Summary:

- Intel beat street revenue estimates for Q3, but badly missed on the bottom line.

- Management provided a decent current quarter forecast.

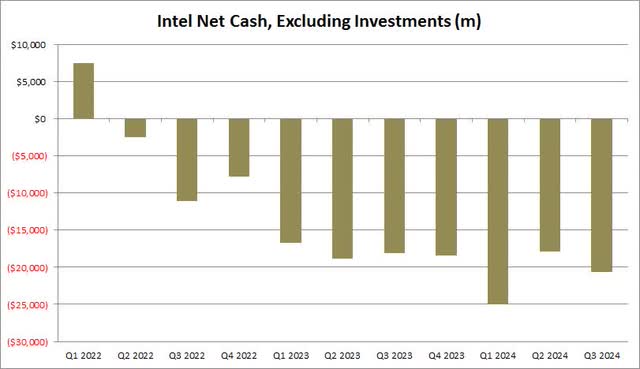

- The company’s balance sheet worsened in Q3, and remains deep in a net debt situation.

JHVEPhoto

Last Thursday afternoon, we received third quarter results from Intel (NASDAQ:INTC). The chipmaker has been one of the most disappointing names in recent years, failing to fully capitalize on tremendous growth in its space, sending shares crashing down while the overall market has soared. While last week’s report was far from a home run, there definitely were some bright spots that give investors a little more hope for the future.

Previous coverage on the name:

My last article on Intel was a couple of weeks ago, at which point I talked about the stock potentially losing its spot in the Dow Jones Industrial Average. With shares having been crushed in recent years, Intel was the lowest weight in the Dow 30, with the next lowest being roughly double that. Given that the top 5 and 10 holdings had become a bit overweight vs. historical norms, I thought that removing Intel for a higher priced stock could balance things out a bit more. As it turns out, it was announced that Intel would be booted after the bell on Friday, with Nvidia (NVDA) being the one to replace it.

In that article, I also mentioned a few key items I was watching for the Q3 report, primarily the end of this revenue decline cycle. Intel definitely needed to get its revenues growing again, and that could help provide some margin tailwinds. I was also curious to see if management talked about needing to raise more capital to shore up a debt heavy balance sheet. Since my last article, Intel has rallied 4% versus a small loss for the S&P 500, but I will note that the stock was behind the index going into last week’s report.

The Q3 report:

Intel expectations have been coming down for some time, but they definitely took a hit back in July when the company’s Q2 report was a true disaster. The company missed heavily reduced estimates and gave much weaker than expected guidance for Q3. Analysts were hoping then for revenue growth in the September period, but management said that a decline would be coming.

In the end, things weren’t as bad as previously thought. Revenues did decline by nearly 6.2% over the prior year period to $13.28 billion, but that beat by almost $250 million, with the street expecting a nearly 8% decline. Intel products revenue was down 2%, with the most important Client group down 7% as clients reduced inventory levels. The good news came from the Data Center up 9% and Network up 4%. The real hit in the period came from the company’s other segments, including Altera and Mobileye, which plunged 28% year over year.

With Intel announcing a major restructuring previously, the rest of the income statement was really scary. The bottom line took a major hit due to $15.9 billion of impairment charges and $2.8 billion of restructuring charges. Thus, non-GAAP gross margins were more than halved from 45.8% to 18.0%, leading to a 46 cent adjusted per share loss in Q3. The street was looking for a 3 cent adjusted loss, so this really was a kitchen sink quarter.

Looking ahead to Q4 and 2025:

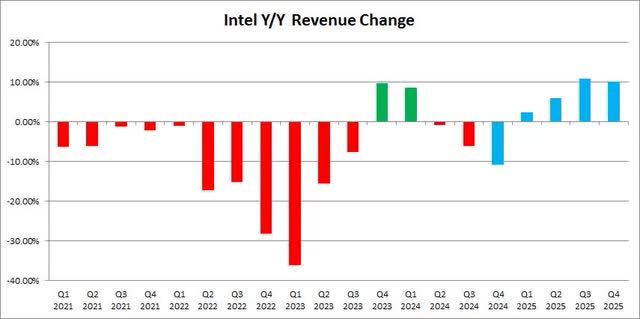

I mentioned previously that the current quarter is hopefully to be the last one where revenues decline on a year-over-year basis for a while. As the chart below shows, Intel has reported numerous revenue declines or even plunges in recent years, whether it be due to divestitures or bad performance. The blue bars represented street estimates going into last Thursday’s report, with hopes that 2025 would be a decent year of growth.

Intel Revenue History And Estimates (Seeking Alpha)

For the current period, Intel guided to revenues of $13.3 billion to $14.3 billion. The midpoint of that range came in a little above the street’s average estimate of $13.72 billion, which was nice to see. With those large charges in the rearview mirror, management thinks it can get to nearly 40% non-GAAP margins. The forecast for non-GAAP earnings of 12 cents was a nickel ahead of the street. It was stated on the conference call that management expects to size the business to support trend line revenue growth of 3% to 5% annually, with the ability to scale up to 7% to 9% as demand dictates. However, there was a note of caution regarding margins as it ramps Intel 18A and has a higher mix of outsourced products in the Client group.

Balance sheet and cash flow:

As Intel has seen large losses in recent years, the company’s balance sheet has gone heavily into a net debt situation. The good news is that Intel has received several billions in capital from partner contributions, or its large capex plans would have resulted in the need for further debt or equity raises. The company finished Q3 with a little more than $20 billion in net debt (when including equity investments), but above $26 billion when excluding them. As seen in the chart below, things took a hit sequentially.

Intel Quarterly Net Cash (Company Earnings Reports)

The company reported adjusted cash burn of $2.7 billion in Q3, and it expects to see the principal cash costs associated with the restructuring charges land in Q4 of this year. The good news is that management currently expects to see positive adjusted cash flow in 2025, which will hopefully allow the company to deleverage a bit. This would also reduce the possibility of any equity raises being needed, although there could be a debt raise if the company can get some favorable refinancing transactions through.

A look at current valuations:

The decline this year has put Intel shares at a valuation that makes them look like a depressed asset in this space. Since we’re almost all of the way through 2024, and now next year is expected to be the first major recovery for Intel revenue and earnings, I wanted to take a look at valuations based on each company’s next fiscal year. For Intel and Advanced Micro Devices (AMD), that’s December 2025, with Nvidia’s next fiscal period ending in January 2026.

Intel currently trades for about 22.6 times next year’s expected adjusted earnings and less than 1.77 times expected sales. AMD goes for about 27.4 and 7.1, respectively, while Nvidia is at 33.6 and 18.7 now. Intel is forecast to show the least amount of revenue growth next year of the three companies. For a while, Intel was expected to show the most earnings growth in percentage terms, but that was only because it was coming off a near zero base with extremely limited profitability.

Currently, street analysts are expecting an adjusted loss this year for Intel, so technically the growth here is just the company going to a profit from a loss, and analysts have continued to cut their estimates after the large Q3 miss. Additionally, with an expected profit in 2025 of just over $1 per share currently, Intel’s forward P/E could jump exponentially if estimates were to drop closer to zero like they did during this year. Going into Intel’s Q2 report, for example, the street expected an adjusted profit of $1.08 this year and $1.92 next.

Final thoughts and recommendation:

Intel reported a mixed quarter last week, but it was enough to get shares moving higher. The top line showed a nice beat, but large charges taken in the period led to dramatically larger than expected losses. Intel burned a few billion more in cash during Q3, but hopefully that trend will end next year. Investors and analysts are also looking to see if the current quarter is the last one where revenues decline on a year-over-year basis for now.

After last week’s report, I’m going to keep a hold rating on the stock. While the worst seems to be behind us, Intel is certainly not out of the woods just yet. This management team still has a lot to prove in terms of revenue growth and an earnings rebound, and the balance sheet remains a bit troubled. Perhaps if we get another quarter or so of good results, I can upgrade to a buy, but given Intel’s recent history, things could just as easily turn negative again.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.