Summary:

- We’re downgrading Intel Corporation to a sell.

- While we believe our investment thesis regarding moderating CPU share loss to Advanced Micro Devices, Inc. and potential foundry growth remains in play, we expect the A.I. boom to hurt CPU sales.

- A.I. applications require much more parallel computing power, necessitating more GPUs; hence, the most advanced systems will require a higher ratio of GPUs to CPUs.

- In the near to medium term, we also don’t expect Intel Corporation’s lineup of xPU or GPU to be able to compete meaningfully with NVDA’s GPU for A.I. applications.

- We recommend investors explore exit points at current levels, as we expect Intel Corporation to underperform through 2H23.

Eloi_Omella/E+ via Getty Images

We’re downgrading Intel Corporation (NASDAQ:INTC) to a sell, as we expect the A.I. (artificial intelligence) boom will negatively impact CPU sales. While our investment thesis of moderating CPU share loss to Advanced Micro Devices, Inc. (AMD) and foundry growth toward 2025 continues to play out, we expect INTC is at higher risk of underperforming as the A.I. boom favors higher ratios of GPUs to CPUs for A.I. applications.

Intel Corporation derives the bulk of its revenue, roughly 50% in 1Q23, from its Client Computing Group or CCG; hence we expect the company to underperform in 2H23 as demand for GPUs outweighs that of CPUs due to the nature of A.I. applications that necessitate a higher computing power, i.e., GPUs. Nvidia Corporation’s (NVDA) DGX system, currently the gold standard for A.I. applications, uses a ratio of two CPUs to eight GPUs (2:8); we expect the most advanced systems will continue to require a higher ratio of GPUs to CPUs. Unless server capex spending gets revised up significantly, which is unlikely amid current macro headwinds, we believe CPU unit growth will be meaningfully impacted as demand for GPUs that primarily power today’s A.I. applications spikes. We recommend investors exit the stock at current levels as we see INTC underperforming in 2H23.

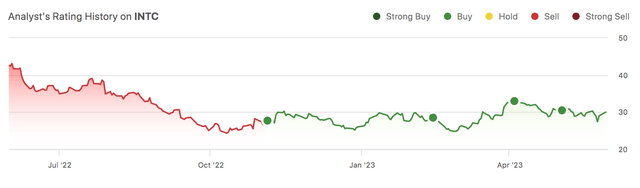

The following outlines our rating history on INTC.

A.I. boom is not good news for CPUs

Last week, NVDA’s guidance for $11B in sales for its 2Q24 quarter versus estimates of $7.15B took the market by storm; the company is clearly the main benefactor of the public wakeup to A.I. capabilities. We don’t expect INTC to experience the same demand tailwinds from the A.I. boom; in fact, we believe CPU sales, which INTC dominates with rival AMD, will experience a steep unit growth slowdown as more server capex is allocated to A.I. servers over compute servers. NVDA’s CEO Jensen Huang touched on this in an interview, stating, “We know that CPU scaling has slowed; we know that accelerated computing is the path forward.” There are two key data points to look at here:

- Soaring demand for A.I. applications and, by extension GPUs

A.I. servers are seeing massive demand tailwinds from Meta Platforms, Inc. (META), Alphabet Inc. (GOOGL), and Microsoft Corporation (MSFT), among others; we know this from NVDA stating that demand for its flagship H100 GPU has outweighed supply in 1H23. Nvidia CEO Huang highlighted this in the 1Q24 earnings call last week, noting, “We are significantly increasing our supply to meet the surging demand.” The nature of A.I. applications requires massive computing power, which necessitates GPUs, specifically NVDA’s DGX system GPUs. In the near to medium term, we don’t see INTC’s lineup of xPU or GPU competing successfully with NVDA’s GPU for A.I. applications. The same goes for AMD’s MI300; we believe AMD’s offering remains inferior to NVDA H100 in developing, training, and deploying generative A.I. and large language models ((LLMs)).

NVDA’s superiority in the generative A.I. space is also visible when analyzing data center revenue growth across all three companies this quarter; NVDA’s data center business grew 14% Y/Y in 1Q24, while AMD reported flat growth Y/Y for the quarter, and INTC reported a 39% Y/Y drop in its Data Center and A.I. Group (DCAI).

- A.I. Server ASP versus Compute Server ASP

The more damning factor here is price; the A.I. server ASP is ~$200K, while the compute server ASP stands at ~$15K – there’s a massive gap between the two. To put this into perspective, for each A.I. server capex spent, we lose 13 compute servers. We’re seeing the industry replace millions of CPUs with fewer CPUs connected to millions of GPUs. With limited server capex, we expect to see more capital dedicated to A.I. server spend in 2H23, causing constraints on the available compute server capex. We also don’t see the server capex being revised up in 2H23 due to the current macro backdrop of inflationary pressures and higher interest rates.

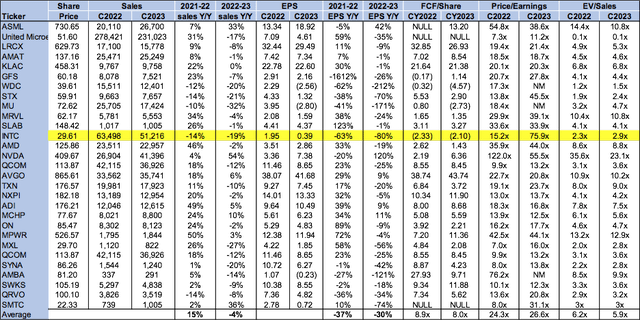

Valuation

Intel Corporation is trading above the peer group on a P/E basis at 75.9x C2023 EPS $0.39 compared to the peer group at 26.6x. The stock is trading at 2.9x EV/C2023 Sales versus the peer group average of 5.9x. We see further downside ahead, and we recommend investors avoid the stock in the near term as CPU unit growth is likely to drop steeply.

The following chart outlines INTC’s valuation.

Word on Wall Street

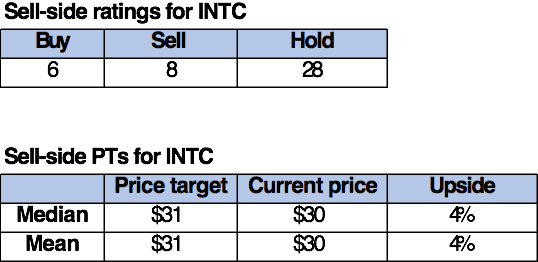

Wall Street shares our bearish sentiment on Intel Corporation stock. Of the 42 analysts covering the stock, six are buy-rated, 28 are hold-rated, and the remaining are sell-rated. Wall Street’s been bearish on the stock since we first began publishing on INTC a little over a year ago. We attribute Wall Street’s bearish sentiment to INTC’s lack of competitive edge over the past couple of years, but we’re seeing this turnaround after INTC’s DCAI roadmap. Our bearish sentiment, however, is driven by our expectations of a downside due to the CPU unit drop in 2H23.

The following chart outlines INTC’s sell-side ratings and price targets.

TechStockPros

What to do with Intel Corporation stock

While we continue to be constructive on Intel Corporation stemming share loss in data center and CPU fronts against AMD and its potential foundry growth in the longer term, we expect the company to be negatively impacted by the drop in CPU sales in 2H23. We’re downgrading INTC to a sell as we believe Intel Corporation will face pressure from its main revenue stream, CCG, and don’t believe INTC has the competitive edge to gain share against NVDA with its xPU or GPU lineup in the near term. We recommend investors explore exit points at current levels, as we think Intel Corporation stock will underperform in 2H23.

Our Investing Group, Tech Contrarians, will launch on June 1st with a significant discount on the annual subscription for the life of the service. We cover everything software/hardware and semiconductors as engineers turned top analysts. Keep reading our work to see more of what’s ahead.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.