Summary:

- Intel’s stock remains significantly overvalued despite a 37% drop since mid-June, with a “Strong Sell” rating due to inefficiencies and poor strategic decisions.

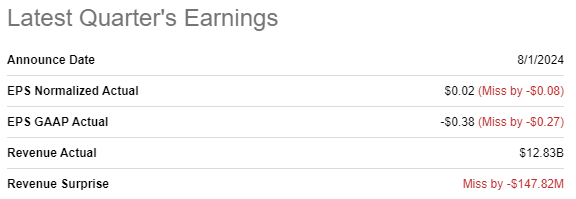

- Recent quarterly earnings missed estimates, with revenue down 1% YoY and adjusted EPS dropping to $0.02, highlighting financial struggles.

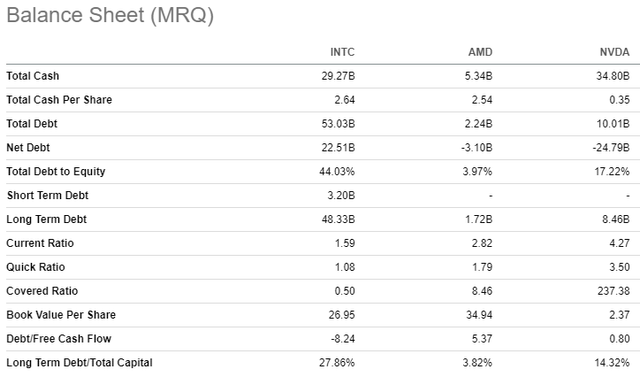

- Intel’s balance sheet is weaker than rivals like Nvidia and AMD, with high debt and lower profitability, making it less competitive.

- The CAPEX-heavy business model hinders growth and innovation, and even with optimistic FCF assumptions, Intel is still about 30% overvalued.

JHVEPhoto

Investment thesis

My previous bearish thesis about Intel Corporation (NASDAQ:INTC) aged well, as the stock lost around 37% of its value since mid-June. Despite such a massive drop over the relatively short timeframe, I do not recommend buying the dip.

The stock is still significantly overvalued, and the company’s capital-intensive business model appears to be not efficient in competing with fabless players like NVIDIA Corporation (NVDA) and Advanced Micro Devices, Inc. (AMD). Intel is much weaker positioned to compete with more flexible and aggressive rivals. I also see apparent flaws in strategic decision-making. All in all, I reiterate my “Strong Sell” rating for INTC.

Recent developments

INTC released its latest quarterly earnings on August 1, underperforming against consensus estimates. This was the second consecutive quarter of missing quarterly revenue forecasts. Revenue declined by 1% YoY, and the adjusted EPS deteriorated from $0.13 to $0.02.

Seeking Alpha

The company’s balance sheet is still highly leveraged in absolute terms. Total outstanding debt as of the latest reporting date was $53 billion, which is more than $20 billion higher compared to outstanding cash. INTC bulls might say that the total debt is still lower than the company’s market cap. This is true, but I want to emphasize that Intel’s balance sheet is much weaker compared to its closest rivals. NVDA has a massive net cash position, and AMD’s balance sheet is also much cleaner compared to Intel’s. Therefore, Intel is in a very weak position to compete with rivals, if we speak from the perspective of financial position.

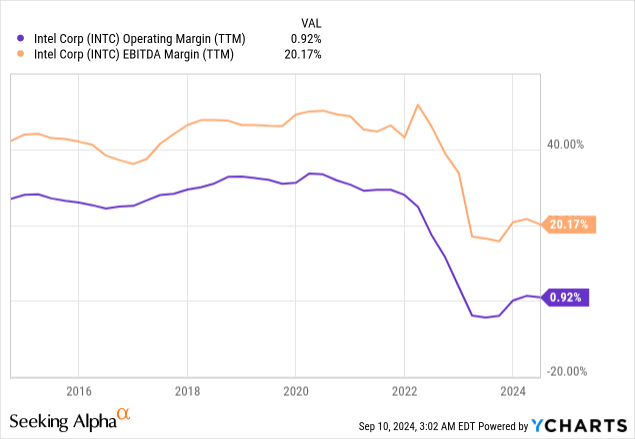

Another big red flag is that even the AI-driven boom in the industry did not help Intel to capitalize on it. Intel’s operating margin and EBITDA margin are still significantly lower compared to historical levels, and the late 2023 rebound was insignificant. A weaker balance sheet compared to rivals together with stagnating profitability is a very weak blend, meaning that INTC is not ready to compete.

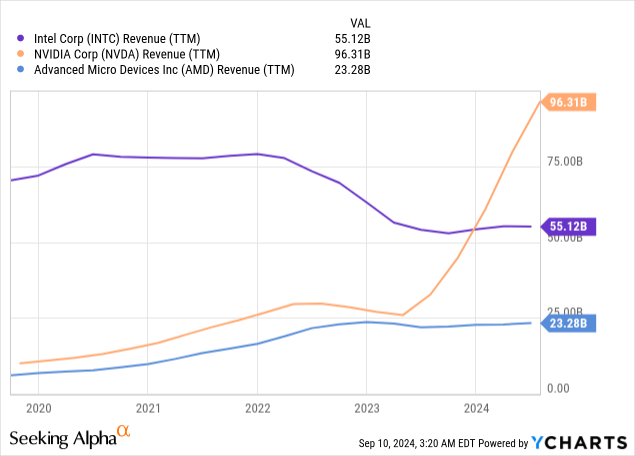

Intel’s business approach itself appears to be obsolete. Of course, fabless players like AMD and Nvidia face significant geopolitical risks when they outsource production to Taiwan Semiconductor Manufacturing Company Limited (TSM). On the other hand, without spending resources on maintaining and expanding their production facilities, these companies are free to focus all their resources on innovation. When we look at how these three companies’ revenues behaved over the last decade, we can see that five years ago, Nvidia’s revenue was nowhere near Intel’s. As of the latest reportable quarter, Nvidia’s TTM revenue is almost two times higher than Intel’s. The gap between INTC and AMD in terms of revenue is much narrower today than it was before the pandemic. Therefore, it appears that the fabless business model is likely more efficient in driving growth and innovation. Analysts from Citi agree with me, as they recently shared their opinion that Intel should exit the foundry business.

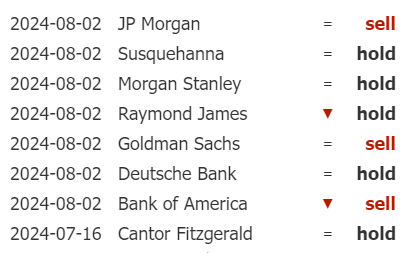

Prominent Wall Street names agree with my overall bearish stance on INTC. Banking giants like JPMorgan Chase & Co. (JPM), The Goldman Sachs Group, Inc. (GS), and Bank of America Corporation (BAC) have downgraded INTC to “Sell” after the company released its latest earnings report.

TrendSpider

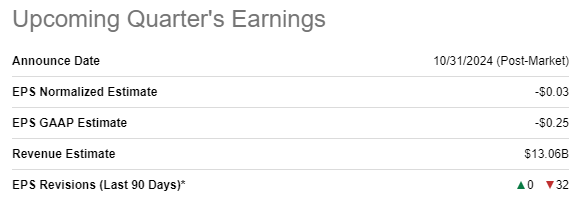

My pessimism is also backed by the sentiment around the next quarterly earnings release, which is scheduled for October 31. There were 32 downward EPS revisions over the last 90 days, which is another red flag. Quarterly revenue is expected to be $13.06 billion, almost 8% lower compared to a YoY basis. The adjusted EPS is expected to plunge from $0.41 to -$0.03.

Seeking Alpha

Strategic decision-making at Intel is also questionable. The company acquired Mobileye Global Inc. (MBLY) for a massive $15.3 billion not so long ago, but it appears that the management already decided that this investment is not paying off. Intel started selling its stake in MBLY last summer when the stock traded at around $40. MBLY has lost around 70% of its value since then, but INTC is considering selling more shares. With all these developments around MBLY, it is highly likely that the quality of due diligence made before the deal lacked quality. MBLY currently has a “Strong Sell” rating from Seeking Alpha Quant. If Mobileye’s shares continue falling down, this will further diminish Intel’s shareholders’ wealth.

Valuation update

INTC declined by more than 60% YTD, a significantly weaker performance compared to the broader U.S. market and the iShares Semiconductor ETF (SOXX). Intel has a very low “D+” valuation grade from Seeking Alpha Quant, meaning that the stock is overvalued. Indeed, a 73-forward non-GAAP P/E ratio is ridiculous for a fundamentally weak company like INTC.

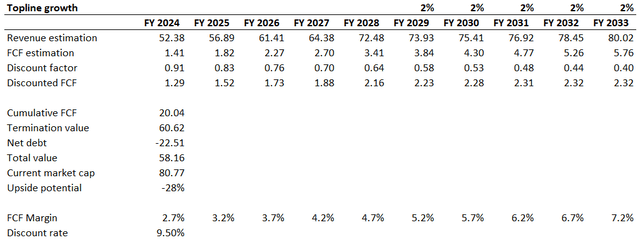

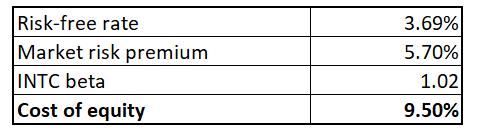

To figure out Intel’s fair share price, will simulate the discounted cash flow [DCF] model. I need to figure out the cost of equity using the CAPM approach. All assumptions for the cost of equity calculation are publicly available. The risk-free rate is the current 10-year Treasury bonds’ yield.

Author’s calculations

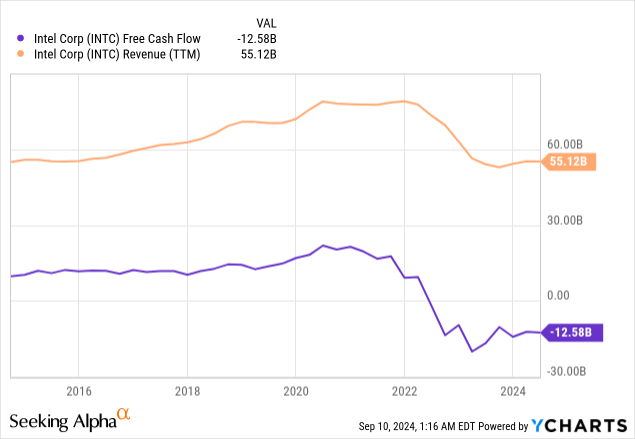

Now I can proceed with other assumptions for my DCF model. Intel’s consensus revenue estimates are available up to FY 2028. I will rely on consensus for FY 2024-2028. However, since INTC’s revenue has been stagnating over the past decade, I cannot give it a revenue growth rate above the 2% inflation for the years beyond FY 2029. For the base year, I use a 2.7% FCF margin, which is INTC’s last five years’ average. I incorporate a 50 basis points yearly FCF margin expansion.

As we see, the business’s fair value is still below its market capitalization, even after a recent sharp dip in the share price. Moreover, please pay attention that I incorporated FCF margin expansion in my DCF model. I did that on purpose, to demonstrate to readers that INTC is still around 30% overvalued even with unrealistic FCF assumptions. I call them unrealistic because, over the last decade, INTC’s FCF has been demonstrating a weaker dynamic than the company’s top line.

Risks update

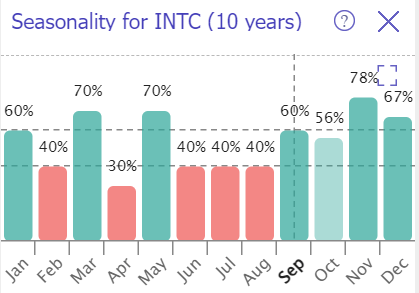

INTC’s seasonality trends suggest that the stock’s historically the weakest months are behind us. INTC usually performs better closer to the year-end, which means that the stock might show a short-term rally over the next few months. The stock dipped by around 62% YTD, which also might be tempting for some investors to buy the dip, further fueling some near-term rally.

TrendSpider

In 2023 Intel had the same fundamental weaknesses, but nevertheless, the stock rallied by 90% in 2023. The AI boom in the stock market fueled lots of semiconductor stocks, while not all of them have strong AI exposure. Intel is a widely known company with a vibrant brand, and this might be misleading for some investors who think that buying INTC will give them strong AI exposure.

Despite all fundamental flaws, INTC is still a giant company with the capacity to invest billions in R&D. This means that there is always a possibility that the company can present a disruptive product to the market. Given all the fundamental flaws, I think that the probability of such a scenario is extremely low, but the positive magnitude might be significant.

Bottom line

To conclude, INTC is still a “Strong Sell”. The stock is still significantly overvalued, even if I incorporate the highly unlikely FCF margin expansion trajectory. The balance sheet is much weaker compared to the closest rivals, and profitability is deteriorating. The CAPEX-heavy business model highly likely does not allow the company to concentrate most of its resources to drive growth and innovation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.