Summary:

- Intel’s recent struggles include suspending dividends, delaying factory construction, and drastic cost-cutting measures, reflecting significant financial challenges.

- Despite disappointing quarterly results, management remains optimistic about long-term improvements in margins and free cash flow by 2026.

- Rumors of a Qualcomm takeover are circulating, but financial and strategic hurdles make such a deal unlikely.

- Intel’s stock is undervalued, trading below book value, presenting a long-term buying opportunity despite short-term volatility and pessimistic sentiment.

- And on Monday morning, the news broke that CEO Pat Gelsinger retired and was replaced by David Zinsner and Johnston Holthaus.

hapabapa

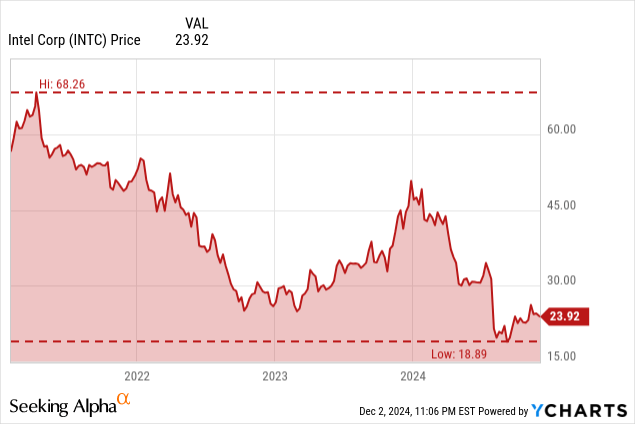

In my last few articles about Intel Corporation (NASDAQ:INTC) (NEOE:INTC:CA), I was always bullish, and I don’t want to justify myself here in any way. I was clearly wrong about Intel in the last few quarters and obviously too optimistic about Intel turning around quickly. I am always pointing out that I am a long-term investor and part of my strategy is to buy stocks when I consider them to be undervalued from a fundamental point of view. And as mentioned countless times, not fundamentals are driving the stock price in the short term, but sentiment and this might result in stocks struggling for several more quarters after I have bought them.

Of course, I have to be right in the long run and since my last bullish article, which was published at the beginning of July 2024, Intel declined about 21% again. Let’s look at Intel again and discuss if there are still good reasons to hold the stock.

Only Bad News

When looking at the major news stories surrounding Intel in the last few months, there is hardly anything positive we can find. During the second quarter earnings call, management already announced the suspension of the dividend:

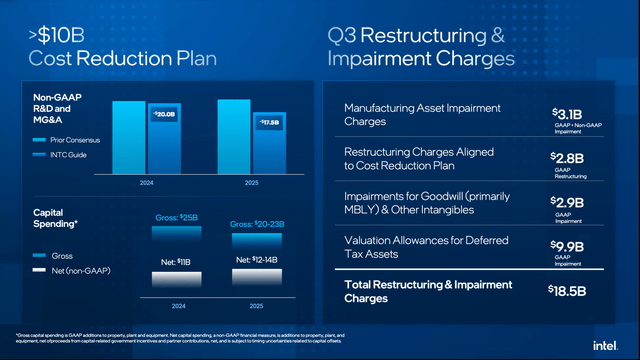

We are taking the added step of suspending the dividend at the beginning of the fourth quarter, recognizing the importance of prioritizing liquidity to support the investments needed to execute our strategy. We reiterate our long-term commitment to a competitive dividend as cash flows improve to sustainably higher levels. Reductions across OpEx, CapEx, and cost of sales total well over $10 billion in direct savings in 2025 and provides clear line of sight to a sustainable model with the ongoing financial resources and liquidity needed to support our long-term strategy. We remain confident that we have and will continue to make the investments needed to drive long-term shareholder value and we view cost discipline as the compass that drives effective execution, helping teams stay on track to both prioritize and achieve measurable results.

While suspending the dividend was probably the right choice to preserve cash, it is showing that Intel is struggling right now. And it is not just the dividend showing Intel’s troubles right now. A few months ago, Intel already announced it will delay the construction of its factory in Magdeburg. This is not only a problem for Germany and the European chip strategy, but it also shows the struggles of Intel once again.

Intel Q3/24 Presentation

Intel is also in the process of restructuring its business and taking drastic measures to reduce costs and become more efficient. And while it is always positive when businesses are trying to get more effective and save costs, it is mostly showing a business is in trouble when the cost-saving measures are so drastic as with Intel right now. Intel is not only in the process of reducing its workforce by more than 15% (a process that should be finished by the end of the year). The company is also reducing its capital expenditures by over 20% relative to the plans Intel had at the beginning of 2024. And as Pat Gelsinger outlined during the earnings call, Intel is also simplifying its portfolio:

Third, we have begun to simplify and streamline parts of our portfolio to unlock efficiencies and create value. We are re-establishing product portfolio leadership by narrowing our focus on fewer projects with the top priority being to maximize the value of our x86 franchise across the client, edge and data center markets.

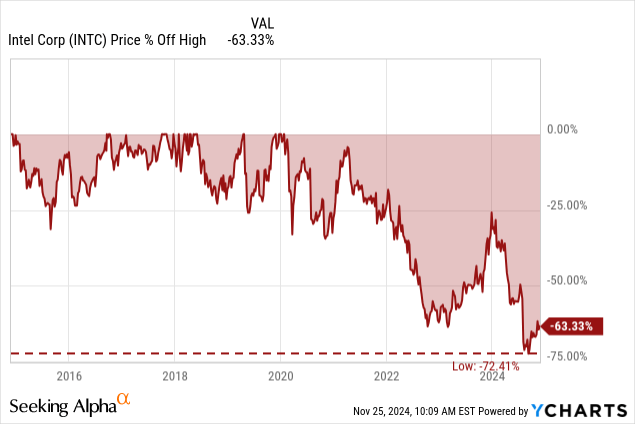

And we see in the chart above that management made huge restructuring and impairment charges in the third quarter – in total $18.5 billion. All these negative headlines continued to drive down the stock price and after losing 72% from its previous high (not the all-time high!) other speculations suddenly arose.

Qualcomm taking over Intel

Another story that was developing in the last few weeks is about Intel becoming a potential take-over target. In September 2024, it was reported that QUALCOMM Incorporated (QCOM) approached Intel about a takeover. According to the rumors – and so far, it seems to be only rumors as no official statement was made – the conversations are at an early stage and no offer has been made so far. Recently, it was reported by different sources (see here and here) that Qualcomm wanted to wait after the U.S. election before deciding how to proceed. But so far, I could not really find any reliable news updates.

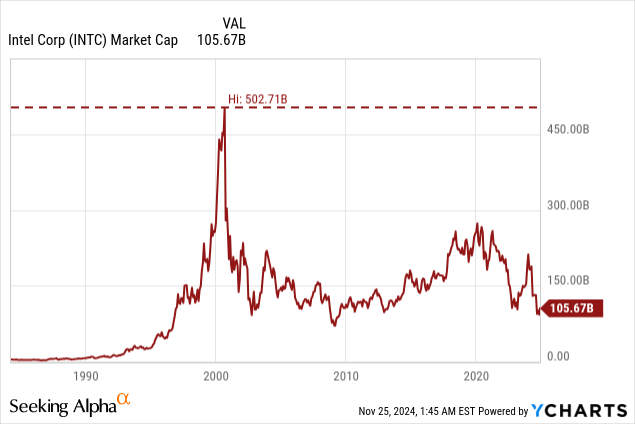

We can also question how likely and realistic such an acquisition would be – and talks were always about an acquisition (I did not really read the word “merger”). However, a takeover seems to be rather difficult – if not to see impossible. At least a takeover where Qualcomm is paying Intel shareholders in cash. At the time of writing, Intel has a market capitalization of $105 billion and considering that businesses are almost always acquired with a premium we must assume a purchase price of at least $120 billion.

Qualcomm has about $11 billion in liquid assets on its balance sheet that could be used for a purchase. Therefore, the company would have to take on about $100 billion in additional debt, which would be added to the existing debt of already more than $15 billion. These are completely unacceptable numbers and probably no bank would lend Qualcomm such an amount.

However, there are other options. As mentioned above, Intel and Qualcomm could merge in some way and Qualcomm might issue additional stocks for Intel investors. When assuming a purchasing price of $120 billion and Qualcomm has a market capitalization of $180 billion, it would increase the number of outstanding shares by almost 70%, and it is questionable if Qualcomm investors would agree to such a dilution.

Aside from Qualcomm, we also find Apple Inc. (AAPL) as well as Samsung Electronics Co., Ltd. (OTCPK:SSNLF) being mentioned as companies potentially acquiring Intel. And while Apple certainly has the cash to acquire Intel, it is only speculation at this point. Samsung, on the other hand, seems rather unlikely as a story by the CSIS is pointing out what a valuable asset Intel is for the United States and a company the government should not lose. In the article, they came to the following conclusion:

The United States and its allies confront an unparalleled strategic challenge from China that has the potential to escalate. In any such confrontation, leadership in and access to advanced semiconductor technology—and the AI systems these innovations enable—will play a central role and could even be decisive. Numerous recent analyses conclude that China is investing heavily in the sector and is rapidly gaining on the United States in strategic areas of microelectronic production, a dynamic that raises major national security concerns.

The authors also wrote:

While Intel is at present trailing TSMC and Samsung in chip process technology, it is the only U.S.-headquartered firm within striking distance of regaining U.S. capabilities at advanced process nodes. The company has made massive commitments to invest heavily—more than $100 billion over the next five years—in new chipmaking capability and capacity on domestic soil, aiming to develop and manufacture chips at the most advanced process nodes of 2 nanometers (nm) and below.

But it is certainly difficult to see Intel as a valuable asset when the company is reporting terrible results quarter after quarter.

Quarterly Results

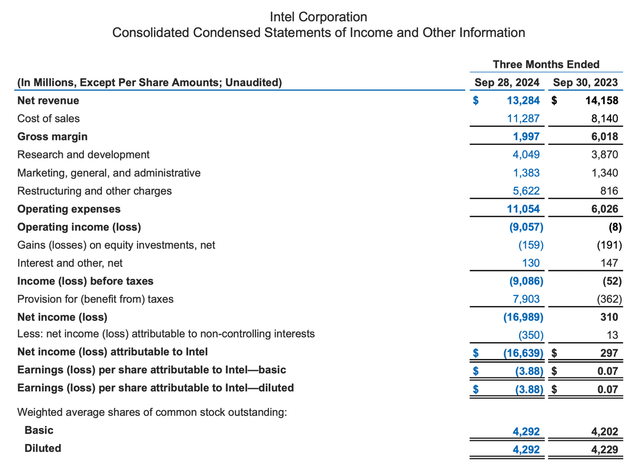

Intel had to report another round of rather disappointing results for the third quarter of fiscal 2024. Net revenue declined from $14,158 million in Q3/23 to $13,284 million in Q3/24 – resulting in a decline of 6.2% year-over-year. In the same quarter last year, Intel already had to report an operating loss of $8 million, but this quarter the operating loss increased to $9,057 million. Instead of diluted earnings per share of $0.08 in Q3/23, Intel now reported a loss per share of $3.88 in Q3/24. And instead of an adjusted free cash flow of $943 million, the company reported a negative adjusted free cash flow of $2,702 million in Q3/24.

Intel Q3/24 Earnings Release

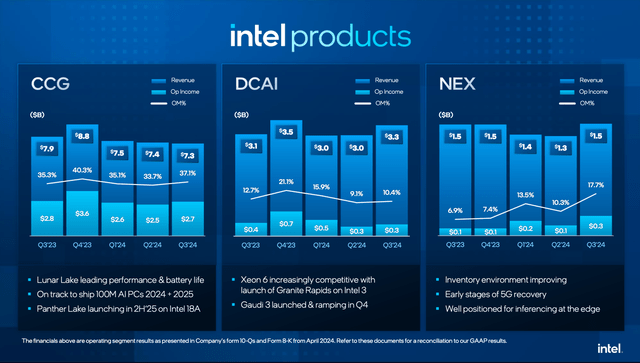

When looking at the different segments, the Client Computing Group is still responsible for the biggest part of revenue, but revenue also declined 6.8% YoY to $7,330 million. Operating income also declined slightly (2.1% YoY) to $2,722 million. While revenue for the Client Computing Group declined, revenue for Data Center and AI increased 8.9% year-over-year to $3,349 million in Q3/24. But operating income declined 11.3% year-over-year to $347 million. And the third segment among the Intel Products – Network and Edge – also reported growing revenue and improving profitability. Revenue increased 4.2% year-over-year to $1,511 million and operating income jumped from $100 million in the same quarter last year to $268 million this quarter, leading to an operating margin of 17.7% (compared to 6.9% in the same quarter last year).

Intel Q3/24 Presentation

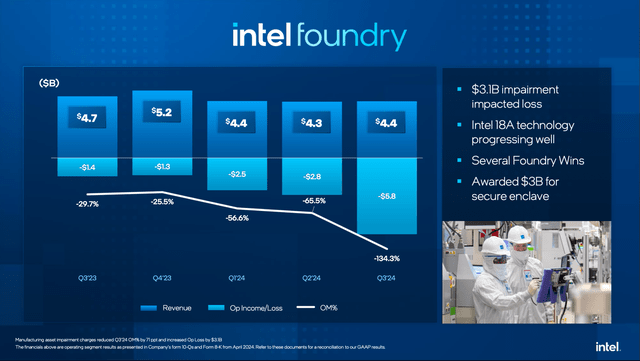

Aside from the Intel Products segment, Intel Foundry is the second major segment and generating a huge part of revenue. However, revenue also declined 8.0% year-over-year to $4,352 million and the operating loss is getting bigger and bigger. In Q3/23, the segment already reported a loss of $1,407 million, this quarter the operating loss was $5,844 million.

Intel Q3/24 Presentation

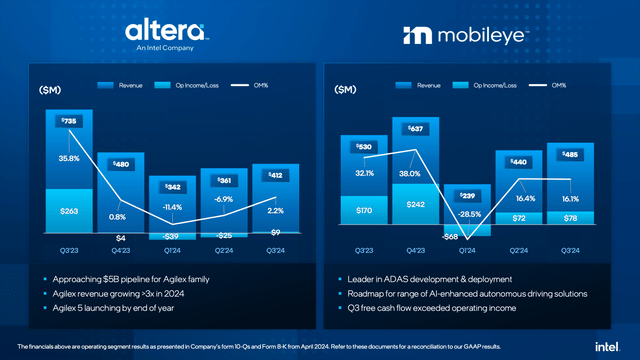

Aside from these two major business segments, Altera generated $412 million in revenue in Q3/24, which is a decline of 44.0% And instead of an operating income of $263 million in the same quarter last year, it reported only an operating income of $9 million. And finally, Mobileye generated $485 million in revenue – 8.5% lower than in the same quarter last year – and $78 million in operating income – a decline of 54.1% compared to the same quarter last year.

Intel Q3/24 Presentation

I think it is safe to say that Intel is struggling on all fronts and only DCAI and NEX can be seen as slightly positive – in the case of NEX, especially due to the improved margins and operating income.

Still Optimistic

The results are still not great, and it is difficult to see shimmer on the horizon. Nevertheless, management is still optimistic and CFO David Zinsner, for example, is expecting margins to improve significantly in 2026:

We expect gross margin fall-through to significantly improve in 2026 driven by the vastly improved cost structure of Intel 18A, the return of tiles to a meaningfully underutilized Intel Foundry and operational efficiencies.

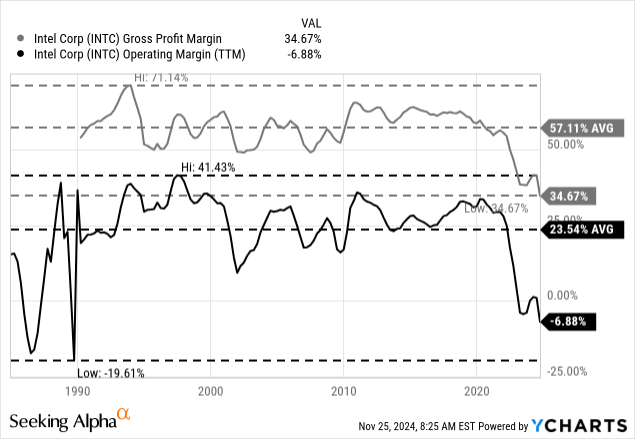

When talking about improving margins, we should also not ignore that margins are extremely low right now and when taking that low margins as basis, it is not so difficult to improve margins. In the case of the operating margin, we have to go back to the late 1980s to see similar lower numbers, and the gross margin was never so low (at least for the timeframe we have numbers).

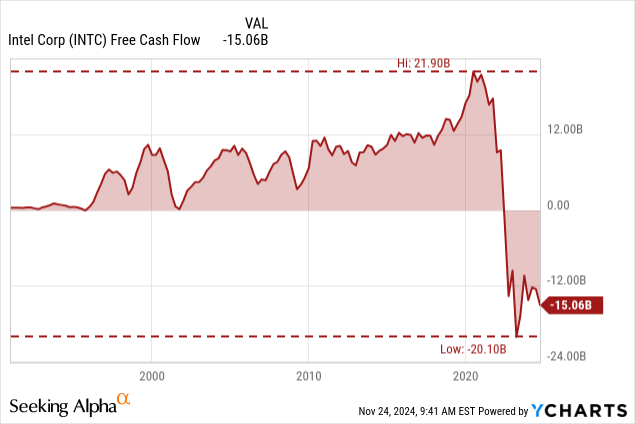

But not only margins are expected to improve, Pat Gelsinger claimed that adjusted free cash flow will also be positive next year:

We expect adjusted free cash flow to be positive next year and we will focus on decreasing leverage and improving liquidity.

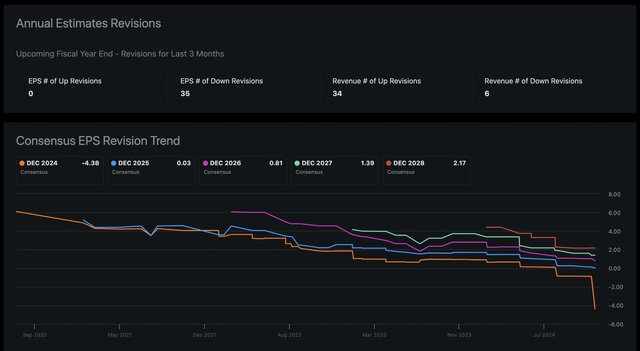

I also think Intel will manage the turnaround and although it seems to take longer than anticipated at first, I remain confident that Intel is a good long-term investment at this point. But despite all the optimism, we have to acknowledge that analysts are still rather pessimistic and are constantly lowering estimates for earnings per share in the years to come.

Seeking Alpha Earnings Estimates

And while these estimates do not have to be correct and don’t tell us much about the fundamental business and performance, they tell us something about investors’ sentiment and sentiment is driving the stock price in the end.

Intrinsic Value Calculation

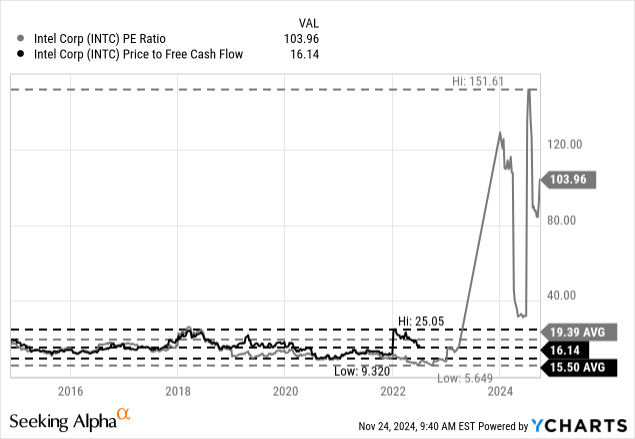

And the stock price is playing an important role as the price we have to pay for an asset is also determining if something is a good investment or not. Usually, we are looking at the price-earnings ratio as well as the price-free-cash-flow ratio to get a feeling if a stock is rather expensive or not. In the case of Intel, both metrics are rather useless right now.

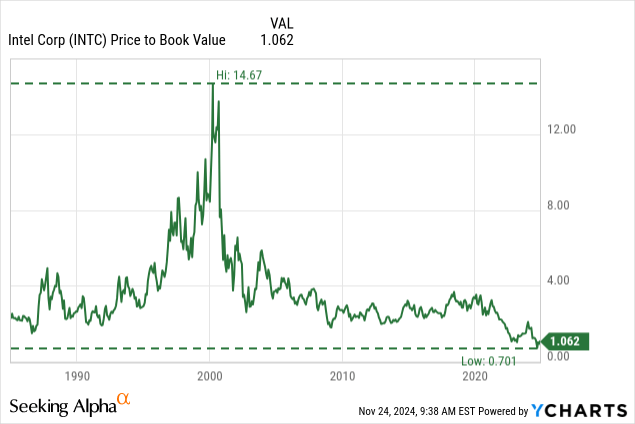

While these two numbers are not perfect right now, we can look at the price-book-value-ratio. It is usually not a metric we are paying much attention to, but in the last few months Intel was trading below its book value and that is certainly interesting. In such a scenario, two explanations are plausible. First, a stock trading below the company’s book value is indicating a bargain and undervaluation as the company itself (the assets) are worth more than we must pay. But there is a second explanation: A company with a stock trading for such a low P/Bv-ratio is usually in trouble.

The question we must answer now is the following: Is Intel in trouble, or is it a bargain? I offered several calculations in past articles, and I don’t want to offer another one. Especially as the free cash flow Intel might generate in the years to come is very speculative. When calculating with 4,292 million in diluted shares outstanding (the last reported number) and not assuming a major dilution, Intel must generate about $10,500 million in free cash flow annually from now till perpetuity to be fairly valued.

Of course, the free cash flow in the last two years does not inspire optimism about Intel’s ability to generate $10 billion in free cash flow annually. But when looking at the last two decades, Intel should be able to generate such an amount. It comes down to the question if we are optimistic that Intel manages the turnaround and will be able to grow again.

Pat Gelsinger Leaves

While I was already in the process of publishing this article, the news broke that Pat Gelsinger is quitting and retiring and already left Intel on Sunday, December 1, 2024 (one day before the news). He is replaced by the Co-CEOs David Zinsner (previously CFO) as well as Johnston Holthaus.

And while the stock price rose about 5% when the news broke, Intel finished the day 0.5% lower. And when reading the headlines and comments, almost everybody thinks the decision was right and overdue. However, most commentators think the decision was too late and Intel is doomed (some commentators even talk of bankruptcy – for example in the comments of the Seeking Alpha News Story). It is also criticized that Gelsinger is replaced with someone who was a major part of the management team, and instead radical change is demanded.

I am certainly not a big fan of using the stock price performance of only three years to assess the work of a management team, but we can’t ignore that the stock price performance was horrible since February 2021 when Gelsinger took over.

In the past, I often expressed the opinion that individual names don’t matter as much as systems and structures. I certainly don’t say that CEOs don’t matter or can’t have a (negative or positive) impact on the business. But the social systems and the structural advantages or disadvantages a business has (like an economic moat) are more important. Hence, I don’t think Intel will automatically turn around just because the CEO is replaced.

Conclusion

Intel clearly continues to struggle, and it takes a lot of imagination right now to see the light at the end of the tunnel and assume that Intel will be able to generate free cash flow again. I continue to see Intel as a long-term investment and a great business. And with almost every possible negative scenario priced in, the stock is undervalued and Intel a long-term “Buy”. The road ahead in the next few quarters might continue to be lumpy and the stock might fluctuate heavily. But I am very confident that Intel will be trading much higher in 5 or 10 years from now – and maybe the new CEO can even help to turn the ship around faster.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.