Summary:

- Intel is fairly valued by traditional standards—I estimate a potential 20% gain in enterprise value over two years, making it a Moderate Buy.

- Q3 results showed mixed performance, but management’s cost-cutting and raised guidance indicate a potential return to growth in 2025 and 2026.

- Intel’s foundry services aim for significant expansion, but challenges remain against TSMC. Management’s general operational strategy focuses on efficiency and prioritizing high-growth areas.

- Investors should expect moderate returns, with Intel’s fair enterprise value estimated at $152 billion by 2026—consider selling if the market cap hits $150 billion in 2025.

Fahroni/iStock via Getty Images

In my Q3 earnings preview of Intel (NASDAQ:INTC)(NEOE:INTC:CA), I outlined a 12-month market cap target of slightly over $150 billion—in this analysis, my two-year discounted EBITDA model shows that the stock is realistically fairly valued based on a more comprehensive assessment (if one is holding the stock for two years from the time of this writing). That said, there is still the potential for over a 20% gain in the stock’s enterprise value over two years by my remodeled conservative standards.

In the Q3 earnings call, management outlined several areas where it is proving effective in executing its strategy for higher efficiency to drive more reliable long-term growth—indeed, the results are likely to take time, but with a guidance raise amid difficult restructuring challenges and a compelling valuation, Intel stock remains a Moderate Buy at today’s price.

Q3 Earnings Review: Management Is Back on Track

The headline data is that Intel achieved Q3 revenue of $13.28 billion, beating the consensus estimate by $239.73 million, and delivered a normalized EPS of $0.46, significantly missing the consensus estimate by $0.43. The quarter marked a year-over-year decline of 6.17% in its normalized EPS.

Counter to the disappointment one would have assumed from the market in regard to these results, Intel investors were pleased because management raised its Q4 revenue guidance to between $13.3 billion and $14.3 billion. The midpoint of this guidance—$13.8 billion—was above the prior consensus estimate of $13.5 billion. Moreover, the non-GAAP EPS guidance of $0.12 for Q4 was above the prior expectations, which management attributed to cost-cutting measures and better inventory management.

Therefore, we have somewhat of a mixed profile here. While the company is still currently in a weak state, we’re also getting closer to a return to growth for Intel. Indeed, 2024 has been a bleak year for the company, but 2025 and 2026 are likely to prove accretive. Value investors should not get too distracted by Q3 results, as it is the two-year thesis that deserves the most attention.

Keeping that in mind, in Q3, management executed its previously announced “cost-reduction plan,” reducing its headcount by over 15%, cutting capital expenditures by 20%, and reducing the non-product cost of sales by $1 billion. Moreover, with the company’s transition to extreme ultraviolet (‘EUV’) lithography now complete, Intel is moving to a more normalized cadence of node development, further helping to balance its capital expenditures.

In addition, management has mentioned that its operating expenses are projected to be reduced to $17.5 billion in 2025—a significant decrease—by prioritizing areas like AI, foundry services, and x86 products while trimming less profitable or lower-priority ventures.

Q3 included a significant restructuring charge, including $10 billion in deferred tax asset impairments, a $2.6 billion goodwill impairment on Mobileye, and $2.2 billion related to severance—this explains why the company had such a weak quarter in terms of earnings. These actions and the financial implications prove that management is operating according to its previously outlined plan—I don’t think we have a valid reason to doubt that management can execute a successful turnaround here; it appears that the company is doing what it takes, albeit that it will take some time.

Looking more closely at the company’s foundry services, management emphasized that its external foundry revenue is currently modest but is projected to grow significantly, aiming for approximately $15 billion in annual revenue by the end of the decade. Management maintains that it is seeking to become the world’s second-largest foundry by 2030 (an ambition likely to be challenging to achieve, though possible—and arguably necessary for Western manufacturing competitiveness against China, depending on how much TSMC (TSM) diversifies internationally in the long-term future). Within China, the consensus is that Taiwan is part of the One China policy, essentially espousing that “Taiwan is an inalienable part of China”. It remains to be seen how the West combats this narrative, especially with the current isolationist stance of Trump’s administration on U.S. international relations. I do believe in Intel regarding its foundry operations, but I also do not expect that it will be a path to leadership without setbacks. Many companies, such as Nvidia (NVDA), Qualcomm (QCOM), and Broadcom (AVGO), have been hesitant to use Intel’s foundry services because Intel also competes with them in chip design. In response to this, the company has decided to split its foundry business from its chip design operations, but it remains to be seen how significantly this changes the perceptions of its key potential long-term customers, who are crucial to Intel’s foundry revenues growing.

Q3 was nothing spectacular, nor was it anything disastrous. In fact, it was what one might expect from the company, given its previous efficiency roadmap amid current hardships and the long-term ambitions that it has outlined. Importantly, we had no more major crises, so the near-term return thesis remains intact for now.

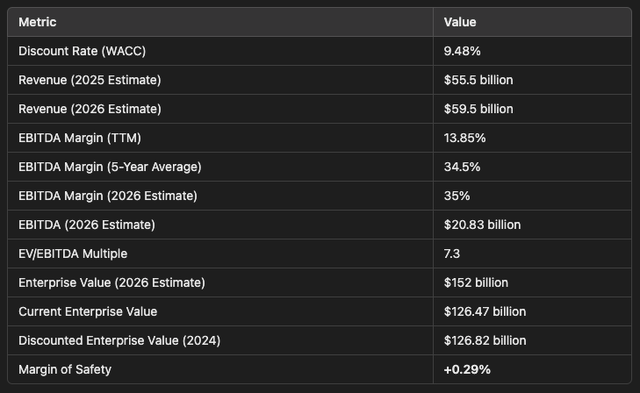

Valuation Analysis: Fairly Valued on a Conservative Basis

As I mentioned, prior to Intel’s Q3 earnings, I outlined an October 2025 market cap target of just over $150 billion. While this near-term target is useful, I will be providing a slightly more protracted, two-year, discounted EBITDA model for this earnings review. The purpose of this is to show investors what margin of safety they are currently getting on the investment if they plan to hold the stock for two years (which is the duration I consider appropriate given the current valuation and cyclical nature of Intel’s growth).

Firstly, I will be using Intel’s weighted average cost of capital (‘WACC’) for my discount rate, which is 9.48%. This reflects the company’s blended cost to finance its operations through a mix of equity (65.7%) and debt (34.3%), factoring in its current cost of equity (13.3%) and cost of debt (2.1%) and a tax rate of 0%.

In keeping with the data from my Q3 earnings preview analysis, I estimate Intel will deliver full-year revenue of $55.5 billion in 2025 and grow this to $59.5 billion for the full year 2026. This is slightly under the consensus revenue estimate for both years, primarily because I do believe that Intel’s operational setbacks have been severe, and there may be further costs with streamlining and quality assessments that reduce demand.

The company’s EBITDA margin is likely to expand significantly from the trailing 12-month margin of 13.85%—its five-year average is 34.5%—largely because it is entering a period of profit harvesting (particularly in 2026) from its integrated manufacturing processes. For the purposes of this analysis, my conservative estimate for its EBITDA margin is 35% by the end of 2026. Therefore, I estimate the company will have an EBITDA of $20.83 billion for the full year 2026. Given that the company has a 10-year median EV-to-EBITDA ratio of 7.3, this is what I will be using for my terminal multiple. I, therefore, anticipate Intel’s enterprise value to be $152 billion by the end of 2026. This is a 20.19% growth from its current enterprise value of $126.47 billion.

Given that the company’s WACC is 9.48%, I have then taken my 2026 enterprise value estimate of $152 billion and discounted this back two years to arrive at a present (two-year-holding-based) approximate intrinsic enterprise value of $126.82 billion. The margin of safety from the present enterprise value of $126.47 billion is, therefore, 0.29%. Intel is, therefore, approximately fairly valued right now by this model. Therefore, for long-term investors, my rating is definitely a Hold. However, for near-term investors, Intel remains a Moderate Buy due to the profit harvesting phase of 2025 and 2026 we are likely to see. It should also be noted that a 7.3 EV-to-EBITDA terminal multiple is highly conservative, given that this is its 10-year median, and its five-year average is 10.3. Therefore, I do expect better returns than this in the next two years, but it pays to be conservative with a company as vulnerable as Intel currently is.

Intel Two-Year Discounted EBITDA Model (Author’s Calculations)

Risks Review

- Intel is unlikely to deliver high long-term alpha. Moreover, the alpha in the near term is unlikely to persist past 2026. Based on my two-year discounted EBITDA model, the company is fairly valued right now. Therefore, the 12-month market cap target I have outlined is heavily reliant on sentiment factors, which brings in an element of speculation in which I prefer not to invest heavily. As a result, consider Intel as a two-year investment if you are comfortable with moderate returns, and if a market cap of $150 billion is reached in 12 months’ time, I generally advise selling.

- Intel wants to be the second-largest foundry in the world by 2030, but the reality is it may face inhibitions—it has already faced a major setback this year. While management seems to have adjusted to recent hardships appropriately, it may be underestimating the pace of advance of TSMC, meaning that even if Intel achieves its 2030 goal, TSMC’s moat remains unimaginably larger compared to Intel’s second-place position. TSMC’s trailing 12-month revenues are $83.5 billion, already far exceeding Intel’s annual 2030 foundry revenue target of $15 billion.

- An investment in Intel is susceptible to further downward momentum, persisting depressed sentiment, and product quality issues that could occur in the coming years. I expect that investors will not want to own a company in such a vulnerable position at a large weight in their portfolios. Nonetheless, as committed value investors, consider a 5% or below weight and monitor the company’s valuation over the next 24 months. I reiterate that Intel is a Moderate Buy.

Conclusion: Moderate Return Prospects

Intel might be appealing to value investors because of its depressed valuation, but the reality is that the stock is relatively vulnerable to persisting negative sentiment even amid a strong 2025 on the horizon. That said, if the market cap reaches $150 billion in 2025, selling is warranted. My conservative 2026 enterprise value estimate is $152 billion—when this is discounted back to present-day value using the company’s WACC, Intel is approximately fairly valued right now. For these reasons, do not expect high alpha from Intel, but moderate returns are likely.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.