Summary:

- Intel’s stock had its worst day since the beginning of the pandemic after issuing a weak forecast for Q1-24.

- The market is underestimating Intel’s performance, as Mobileye and Intel Foundry Services had record sales in 2023.

- Despite the disappointing outlook, Intel beat profit expectations, and the stock is now at a 12% discount, presenting a buying opportunity.

JHVEPhoto/iStock Editorial via Getty Images

Intel Corporation (NASDAQ:INTC) had its worst day since the beginning of the Covid pandemic in 2020 on Friday, the day after the chipmaker issued a forecast for 1Q-24 that lagged estimates.

Intel blamed first quarter headwinds on weakness in Mobileye and its programmable chip business but considering that Mobileye (as well as Intel Foundry Services) produced all-time sales records in 2023, I think the market is erring in its assessment of Intel’s fourth quarter earnings.

Consequently, I would posit that Intel may be good value on the drop, particularly because Intel’s sales are anticipated to slow, albeit at a slower pace.

A recession also doesn’t seem to be on the horizon and Intel’s Chief Executive officers said that it expects no substantial weakness in its main businesses.

Taking into account that Intel also beat profit expectations and that the stock can now be gobbled up at a 12% discount to Thursday’s price, I think that the ‘shock’ earnings release is presenting a compelling buying opportunity.

Intel Delivered A Double-Beat

Intel, one of the largest semiconductor chip manufacturers in the world, was dealt a major blow by investors on Friday even though the company beat the Street’s sales and profit estimates.

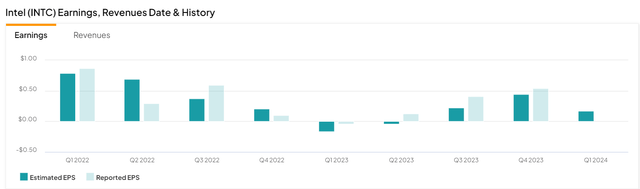

Intel delivered a double-beat, saying that its quarterly normalized earnings amounted to $0.54 per share in the last quarter of the year, which exceeded the estimate of $0.45 per share by a good margin. Total sales amounted to $15.4 billion, thereby exceeding the consensus of $15.2 billion.

Earnings (Yahoo Finance)

Why I Think The Market Is Wrong

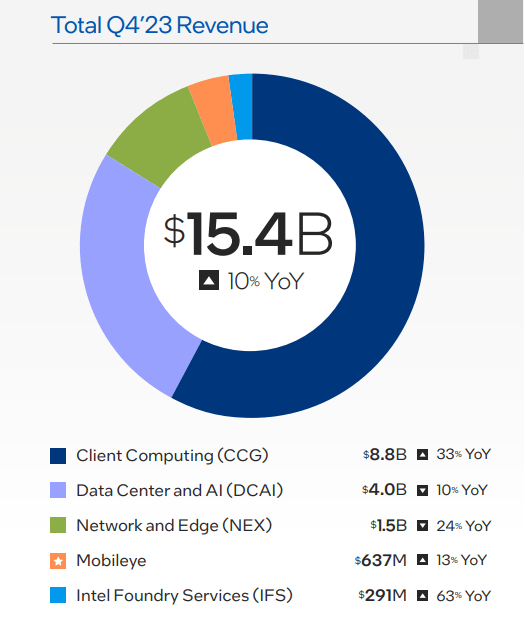

Intel overall reported robust 4Q-23 earnings that in addition to the profit and sales beat showed that three out of five segments, Client Computing, Mobileye, and Foundry Services, produced double-digit growth in the fourth quarter.

The biggest part of Intel’s operations is Client Computing which is primarily dealing with hardware sales. This segment had quarterly sales of $8.8 billion, up 33% YoY, and the segment added $0.9 billion in sales relative to 3Q-23.

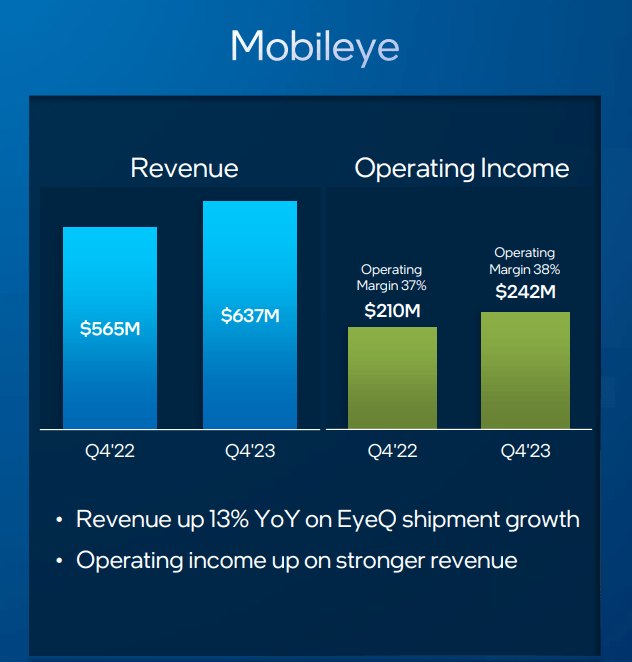

Mobileye, which develops autonomous driving technologies and advanced driver-assistance systems, was spun off from Intel in 2022 and Intel continues to have a majority stake in the company.

Mobileye produced 13% YoY sales growth in 2023 and just had its best year ever in terms of sales ever. Mobileye’s total 2023 sales were $2.1 billion which made it the second-best performing business of Intel’s portfolio.

Foundry Services, which is the key vehicle for Intel to build a global foundry business, had an equally outstanding quarter, producing $291 million in sales and delivering an eye-popping 63% YoY sales growth.

Foundry Services, like Mobileye, had a record year in terms of 2023 sales as well, producing 103% YoY growth and total sales of $952 million.

Total Q4-23 Revenue (Intel Corp)

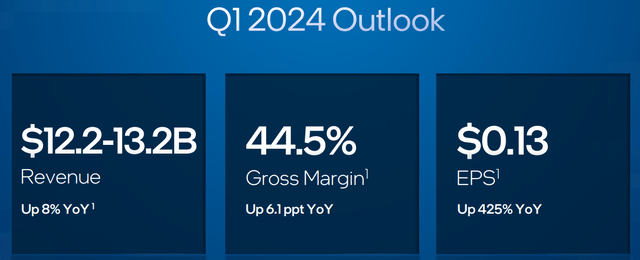

Though Intel’s performance was quite solid, at least as far 4Q-23 was concerned, Intel did disappoint with respect to its 1Q-24 outlook that anticipates a paltry YoY sales growth rate of 8% and sales of only $12.2-13.2 billion. The market anticipated an implied YoY growth rate of 20%.

Intel’s 1Q-24 guidance obviously is a let-down, but investors should not forget how dire the situation was for the company a year ago which is when, in 1Q-23, Intel’s sales plunged 36% YoY. Since then, the business as well as the outlook have noticeably improved.

Q1-24 Outlook (Intel Corp)

Intel’s Chief Executive Officer said on the analyst call that the softer-than-expected outlook for 1Q-24 is mainly due to weakness in Mobileye and doesn’t particularly affect its underlying core businesses in Client Computing and Data Center/AI.

Intel’s stock nose-dived 12% on Friday, erasing about $25 billion in market value as a result. Intel CEO Patrick Gelsinger said that management expects “healthy” demand for its PC and server processors and that it “would report sales at the low end of the seasonal range.”

But I think that the market is wrong here, particularly when recognizing that Intel did guide for HSD (high-single digit) growth in sales on a YoY basis, so we are not talking about negative growth here. Furthermore, Mobileye represents only a rather small fraction of Intel’s overall sales.

Based on 2023 figures, Mobileye produced $2.1 billion in sales whereas Client Computing produced $29.3 billion and Data Center/AI reported $15.5 billion in sales. Only Foundry Services is smaller than Mobileye in terms of 2023 sales with a full-year sales volume of $952 million.

All segments considered, Mobileye accounted for only a very small percentage of sales: 3.9% based on 2023 full-year sales. In short, the 12% stock plunge on Friday is widely out of proportion relative to the actual sales amount at risk of a segment-specific growth slowdown.

Though Mobileye produces a relatively small amount of sales, it does have a lot of potential in the autonomous driving market. Demand for autonomous driving technology is only going to grow as cars get smarter and the development of AI-enhanced driving platforms are key segment strengths that Mobileye could exploit in the long haul.

The segment is very profitable also. In 4Q-23, Mobileye had the highest operating margin, or OM, in Intel’s portfolio with 38%, which was even better than the 33% OM in Client Computing.

Operating Income (Intel Corp)

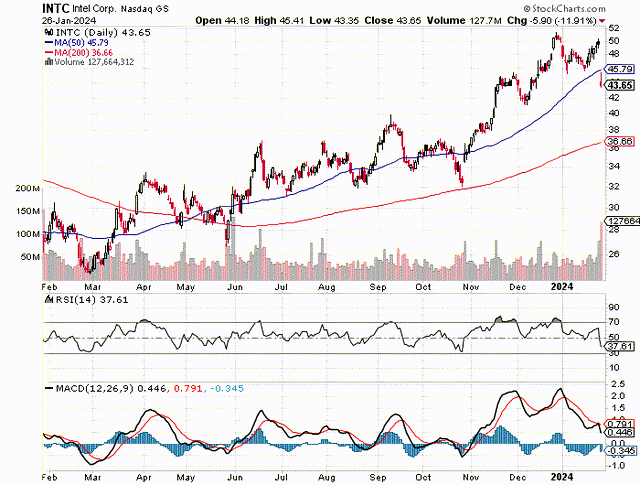

What Does The Chart Picture Tell Investors?

The 12% stock plunge has pushed Intel below the 200-day moving average line, which obviously is a bearish chart signal, but only in the short term. The Relative Strength Index signals relief, meaning Intel was close to being overbought before the drop.

As such, I see the drop as a healthy correction. If Intel’s stock can gather strength here and find support at the 200-day moving average line, Intel may be due for a fast rebound.

Relative Strength Index (Stockcharts.com)

Intel Is Now Selling At A Compelling Multiple

Intel is not a complete steal, but it is cheap enough to suggest that investors are getting a discount deal here, at the very least.

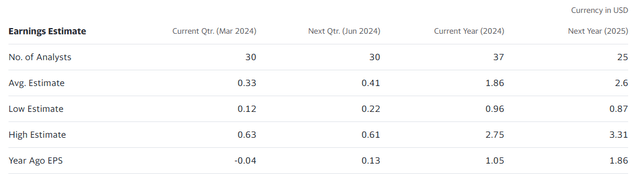

Intel earned $1.05 per share in 2023, but the market’s profit estimates have skyrocketed lately, primarily because the PC market is anticipated to grow 3.4% in 2024, according to the IDC. The recovery in this market is poised to aid Intel’s main business, Client Computing, which is about 14x bigger than Mobileye.

Intel is anticipated to earn $2.60 per share next year which, based on a stock price of $43, reflects a 17x earnings multiple which I consider to be a bargain. This earnings multiple is discounted 12% from last week and I think the multiple is compelling enough to warrant a Buy recommendation.

Earnings Estimate (Yahoo Finance)

Why I Might Be Wrong

Intel’s stock price can head lower in the short term, no doubt about that. There is also the possibility that Intel’s margins will take a hit if weakness in the Mobileye segment continues. The 1Q-24 outlook already implied that Intel’s gross margin will fall 4.3 percentage points QoQ, but on a YoY basis, Intel’s gross margin is still anticipated to grow.

A recession might make things worse for Intel, but this also doesn’t seem to be on the horizon, at least not at the moment. If weakness were to spread from Mobileye to Client Computing and Data Center/AI, then a Buy stock classification may be harder to justify.

My Conclusion

Intel’s 1Q-24 guidance was a bit of a ‘shock’ but the market has lost its mind regardless by shaving off $25 billion of the company’s market value.

Management has clearly stated that it sees short-term weakness related to Mobileye and its programmable chip business, not its main businesses, Client Computing and Data Center/AI.

Mobileye accounts for less than 4% of sales. Though the segment has momentum in terms of sales growth and margins, I think that investors are getting carried away here with negativity.

Intel’s stock is quite attractively valued after the crash and if the 200-day moving average line holds, Intel could rebound in no time. I think the situation is promising from a risk/reward point of view. Buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in INTC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.