Summary:

- Disappointing trends this year are forcing Intel to consider a drastic restructuring, including the sale of its manufacturing unit.

- The company’s products division has presented mixed results but remains profitable with a positive outlook.

- The stock could be a compelling buy-the-dip opportunity with the ability of the company to get back on track with sustainable growth.

hapabapa

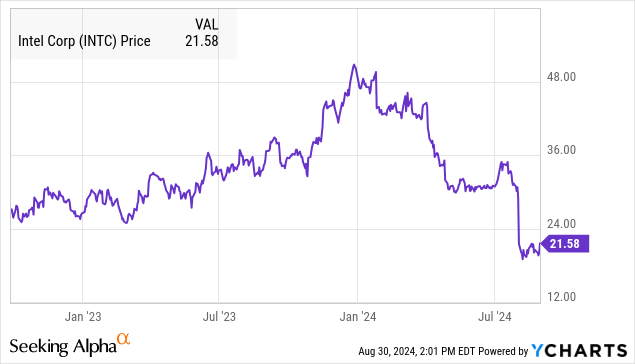

It’s been a frustrating year for Intel Corporation (NASDAQ:INTC) (NEOE:INTC:CA) investors, with the stock rolling back a big rally from 2023, losing more than half its value. Weak second-quarter earnings with poor management guidance have raised market concerns about the chipmaker’s long-term future.

We covered the stock last year highlighting a budding comeback story with shares around $25.00 at the time. A lot has changed, but what has stayed the same are some of Intel’s core strengths including its chip design leadership and significant market share in highly profitable categories.

A report suggesting the company is considering selling its fledgling chip foundry unit could be the drastic strategy shift necessary for Intel to get back on track. We see room to turn bullish on the stock.

Why Intel Stock Has Crashed

When looking at Intel as a pioneer in the semiconductor industry, there are many moving parts in what has been a series of execution failures. The stock price collapse has been in the making for a long time.

The company was slow to address the rise of Advanced Micro Devices (AMD) as a formidable competitor in the consumer x86 architecture CPU market over the past decade. The transition by Apple Inc. (AAPL) since 2020 away from Intel as a supplier to its in-house chip design was also a shock to the business.

We can point to manufacturing delays and high-ticket acquisitions that have failed to deliver all of which help explain the company’s apparent fall from grace.

Maybe the biggest miscalculation was the lack of vision to recognize the revolutionary potential of artificial intelligence. In this case, NVIDIA Corp. (NVDA) has taken off with a multi-year head start on AI-optimized chips that have been a technology game-changer. What we have now is a beaten-down laggard attempting to play catchup.

A reset of expectations

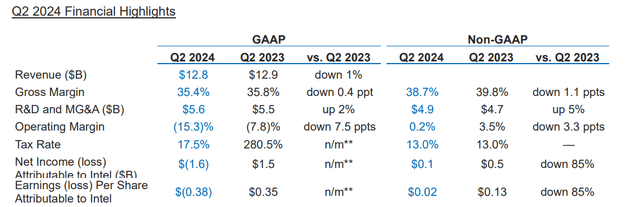

This theme of setbacks has continued into 2024. In Q2, Intel reported adjusted EPS of $0.02, below estimates by $0.08, and also down from $0.13 in the prior-year quarter. The big miss here captured lower-than-expected revenue of $12.8 billion, declining by 1% year-over-year, pressured by weakness in the traditional data center CPU market as the industry shifts spending towards AI chips.

The bulk of the earnings weakness is related to the Intel Foundry segment, where Intel continues to ramp up its newest facilities in Ireland responsible for significant R&D and start-up costs the company expects to continue into 2025. The firm-wide operating margin of just 0.2% fell from 3.5% in Q2 2023.

Citing the disappointing results and a recognition that the company is too bloated, Intel plans to kick off new cost reductions targeting upwards of $10 billion in savings by next year.

This includes a 20% reduction to prior planned capex as well as cuts to operating expenses through a 15% or greater headcount reduction while realigning the priorities into high-value growth areas. The immediate implication is that a pullback in investments may limit the long-term growth outlook, but supports near-term free cash flow and profitability. Intel is also suspending its dividend starting in the fourth quarter.

Overall, the combination of a first half to 2024 that didn’t quite live up to the optimism built from last year 2023, and the consequences of the new restructuring initiatives have led to a reset of expectations evident by the last leg lower in the stock price.

Focusing on the Strengths

Beyond the doom and gloom headlines, several strong points in Intel’s product portfolio work to brush aside any concerns that the company is falling apart. The bigger picture is that Intel has had its missteps, but remains fundamentally sound.

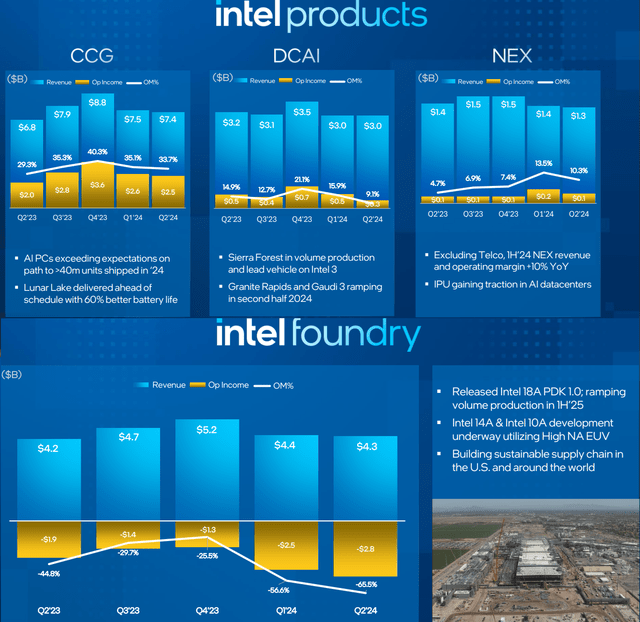

In Q2, Client Computing Group (CCG) generated $7.4 billion in revenue, exceeding expectations by 9% y/y. Intel’s largest and most profitable business is on track to ship more than 40 million “AI PCs” by year-end, exceeding expectations for the latest generation of CPUs tooled for AI performance. The Lunar Lake processor series was launched ahead of schedule and has been noted for its leap in performance efficiency

The enterprise-level Data Center and AI (DCAI) unit posted a modest 3% decline in revenue this quarter, although there is some anticipation that new product launches can lead to a broader rebound going forward.

Intel’s Sierra Forest Xeon 6 processor is set to begin shipping in September as a high-performance general computing data center process. Separately, Intel’s attempt to directly compete with Nvidia is on the horizon with the Gaudi 3 AI accelerator still coming this year. Management is citing a “two-times the performance per dollar” as a major advantage in specialized AI workloads such as deep learning and machine learning.

DCAI remains strategically important for Intel’s growth potential alongside the Network and Edge (NEX) unit. Management explains that excluding some inventory volatility related to major telecom customers this year, first-half growth was a solid 10%.

The pattern that emerges is this contrast between a still dynamics products division against the foundry unit which has been a proverbial money pit dragging the firm lower. The situation isn’t great but there is some underlying value.

What’s Next for Intel?

When we look at Intel stock today as an investment opportunity, the bearish case will be louder, centered on a narrative that the company has lost the AI arms race and the foundry business is a sinking ship.

At the same time, there’s a case to be made that many of these negatives have already been priced in, particularly following shares dropping by 25% just in the past month.

Keep in mind, Intel still generated $8.2 billion in free cash flow last quarter while reporting $11.3 billion in balance sheet cash. The dividend suspension is set to save the company $2 billion in cash next year, providing some additional flexibility to deal with a $48 billion debt position. A bullish case for INTC starts with the ability of the company to turn things around.

Ultimately, a scenario where Intel sells or spins off the foundry business could be the best course of action to place the core product groups on a path for sustainable and profitable growth.

According to reports, Intel is working with banks like Morgan Stanley (MS) and Goldman Sachs (GS) on various strategic options. While nothing has been officially confirmed, this level of restructuring would address what has been the weakest side of the business and likely shore up the balance sheet while unlocking value for shareholders.

The move would also bring the CGC, DCAI, and NEX groups in line with the model that is proving to work with competitors like AMD and Nvidia, which have consistently generated higher margins and profitability.

INTC Stock Price Outlook

Recognizing the highly uncertain and speculative situation, we rate INTC as a buy. The call here is that a combination of reset expectations coupled with underlying strengths and room for an improved outlook could be enough to mark the start of a new rally in the stock, with the $30.00 level being a reasonable upside target over the next year.

In terms of valuation, the key point is that Intel remains profitable and generates positive free cash flow, expected to even accelerate into 2025. Assuming the company sticks to the course without a breakup or sale of the foundry, the current consensus is for EPS to accelerate towards $1.22 by next year, implying 18x 1-year forward P/E ratio. This level could prove to be a bargain if the turnaround strategy works with rebounding growth over the next several quarters.

Covering the downside risks, it is also possible conditions deteriorate. Signs the AI initiatives are failing to gain market adoption, or some sort of technical setback where expected product launches are delayed, would undermine a bullish outlook. Intel also remains exposed to shifting macro conditions, where weaker trends in regions like Asia-Pacific or a deeper slowdown in traditional data-center demand would likely also pressure the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in INTC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein represents the personal opinions and views of Dan Victor only and is intended for informational and/or educational purposes. It should not be construed as a specific recommendation or solicitation to buy or sell any security or follow any particular investment strategy. Please consult with your financial advisor before making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.