Summary:

- Intel’s ongoing transformation under Pat Gelsinger faces setbacks, with layoffs and delayed fabs, casting doubt on business improvements.

- The AWS deal isn’t material enough to turn around a struggling foundry business, and questions exist in why Amazon is using Intel.

- The cost reduction plans, including $10 billion cuts and 15,000 layoffs, highlight financial strain and inefficiencies compared to rivals like Nvidia and AMD.

- Investors should avoid Intel stock as it focuses on cost-cutting and government subsidies, while leading AI chip companies advance with new technologies.

JHVEPhoto

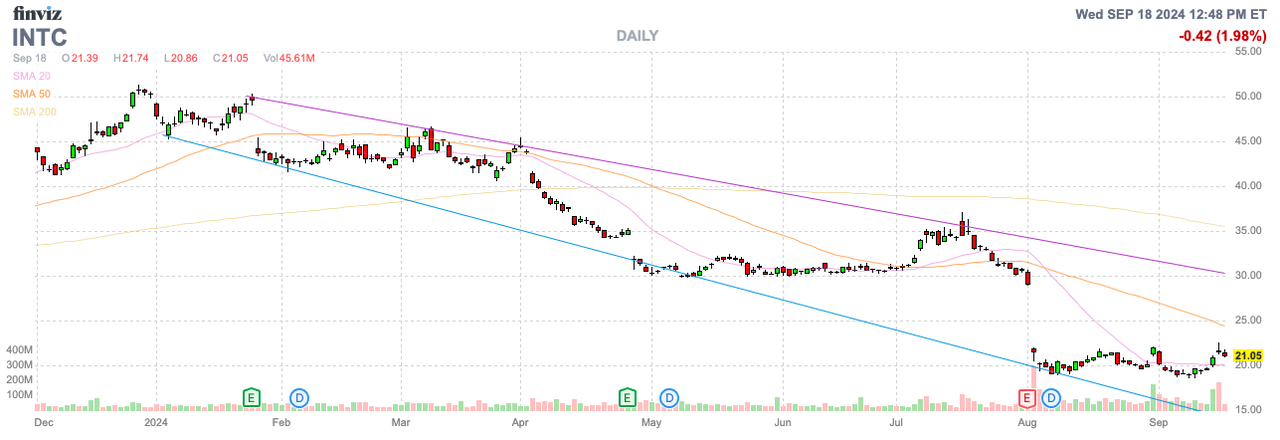

As usual of any corporate transformation, a company tries to present to the market the most positive view of the changes. Intel Corp. (NASDAQ:INTC) has been in a transformation under Pat Gelsinger for the 3.5 years since his hiring in February 2021, yet the company continues to announce more layoffs and pushed out plans. My investment thesis remains Bearish on the stock, even trading at just $20 with no business improvements in sight.

Delaying More Fabs

Intel sent out a message to employees and to Wall Street. The message was focused on the transformation of the business and expanded strategic collaboration firm Amazon Web Services.

The reality is that the only major business news was Intel delaying 2 fabs in Europe, Germany and Poland, for 2 years and working through a current workforce reduction of 15,000 employees. If the AWS deal was so meaningful, Intel wouldn’t be taking these other corporate actions, especially with booming global AI GPU demand.

The AWS deal involves an apparent multi-year, multi-billion-dollar framework covering product and wafers from Intel. Intel will produce an AI fabric chip for AWS on Intel 18A, the company’s most advanced process node. Intel will also produce a custom Xeon 6 chip on Intel 3.

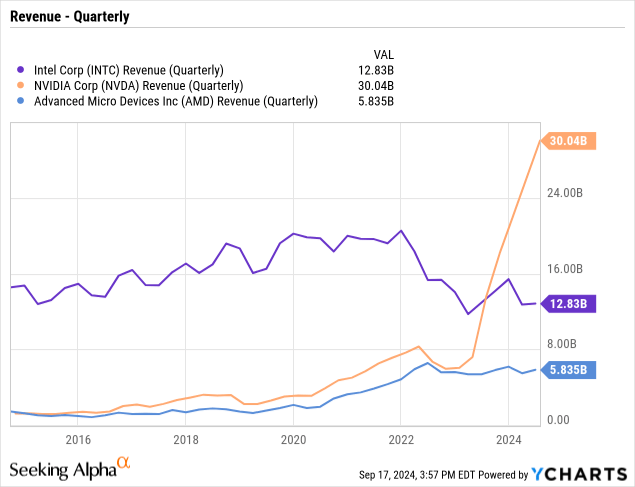

For a chip company with sales still in the $50+ billion range, a multi-billion deal over a period of time isn’t necessarily material. After all, Nvidia (NVDA) has added over $20 billion in quarterly sales in the last year while Intel has failed to delivery competitive GPUs for AI and watched sales fall dramatically.

The biggest issues with deals like this is whether the company trying to transform is providing big discounts to keep a customer, or whether AWS is unable to get capacity at the leading foundry supplier in order to produce the most advanced chips. Either way, the deal doesn’t strike as AWS choosing Intel for their leading technology node where the company would pay premium prices for these chips. Either way, those details are unknown at this point.

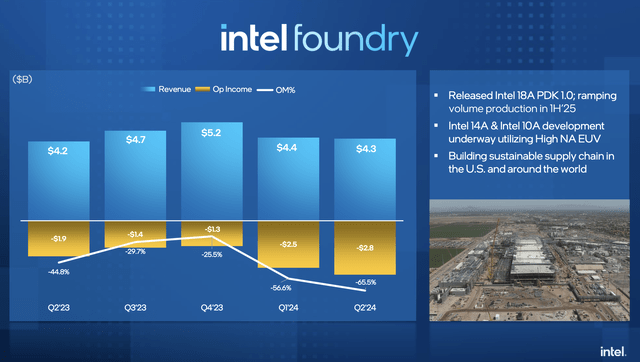

Intel’s Foundry business already technically does nearly $20 billion in annual revenues due to internally producing chips for Intel. The Foundry business lost $2.8 billion in Q2 making the business almost impossible to spinout considering the massive investments required to somehow turnaround the business into producing a profit.

Source: Intel Q2’24 presentation

Considering the size of the foundry business, one has to wonder if Intel isn’t charging itself enough for the manufacturing part. In addition, Intel only produced ~$300 million in revenues for external customers, including existing work with AWS.

Intel claimed $15 billion in future external foundry work through the end of the decade. The AWS part has an unknown impact on those volumes, which adds to the difficulties of analyzing a large “multi-year, multi-billion” program.

Also notably, Intel is the only major chip company focused on U.S. government grants. The foundry company is unique in being so focused on this part of the business, unlike most American chip companies just focused on chip design.

Still, Intel announced up to $3 billion in direct funding via the Secure Enclave program for the U.S. Department of Defense. The company already has funding from the Chips Act, providing $8.5 billion in subsidies and $11 billion in loans.

Again, this is a scenario where a company with a thriving business wouldn’t be so focused on deals with government restrictions and normal red tape.

Misleading Cost Reductions

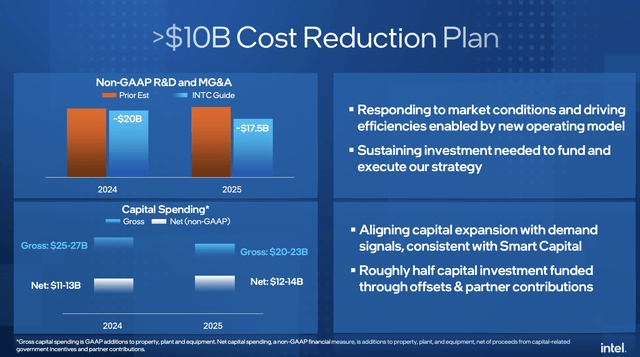

Along with Q2’24 earnings, Intel announced a further $10 billion cost reduction plan. The company only announced a $2.5 billion reduction in operating expenses from the $20.0 billion target in 2024 to ~$17.5 billion in 2025.

Source: Intel Q2’24 presentation

The rest of the cost reductions are with capital spending. Though this is only Intel spending less on the future fabs or funding capital investments via partner contributions reducing the outcome for the chip company.

Intel now forecasts spending roughly $11 to $14 billion annually on net capex for 2024/25. TSMC (TSM) is spending over $30 billion annually, while Intel does forecast still spending over $20 billion gross in 2025. Even worse, Intel is cutting back capex in 2025, TSMC might spend up to $37 billion next year due to surging demand for 2nm capacity.

A big question is how the delayed fabs in Germany and Poland fit into the spending plans back in August. Either way, Intel isn’t investing for the same economic benefit in 2026, whether gross spending is closer to TSMC, or not.

The company does plan to eliminate 15,000 positions in the 2H of the year, with roughly half already terminated. These job cuts are warranted to reduce the cost structure considering Nvidia (NVDA) only spends $3 billion on quarterly operating expenses, which is some $5 billion annually below what Intel still forecasts spending.

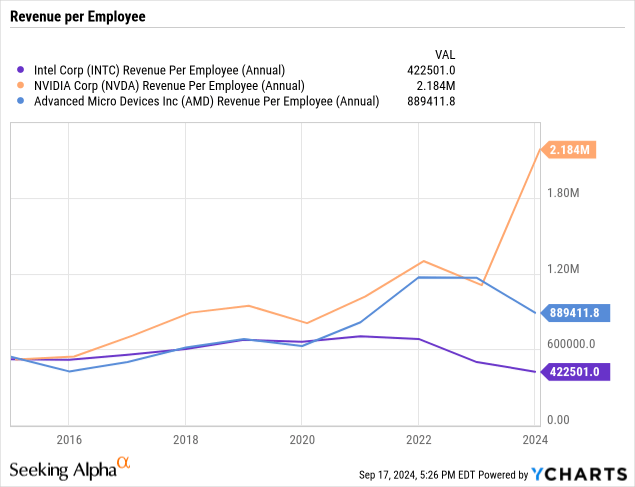

At the start of 2024, Intel was only producing $423K in revenues per employee. While AMD (AMD) has seen their productivity decrease during a tough 2023, but the amount is still more than double that of Intel. Nvidia produced nearly $2.2 billion in revenue per employee, and the metric has likely only expanded during 2024.

The problem with these major job cuts is that these processes are disruptive. Intel cut a limited 5,000 jobs back in 2023 and business has only gotten worse, while these layoffs are slightly more than 10% of its estimated global workforce of around 125,000.

The chip company probably needs to increase layoffs to fully transform the business. The stock only becomes intriguing once the layoffs are out of the way and Intel starts growing again. Right now, management is distracted with cutting employees and shifting work around to remaining employees, while new chips don’t show any promise of re-capturing market share from Nvidia or AMD.

Intel guided to a Q3 EPS loss of $0.03 based on limited gross margins of 38%. Even at $20, the stock has limited appeal, with employee disruptions likely rolling through future results and investors impacted by the suspension of the dividend.

Takeaway

The key investor takeaway is that Intel continues lowering future expectations and focusing on cutting costs and grabbing government subsidies, while the leading AI chip companies are full speed ahead on new chips. The corporate transformation continues to sink and investors should avoid the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market in September, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to double and triple in the next few years.