Summary:

- Intel is a unique semiconductor company due to its extensive ownership of fabrication facilities, something which could become increasingly important in the near future.

- It is also the leading player in the PC GPU market, the next potential growth market for AI chips.

- Furthermore, Intel is headed up by the right executive for the job at hand.

- These unique factors make me bullish on Intel for the long term.

maybefalse/iStock Unreleased via Getty Images

Overview

Intel (NASDAQ:INTC) released a mixed earnings report which the market initially responded to favorably but has since digested into more negative territory. The stock is still up marginally more than the NASDAQ Composite and the S&P 500 over the past 5 trading days.

Ultimately, there was a lot to dislike with Intel’s latest earnings report. Revenues, while beating consensus, were down 36% YoY. Every segment apart from one faced decline, often in the double digits. The slowdown in personal computing spend affected the business materially, and gross margins compressed overall.

These developments overall represent little new or unexpected news for Intel at the moment. It appears that the PC slowdown is perhaps more significant than the market initially expected. The dividend cut, while expected, is of course not appreciated.

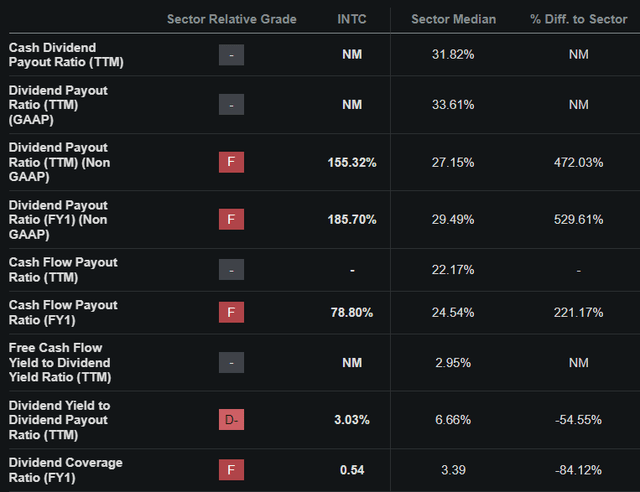

The topic of dividend safety has now entered the conversation around this stock, and here the picture is concerning. Intel has been paying out dividends well in excess of its net income and 78.8% of its free cash flows.

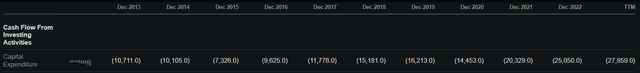

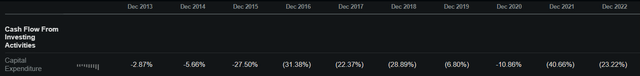

Along with this, Intel has continued to keep its foot on the gas in regards to capital expenditures, which grew significantly in the last 2 years:

These capital expenditures will continue to put pressure on free cash flow and could result in further dividend cuts.

The thing here is that this could be just fine when it comes to the stock. Based on what I’m seeing, it seems that Intel is in the process of becoming less so a dividend stock and more a growth stock; it is investing heavily in future growth. I think Intel will do this and experience significant growth over the next 5-15 years. In this article I’ll detail why I believe this to be the case.

Fabrication Facilities

As is well-known, what makes Intel different than many of its peers is that it builds chips instead of just designing them. While this obviously worsens its margins as well as its balance sheet significantly, I think this is an underappreciated hedge in the current macroeconomic environment. Since the semiconductor supply chain is so concentrated within TSMC (TSM), the risk to semiconductor supply is that TSMC will no longer be able to supply chips. This is feasible given the rising tensions in the Taiwan strait. It is beyond the scope of this article to determine whether anything will materialize in the region, but we must note that Buffett ultimately bought and then sold TSMC. From this I think we can infer that it is indeed a material risk.

If that eventuality were to occur, the US semiconductor supply chain would be significantly compromised. Ultimately, supply would have to be sourced elsewhere. Intel has long-resisted the fabless trend and still owns and operates 15 fabrication facilities – far more than any of its peers. If we include fabrication facilities that are set to come online, this includes 14 stateside. This makes Intel unique as a semiconductor company and the best hedge in the market against the risk inherent in TSMC.

Product Footprint

Reflective of its ongoing investment in itself, Intel has a busy slate of chip launches over the next 2 years.

Additionally, Intel has a lesser-known, yet commanding, presence in what could very well be a top chip growth market: PC GPU sales. Here Intel had 71% of the global market in Q4 2022.

This market is an interesting one to watch in my opinion. While the enterprise GPU market has been heating up significantly due to AI, we have not seen this trend play out in the PC GPU market as of just yet.

Yet, AI computing has already moved to user devices; Apple (AAPL) has had AI chips in its phones since 2017. As AI computing workloads become more commonplace, it is possible that more of them will be offloaded to end user devices – including PC’s. The fact that AI computing is relatively expensive serves to increase the chance that we see this happening, at least to an extent. This leads me to believe that this trend could begin to materialize in the PC GPU market next, and Intel would be a core beneficiary of this.

Executive Factor

Leadership matters for companies and ultimately for their stock price. This is why CEO’s that lose the confidence of their board get fired. This factor is impossible to quantify yet evidently critical for any firm. With Intel, I believe we have an example of a proven executive that is focused on the long-term as well as steeped in Intel culture.

Patrick Gelsinger oversaw VMware (VMW) from 2012-2021, overseeing it through the challenging merger between EMC (former owner of VMware) and Dell (DELL) as well as setting it up for its subsequent spinoff.

Prior to leading VMware, Gelsinger worked at Intel for 30 years. During his time at Intel, he was noted to be a protégé of the legendary Andy Grove, a founder of and the CEO of Intel during its golden age.

Gelsinger has been focused on building up and leveraging Intel’s fabrication capabilities from the start. This was never going to be a quick-and-easy strategy. Frankly, I am not surprised to see dividends caught in the crosshairs here; this is a company legitimately reinventing itself after a decade of decline. Dividends may be important for pleasing investors, but operating expenditures take precedence for a company looking to start growing again.

Conclusion

There is more than meets the eye with Intel. This storied company is at a unique juncture and I believe that it’s well-positioned to succeed in the long run from here on out. I am bullish on Intel for a 10 to 20 year horizon.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in INTC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.