Summary:

- We remain buy-rated on Intel and remain confident about INTC’s potential to continue to outperform expectations through 1H24.

- The PC market is already in recovery, and we expect the PC TAM to grow 5-8% Y/Y in 2024, driving more upside for CCG.

- We also believe the traditional compute-server market will rebound in 2024, fueling further upside for its DCAI business.

- While its foundry business will remain sub-scale and meaningful revenue is still a few years away, we believe investors will turn more positive as INTC executes its process roadmap.

- We continue to see an attractive risk-reward profile for the stock at current levels.

stockstudioX

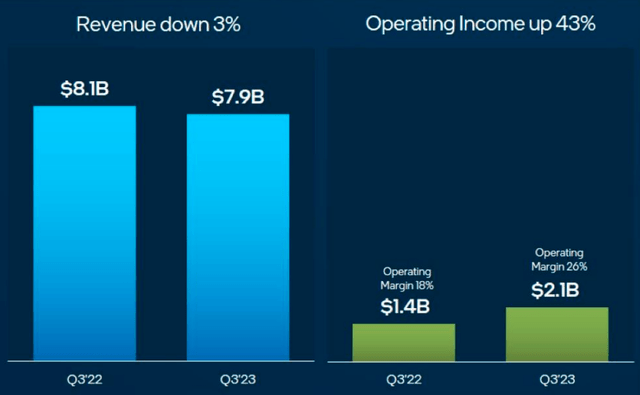

We continue to be buy-rated on Intel (NASDAQ:INTC) after 3Q23 earning results. We remain confident about INTC’s potential to continue to outperform expectations through 1H24. We now think our previous investment thesis of expectations being low enough for INTC to experience outperformance this quarter will extend into next year. Guidance for next quarter is also ahead of consensus at $14.6B to $15.6B versus consensus at $14.35B. We think INTC is better positioned to continue to achieve financial outperformance due to the PC market recovery. We now expect the PC TAM for 2024 to rebound 5-8% Y/Y, driving upside for INTC’s Client Compute Group, accounting for roughly 56% of total net revenue this quarter. The company’s CCG sales increased 16% QoQ and declined 3% Y/Y to $7.97% this quarter, a substantial improvement since last quarter, where CCG sales declined 12% Y/Y sequentially and rebounded 18% QoQ. It’s also critical to note operating income growth after the PC correction; CCG operating income is up 43% Y/Y versus last quarter, up 19%. The following graph outlines CCG results this quarter.

Gartner’s report of global PC shipments also confirms our expectations of a PC market rebound regardless of the macro backdrop; Gartner reported worldwide PC shipments dropped 9% in the third quarter of 2023. We think this is a significant sign of an improvement from the second quarter of 2023, in which shipments declined 16.6%. We think PC end demand rebound will to boost top-line growth more materially in 2024.

Moving to our outlook on INTC’s Data Center and A.I. group, we think our negative thesis of increased customer spend on A.I. servers over traditional compute servers is playing out; sales in the DCAI dropped 5% QoQ and down 10% Y/Y to $3.81B. This year, we saw a major shift in cloud capex to A.I. servers over compute, and this ate up cloud capex as the A.I. servers’ ASP is 10-15x that of the traditional compute. We believe the traditional compute-server market will rebound in 2024, fueling further upside for its DCAI business. Operating income in DCAI rebounded this quarter to $0.1B, up 151% versus last quarter when operating income was down 101% Y/Y. We expect INTC to experience more upside here if the cloud capex expands in 2024.

INTC’s longer-term pride and joy, its foundry business, was another hot topic on the earnings call. Foundry service reported revenue of $311M due to packaging strength. While its foundry business will remain sub-scale and meaningful revenue is still a few years away, we believe investors will turn more positive as INTC executes its process roadmap of five nodes in five years.

Valuation

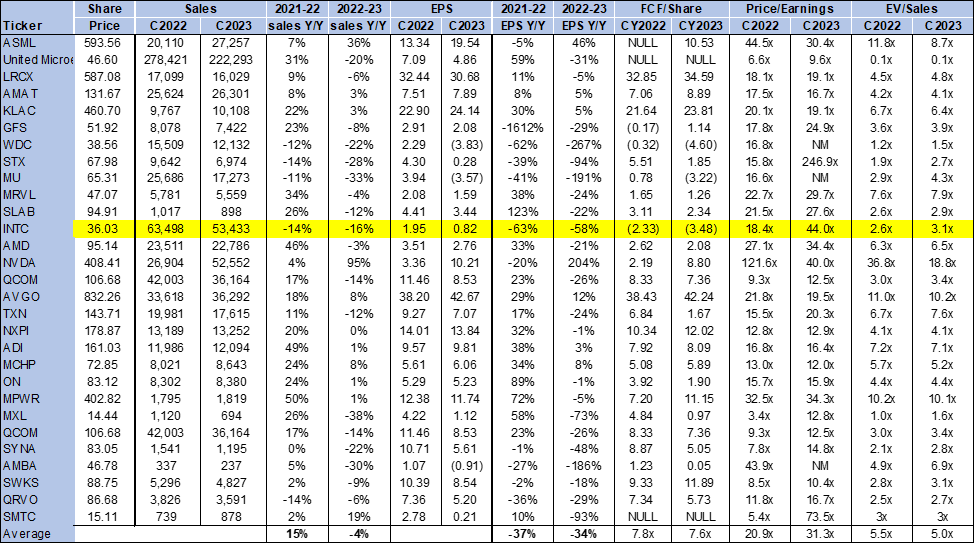

The stock is trading below the peer group average on an EV/Sales metric at 3.1x C2023 versus the peer group average of 5.0x. On a P/E basis, the stock is trading at 44.0x C2023 EPS $0.82 compared to the peer group average of 31.3x. We see INTC outperforming in 2024 and recommend investors explore entry points at current levels.

The following chart outlines INTC’s valuation against the peer group.

TSP

Word on Wall Street

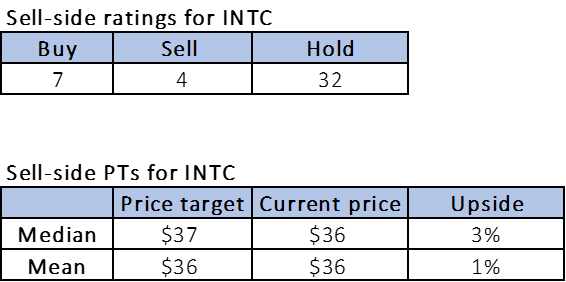

Wall Street doesn’t share our bullish sentiment on the stock. Of the 43 analysts covering the stock, seven are buy-rated, 32 are hold-rated, and the remaining are sell-rated. We attribute Wall Street’s more cautious stance on the company to macro weakness and concerns over the DCAI growth. The stock is currently priced at $36. The median sell-side price-target is $37, while the mean is $36, with a potential 1-3% upside.

The following charts outline sell-side ratings and price targets.

TSP

What to do with the Stock

We continue to be buy-rated on INTC and remain confident about INTC’s potential to continue to outperform expectations through 1H24. We think the PC market will recover and believe INTC is better positioned to leverage end demand rebound into top-line growth through its CCG revenue. We also see the cloud spending environment supporting more traditional compute-server spending next year versus this year, so we expect more upside for INTC’s DCAI revenue. We recommend investors explore entry points at current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Our investing group, Tech Contrarians, discussed this idea in more depth alongside the broader industry and macro trends. We cover the tech industry from the industry-first approach, sifting through market noise to capture outperformers.

Feel free to test the service on a free two-week trial today.