starting to bear fruit. Customers need to have diverse supply chains and their only real option to diversify will be Intel. This (once Intel’s tech catches up to Taiwan Semiconductor (TSM)) will be an irresistible transition for companies due to Intel’s Fabs global presence. This is why we believe if Intel builds it they (customers) will come.

Intel’s advantages in IDM manufacturing, packaging technology, growing AI-driven products division, and hybrid cloud solutions position it well to capitalize on secular growth opportunities. The company’s valuation is compelling at 21.8x forward earnings given its comparative advantage against similar giants. Overall, Intel’s Q3 results illustrate robust business momentum that outweighs short-term cyclical risks, making it a compelling long term semiconductor investment.

Introduction

The semiconductor industry has faced significant headwinds in 2022 and 2023 amid weakening demand, inventory reductions, and macroeconomic uncertainty. However, Intel has remained resilient through this downturn, demonstrating its robustness with still (despite media reports) strength in its Intellectual Property Pipeline, manufacturing scale, and financial discipline.

Based on Intel’s strong Q3 2023 earnings results and outlook, it is clear the company has upward growth in the semiconductor space by leveraging its Integrated Device Manufacturer (IDM 2.0) strategy focused on advancing process leadership and foundry services, ramping next-generation products to meet customer demand, and maintaining operational discipline. With government support (both domestic and international), Intel is also aggressively expanding manufacturing capacity globally. Despite near-term cyclical challenges, Intel appears well-positioned for long-term growth and value creation as a leading technology innovator, helping them get out of the multi quarter rut they’ve been in.

Financial Performance

Intel reported standout Q3 2023 results that beat expectations, demonstrating the progress it has made on executing its (IDM) 2.0 strategy focused on process technology leadership, foundry services and bringing AI everywhere.

The company generated Q3 revenue of $14.2 billion, down 8% year-over-year but above the high end of guidance driven by strength across business segments. EPS was $0.41 on a non-GAAP basis, up 11% from last year and $0.21 above guidance, reflecting strong operational leverage and expense control.

Intel’s data center group grew server average selling prices by 38% as it shifted mix away from low-margin hyperscale business towards higher value enterprises and has made efforts to implement innovative AI products. The client computing group increased notebook volumes by 8% sequentially as customer inventory levels normalized (10Q). These results illustrate Intel’s ability to drive Average Selling Prices (ASPs) higher through product mix even amidst a downturn.

For Q4, Intel guided revenue of $14.6 billion to $15.6 billion, the midpoint exceeding consensus estimates by 4%. It expects non-GAAP gross margin of 46.5%, up approximately 3 percentage points sequentially due to higher ASPs and lower factory underutilization charges (Q3 earnings transcript). This demonstrates Intel’s ability to expand margins through improved utilization.

Overall, Intel’s revenue outlook signals a bottom, with growth resuming in Q4 as demand recovers and inventory drawdowns complete. The company expects PC market consumption to reach 270 million units in 2023, in line with initial guidance (Q3 earnings transcript). Intel’s outlook showcases robustness within its operations, predicting a rekindling of trust among enterprise clients who, driven by the necessity of diversifying their supply chains, are likely to revert to Intel as close partner/manufacturer. Firms cannot afford to have all of their chips made by just one origin supplier (Taiwan Semiconductor (TSMC)). The integration of AI capabilities (more on this later) in their offerings not only enhances product appeal but may also expedite the reversion of clientele towards Intel. These factors collectively project a promising conclusion to 2023, a sentiment strongly echoed by the company’s management (Q3 earnings transcript).

Upcoming Technology Leadership

Intel’s strategic progress and technology leadership were major highlights for Q3, as it makes significant advancement on its IDM 2.0 strategy to regain process dominance.

The company achieved an excellent yield ramp of Intel 4, its first 7nm node manufactured using extreme ultraviolet (EUV) lithography. Intel 4 is now in high volume production across three global factories, underscoring the company’s scaling efforts (Q3 earnings transcript).

Intel also hit a critical milestone on its next-gen Intel 3 and Intel 18A nodes, keeping it on track to deliver its five nodes in a four-year roadmap by 2025. Feedback from lead customers indicates Intel 18A will re-establish clear transistor performance leadership versus competitors (Q3 earnings transcript). The successful execution so far on Intel’s revamped process roadmap demonstrates its engineering prowess and provides confidence it can achieve its aggressive timelines.

Beyond process technology, Intel is innovating in advanced packaging to deliver new capabilities. The company recently unveiled ribbonFET and PowerVia, both cutting-edge technologies poised to transform the semiconductor industry, enhancing both performance and power efficiency. Intel also announced it is developing glass substrate packaging, which enhances mechanical, physical, and optical characteristics, facilitating the connection of a greater number of transistors within a package. This advantage promotes improved scaling and allows for the assembly of larger chiplet configurations, termed as “system-in-package”, when compared to the organic substrates currently in use. The combination of these new innovations will enable continued density and performance (Q3 earnings transcript).

Lastly, Intel is laser focused on AI and unleashing the potential of data across the computing continuum from cloud to network to edge. Its suite of AI accelerators, Xeon CPUs and software like OpenVINO toolkits position it strongly to benefit from surging AI workloads and the $1 trillion semiconductor TAM expected by 2030 (Q3 earnings transcript). Intel has the potential to secure a substantial market share with these AI advancements, placing them on a competitive footing with Tower Semiconductor. Overall, Intel is leveraging its unmatched R&D capabilities and product portfolio breadth to cement technology leadership as computing enters the AI-driven data era.

All of this matters for one major reason: Intel has lost much of the semiconductor battle over the last 10 years because the chips they made were not sophisticated enough compared to TSMC. With better chips coming online, they are becoming a serious competitor. With the need for companies to diversify their supply chains, Intel is becoming an obvious component.

Manufacturing Scale and Capacity Expansion

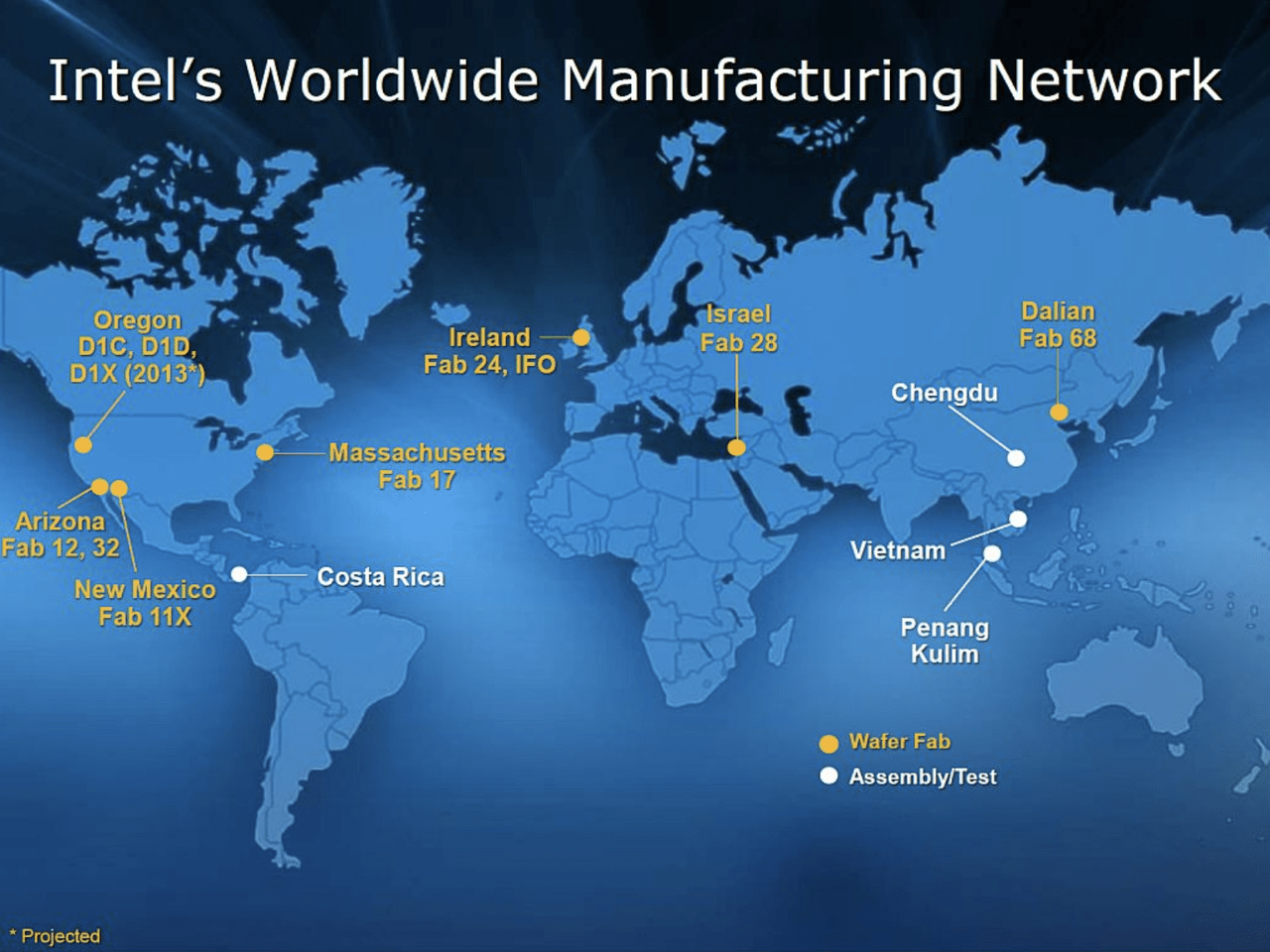

Intel is aggressively expanding its global manufacturing footprint to support IDM 2.0 and foundry services for external customers. This massive capacity expansion will solidify its scale advantages. The biggest kicker is that Taiwan Semiconductor, who holds the largest market share by revenue, has 16 of their 18 Fabs located in Taiwan (other two locations: China and Washington, US). On the other hand, below is an image that depicts Intel’s global reach, which makes for a compelling argument for why customers will soon be utilizing Intel for their widespread facilities.

Intel Manufacturing Network (Wikipedia)

CEO of Intel, Pat Gelsinger, mentioned:

We have submitted all four of our major project proposals in Arizona, New Mexico, Ohio, and Oregon, representing over 100 billion of U.S. manufacturing and research investments, to the CHIPS program office and are working closely with them as they review these proposals… We are on a mission to bring AI everywhere. – Q3 Earnings Transcript

Intel is also expanding internationally, recently opening its fabrication 34 facility in Ireland which represents the first high-volume EUV production in Europe (Q3 earnings transcript). It is moving fast to build out leading-edge capacity across geographies to de-risk supply chains.

In late 2022, Intel broke ground on two new Fabs in Ohio on the heels of receiving a $600 million grant from the state. These locations are progressing and created 7,000 construction jobs and soon to be 3,000 full time roles. The sites will produce chips by 2025 as government subsidies will reduce the opportunity cost of doing other things, according to Intel.

To support its foundry services business, Intel signed an agreement with TSMC to provide 300 million manufacturing capacity and foundry services through its New Mexico facility (Q3 earnings transcript). This highlights Intel’s ability to leverage existing assets for foundry customers. This agreement sparked after the two companies’ merger fell through due to disapproval from regulators in China.

Pat Gelsinger (CEO) added:

I’d also emphasize that as we build our foundry capacity, we build more capacity in our factory network for our internal and external customers. – Q3 Earnings Transcript

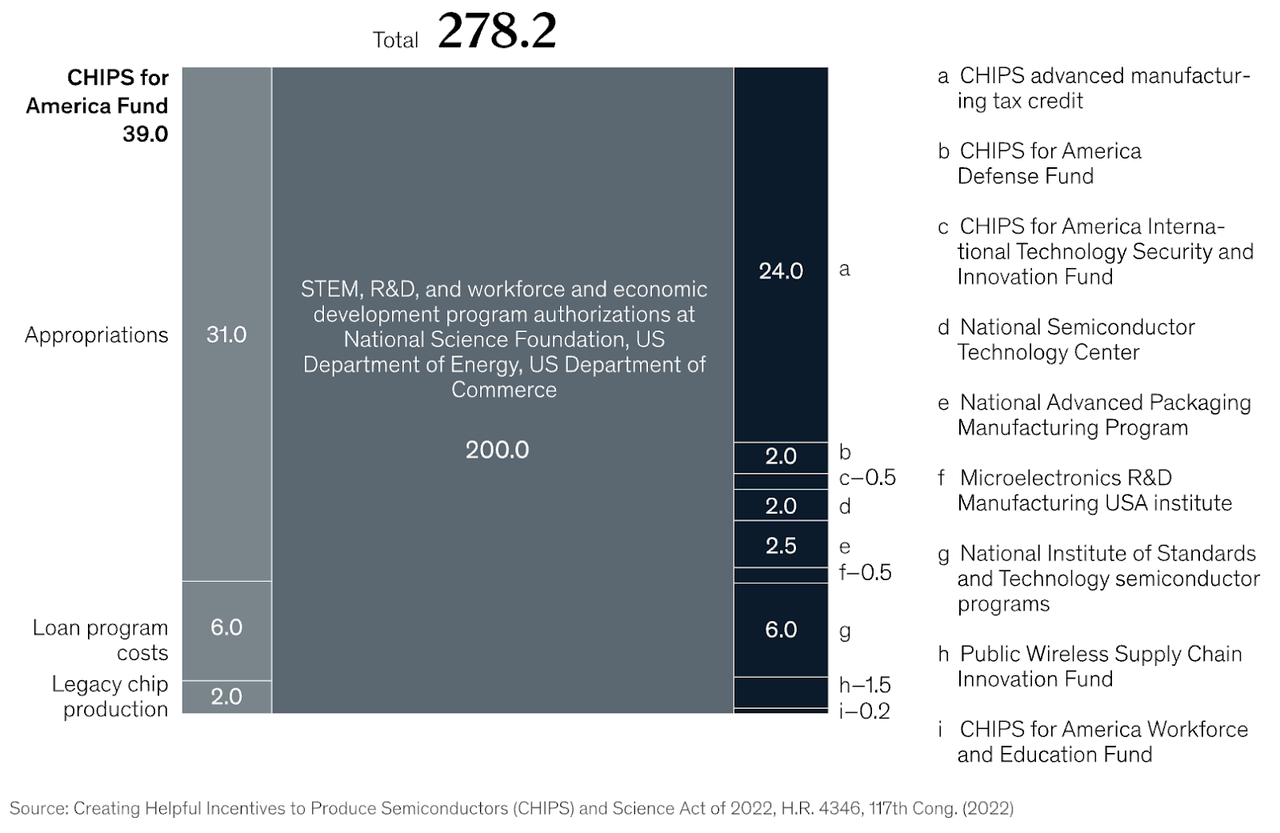

Following, government funding and incentives will play a key role in accelerating Intel’s capacity expansions. The CHIPS Act allocates $52.7 billion for the advancement of semiconductor manufacturing, research and development, and workforce development in the U.S. Additionally, it offers an additional $24 billion in tax incentives for chip production. The figure below illustrates a comprehensive breakdown of the total $278.2 billion in spending over the next ten years.

US Government Chip Funding (McKinsey)

Financial Strength

Intel is maintaining financial outperformance and discipline in Q3 2023. The company generated operating cash flows of $5.8 billion, up $3 billion sequentially, and paid dividends of half a billion this quarter, demonstrating the resilience of its cash generation (Q3 earnings transcript).

Intel has an exceptional balance sheet with $7.6 billion in cash and $17.4 billion in short-term investments as of Q3 2023 for total liquidity approaching $25 billion. They also have an untapped $10 billion credit facility (10Q).

This robust cash position and balance sheet strength provides Intel significant flexibility to fund R&D investments and capacity expansions. It also enables Intel to pursue strategic M&A opportunities. Its Q3 non-GAAP gross margin of 45.8% expanded sequentially and beat guidance as higher ASPs and lower costs flowed through (3Q Conference Call). Margins stand to benefit enormously once Intel regains process leadership.

With rock solid liquidity, a phenomenal credit facility, an exceptional balance sheet, and strong cash flow generation, Intel has the financial foundation and discipline needed to navigate cyclical downturns and emerge stronger on the other side.

Risks

While Intel faces some near-term uncertainty, the company is well-positioned to overcome these challenges and drive growth over the long run. Soft PC demand will likely rebound as macro conditions improve. Competitive threats from new ARM-based chips will incentivize Intel to accelerate its innovation in next-generation processors like Meteor Lake. Geopolitical issues may cause short-term headwinds in China, but Intel has a balanced global footprint to weather disruptions. The ramp-up of foundry services will generate profits once start-up costs subside. With its technology leadership and $100B manufacturing expansion, Intel is poised to recapture market share across segments. These momentary risks should not obscure Intel’s strengths—its turnaround strategy will unlock significant value if executed properly. Despite current volatility, Intel remains an attractive long-term bet in semiconductors.

Why Intel’s Current Valuation Is a Compelling Price

Intel stock has taken a beating over the last 5-6 years as investors have gone through multiple CEOs (both fired for different reasons). The stock is down from its high in the high $60s in 2021 to even a mildly recovered price of $35 a share today.

Given this (and Foundry Sales accelerating -sales quadrupled last quarter) the stock looks cheap. 21.8x forward earnings when their foundry has clear product market fit in the AI chip fabrication space is cheap from my view. AI chips are powering exponential growth at Nvidia, AMD and others. Intel will ride much of this same wave and deserves a higher valuation because of it.

The advantage as their CEO said is “with the rise of AI and high-performance computing applications, our advanced packaging business is proving to be yet another unique advantage…[the company has seen]…a surge of interest in our advanced packaging from most leading AI chip companies.”

This is a key advantage. As we have argued before, Intel’s increasingly robust supply chain means better control over chip supply. Compared to other chip makers (that don’t even have this) they have yet to be rewarded by it.

| AI Chip Companies For Enterprise | INTC | AMD | NVDA |

| PE Ratios (FWD) | 21.8 | 35.06 | 37.16 |

| Chip Packaging | INTC | AMKR | ASE | Sector Median |

| PE Ratios (FWD) | 21.8 | 12.98 | 15 | 20.11 |

On the chip packaging side, their PE is slightly higher than the low margin pure plays but is basically in line with sector median even though they do not have the vertical integration benefit. I think the blended company deserves a higher PE due to a more robust valuation and the ability to pick up strong business. After all, their AI chip foundry revenue Quadrupled while Taiwan Semiconductors’ revenue dropped and AI chip sales for them were not enough to offset a decline. Intel is becoming a way to strategically diversify fabrication. We’re seeing it.

I think the company deserves to trade at a PE ratio closer to 25 than 21. This represents about 20% upside from here. Sell Side is less optimistic than me, but then again they tend to follow good news and upgrade, not precede it. I think upgrades to the stock could provide the catalyst needed to give it a boost once more investors notice the story here.

Takeaways

In conclusion, Intel’s dominant position in semiconductors is evident based on its standout Q3 2023 earnings performance driven by product execution and financial discipline. The company is aggressively investing in breakthrough technologies like ribbonFET, PowerVia, EUV and advanced packaging to cement process leadership and product differentiation. Intel is scaling capacity globally to capture surging data-driven demand, tightened supply, and benefit from government incentives. With strengths in manufacturing scale, research and development, and financials, Intel remains an attractive long-term investment opportunity in semiconductors. I am excited to see the market price in a stronger Intel with many more core AI capabilities in house.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox is the Co-Managing partner of Noahs' Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.