Summary:

- Intel Corporation stock has lagged behind the broader semiconductor sector’s rally this year, and the Q4 outperformance has offered little respite.

- The company’s weak forward guidance further exacerbates the situation, suggesting a lack of Intel momentum in catching up to peers with its “AI Everywhere” mandate.

- Looking ahead, Intel will likely remain a function of broader market trends (e.g., PC recovery; auto slowdown), but struggle to carve a competitive advantage.

- This is expected to hinder prospects of an upward valuation re-rate needed to justify the costly IDM 2.0 strategy, as confidence in Intel’s ability to capitalize on the emerging AI opportunity starts to dwindle.

Leon Neal

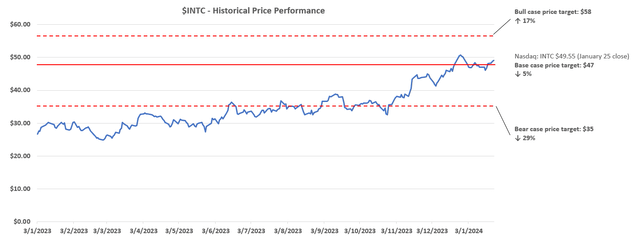

Intel Corporation (NASDAQ:INTC) stock has largely lagged behind the broader semiconductor sector’s rally in recent weeks. Led by relentless optimism over at rival NVIDIA Corporation’s (NVDA) recent product launches at CES 2024, the Philadelphia Semiconductor Index (SOX) has appreciated about 11% since the start of the new year. This compares to Intel’s sluggish ~4% move over the same period.

In our previous coverage on Intel, we had praised the chipmaker’s differentiated focus on AI opportunities in PC and other mobile applications – an area in which it dominates. Yet Nvidia’s recent upgrades made to its slate of GeForce RTX GPUs curated for the AI PC era have largely overshadowed Intel’s ambitions on this front.

In an attempt to expand its “AI everywhere” aspirations, Intel is now touting AI automotive applications with a series of new initiatives to establish its leadership in the emerging field. Yet the efforts are likely to be met with a structural normalization of demand in the auto industry amid tightening financial conditions. This is further exacerbated by emerging signs of inventory indigestion within the auto industry, as reported by its subsidiary Mobileye Global Inc. (MBLY) earlier this month.

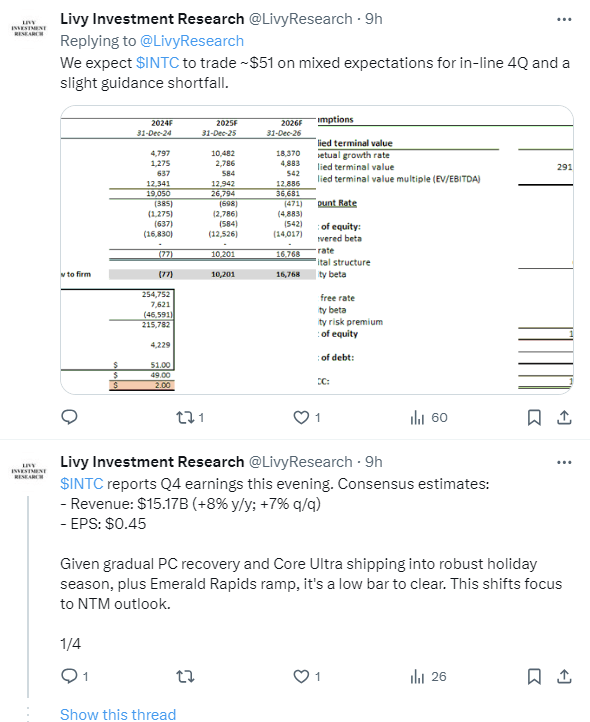

Intensifying competition continues to thwart Intel’s capabilities in re-emerging in the lead amidst a heated AI arms race. We remain optimistic about the emerging tailwinds to Intel’s fundamental performance given an impending PC recovery and incremental AI-induced total addressable market, or TAM, expansion opportunities. This is corroborated by Intel’s Q4 outperformance, albeit over the low bar set by consensus analyst estimates.

But the company has yet to demonstrate how it can resurface as a leader in data center and AI, and PC applications at the end of its costly IDM 2.0 turnaround. This is further exacerbated by the disappointing guidance for Q1, which underperforms even modest consensus expectations with consideration of the seasonal slowdown. Although we had previously anticipated the guidance shortfall, management’s latest commentary further reinforces concerns that forward uncertainties to Intel’s turnaround persist.

Twitter

The lack of momentum, particularly on ramping its latest DCAI products, continues to preclude Intel from the upward valuation re-rate to make sense of IDM 2.0 in our opinion.

Nvidia’s Out for Blood Against Intel

Intel’s AI PC strategy touted during its recent “AI Everywhere” product launch event is already at risk. In our previous coverage, we detailed how Intel’s prescient integration of AI capabilities in its newest Core Ultra PC processor could compensate for its technological inferiority in accelerated computing. But Nvidia’s recent upgrades made to its flagship GeForce RTX GPUs risk one-upping Intel’s ambitions in this foray.

Specifically, Intel Core Ultra is inherently optimized for AI acceleration in PC use cases. It combines a neural processing unit (“NPU”) with a CPU and GPU. With the NPU optimized for processing AI workloads, it essentially frees up capacity for the CPU and GPU to take on other tasks. The combination is designed to efficiently allocate computing power, as the PC faces increasingly complex workloads with the advent of AI. To ensure there is value to its push for AI PCs, Intel has also partnered with 100+ ISVs in creating 300+ AI-accelerated PC features uniquely optimized on Core Ultra.

But Intel just cannot catch a break. Nvidia has effectively put Intel on notice with the announcement of its own slate of next-generation AI PC hardware earlier this month at CES 2024. Specifically, the AI leader has introduced three variants to its upgraded GeForce RTX 40 SUPER Series GPUs. The graphics chips, which are capable of as much as 1.7x speedier processing of AI workloads compared to its predecessor, start shipping later this month. Nvidia also boasts a network of 500 PC applications that are already optimized on the GeForce RTX 40 SUPER series GPUs. This effectively outpaces Intel’s current count of more than 300 PC features optimized on Core Ultra.

Admittedly, Nvidia’s recent AI PC-related product launch largely focuses on bolstering next-generation gaming graphics and performance. Meanwhile, Intel’s Core Ultra better addresses general AI use cases in Windows-based PCs by encompassing the GPU, CPU, and NCU in one.

Yet adoption of AI PCs primarily depends on the build-out of relevant applications and a supporting ecosystem from development to deployment. This is consistent with still mixed user reviews on the recently launched first-generation AI PCs fitted with Core Ultra. As previously discussed, early users have indicated nominal differences between Core Ultra AI PCs and regular PCs in performing common generative AI tasks, like running ChatGPT. This continues to highlight the importance of AI integration into day-to-day computing tasks to bolster AI PC adoption in the long run.

And Nvidia has once again emerged in the lead on this aspect. With Nvidia already a sizable step ahead of building out its AI PC ecosystem, Intel faces stiffening competition in safeguarding optimal market share gains in this nascent field.

However, Intel’s existing market leadership in the PC market could remain a competitive advantage in the impending upgrade cycle. This is consistent with observations that most first-generation Windows-based AI PCs fitted with Ultra Core are also currently complemented by Intel Arc GPUs. Intel has also safeguarded partnerships with key enterprise PC makers on the launch of Core Ultra, including Lenovo Group Limited (OTCPK:LNVGY, OTCPK:LNVGF). This is a step in the right direction in our opinion, as it allows Intel to better tap into the commercial setting where AI PC adoption will likely take place first.

AI Auto Ambitions at Risk

Automotives have emerged as the next key piece to Intel’s “AI everywhere” aspiration. During CES 2024, the chipmaker has announced a series of initiatives that would bolster its footprint in the foray:

- Acquisition of Silicon Mobility SAS – Intel has announced the acquisition of Silicon Mobility, which focuses on the design, development, and deployment of SoCs tailored for EV energy management. Transaction details were not disclosed, but the amalgamation would be accretive to Intel’s AI automotive ambitions by expanding its foray beyond autonomous mobility.

- Intel AI-enhanced “software-defined vehicle system-on-chips” (“SDC SoCs”) – This represents Intel’s newest family of SoCs designed for automotive applications. The products feature built-in “AI acceleration capabilities” similar to the Core Ultra in Intel’s PC roadmap. The chips are optimized for supporting advanced in-vehicle AI workloads. This allows the realization of improvements to cost efficiencies, and deployment scalability while enabling integration with OEMs’ “own custom solutions and AI applications.”

- Introduction of industry’s “first open automotive chiplet platform” – Intel has initiated its commitment to becoming the “first automotive supplier to support the integration of third-party chiplets into its automotive products.” This is in line with the latest SDV SoCs’ integration capabilities with auto OEMs’ own in-vehicle AI applications and solutions, which is critical to optimizing scalability. To ensure that its nascent “automotive chiplet platform” is well-suited for the industry, Intel has proposed a partnership with IMEC, the global leader in digital technologies R&D. Specifically, Intel’s intended partnership with IMEC will focus on stress-testing its “advanced chiplet packing technologies” for automotive applications, and ensure the industry’s “strict quality and reliability requirements” are met.

- Partnership with Geely Automobile Holdings Limited’s Zeekr (OTCPK:GELYF / OTCPK:GELYY) – Intel has long been a key ecosystem partner to and an early investor in Chinese automaker Geely’s EV brand, Zeekr. In addition to Mobileye, Zeekr has recently signed up to be the first auto OEM to integrate Intel’s newest “SDV SoCs.” While the partnership provides validation to Intel’s newest automotive product, it remains to be seen if this represents a gateway to greater opportunities in the Chinese auto market – the world’s largest. China currently represents Mobileye’s largest market, accounting for almost a third of its quarterly revenue. If Intel can replicate a similar pace of market share gains in China with its SDV SoCs, then the latest development could be value accretive to its IDM 2.0 strategy.

- SAE Automotive Vehicle Power Management Standard – Intel has partnered with SAE International, the agency for developing automotive industry standards, in creating the framework for “Vehicle Platform Power Management.” Intel will chair this workgroup, which aims to draw from learnings in “advanced power management concepts” suited for the PC industry and apply them in EV use cases. The first draft of the Vehicle Power Management Standard is expected to materialize within 12 to 18 months.

Intel has largely shrugged off the disappointing outlook that subsidiary Mobileye Global Inc. (MBLY) reported earlier this month, citing signs of inventory indigestion in the industry. Mobileye’s latest warning defies the relative resilience that demand for automotive chips has demonstrated amid the broader cyclical downturn experienced across the semiconductor industry. Specifically, chip supply for the automotive industry has largely been constrained in recent years.

In addition to pandemic-era supply chain bottlenecks, the secular shift in demand for increased in-vehicle technology integration has also driven up the number of chips needed per car. But there are now emerging signs that OEMs are dealing with excess inventory levels, as the broader auto demand environment slows. These concerns were recently echoed by peers like Texas Instruments Incorporated (TXN), which has noted early signs of shrinkage in automotive sector chip demand.

Unlike AI PCs, which are shipping into an impending cyclical recovery, Intel’s AI ambitions in the automotive market are potentially to be met with a structural normalization of demand. Specifically, the combination of ongoing consumer weakness and the broader shift in demand dynamics across the EV industry where chip demand is most prevalent are likely to thwart Intel’s opportunities.

In the U.S., electric vehicle, or EV, sales growth slowed to 1.3% q/q to 317,168 units in the fourth quarter. The results show marked deceleration from +5% q/q during the third quarter, and +15% q/q during the second quarter. Meanwhile, in China, EV shipments are expected to slow further in 2024 to +25% y/y, down from +36% y/y in 2023 and +96% in 2022. In addition to macroeconomic headwinds experienced in two of Intel’s core end markets, the EV industry is also reeling from the exhaustion of early adopters, and slower mass market uptake rates. As the demand driver for EVs shifts from more affluent early adopters to the broader mass market, there will likely be a normalization of demand for advanced technologies. This is expected to inadvertently impact sales of Intel’s new AI-enhanced SDV SoCs and Mobileye offerings as well.

While Intel’s initial go-to-market partnership with Geely’s Zeekr taps into the larger, though slowing, Chinese auto market, there are also incremental regulatory and geopolitical risks to consider. In addition to protracted macroeconomic weakness in the region, there is also an ongoing chip war between China and the U.S. – particularly surrounding advanced AI technologies. The tightening export curbs levied by the U.S. government on exports of advanced semiconductor technologies has resulted in the “steepest drop” in China’s chip imports in almost two decades. Specifically, China chip imports declined by -15.4% in value, and -10.8% in volume in 2023. This is corroborated by previous investors’ concerns about the potential longer-term impact on Intel’s DCAI products, particularly Gaudi, to China in recent quarters.

While the current restrictions are primarily impacting sales of advanced AI chips in data centers and high-performance computing applications, there are also spillover implications to Intel’s broader AI-enhanced product portfolio. Said risks are already corroborated by increasingly hampered iPhone sales in China due to restricted use by local government agencies and heightening competition from Huawei. This has subsequently affected the upstream supply chain from chip fabs to assemblers of the device. Citing national security concerns, Beijing has also ordered local government agencies to limit the use of foreign-branded PCs in favor of “domestic alternatives.” This has been a boon for Chinese PC makers like Lenovo, which is still a key customer of Intel with its latest launch of Core Ultra-powered ThinkBook AI PCs. But regulatory restraints risk thwarting Intel’s participation in the region’s growth opportunities, nonetheless.

Due to tightening U.S. export curbs, China’s increased urgency for self-sufficiency is expected to double its chipmaking expertise and capacity by the end of the decade. This would accordingly alleviate some of China’s reliance on foreign chip supply in the long run. Although China’s technology is expected to remain inferior to that of the U.S., its anticipated chipmaking improvements are likely to suffice in powering the key electronic functions in automobiles and mobile devices. This underscores the risks of dilution in Intel’s prospective share of opportunities in the region over the longer term.

Riding on Industry Tailwinds

Meanwhile, Intel Foundry Services was a key part of the company’s IDM 2.0 turnaround strategy. A return to its foundry roots was key to complementing Intel’s “five nodes in four years” goal to ensure restored superiority in technological competence at Intel against peers. Yet the advent of AI and the technology’s rapid mass market adoption has likely induced adjustments to Intel’s roadmap. This is corroborated by Intel’s increasing focus on AI PCs, and now on to AI autos. The company has also recently ventured deeper into enterprise AI software opportunities optimized on Intel hardware through the spinoff of Articul8.

But related payoffs have been limited so far. Intel’s new nodes and ensuing products have kept the company in the race, but have done little in catapulting the chipmaker to the industry’s forefront. This suggests that much of Intel’s near-term upside potential will likely depend on broad industry dynamics – particularly the impending PC recovery, as Intel remains the market leader.

Specifically, a substantial part of Intel’s existing and prospective fundamental improvements remain a function of PC uptake. Intel expects PC shipments to top 300 million units in 2024, up from 250 million previously estimated for 2023. This marks a modest improvement of about 20% y/y compared to the growth observed during the pandemic era. It also tempers optimism for the impending upgrade cycle coming off of the three-year mark since the pandemic-driven buying frenzy, complemented by emerging AI PC tailwinds. As a result, Intel’s near-term prospects likely ride on industrywide tailwinds, which offer limited upside potential. Meanwhile, on AI-specific opportunities that have been key in driving multiple expansions, Intel still faces stiffening competition that undercuts its prospects.

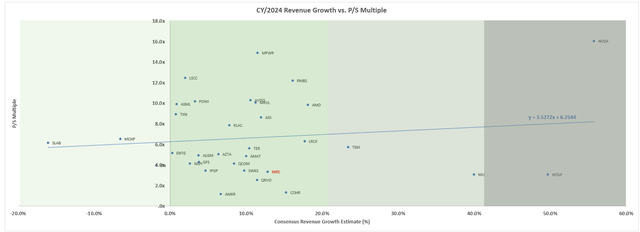

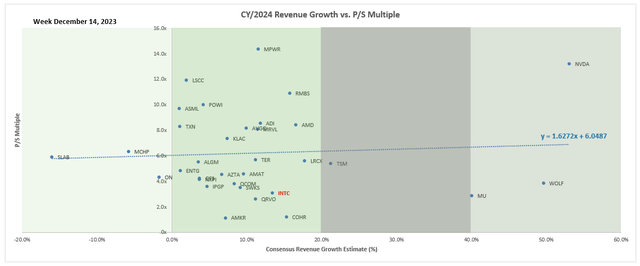

Taking a look at the broader semiconductor industry peer comp, Intel still trades at a significant discount to the sector average and to its peers with a similar growth profile.

The differential between Intel’s valuation trendline and the broader sector trendline has also shown limited progress in narrowing in recent months.

This contrasts the recent SOX upsurge and the industry’s mission-critical role in supporting AI opportunities, which have been a key driver of market valuation multiple expansion. The trend implies there is still much work left to be done at Intel to narrow its valuation gap from leading industry rivals.

In addition to riding on industrywide tailwinds, Intel still needs to demonstrate differentiation and unique competitive advantages in its technology roadmap coming out of its significant IDM 2.0 investments. Although the company has consistently delivered on positive fundamental progress, there are limited signs still that portend to rebuilding an Intel-specific moat. This kind of achievement would be critical for an upward valuation re-rate capable of catapulting the stock back to comparable levels with Intel’s leading rivals.

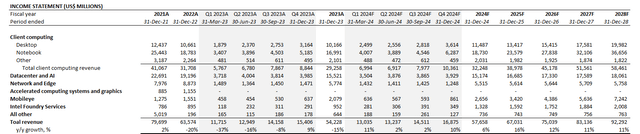

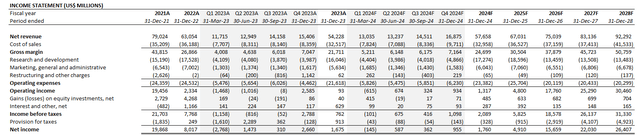

Fundamental Considerations

Adjusting our previous forecast for Intel’s actual Q4 performance and 2024 outlook, we expect the company to grow 7% y/y to $57.7 billion in revenue in the current year. Specifically, the gradual client computing segment recovery observed over recent quarters is expected to persist through 2024, though lumpy. We estimate demand to be back-end weighted due to the anticipated seasonality boost that will be complementary to an impending upgrade cycle as the AI PC ecosystem ramps up. Meanwhile, DCAI is likely to remain dragged by the market’s hyper demand for accelerators over CPUs, given Gaudi’s comparatively lesser interest in rival products in the market. The ramp of AI-optimized Emerald Rapids shipments to OEMs in Q1 could likely have some of its share cannibalized by subsequent launches of Sierra Forest and Granite Rapids later in the year.

On the cost front, Intel’s progress on realizing annualized cost savings of $3 billion exiting 2023 is accretive to continued margin expansion efforts in the current year. However, Intel faces inherently higher costs in the first half to accommodate the ramp-up of recent product launches. This is in line with the slight gross margin compression guided by management for Q1, which likely will not normalize until later in the year. Hence, the full-year 2024 impact of annualized cost savings reached in 2023 is likely to be partially offset by the near-term production cost dynamics.

But over the longer term, we view Intel’s recent spinoff of its Articul8 enterprise AI software platform as a boon to its opex structure. Specifically, corporate venture capital and external investments into adjacent technologies have been on a rapid rise. The strategy allows companies to invest and partake in innovative growth investments, without bearing material implications on the parent’s P&L. This has also been largely incentivized in recent years, as investor preference shifts from “growth at all costs” to sustained profitable expansion.

Through its spun-out investment in Articul8, Intel effectively reduces its corporate R&D exposure without fully compromising on its longer-term participation in innovative growth opportunities. This accordingly enables a positive impact on Intel’s EPS by also contributing favorably to furthering its $3 billion annualized net cost savings target in the long run.

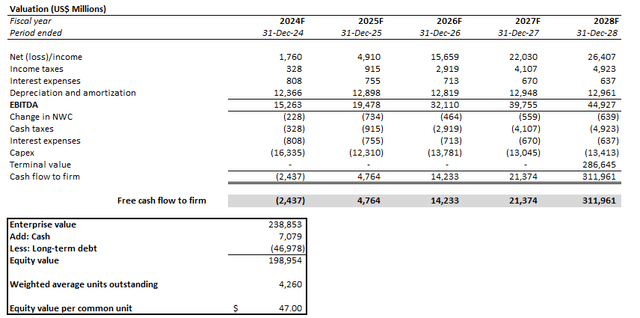

Intel_-_Forecast_Financial_Information.pdf.

Valuation Considerations

While the progress of new customer wins and node advancements at IFS are key positive developments to Intel’s IDM 2.0 strategy, the segment remains a core driver of Intel’s capital outlay. This is consistent with the recent start of production of “Fab 9” in Mexico, which specializes in Intel’s proprietary “Foveros” 3D packaging technology. As such, we expect capex in the ~$16 billion range for the full year 2024, which is largely in line with spending in the prior year. Specifically, Intel’s capital intensity pertaining to IDM 2.0 is not expected to normalize lower until mid-decade when the go-to-market of its “five nodes in four years” ambitions start to scale. This is consistent with the fact that currently available IFS capacity is still primarily a function of internal use by Intel.

Meanwhile, as discussed in the earlier section, Intel has also yet to demonstrate potential for the realization of an upward valuation re-rate in the near term. There are limited catalysts ahead for Intel, as emerging opportunities like AI PC keep getting undercut by rivals’ offers of better alternatives.

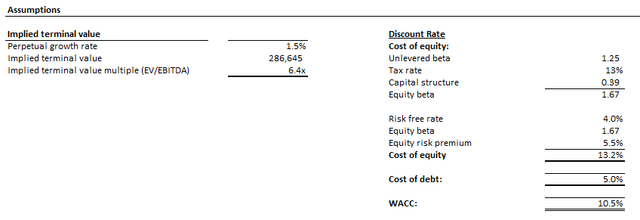

Taken together, we are setting our price target for Intel at $47.

The price target is computed under the discounted cash flow, or DCF, method based on projections taken in conjunction with the fundamental analysis discussed in the earlier section. The analysis assumes a 10.5% WACC in line with Intel’s capital structure and risk profile. A perpetual growth rate of 1.5% is applied to reflect Intel’s longer-term prospects. We have dialed down our perpetual growth rate estimate from the previous analysis to be closer to the pace of long-term economic growth across Intel’s key operating regions. The change reflects our conservatism as Intel’s recent fundamental progress demonstrates insufficient support for prospects of an upward valuation re-rate nor durable valuation premium to peers in the near term. The assumption is also consistent with our conservative view on the AI premium attributable to the stock, as Intel’s efforts in building a differentiated competitive advantage remain in the works.

The Bottom Line

Admittedly, Intel’s consistent positive progress observed in executing its underlying operations over recent quarters is an impressive feat. However, the stock’s valuation multiple expansion prospects remain largely a function of industrywide and broader market trends, which is a limitation in our view. Intel continues to lack a company-specific moat capable of catapulting its valuation back to levels comparable to the average of peers with a similar growth and earnings profile. And with regards to AI tailwinds, Intel also has much to prove as its ability to substantially monetize has not yet come through. While we appreciate the fundamental progress made, we are remaining on the sidelines as Intel Corporation’s prospects of unlocking a much-needed upward valuation re-rate to make sense of its significant IDM 2.0 investments remain to be seen.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly, exclusive research content and ideas, and tools designed for growth investing, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to research coverage, exclusive ideas and complementary financial models

- Monitored and regularly updated price alerts for our coverage

- A compilation of complementary tools such as growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!