Summary:

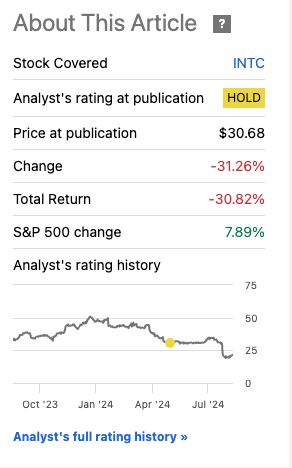

- Intel’s Q2 ’24 earnings disappointed, leading to a 30% drop in share price and reaching the fair value target quicker than expected.

- Revenue growth has been stagnant, with challenges in the AI PC market and competition from companies like Qualcomm and Nvidia.

- Margins have taken a hit, with job cuts expected to save $10 billion in 2025, but there is a long road ahead for Intel to recover profitability.

JHVEPhoto

Introduction

Intel Corporation (NASDAQ:INTC) recently reported its Q2 ’24 earnings, which were negatively met by the Street, to say the least. I wanted to take a look at the company’s financial situation and comment on its outlook, outlining my reasons why, even reaching my previously established fair value per share, I am still not convinced. The company may be heading in the right direction on paper, but it is going to take a lot more, which means the company’s share price will not recover any time soon; therefore, I am in no rush to start a position here.

Back in May, I upgraded Intel to a hold mainly because I saw some signs of a turnaround, but it was still too expensive given how slowly it is turning itself around. Fast-forward a quarter, and the company is at my fair value target; however, I am not jumping it just yet.

Seeking Alpha

Briefly on the Results

Starting at the top, the company’s revenues came in at $12.83B, down about -1% y/y, and missed by $150m versus analysts’ estimates. On a GAAP basis, the company recorded a loss of -$0.38 a share vs +$0.35 a year ago, while on an adjusted basis, EPS came in at $0.02, a miss of $0.08 a share versus analysts’ estimates.

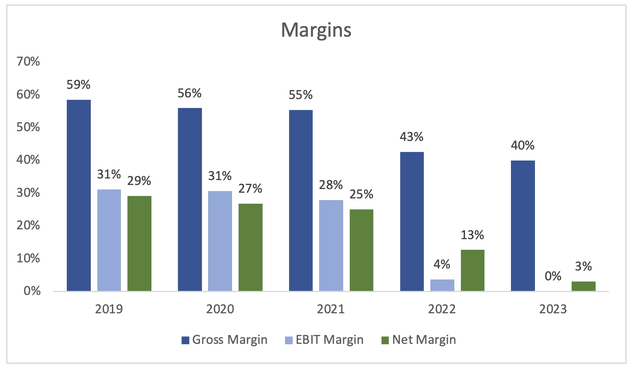

In terms of margins (non-GAAP), GM came in at 38.7%, down 110bps y/y, and almost 500bps below the company’s April outlook. EPS of 2 cents (non-GAAP) is down 11 cents y/y and well below the management’s April outlook (8 cents below).

On the next quarter outlook, the guidance came in much lower than consensus estimates, with revenues projected to be $13B at the midpoint vs $14.39B consensus, non-GAAP EPS of -$0.03 vs $0.32 consensus.

In terms of the company’s financial position, the cash and equivalents stood at around $29.2B against a massive pile of debt of $48.3B. It’s a bit risky when the company’s operational performance has been anything but satisfactory, however, given that its interest line comes in positive, it means the company’s cash and ST investments generate more than it is paying out in annual interest expenses on said debt. I’d say it would be worthwhile to start to meaningfully pay down this debt in the future, with all the savings it plans to do over the whole, which I’ll touch on in the next section. Many investors don’t like when companies overindulge in debt, and with the recent plummet in the company’s value, that debt stands at half of its market cap.

This quarter was just bad all around. With such a disappointing performance and disappointing guidance, the company’s share price plummeted 30% at one point, reaching my PT I set back in May much quicker than anticipated.

Overall, I can see a company that has been struggling to find itself, and drastic measures are needed to prove to its loyal shareholders that the light at the end of the tunnel is in sight, which in my opinion, is just a small dot in the darkness so far. So, let’s look at some reasons why the company hasn’t convinced me yet.

A Challenging Road Ahead

Revenue Growth

Over the past decade, the company’s revenues moved nowhere. In 2014, the top line came in at almost $56B. In 2023, that number came in at a little over $54B, which means its 10-year CAGR was -0.3%. Analysts’ estimates see another -3% growth for FY24, so the CAGR is just getting worse. So, what is going to help the company’s top-line going forward? The AI PC refresh cycle should give it a decent boost, I would; however, I don’t think that alone is sufficient. The company’s CCG segment saw around 9% growth y/y, which could just be the beginning of the refresh cycle, and we should expect it to ramp over the next year; however, it is hard to tell if that is going to be the case. The global PC market saw a 3% growth in Q2 ’24, so a recovery in this segment is on its way, which should benefit INTC going forward; however, I believe we will see higher growth numbers going forward due to the products having AI capabilities, which should attract decent demand for the next few years. We don’t know how receptive the public is going to be to such products, but I am sure there will be many who will want to try out the new powerful gadgets going forward, for the right price that is. I’d like to see much more robust growth going forward to convince me that these AI-capable laptops and PCs are worth the money and drive significant growth. With Qualcomm’s (QCOM) Snapdragon X Elite Chip, ARM-based chips are getting a lot more popular due to their efficiency and running snappier and quiet, unlike the chips from INTC, which left a bad taste in many customers’ mouths who still opted for an Intel-based chip in Macs instead of M1 chip. With such great reviews coming from X Elite chip laptops, INTC has stiff competition now not just from Apple (AAPL) but also QCOM who have entered the laptop market with an amazing chip that is a lot more powerful and efficient. So, I am worried that growth in this segment may not be good enough when buyers opt for a better product, which may not be an Intel product.

Foundry Business – The Catalyst

Many investors who still hold INTC in their portfolio seem to bank on the company’s Foundry Business, and yes, it is a significant part of Intel’s strategy, I don’t think it is going to be the thing that will propel its revenue growth any time soon, mainly because of the significant competition that is the juggernaut Taiwan Semiconductor (TSM). Intel surely has made significant investments in the foundry business, TSMC is just so much further ahead and has a lot more experience overall, that it is hard to see how anyone would choose IFS instead of TSMC. However, I also don’t doubt that IFS will power through and start to grow at a decent pace mainly because of the CHIPS Act, and that the government will most likely do anything in its power to make IFS as competitive as possible to reduce its reliance on international chipmaker companies due to national security reasons and political risks. This can only be good for INTC, however, given the fact that the US government is pushing TSM to build factories on American soil, everything is up in the air regarding the competitive position of IFS when the big player is also entering the same region. Last month, TSM reported its Q2 earnings that showed robust top-line growth, while Intel’s IFS barely grew 3.5% y/y this quarter. INTC needs a customer like Nvidia (NVDA) to help its top-line growth. In the revolution era of AI, such growth is not acceptable, and it looks like some priorities need to be shifted.

Artificial Intelligence

The company’s Gaudi 3 is the product to compete with Nvidia’s AI chips, specifically with the H100. Here, once again, we can see that the alternatives are better. Nvidia’s H100 can almost be considered outdated by now, with the announcement of the next-generation GPU. So, Intel’s Gaudi can only compete with the H100, and I supposed to be much more economical and efficient than the H100, however, many big players in the tech industry like Amazon (AWS), Microsoft (MSFT), Alphabet (GOOG), and Meta Platforms (META) are ramping up their AI spending, which to me sounds like they are going to aim for the top-player in the business in terms of power, and that will be the upcoming Nvidia AI chips.

However, I do think there will be a demand for INTC’s Gaudi 3, for example, companies who are not looking for the raw power output and are looking for efficiency and affordability. In other words, the company is fine with lower performance because it doesn’t need all of that next-generation performance, so it is good to have alternatives.

Margins Progress

Over the last few years, the company’s margins took a big hit. At the height of the pandemic, and a little before it, the company’s margin profile looked very different. The last two years show a completely different company. A company that may have invested in the wrong ventures along the way that eroded its profitability. The management says that these investments will take time to bear fruit, and that may be true; however, I am not confident that it will improve any time soon. The quickest fix to this right now came from the company’s announcement that it will cut 15% of its workforce, which is around 15,000-18,000 jobs. The immediate savings are unknown, but the company expects to save over $10B in 2025. That is sorely needed. I would like to see how these job cuts will turn out in the next two quarters, as the company did mention that most of it will happen in the second half of 2024. Are we going to see a drastic shift in margins? Q3 certainly not because the company still guides GM to be 34.5% and 38%, GAAP and non-GAAP, respectively.

I would like to see the company’s margins begin to recover, and it looks like there is still a long way to go, especially since the management expects further margin pressures to drive the AI PC category.

Closing Comments

So, it looks like the company still has a long way to go. Also, a theme emerges. Whatever the company is planning on producing, competition seems to be a few steps ahead. That doesn’t mean that the company’s products are no good, but it certainly means it is not the leader it once was. Other players came along, while Intel was enjoying its dominance a decade ago, maybe ignoring the competition and thinking it will continue to be the best. The competition caught Intel slacking and took advantage, and now the former king is playing catch up in many of the categories, and it will take a long time. However, being an American company, I have a hard time believing that it is not going to happen. With that said, I still think there is a lot of volatility ahead for the company and I could see the shares not performing well compared to the broad market and its competitors; therefore, I am staying away even as it reached my fair value target recently. I am not fully convinced it is close to a turnaround.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.