Summary:

- Intel’s revenue reached $35.9 billion YTD 2024, growing 6.2%, while operating margins rose to 27%, showing cost management improvements.

- Core Ultra 200V and 200S processors address AI demand in mobile and desktop markets, with a projected 100 million AI PCs by 2025.

- The x86 Ecosystem Advisory Group boosts software compatibility, accelerating the adoption of AI-compatible Intel-based systems.

- Intel’s independent foundry unit targets new clients backed by AWS investments and U.S. government funding.

- Intel faces intense competition from Nvidia, production delays, and financial strain from workforce cuts and unproven foundry ventures.

tupungato

Investment Thesis

Intel Corporation (NASDAQ:INTC) is stepping up its game with a powerful combination of AI-driven innovations, bold alliances, and strategic shifts in chip manufacturing. With its Core Ultra processors and partnerships like the x86 Ecosystem Advisory Group, Intel is doubling down on AI and data-centric growth. Despite fierce competition from Nvidia and AMD, Intel’s renewed focus on high-performance computing and diversified revenue through its foundry business signals a comeback story.

However, Intel faces significant challenges, including a declining market share in AI semiconductors against rivals like NVIDIA Corporation (NVDA). Its unique in-house manufacturing strategy has led to production delays, risking competitiveness and customer attrition to faster-moving competitors that outsource production. Cost-cutting measures, including workforce reductions, could also impact innovation and R&D, vital for maintaining a technological edge. Intel’s foundry business is still unproven and could become a financial strain if it fails to attract external clients and regain market relevance.

AI PCs And x86 Ecosystem Advisory Group to Accelerate Fundamentals

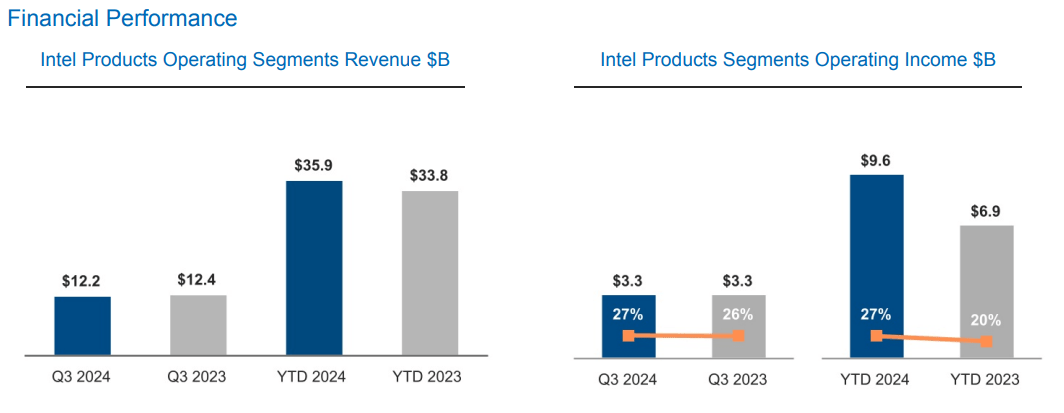

To begin with earnings, Intel saw minor revenue and operating income growth, reflecting its capability to fund further advancements and stay competitive. Intel’s consolidated product revenue hit $35.9 billion YTD 2024, up from $33.8 billion YTD 2023, with a 6.2% annual growth. This growth is derived from higher demand in Intel’s Client Computing Group (“CCG”) and Data Center and AI (“DCAI”) segments.

At the bottom line, Intel’s operating income rose to $9.6 billion with a 27% margin, up from $6.9 billion with a 20% margin in YTD 2023. This 7%-point improvement in margin marks the progress of Intel’s cost management efforts and operational improvements. This trend points to Intel’s revenue growth increasing in absolute terms and profitability, driven by lower inventory charges and a sharp cost structure. The change in revenue and operating margin may bring considerable financial stability and Intel’s capability to reinvest in core R&D, giving it a slow but favorable lead against competitors over time.

Intel 10Q

On the product side, Intel introduced two new processor lines: Core Ultra 200V (Lunar Lake) for mobile devices and Core Ultra 200S (Arrow Lake) for desktops. The Core Ultra 200V series focuses on performance and battery savings, aligning with solid demand across consumer and enterprise markets.

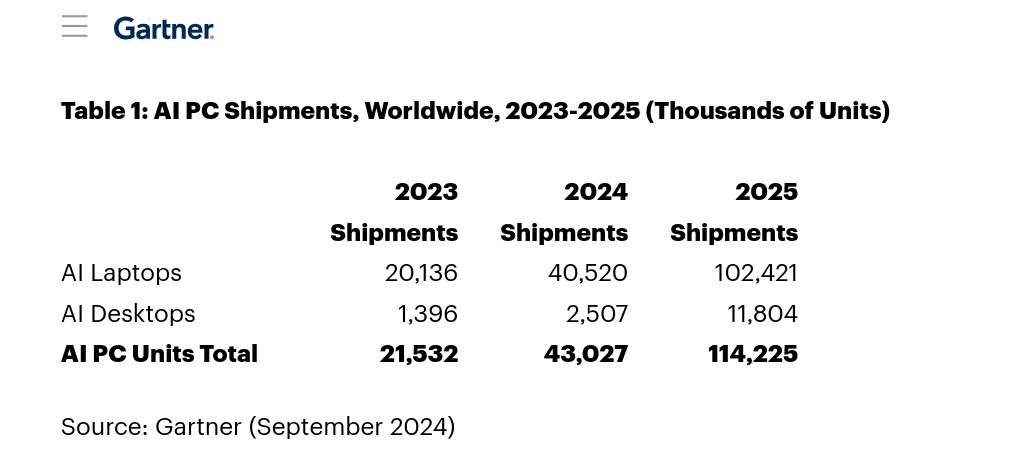

Meanwhile, the Core Ultra 200S series enhances performance per watt, a core metric for operational sharpness, and boosts Intel’s competitive lead in desktop markets. The Desktop market may continue to be stable in revenue with an annual growth rate of 0.06% (2024-2029) and have a volume growth of 0.3% in 2025. On the AI side, Intel projects over 100 million AI-enabled PCs by the end of 2025. The projection aligns with Gartner’s forecast of 114 million AI PCs to be shipped in 2025.

AI PCs are becoming a bigger part of Intel’s product focus, with partnerships involving over 100 independent software vendors and 300 AI applications. The launch of the Neural Processing Unit (“NPU”) for desktops and workstations in the Core Ultra line marks Intel’s edge on AI-driven devices, a growth area driven by enterprise needs for computing power.

gartner.com

In the DCAI segment, Intel’s Xeon 6 (Granite Rapids) processor doubled the performance of its prior version, aimed at AI servers with boosted core counts and memory bandwidth. The Gaudi 3 AI accelerator delivers 1.5 times more memory bandwidth and twice the networking bandwidth of its predecessor, boosting cost-effectiveness for large language model workloads. Although the adoption of the Gaudi series has been slower than expected, Intel’s latest partnerships, such as with IBM Cloud, may push it for a high market position and revenue growth in the specialized AI hardware market.

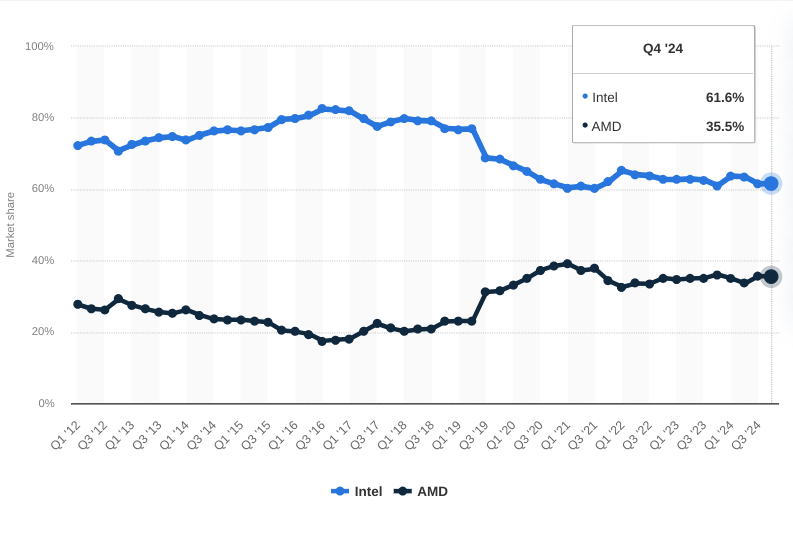

The x86 Ecosystem Advisory Group, created with AMD, is a strategic move to boost Intel’s ecosystem strength. Intel and AMD aim to boost software compatibility and interface consistency within the x86 ecosystem by setting architectural guidelines. This approach creates a constant development environment for software vendors, speeding up advancements and boosting the adoption of x86-based systems across client, data center, cloud, and embedded device markets. The advisory group encourages developers to provide feedback on core functions, shaping the x86 architecture to support modern AI workloads, 3D packaging, and custom chiplets. This move helps Intel keep its market lead (62% global share) by making x86 architecture scalable and adaptable for advanced computing demand.

statista.com

Finally, Intel has transitioned to Extreme Ultraviolet Lithography (“EUV”), which may boost product productivity by offering finer chip sizes. Intel’s roadmap includes Intel 18A, the fifth node in four years, set to launch with major products like Panther Lake and Clearwater Forest. This node development may boost Intel’s lead in high-performance computing and advanced packaging.

In this direction, Intel is setting up its foundry as an independent subsidiary, aiming to attract outside clients and diversify revenue against competitors like Taiwan Semiconductor Manufacturing Company Limited (TSM). Recent multibillion-dollar support from AWS and additional funding for the Secure Enclave program from the U.S. government may support Intel’s product value in commercial and government areas, securing its role as a vital supplier in the semiconductor ecosystem.

Finally, Intel’s foundry plan and advancements in processing directly add to its top-line growth potential, ensuring Intel stays a core player in high-value chip production for AI, cloud, and defense applications.

Intel Is Out Of Dow Jones Industrial Average, What’s Next?

In 2024, Intel’s stock lost over half its value, a massive underperformance against Nvidia’s, which has yielded a surge of more than 175% in 2024, following a solid 221% increase in the last 12 months. Nvidia’s market cap now stands at a solid $3.3 trillion, second only to Apple Inc. (AAPL).

Meanwhile, Intel’s market cap has fallen below $100 billion before earnings. This widening gap between these companies’ market valuations shows Intel’s inability to keep pace in the competitive AI semiconductor market. Intel’s share price drop and declining market cap point to its reduced market relevance and the street’s estimation of future financial performance.

With all that, Nvidia’s stock split and share price adjustments allowed it to join the Dow Jones Industrial Average, replacing Intel. This shift marks Nvidia’s dominance and Intel’s diminishing influence, removing it from the blue-chip index. In short, the contrast in stock performance and market cap reflects the street’s current skewed toward Nvidia’s AI-driven growth over Intel’s CPU focus. Intel’s inability to capture AI market optimism shows a growth barrier that may continue to lead to a declining stock price.

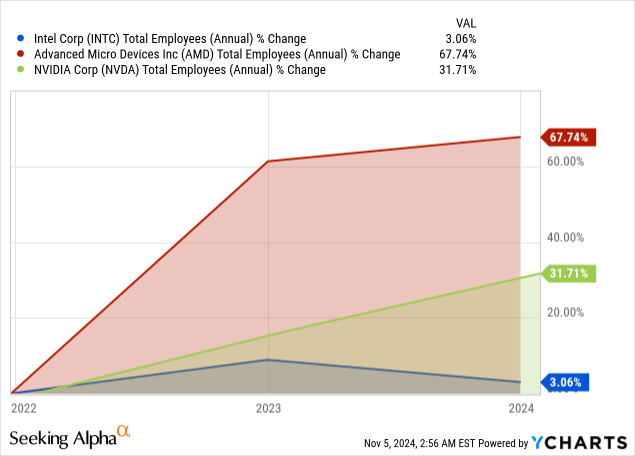

Moreover, Intel’s operational streamlining efforts include a 16.5K employee workforce reduction and cost-cutting aims of $10 billion. On the downside, this initiative reveals deeper strategic issues and financial strain, especially compared to Nvidia’s aggressive hiring to match AI demand. Moreover, Intel’s cuts to real estate and operational expenses reveal limitations in scaling operations to match industry production trends.

By cutting a significant portion of its workforce, Intel risks losing valuable talent in R&D, essential for advancement in semiconductor technology. Further, cost-cutting limits Intel’s capacity to invest in advanced AI processors or efficient chip fabrication methods. Nvidia’s expanding R&D efforts develop cutting-edge AI GPUs. Intel’s CapEx (resource) reduction could render it less competitive in next-generation chip tech.

Fundamentally, Intel’s in-house chip manufacturing strategy has traditionally set it apart (making growth more sustainable), while competitors like Nvidia rely on outsourced production, especially with TSMC in Taiwan. At the core, Intel’s struggle to keep up with TSMC’s advances has led to missed production timelines, reducing the competitiveness of its offerings. Intel is trying to catch up by accelerating its 18A chip technology, but industry skepticism on its scalability remains.

Due to mismanagement of its core strengths, Intel’s fabs-centered production strategy has become a liability, and TSMC has pulled ahead technologically. Simply put, Intel’s lag behind TSMC means its chips have lower performance efficiency, a core metric for high-performance AI applications. Even as Intel develops 18A chips to match TSMC, the timeline pressures and associated costs create long-term uncertainty. Intel’s manufacturing delays have allowed previously smaller companies like Nvidia and AMD to capture Intel’s possible market share.

For instance, Nvidia is leveraging TSMC’s advanced production capabilities. Nvidia’s adoption of efficient TSMC production pipelines has allowed it to design quickly and secure massive contracts with tech giants like Microsoft, Amazon, and Google. If harnessed sharply and timely, Intel’s in-house manufacturing approach could be a game changer in AI markets. But now, the foundry business is both a financial burden and a disadvantage regarding adaptability for rapid growth.

Takeaway

Intel’s thesis highlights growth in AI products and collaborations like the x86 Ecosystem Group, while progress in EUV lithography supports chip leadership. Yet, risks include AI market share loss to Nvidia, production delays, and potential R&D setbacks from workforce cuts. Its foundry business also faces financial risks if it struggles to attract clients and regain competitiveness.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.