Summary:

- Intel’s stock has increased by 23% since a bad Q4 2022 earnings report, outperforming the Nasdaq, Dow and S&P 500.

- The market is valuing Intel at under 3x TTM revenue, but the company still faces challenges in generating positive cash flow.

- Despite the numbers, we believe Intel is a wise investment due to potential US protectionist measures and the new CEO’s ability to improve performance.

Rawf8

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice, and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Make Chips Great Again

Back in January this year, we posted a relatively unusual earnings review covering Intel’s (NASDAQ:INTC) diabolically bad Q4 2022. The numbers, we said, were truly dreadful, but we thought the stock would probably go up anyway.

January 2023 INTC Stock Note (Seeking Alpha, Cestrian Capital Research, Inc)

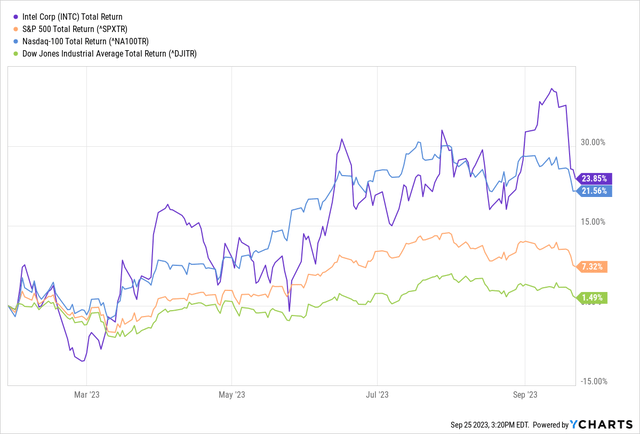

This has been a righteous call so far, with INTC up 23% on a total return basis since then, a whisker ahead of the mighty Nasdaq but a country mile ahead of the Dow and the S&P 500.

INTC vs. US Equity Indices, Total Return 27 Jan 2023 To Date (YCharts.com)

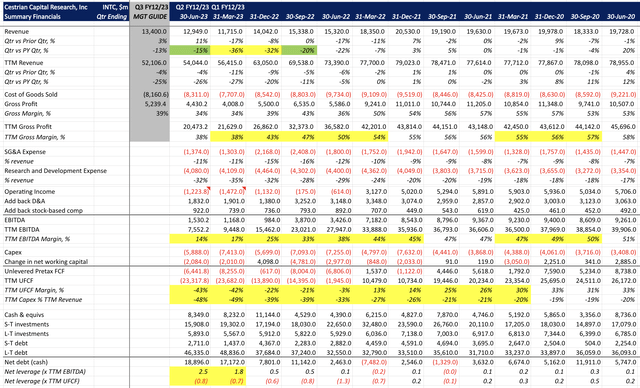

Since that time, Intel has delivered two more earnings reports, for Q1 and Q2 of FY12/23. The best we can say about those prints is that the revenue line is getting worse more slowly than before. And the worst we can say is that positive TTM unlevered pretax free cash flow remains a far-off mirage for this formerly cash-gushing business.

Let’s take a look at the up-to-date numbers.

INTC Fundamentals (YCharts.com, Company SEC Filings, Cestrian Analysis)

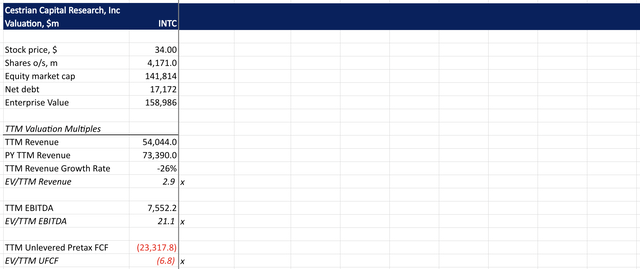

The market is asking you to pay a touch under 3x TTM revenue for INTC.

INTC Valuation (YCharts.com, Company SEC Filings, Cestrian Analysis)

Is this a wise investment still? Was the run from January merely a fluke, an artifact of the tech stock recovery in the first half of 2023? You can see that already Intel stock is down from its highs of the year. Will reality (look at that cashflow multiple!) bite?

Well, we believe our original thesis remains intact. It’s still not about the numbers – at least not the look-backwards numbers – it’s about the US protectionist play.

Bloomberg today reported that the US Treasury Department is working on a sector-specific stimulus measure designed to further advantage the US in the race for global silicon supremacy. Intel remains the US’ best shot to re-shore advanced semiconductor manufacturing. We believe this amounts to a soft “DC put” underpinning the stock. Our opinion – which has yet, in truth, to be supported by the numbers – is that the new CEO is capable of fettling Intel and getting it back on the right track, which is to say capable of moving through process nodes at the right time, spotting and executing on new market opportunities, and turning around that cash flow performance.

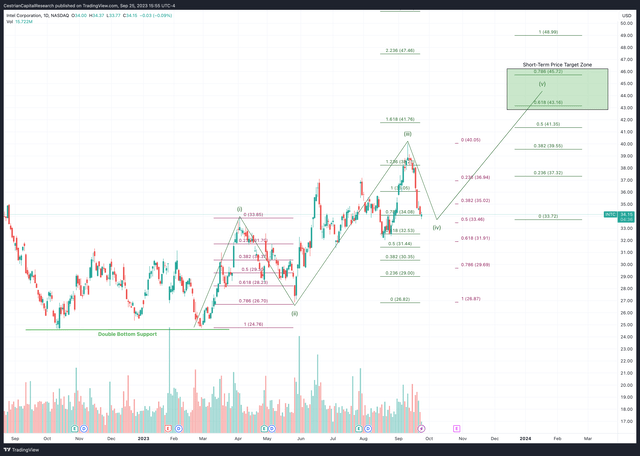

Intel peaked at $40 this year and has since sold down to $34. We believe the stock is putting in a short-term low around now, and can make a short-term run to somewhere between $43-46, a 25-35% return from here. Here’s our short-term chart (you can open a full page version here).

INTC Short Term Chart (TradingView, Cestrian Analysis)

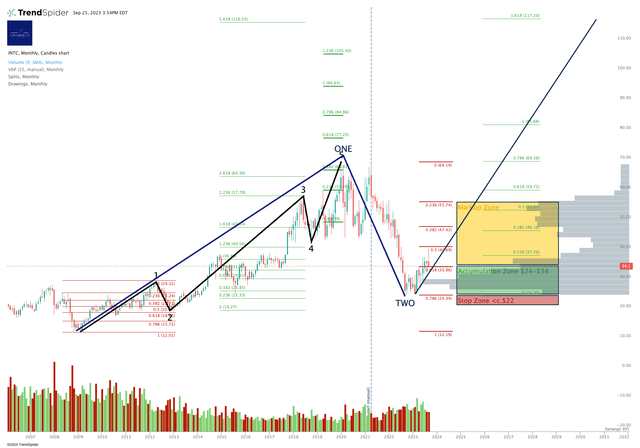

Longer term, we think the name can truly run. Here’s our longer-term chart – you can open a full page version, here. We think north of $110 – better than 3x money from here – is possible.

INTC Medium Term Chart (TrendSpider, Cestrian Analysis)

With the stock right on the line between our Accumulate and Markup Zones, we rate the name at Accumulate, given the significant potential we see from here.

Cestrian Capital Research, Inc – 25 September 2023.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives.

Business relationship disclosure: See disclaimer text at the top of this article.

Cestrian Capital Research, Inc staff personal accounts hold long positions in INTC

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

GET INSTITUTIONAL GRADE BUYSIDE RESEARCH FROM CESTRIAN CAPITAL RESEARCH

We provide investment research prepared to institutional investor quality, presented in a way anyone can understand. Our work allows you to make sense of company fundamentals and stock technicals without resort to jargon or esoterica. We provide actionable ideas and disclose all staff personal account positions in covered stocks. Superb investor community works together 24/7 to achieve better outcomes. Join us! Click HERE for more.