Summary:

- Intel stock has seen a massive jump since the recent earnings, but the market seems to be getting ahead of itself.

- The gross margin of Intel has declined by another 10 basis points compared to the year-ago quarter.

- Most of the improvement in operating margin has been through cost cuts in R&D and SG&A expenses.

- It will take another six months to get a definitive idea about the progress made by Intel on its process road map.

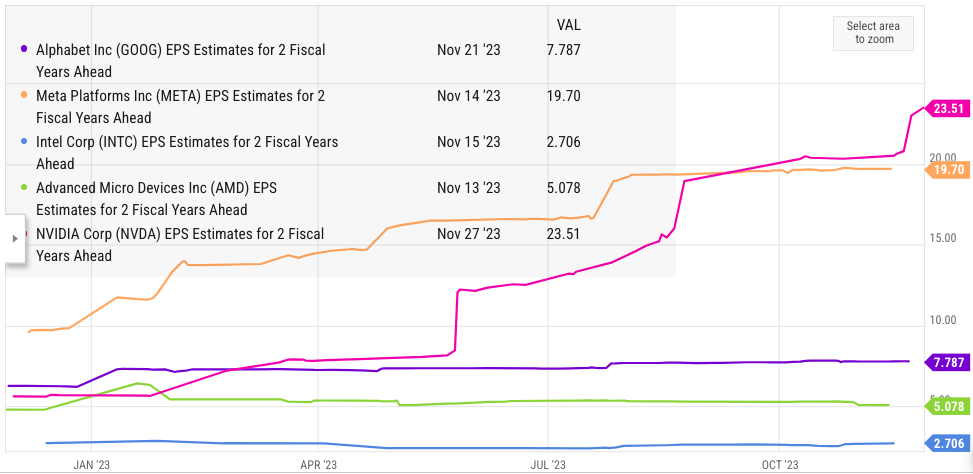

- Intel stock is quite expensive compared to other big tech, even when we look at EPS estimates 2 fiscal years ahead.

JHVEPhoto/iStock Editorial via Getty Images

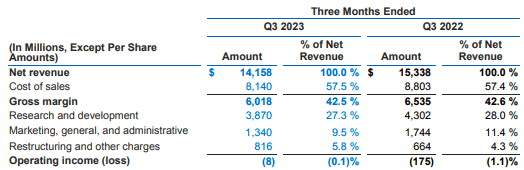

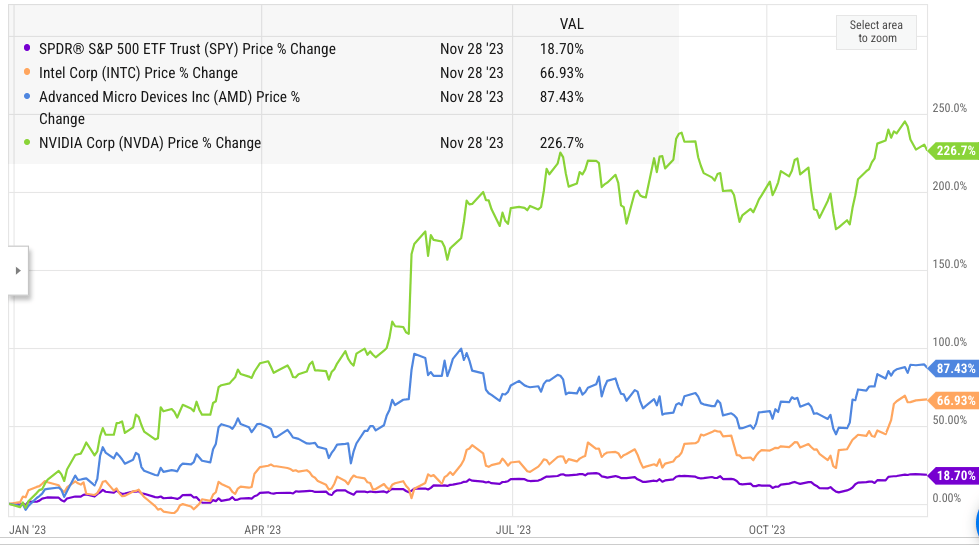

Intel (NASDAQ:INTC) stock has seen a big jump since the recent quarterly earnings. In the YTD, Intel stock is up by 68% compared to 20% by S&P 500. However, the market seems to be getting ahead of itself, as a number of metrics reported by Intel are quite modest. Intel reported another quarter of fall in gross margin, which declined to 42.5% from 42.6% in the year-ago quarter. The operating margin improved from negative 1.1% to negative 0.1%. Most of this improvement has been due to a big reduction in research and SG&A expenses. In a previous article, it was mentioned that the margins are under threat, and we could see a decline in gross margin in this quarter.

Intel needs to prove a lot in 2024. If it falters in its process roadmap, we could see most of the stock gains evaporate. It should be noted that Intel is spending heavily on capex which makes it a high-risk strategy. The company is getting significant subsidies from many governments, but it will take another two or more years before the foundry business is able to show meaningful impact on Intel’s operating numbers.

The EPS estimate for Intel for 2 fiscal years ahead is $2.7 which means the stock is trading at 16.5 times this number. On the other hand, most of the stable big tech companies like Meta (META) and Alphabet (GOOG) are trading at a cheaper multiple. Even Nvidia (NVDA) stock is trading at less than 20 times its EPS estimate for 2 fiscal years ahead. At the same time, there are lots of risks associated with Intel’s strategy. Investors looking to enter at the current price need to closely look at the recent trends.

Good numbers, but at what cost

Intel improved the operating margin by 1 percentage point compared to year-ago quarter. Most of this improvement was due to big cuts in research department. This year has been the year of efficiency for most big tech companies and Wall Street has rewarded them with its strong approval. Intel has also made deep cuts in order to improve its operating efficiency.

Company Filings

Figure: Intel’s decline in research and SG&A expense helped improve operating margin. Source: Intel Filings

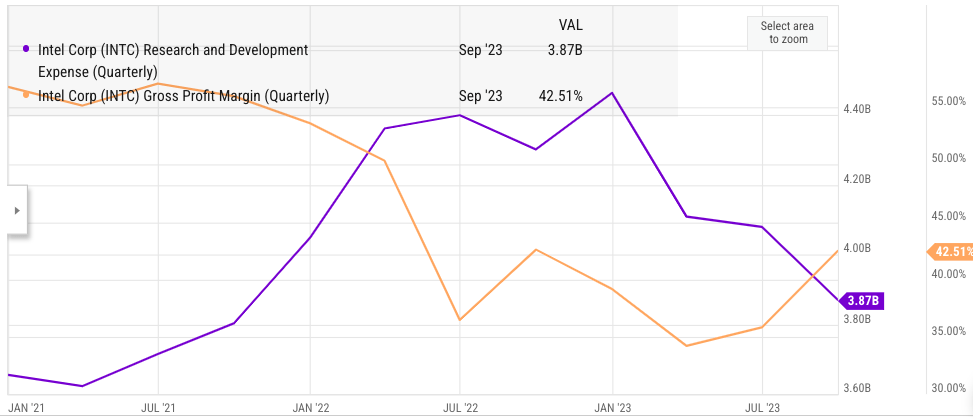

There have been concerns over rapidly increasing R&D expenses in Intel as the company tries to improve its process roadmap. The recent cuts will come at a crucial time when the company is close to launching its highly marketed 20A and 18A processes in the next few months.

Ycharts

Figure: Gross margin and R&D trends of last few quarters. Source: Ycharts

It remains to be seen if these cuts will have any negative impact on the research capability of Intel. However, it is unlikely that Intel will be able to reduce expenses significantly in the next few quarters. Unless we see a strong uptick in gross margin, Intel could report modest operating margins in the next few quarters of 2024.

Progress in process roadmap

Intel’s management has staked a lot on achieving its five nodes in four years upgrade. At the end of this road, Intel should have process leadership with its 18A technology. However, it will take at least another few months to see if Intel can stick with the current plan. We have already seen some technological difficulties faced by TSMC (TSM) when working with lower nodes. Intel will also likely face the same issues and will need to give definitive proof to clients before it can get massive orders.

Intel stock has already jumped by close to 70% in 2023. Even with a successful rollout of new nodes, Wall Street might not reward the stock significantly unless there is a big improvement in the bottom line. Intel has been investing massively to expand its foundry business. It is already a very risky strategy and the market seems to have got ahead of itself when gauging the long-term potential of Intel’s strategy.

Risk/return is lopsided

The EPS estimate of Intel stock for 2 fiscal years ahead is $2.7. According to this estimate, the stock is already trading at a multiple of 16.5 of this number. It should be noted that these estimates are based on the successful completion of the current road map and improvement in the PC demand over the next few quarters.

Ycharts

Figure: EPS estimate of 2 fiscal years ahead of Intel and other companies. Source: Ycharts

On the other hand, more stable stocks with a better moat like Alphabet are trading at a cheaper valuation when we look at this multiple. Even Nvidia, despite the massive bull run in 2023, is trading at less than 20 times the EPS estimate of 2 fiscal years ahead. It is certainly possible that Intel beats the expectation and is able to deliver better-than-expected profitability growth in the next few quarters. However, the downside for Intel stock is also quite significant because of the massive investment in foundry business.

Impact on Intel stock in 2024

Next year will be quite eventful for Intel as it will launch new process nodes. Any delay in these launches could lead to a major correction in the stock. At the same time, profitability improvement in the stock is not expected till well into 2025. Most of the upside potential of Intel stock has been priced in and we can expect at best a sideways trade in Intel stock for the next few quarters.

Ycharts

Figure: Price movement in Intel and other chip stocks in 2023. Source: Ycharts

This year has been the case of “a rising tide lifts all the boats”. Intel’s performance has still been below that of Nvidia and AMD (AMD). However, it has been much better than S&P 500. This also shows the cyclical nature of this industry. All the chip stocks are now trading at a high valuation and future growth will depend greatly on company-specific performance. Intel will need to deliver on its strategy before Wall Street turns sour on the company. The stock is not cheap and there are lots of risks associated with the company in the next few quarters.

Investor Takeaway

Intel stock has had a good run this year as the company reduced operating expenses by cutting research and SG&A expenses. However, there has not been any improvement in gross margin as the inventory levels remain elevated, and customer spending is modest. Intel stock is trading at a multiple close to other stable big tech companies and Nvidia when we look at EPS estimates of 2 fiscal years ahead. This makes a bet on the stock at the current price quite risky.

Intel has a lot to prove in the next few quarters. Any delay in the launch of new process nodes can completely change the narrative around the stock and cause a correction. Investors should also watch the massive capex of Intel and its impact on the debt condition, especially in the current high-interest environment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.