Summary:

- Intel stock has dropped to a historically low $20 per share, much more than the recent market dip.

- CEO Pat Gelsinger’s ambitious plans to turn the company around have sadly led to reduced dividends, increased capex, and disappointing revenue.

- With declining cash flows, increased debt, and uncertain future prospects, Intel’s valuation remains questionable, making it a Hold for now.

PeopleImages

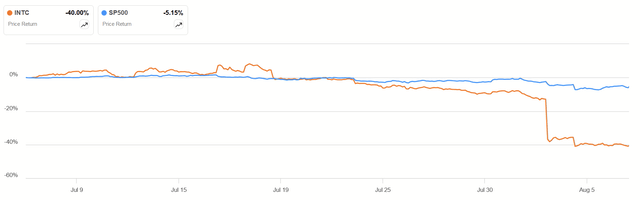

Intel (NASDAQ:INTC) has once again captured investors’ attention, its stock taking a shocking tumble, even compared to a broader market that experienced a dip recently.

INTC vs. S&P 500 1M Price Change (Seeking Alpha)

At around $20 per share, (some folks believe) INTC is finally in prime Buy territory. In my view, however, the last few years have also indicated to me that they haven’t quite figured out the right way to allocate capital. Therefore, I think the stock is a Hold until a much deeper discount presents itself or until there is a positive change in the financial winds.

Background

In 2021, Intel announced Pat Gelsinger was returning as CEO to replace Bob Swan. Swan had been heckled as a “bean counter.” Writing for MarketWatch in 2019, Therese Poletti observed:

Swan is a relative outsider, because he has only worked at Intel since 2016, compared with past Intel CEOs who have risen up through the ranks in long careers at the chip giant. More important, his expertise is in finance instead of technology, a problem at a company that has made its name as Silicon Valley’s most storied technological innovator.

With a record as CFO for Intel and other companies prior, many believed his leadership was the reason Intel was getting its lunch eaten by the likes of Nvidia (NVDA) and AMD (AMD), as they both captured more semiconductor market share. This eventually prompted the return of Pat Gelsinger, an engineer who had a deep history with the company, as the new CEO.

Gelsinger soon launched ambitious plans to turn the company around, reasserting its position as a chip leader. In 2021, they announced a $20 billion plan to develop two enormous fab sites in Arizona. Further plans were announced to expand their manufacturing capacity at greater scales than before, leading to much higher capital expenditures and lower free cash flow.

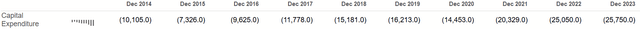

Trade-Offs In Capital Allocation

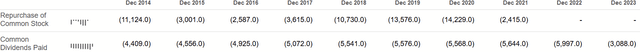

A few years into Gelsinger’s tenure, we’re in a position to judge if these decisions have started to pan out as previously imagined. Let’s talk first about what was given up that previously existed under Swan’s leadership: buybacks and dividends.

Buybacks and Dividends (Seeking Alpha)

These were a significant part of the investment thesis for much of the past decade. While INTC did not produce tremendous returns in the decade prior to Gelsinger’s tenure as CEO, this did make it a steady compounder for long-term holders.

INTC Total Return 2011 – 2020 (Seeking Alpha)

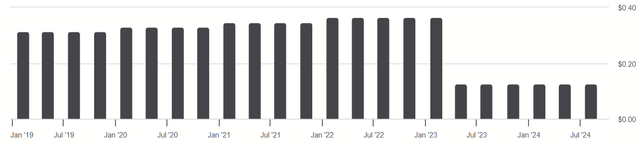

With buybacks grinding to a halt almost immediately in 2021 and the dividend experiencing a cut in 2023, anyone who relied on the old thesis needed to readjust and determine (re-think and decide whether) if Gelsinger’s plan would still produce attractive returns.

INTC 5Y Dividend History (Seeking Alpha)

During this announcement in 2023, the company stated:

Since first initiated in 1992, Intel’s dividend has delivered more than $80 billion in cash returns to the company’s stockholders, and the board is committed to maintaining a competitive dividend.

Reducing cash returned to shareholders enabled the company to finance these capital projects. Since then, annual capex is about $10B higher than it was under Swan.

Turning Point: Q2 2024

While there were some who believed in this new Intel up to this point, their latest earnings release and discussion alongside it has shattered whatever positive vision was previously held. The company reported disappointing revenue, plans to suspend the dividend entirely at the end of the year, and layoffs. In a public letter, Gelsinger wrote:

We plan to deliver $10 billion in cost savings in 2025, and this includes reducing our head count by roughly 15,000 roles, or 15% of our workforce. The majority of these actions will be completed by the end of this year.

This is painful news for me to share. I know it will be even more difficult for you to read. This is an incredibly hard day for Intel as we are making some of the most consequential changes in our company’s history…Simply put, we must align our cost structure with our new operating model and fundamentally change the way we operate. Our revenues have not grown as expected – and we’ve yet to fully benefit from powerful trends, like AI. Our costs are too high, our margins are too low.

Three years ago, Gelsinger was making a heroic return. Today, he’s sharing “painful” news and less revenue than “expected.” It seems to me that he did not set realistic expectations for investors (or perhaps for himself).

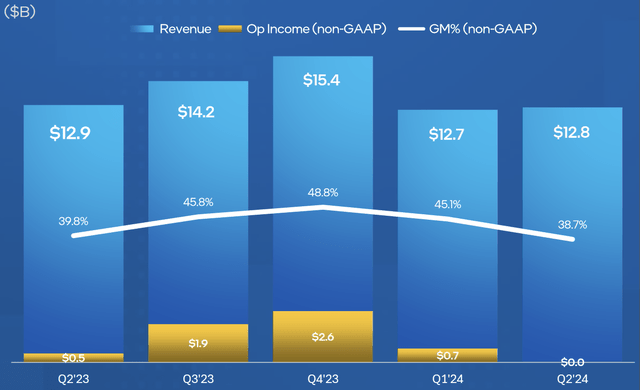

Declining Revenue (Q2 2024 Company Presentation)

Intel once reported $79B in revenue. For the trailing twelve months, that figure is a disappointing $55B. That difference is cash they needed to finance and fuel their continued developments. Its absence is forcing this tough decisions to find the money elsewhere.

Where just about every tech company reports record revenue with the advent of AI, Intel stands out in its struggle to maintain previous levels. This reads to me as more than just a temporary setback; I believe there is a fundamental misalignment among strategy, execution, and value with this company.

Valuation

We are left to ask: What is there for shareholders at this point? Buybacks are gone. Dividends will be soon as well. Operating cash flows, while remaining positive, have shrunk and are outgrown by capex. It’s unclear when or if these will return.

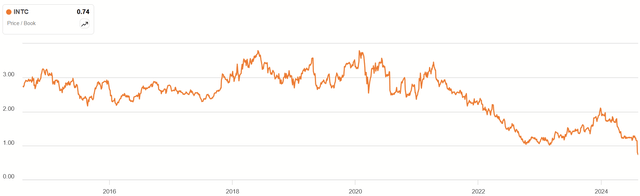

INTC Price/Book 10Y History (Seeking Alpha)

Some might note that INTC trades at a discount to book value for the first time in a decade now. Perhaps this reflects something, but let’s also consider what’s happening with its balance sheet.

LT Debt 5Y History (Seeking Alpha)

As free cash flow declined and disappeared, more long-term debt was necessary to finance these capital projects. Should Intel find itself needing more cash to cover its costs (and this seems likely with its depressed revenues), additional debt could prove to be a drag on book value. Alternatively, it may have to issue new shares, diluting current holders and closing the value gap on the balance sheet that way.

With its earnings release, Intel did point to some greener pastures on the horizon: an AI opportunity with its own AI PCs, declining capex as these projects reach their end, and tens of billions in opex saved for 2024, 2025, and 2026 with the recent layoffs and fat-trimming. Yet, it seems to me that for three years we’ve been told that things will get better, and that doesn’t appear to be the case.

At this point, I’m more skeptical than I have been before. With its failure to execute Gelsinger’s plan, Intel has more to prove now than it did then. For this reason, I think even a discount to book value at 25% likely represents a fair value, as more potential for a decline seems about as possible as a turnaround. Yes, that I even used “turnaround” for Intel is something in itself.

Conclusion

To say I want a better price is not to say that Intel is doomed. Rather, the company is soul-searching, rather uncomfortably, and it’s unclear when this will result in better fundamentals. It has room to err, survive, and eventually become a great investment again. Calling the recent dive in a share price a correction is apt. It achieved a more correct price, and the upside potential just isn’t quite potent enough for me to consider this undervalued.

Warren Buffett has spoken before about how some managers are great operators but not great capital allocators. As much as Swan was derided for his “bean counting,” there was at least some return on capital with this approach. With the fruits of Gelsinger’s three years so far, I am starting to doubt if he has an eye for capital allocation that will make INTC an attractive investment. For these reasons, I consider the shares a Hold until his plans start to produce the results he actually wants for a change.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.