Summary:

- Intel’s third-quarter earnings exceeded expectations. Intel’s Q3’23 showed strengthening fundamentals in the device market and positive operating income momentum in the Client Computing Group.

- The growth in gross margins indicates that the worst may be behind Intel in terms of consumer spending headwinds.

- Gartner projects a recovery in device sales in the fourth-quarter, suggesting a potential return to positive top line growth and margin expansion.

- Intel’s guidance for FY 2023 is robust.

- A new round of EPS upward revisions may trigger a revaluation of Intel’s shares.

hapabapa

Intel’s (NASDAQ:INTC) submitted a much better than expected earnings sheet for the third-quarter on October 26th. And the chip maker convinced with a strong guidance for Q4’23 (revenue growth and sequential gross margin expansion) and improving operating fundamentals in Intel’s important Client Computing Group. The situation in the device market, which has seen back-to-back quarterly declines in device shipments in Q1’23 and Q2’23, improved in the third-quarter and Gartner is now projecting the beginning of a recovery in the PC market in the fourth-quarter. I believe operating conditions are set to improve and shares of Intel are a buy after the release of third-quarter earnings!

Previous rating

I previously rated Intel as a hold in August after the chipmaker presented results for its second-quarter after the PC market showed early signs of a stabilization. Given that the PC market situation has further improved in Q3’23 and that the chip maker is seeing positive growth in its gross margins as well as operating income growth in its Client Computing Group, I am upgrading shares to buy.

Client Computing Group’s fundamentals are improving

A slowing decline in global PC shipments as well as spending cuts have fundamentally improved the earnings picture of Intel’s operations, especially in the Client Computing Group in the third-quarter.

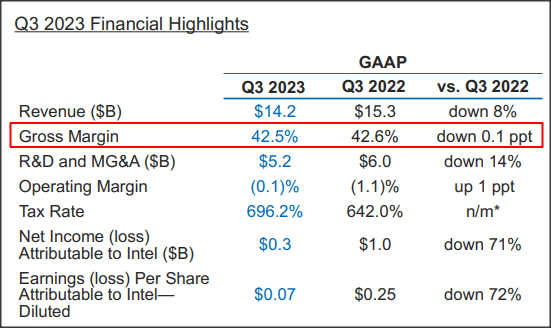

The Client Computing Group remained Intel’s most important revenue-generating segment in Q3’23 with a revenue share of 56%. Intel reported a consolidated top line of $14.2B in the third-quarter, showing a decline of 8% year over year… however, the revenue situation is clearly improving. In the second-quarter, Intel’s revenues were down 15% and in the quarter before that they declined 36%, also on a Y/Y basis.

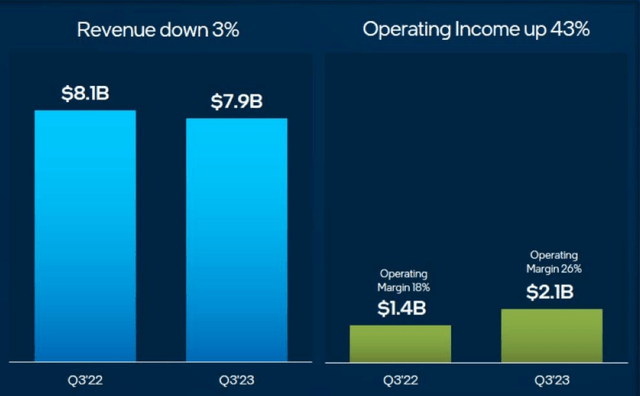

An aggressive focus on costs — Intel’s total OpEx declined 10% year over year to $6.0B in Q3’23 — combined with improving PC market fundamentals resulted in positive operating income momentum in the CCG unit… which saw its second consecutive increase in operating income on a Y/Y basis in FY 2023. Intel’s operating income crashed 81% in the first-quarter as the PC market aggressively tanked. In Q3’23, Intel’s operating income rebounded 43% to $2.1B and the business is solidly profitable.

Source: Intel

Gartner projects rebound in device sales in the fourth-quarter

I believe the rebound in Client Computing Group operating income is set to continue in the fourth-quarter (and beyond) as economic growth is surging. As was reported on Thursday, U.S. annualized GDP growth in Q3’23 was 4.9% — which was the fastest growth since Q4’21 — and this growth has been boosted by a 4.0% jump in consumer spending. In other words, the U.S. consumer is in a spending mood which may lead to increased spending on electronics products as well. This view is corroborated by recent shipment data from research company Gartner.

Gartner estimated in October that global device shipments declined 9% in the third-quarter. This achievement is not especially worthy of celebration by itself, but the device market has been in a significantly worse situation in the first six months of the year. In the second-quarter, also according to Gartner projections, global device shipments — which include PCs and laptops — declined 17% year over year… which itself was an improvement over the first-quarter which saw a 30% contraction in the device market. The PC market is rebounding and Gartner also projects that it will see the beginning of a recovery in the fourth-quarter… which creates positive margin tailwinds for Intel.

Gross margin expansion

The biggest take-away from Intel’s third-quarter earnings release was that the chip maker, on a consolidated basis, saw a large, sequential uptick in gross margins: Intel’s gross margins increased from 35.8% in Q2’23 to 42.5% in Q3’23, showing a 6.7 PP swing in margins Q/Q. Intel’s gross margins fell off a cliff in Q1’23 and the stabilization in the margin picture, together with a significant operating income gain in CCG, indicates that the worst is likely behind Intel in terms of consumer spending headwinds that so clearly affected the PC market at the beginning of the year.

Source: Intel

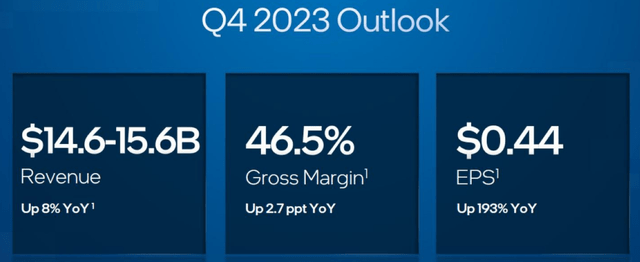

Outlook for Q4’23

Intel guided for positive top line growth in the fourth quarter as well as a sequential margin gain… which signals increasing confidence that the PC market situation is set to further improve. Intel expects 8% year over year top line growth and $14.6-15.6B in revenues. The company’s gross margin is expected to grow another 2.7 PP year over year to 46.5%.

Source: Intel

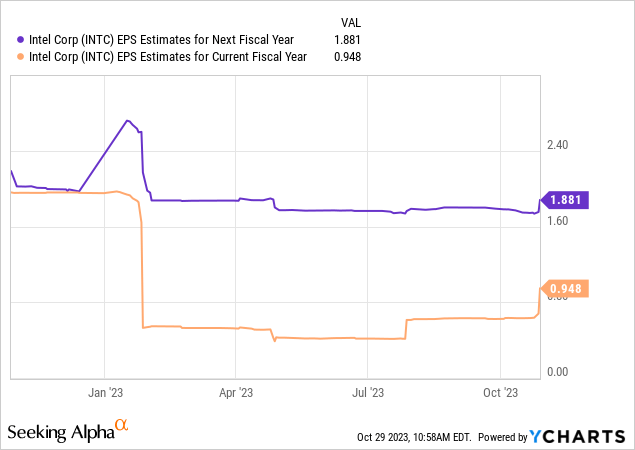

Intel’s valuation, EPS upward revision cycle to begin

Intel is likely set, in my opinion, for a new round of EPS upward revisions following the strong earnings release last week. Analysts currently expect $1.88 per-share in earnings for next year which implies a near-doubling of earnings year over year.

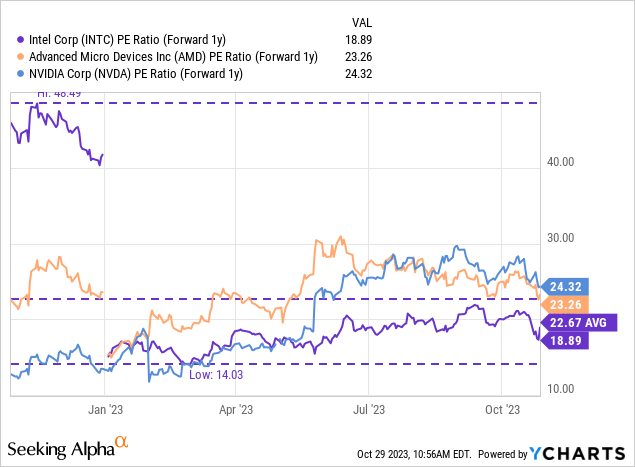

Intel is currently valued at 18.9X FY 2024 earnings and is therefore the cheapest of the major chip makers. Both AMD (AMD) and Nvidia (NVDA) have higher valuation multipliers of 23.3X and 24.3X. Intel is still trading below its 1-year average P/E ratio, however, which implies a current discount of 17% to the longer term P/E ratio. I believe Intel could trade, with a rebound in the PC market ahead and with improving profitability and margins in the Client Computing Group, at 23-24X forward earnings, implying a $43-45 fair value. With shares trading at $35.54, INTC may have up to 27% revaluation potential.

Risks with Intel

The obvious risk for Intel is that the PC market weakens again so that its gross margin potential may not be realized. Since Intel is very reliant on processor sales, a weak PC market would immediately hits its large and profitable Client Computing Group. Slowing demand for semiconductors in a recession is a risk for Intel as well, as are cyclically contracting gross margins. A U.S./China trade war and new bans on high-performance chips to China would also be a potential headwind for Intel.

Final thoughts

Intel submitted a very strong earnings report for Q3’23 and the strong rebound in operating income in the Client Computing Group, sequential gross margin improvements and a generally improving near term picture in the PC market indicate that the bleeding has stopped for Intel… and that the chip maker could now benefit from a new cycle of EPS upward revisions as well as rebounding operating income growth in its core CCG business. I believe shares of Intel have now a much better and much more favorable risk profile than before the earnings release and I am upgrading shares to buy!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.