Summary:

- Intel’s Q3 earnings exceeded expectations with solid revenue and EPS numbers, showcasing the company’s execution on its product roadmap.

- The gap between Intel and AMD is narrowing, and Intel has a chance to reclaim its leadership position in the industry.

- While Intel’s outlook and margins are improving, there are concerns about the short-term prospects of the stock due to outside factors.

- Ongoing capital requirements would also continue to put downward pressure on Intel’s share price.

Justin Sullivan

After a very strong quarter, Intel (NASDAQ:INTC) share price has moved rapidly on the news with investors recalibrating their short-term expectations.

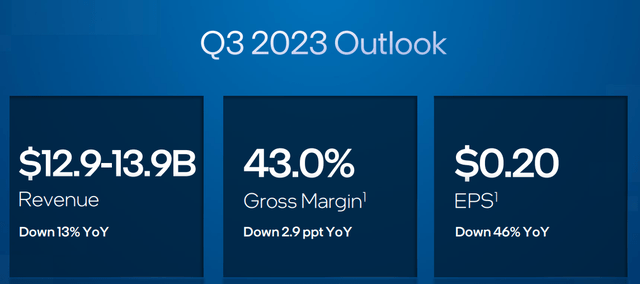

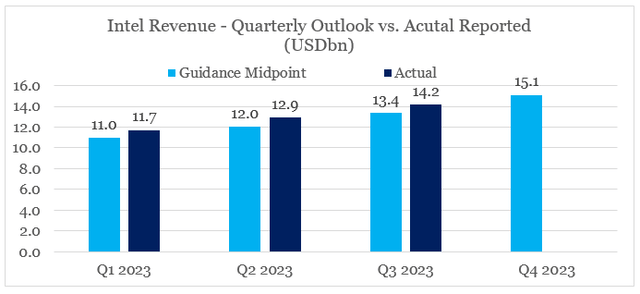

The reported Non-GAAP EPS of $0.41 came at nearly twice the guidance provided by Intel’s management during the previous quarter (see below). Revenue came above even the high end of the guidance range with the company reporting $14.2 billion worth of sales for the quarter.

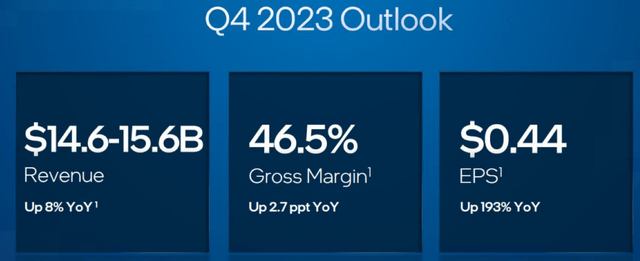

Guidance for the next quarter was even better, with EPS expecting to come at $0.44 on the back of higher revenues and a gross margin as high as 46.5%.

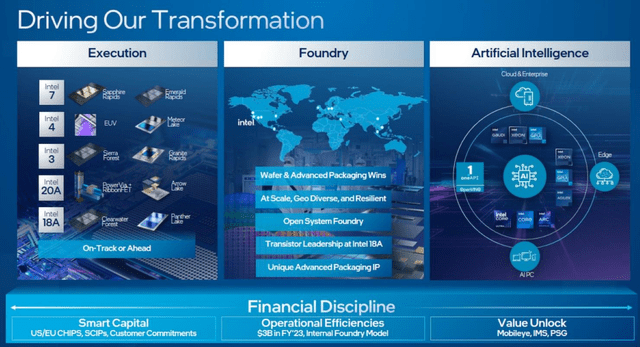

The quarter has also shown that Intel continues to execute on its ambitious product roadmap, which is a cornerstone in its strategy to catch up with AMD (AMD) and reclaim its leadership in the space.

Intel 7 is done with nearly 150 million units in aggregate (…) in the market. (…)

In Q3, we began initial shipments of Meteor Lake on Intel 4, which we are now aggressively ramping on the most productive fleet of EUV tools in the industry, providing us with a greater than 20% capital efficiency advantage, compared to when EUV tools were first launched. High volume EUV manufacturing is well underway in Oregon and more recently in Ireland.

Source: Intel Q3 2023 Earnings Transcript

As impressive as all that is, the strong consumer spending and PC demand was the much needed tailwind for Intel to achieve all that and sustain short-term momentum in its Client Computing segment (more on that later).

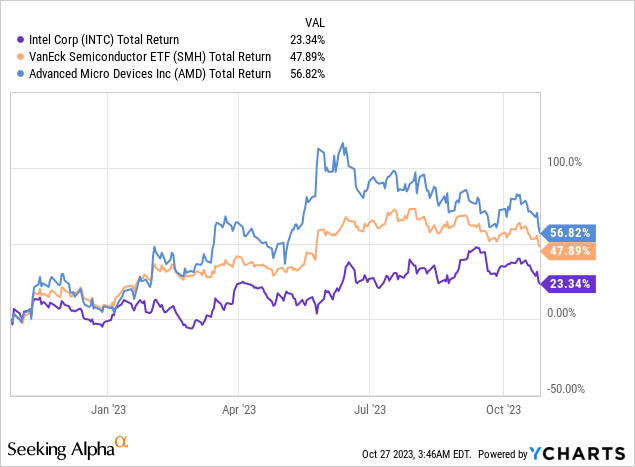

As a result, the gap with AMD and the VanEck Semiconductor ETF (SMH) has been slowly narrowing down in recent months and is on track to fully disappear before 2023 is out.

In the light of all this, I remain optimistic on Intel’s new strategy and the recent quarter only confirms the company’s ability to position itself a leader once again.

But as the title of this article suggests, I am still cautious on the short-term prospects of the stock and will refrain from rating it as a “Buy” for the time being for reasons that I will explore in the following lines.

Improved Outlook and Margins

As we saw already, Intel’s outlook for the last 3-month period of the year is to say the least encouraging. Even more important is the fact that Intel’s management has been steadily delivering on its strategy and over delivering on its quarterly guidance as of late.

As we see in the graph below in each of the 3 quarters for this year, INTC has consistently delivered higher revenues than the mid-point of its guidance.

prepared by the author, using data from quarterly presentations

On a year-on-year basis, the guidance for the first quarter of this year was for an annual drop in revenue by 40% from a year ago, followed by guidance for a 22% fall in Q2 and then by an even smaller reduction year-on-year of -13%. The expectation for Q4 2023 is now for revenue to increase by 8% yoy, which represents an important pivot in Intel’s sales.

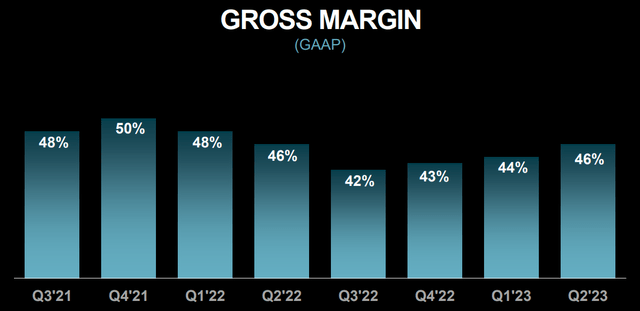

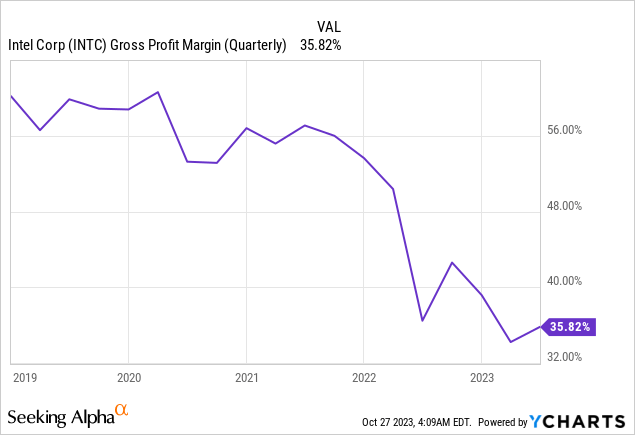

Although higher sales are usually providing a tailwind for operating margins due to economies of scale, Intel’s gross margin also seems to have bottomed already.

For the 3rd quarter, gross margin stood at 45.8% and as we saw above, the expectation for the next 3-month period is for it to reach 46.5%.

Of course, Intel’s strong execution on its IDM 2.0 is a key ingredient for this success, but a similar development has benefited AMD’s pricing power as well and its margins are following a similar trajectory over the past 2-years.

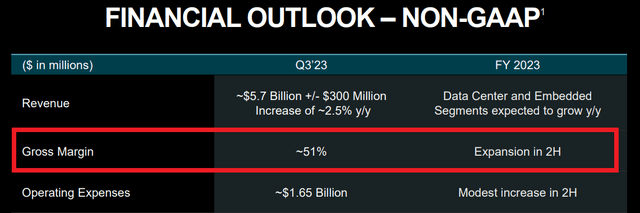

What’s more is that AMD is expected to report a Non-GAAP gross margin of 51% for its 3rd quarter this year which is much higher than the one Intel just reported.

Apart from AMD’s current lead in the CPU market, this also confirms the view that it is macroeconomic and industry-wide tailwinds driving this margin improvement for both Intel and AMD.

As we will see later on, these tailwinds could quickly disappear as the strength of the U.S. consumer is now hanging in the balance.

Nonetheless, as long as Intel continues to execute on its strategy it has very good chances of achieving record high gross margins beyond the short-term and this a key aspects of my investment thesis.

I would just say just on a longer-term basis, Pat has talked a lot about gross margins of 60%. And I feel like we are even more confident around our ability to hit that 60% threshold for a number of reasons. One, the execution that Pat talked about on five nodes in four years. When we get through that, of course, we eliminate the headwind on margins, but it turns around to a tailwind because when you’re a process leader, you get better gross margins.

Also as product execution improves, that also as we launch the products that are competitive in the marketplace. And we’ve seen that already in the client space, that helps on the gross margin side. But then more importantly, maybe the thing that’s near and dear to my heart is this internal foundry model that we’ve built, where we’re now measuring the manufacturing and TD organization as a separate P&L. We’ll officially do that next year and we’ll segment report it that way.

Source: Intel Q3 2023 Earnings Transcript

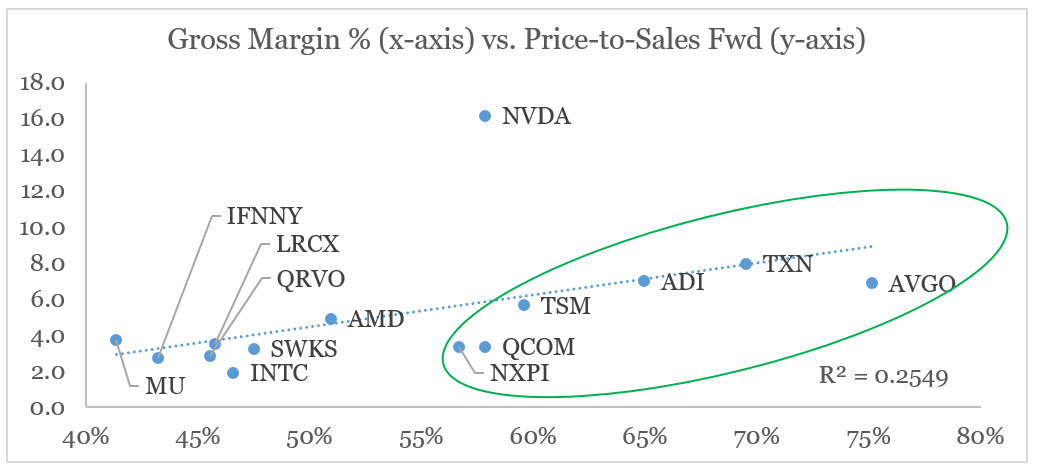

In January of this year I took a deep dive into the semiconductors sector for subscribers of my investment group and showed the importance of gross margins as a key driver of price-to-sales multiples (see below).

At the time, Intel was trading at a discount relative to its gross margin on a 12-month basis as the market was expecting a drop, but as we saw above this has proven to be a transitional event.

prepared by the author, using data from Seeking Alpha

More importantly, if Intel achieves 60% gross margins, the stock will be rewarded with a much higher multiple which in combination with the higher revenue number could create a double whammy effect.

Mostly Due To Outside Factors

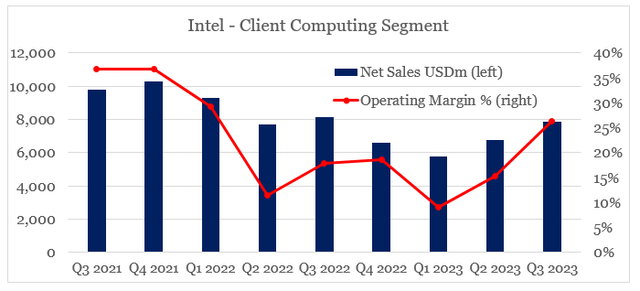

As good as all that sounds, the most recent quarter was largely impacted by outside factors and strong demand for PCs. That is why, both sales and margins of Intel’s Client Computing segment saw a dramatic increase sequentially.

prepared by the author, using data from quarterly reports

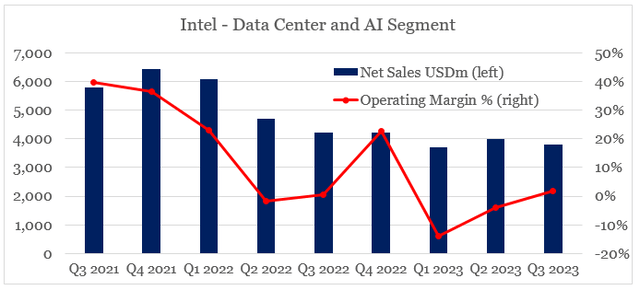

A slow and steady progress is being made in the Data Center and AI segment as well, albeit nothing too excited in comparison to the Client Computing segment.

prepared by the author, using data from quarterly reports

So far in 2023 U.S. consumers are showing resilience in spite of higher prices, but the case for hard landing of the economy in the first half of 2024 has strengthened in recent months and is now threatening to put an end to Intel’s Client Computing segment recovery.

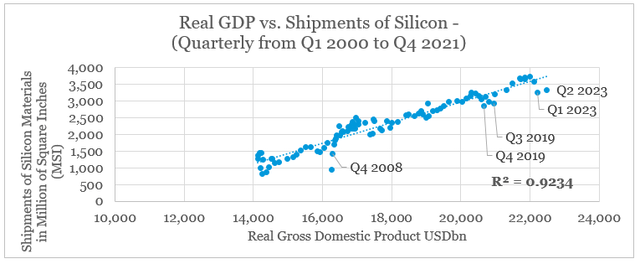

We could also see the early signs of that by comparing real GDP numbers to the quarterly shipments of silicon materials. The latter is now below the trend line below which happened before in late 2019 and late 2008.

prepared by the author, using data from FRED and semi.org

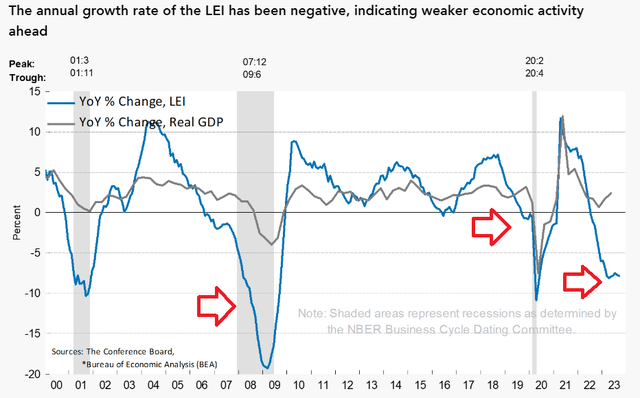

In late 2008, the U.S. was already in a recession while in late 2019 the annual change of the Leading Economic Index (LEI) was in negative territory, thus suggesting a major economic slowdown. Even though it was the pandemic lockdown that ultimately caused the brief recession in 2020, the unprecedented amount of stimulus caused a v-shaped recovery.

This time around, LEI is once again warning a severe recession and in combination with current credit conditions, the strength of the U.S. consumer is likely to be short-lived.

The Capital Intensive Strategy

Even if we put all macroeconomic developments aside, the ambitious and capital intensive strategy behind Intel’s foundry capabilities will continue to weigh on its share price performance.

For the first nine months of this year, capex amounted to a total of $19bn, which is not materially different from the amount spent during the same period of last year.

When comparing these numbers to cash flow from operations for the 9-months of this of slightly less than $7bn, we could see that the management would continue to rely on external sources of financing.

On one hand, these represent divestments of non-core assets and attracting new investors through initial public offerings.

In Q3, we announced the sale of 10% of our IMS nano fabrication business to TSMC, following the investment from Bain Capital in June.

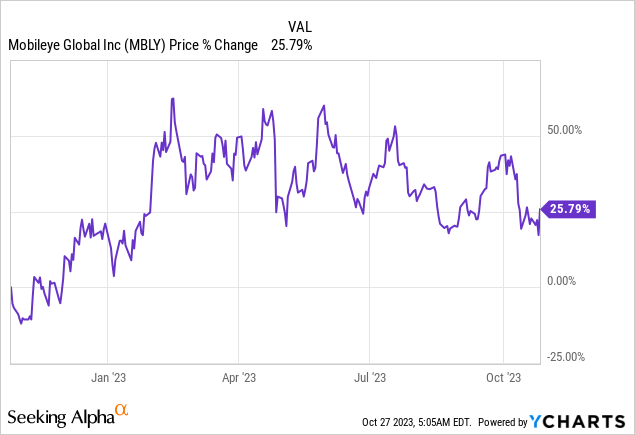

When combined with the Mobileye IPO, these transactions have unlocked more than $30 billion of value. Earlier this month, we signaled our intent to pursue private investment and ultimately, an IPO for our PSG business as we continue to pursue opportunities to increase value for our shareholders.

Source: Intel Q3 2023 Earnings Transcript

As we see from the recent extract from Intel’s Q3 2023 earnings transcript, these deals have generated significant amounts of capital that will be able to cover capital expenditures for a bit more than a year. The deal for Mobileye (MBLY), for example, has been a great success for Intel’s management. Since the IPO, MBLY has gone up in value by more than 25% and as I highlighted late last year – the deal was not done out of desperation and was about to create significant shareholder value.

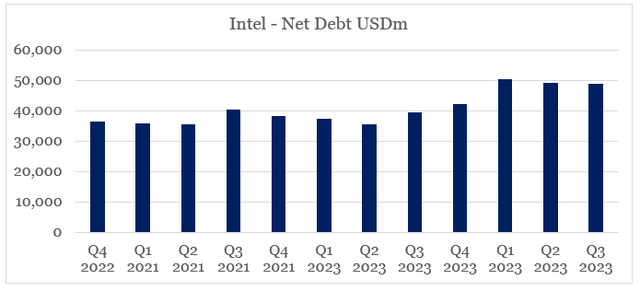

Additionally, net debt has also increased significantly over the past year (see the graph below) and is likely to continue on that trajectory.

prepared by the author, using data from Seeking Alpha

Given Intel’s operating loss for the past quarter, the rising interest rates and the potential widening of credit spreads, this would continue to be a major risk for Intel’s shareholders and in my view will weigh on returns over the coming year.

Conclusion

Intel continues to move in the right direction when it comes to its long-term strategy. The recent quarter was a breath of fresh air for shareholders and I expect the performance gap between Intel and the semiconductors industry to continue to narrow down in the coming months. Having said that, however, I don’t see the recent momentum as a sustainable trend, unless we avoid a recession in 2024 and instead experience the opposite. Even in this scenario, however, Intel’s ambitious strategy would take time to bear fruit and high capital requirements would continue to put downward pressure on the share price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for similarly well-positioned high quality businesses?

You can gain access to my highest conviction ideas by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

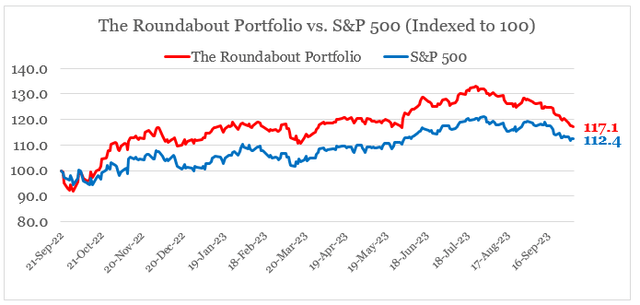

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.