Summary:

- Intel’s stock price has declined by 50% in the past 3 years, driven by product delays, the changing of the competitive landscape, management changes, and recession fears.

- Many investors are considering INTC’s stock as one, which could provide growth at a reasonable price. However, the growth and its extent are quite uncertain in the current macroeconomic environment.

- We are taking a more conservative approach and are valuing INTC’s stock solely based on its dividends and potential dividend growth.

- Other factors, like share buybacks and the impact of the CHIPS Act, are also taken into consideration.

- Currently, we rate INTC as hold.

RobsonPL

Introduction

Intel Corporation (NASDAQ:INTC) engages in the design, manufacture, and sale of computer products and technologies worldwide. In the recent years, the firm has been closely followed by many as mixed news have been surfacing about Intel’s management changes, CAPEX spendings on expansion and struggles with keeping up with the competitors, resulting in a significant stock price volatility.

For reference, here we have collected some pieces of news, chronologically, that have had a material impact on the stock price in the past three years:

- Intel drops 9% as product delay offsets strong earnings, lifting competitor AMD

- Intel shares soar 6% as activist hedge fund Third Point pushes for strategic alternatives – Reuters

- Intel gains 10% as CEO Bob Swan will step down; AMD drops 3%

- Intel stock rallies on $20B manufacturing expansion to become global foundry player

- Intel stock drops after delaying Sapphire Rapids data center processor

- Intel falls 11% amid flurry of downgrades by Morgan Stanley, Mizuho, UBS after Q3 earnings

- Intel shares surge as investors cheer Mobileye spinoff

- Intel CEO Gelsinger sees company turnaround taking at least five years–report

- Intel declines as long-awaited Arc graphics card delayed again: report

- Intel seen as biggest beneficiary of CHIPS Act, but not a ‘silver bullet,’ BofA warns

- Intel surges as job-cut plans meet with Wall Street’s approval

- Intel shares slip as chipmaker taps brakes on new German plant

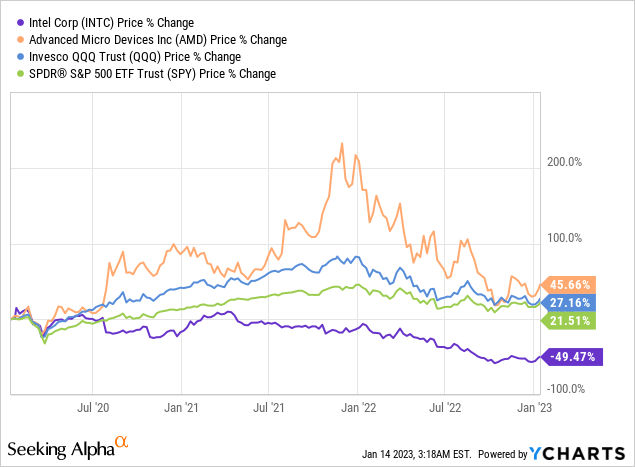

All in all, in the past 3 years INTC’s share price has halved. In the same period, Advanced Micro Devices (AMD), one of INTC’s main competitors, has increased in value by more than 45%. Indexes, like the QQQ and the SPY have also significantly outperformed Intel.

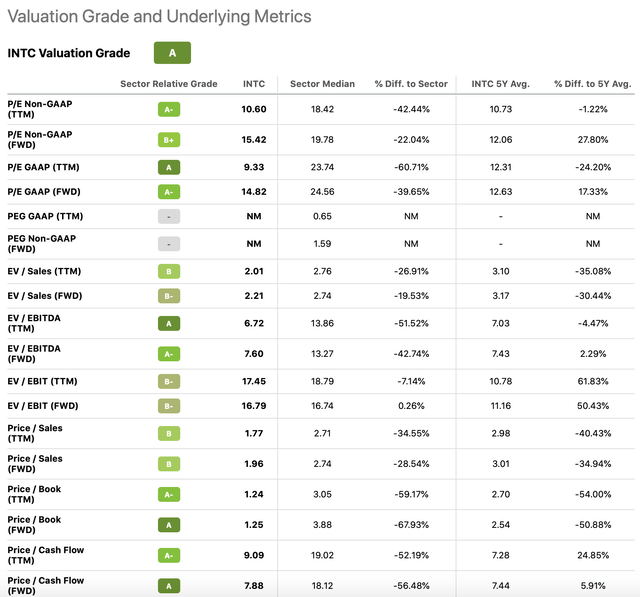

During the past years, many investors have been looking at INTC’s stock as one which could offer growth at a reasonable price, as INTC has been the dominant player in the sector. This view can be well justified when we take a look at INTC’s price multiples and how they compare with the information technology sector median.

Valuation metrics (Seeking Alpha)

But due to the uncertainties surrounding the chip market (including supply-demand and supply chain issues) in the near future, the changing competitive landscape, the company’s expansion and further potential product delays, many are also asking the question, is Intel perhaps a value trap?

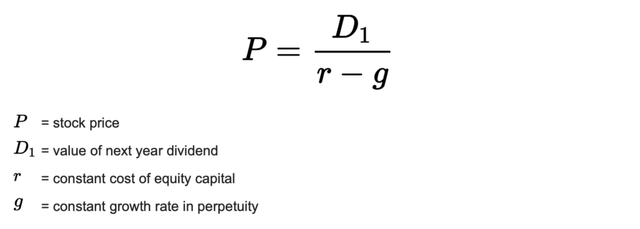

For these reasons, we have decided to take a conservative approach to value Intel’s stock. In this article, we will be valuing INTC’s stock solely based on its dividends and dividend growth, using the Gordon Growth Model.

Valuation

Gordon Growth Model

The Gordon growth model [GGM] is a simple and well recognised dividend discount model, used to value the equity of dividend paying firms. The primary assumption of this model is that the dividend grows indefinitely at a constant rate. Due to this criterion, this valuation model is particularly appropriate for companies that are:

- Paying dividends

- In the mature growth phase

- Relatively insensitive to the business cycle

A strong track record of steadily increasing dividend payments at a stable growth rate could also serve as a practical criterion if the trend is expected to continue in the future.

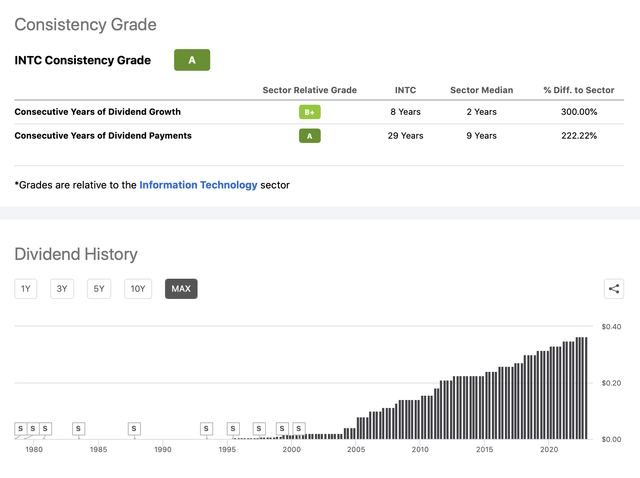

While INTC’s business may not be completely insensitive to business cycles, we believe the firm’s strong track record of growing dividend payments over the years makes the stock an appropriate candidate to be valued using this dividend discount model.

Dividend history (Seeking Alpha)

Intel has been paying dividends in each of the past 29 years, and they have even managed to increase the payments in most years, which signals the company’s strong commitment to returning value to shareholders in this form. The current quarterly dividend is $0.37 per share, which corresponds to an annual yield of about 4.9%.

Now, let us take a look, what the GGM actually is. The model is described by the following formula:

GGM (wallstreetprep.com)

To make sure that our estimated fair value is realistic, we have to make sure that our assumptions for the input parameters are also reasonable.

1.) Required rate of return

In most cases, we prefer to use the form’s weighted-average cost of capital [WACC] as the required rate of return for our calculations.

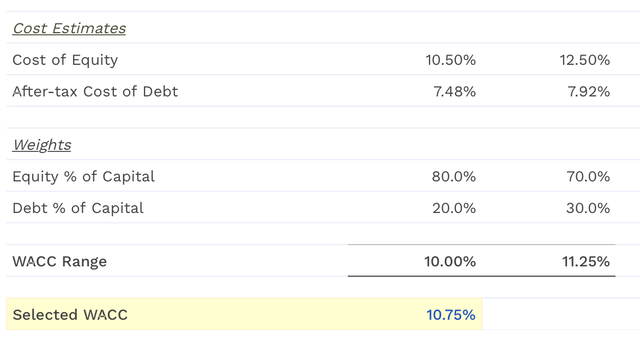

WACC (finbox.com)

Intel’s WACC is estimated to be in the range of 10% to 11.25%. Going forward, we will be using the 10.75%, highlighted in yellow.

2.) Reasonable constant dividend growth rate in perpetuity

Intel’s historic dividend growth trend could help us come up with a reasonable range of growth assumptions.

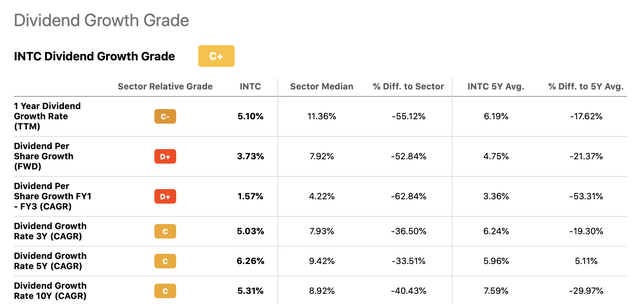

Dividend growth (Seeking Alpha)

Depending on the timeframe that we are looking at, INTC’s dividend growth in the past years has been between 1.5% and 6.3%, which is somewhat lower than the information technology sector median of 4.2% to 11.4%.

Independent judgement is needed now to determine what could be a “reasonable” value in perpetuity.

We will be using 2% to 5% for our calculations. The reasons behind our choice are the following:

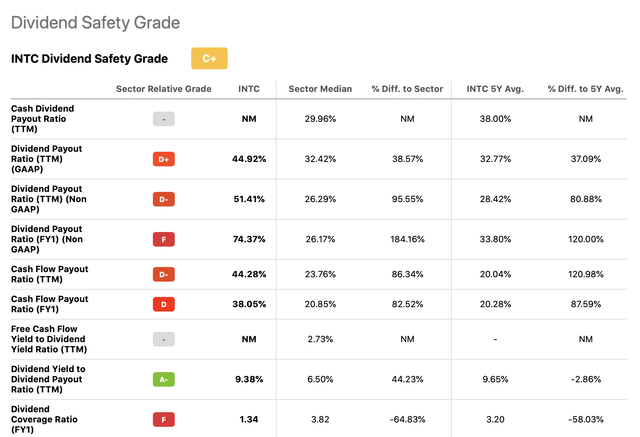

1.) Currently the dividend payout ratio is relatively high compared to the sector median, while the coverage ratio is relatively low.

Dividend safety (Seeking Alpha)

While we believe that Intel will not have to cut or pause its dividend in the near future, they may not be able to increase the payments at a high rate.

2.) Using unreasonably high growth rates have a substantial impact on the fair value and could lead to a significant overestimation.

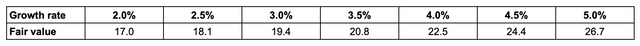

Using the above-defined assumptions, we get the following range of fair values for INTC’s stock:

Fair value estimates (USD per share) (Author)

As the stock is currently trading around $30 per share, we would like to see the stock price pull back, before starting a new position. During the past 12 months, Intel’s stock has been trade around $25 several times, so it is not unlikely that we get into this value territory again in the near future.

Does it mean that the stock is a sell now? Absolutely not. There are several factors, which are not captured by the Gordon Growth Model and can have a significant impact on the share price and on the fair value. Let us take a look at some other considerations.

Other considerations

Share buybacks

Over the past decade, INTC has not only been returning value in the form of dividend payments, but also through share buyback programs.

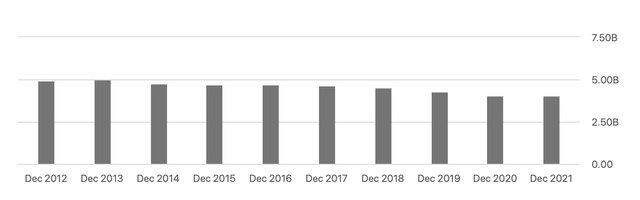

Shares outstanding (Seeking Alpha)

Since 2012, Intel has reduced its number of shares outstanding by as much as 17%. In our opinion, share buyback programs are a more flexible and sometimes a more tax efficient way of returning value to shareholders. How many shares the firm buys back in a quarter is up to the management and does not have a dramatic impact on the share price, if the amount is somewhat less in a given quarter. On the other hand, if the dividend is cut or paused, it can have substantial impacts on the share price.

The GGM does not take the positive impact of the share buybacks into account.

CHIPS Act

The CHIPS act has been defined as an initiative created by the U.S. government “to bolster US semiconductor capacity, catalyze R&D, and create regional high-tech hubs and a bigger, more inclusive STEM workforce” by providing $280 billion. We believe that Intel will definitely benefit from this funding, however its domestic competitors will do, too. The potential positive impacts of this act on INTC’s financial results are also not captured using the GGM.

Macroeconomic environment

While Intel’s CEO has earlier said that the company’s turnaround will take at least 5 years, we believe that due to the current macroeconomic environment and its negative impact on costs and demand may make this turnaround process longer. For this reason, at this point we are not considering Intel as a stock with exceptional growth opportunity.

To sum up

All in all, we believe that INTC’s stock is currently trading at a somewhat higher price than the fair value range estimated by using the Gordon Growth Model. This model, however, does not take into account the positive impacts of the share buyback programs and the potential positive effects of the CHIPS Act. For these reasons, we currently rate INTC’s stock as hold.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.