Summary:

- Intel’s IDM 2.0 strategy has faced challenges in 2024 with the Foundry segment rapidly losing revenue and operating profit.

- AMD’s rapid ascent in x86 market share continues to threaten Intel’s long-term earnings growth prospects.

- The rise of AI PCs poses a threat to Intel’s x86 dominance, but it’s unlikely Intel will be outright disrupted.

- Intel presents a relatively solid valuation compared to TSMC, especially on a P/S basis.

FinkAvenue

I first covered Intel Corporation (NASDAQ:INTC) in January of 2024 with a Sell rating. In that article, titled “Intel: The Risk Of Being Everything To Everyone”, I described the IDM 2.0 strategy, highlighted the associated risks, and shared why I believed Intel did not present a very compelling opportunity. While the S&P has gained 13% since that article, Intel is down 28%. The market has punished Intel following the new financial reporting model under the IDM 2.0 model. The report, filed on April 2nd of this year, set off a wave of selling that has brought the stock from $44 to the current price of $32.

The report included restated financials which painted a grim picture for the widely hyped Intel Foundry. The segment is bleeding cash with a significant amount of intersegment revenue leaving the foundry in 2023. Some reason for optimism is the external revenue figure, which nearly doubled from $479m in 2022 to $953m in 2023. The uplift was driven by packaging, a segment of the chip industry Intel has a solid position in with its EMIB and Foveros technology.

Intel’s IDM 2.0 strategy dominated the narrative in 2023 but the market has now made it abundantly clear that the IDM 2.0 talk has to be backed up by results. Today I’d like to revisit my thesis and upgrade Intel from Sell to Hold given the more compelling valuation presented now relative to earlier this year.

Despite a solid valuation, I do not yet rate Intel a Buy. The company is losing overall CPU market share while CPUs are concurrently losing data center floor share to GPUs. Meanwhile, the PC market is undergoing disruption as AI devices begin to permeate the market.

In this article, I’ll discuss the risks that Intel still faces yet why I believe success is still likely.

x86 Challenges

The x86 instruction set architecture (“ISA”) created by Intel has remained the dominant CPU design since the computer era began. Being a complex instruction set architecture, it offers superior power and performance compared to ARM’s (ARM) reduced instruction set architecture. The ISA determines the actual operations a computer system can perform, upon which the operating system and associated software is built. As the ecosystem grew and x86 became the dominant architecture, switching costs quickly became Intel’s moat.

It wasn’t until mobile phones changed the computing paradigm that this moat was disrupted. Apple (AAPL) created the computer in your pocket and built it on the ARM reduced instruction set architecture. The decision to build on ARM was made only after Intel turned down the offer to supply x86 chips for iPhone’s, in one of the greatest blunders in business history.

The rise of cloud computing helped propel the next leg of growth for Intel once the PC market was saturated. Strong sales growth in server CPUs helped shield Intel from its flailing IDM model as TSM was growing dominant. Now, the only other company with a license to sell x86 CPU’s is presenting a series challenge to Intel’s dominance. Advanced Micro Devices (AMD) Epyc data center processor continues to take share from Intel.

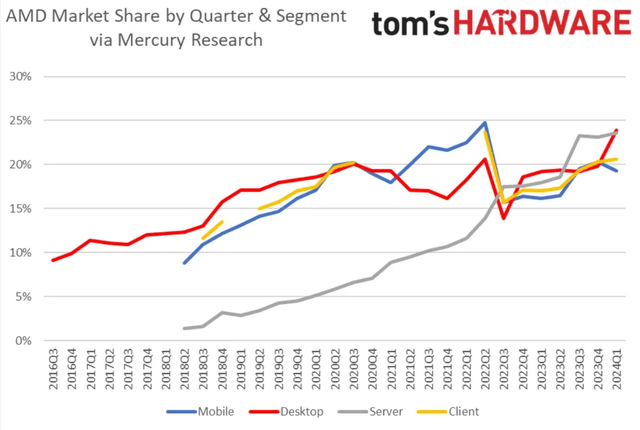

AMD has been gaining ground on Intel for years across virtually the entire CPU landscape, but the Server growth is incredible. These are Intel’s core markets and have been cash cow businesses for years. AMD won share by positioning itself as a performance-first product. It appealed to gamers and data center operators who need maximum performance. While Intel CPUs maintain the dominant market position, there have been few times in the company’s history that its position was as threatened as it is now.

This threat compounds with the explosion of data center GPU sales targeted at AI commercialization. In the race to deploy AI, one thing is clear: GPUs are much more important than CPUs. Data center operators are now relegating more floor space to GPUs, making the pie smaller for CPUs. Not to mention AI GPUs are being sold bundled with CPUs, so Nvidia’s (NVDA) Grace CPU and AMD’s chiplets are taking further share from Intel.

Meanwhile, the company is grappling with an influx of low-power consumption competitors with built on the ARM architecture. A years-long exclusivity agreement between Microsoft (MSFT) and Qualcomm (QCOM) to develop ARM chips for Windows is coming to an end. Some industry pundits have even said that Qualcomm’s ARM-based Snapdragon PC chipset could be a death knell for Intel. Now Nvidia and AMD are reportedly developing ARM chips for Windows to compete with the Snapdragon line.

While Intel is battling with AMD over x86 CPU market share and data centers are becoming dominated by GPUs, the x86 architecture itself is also at risk.

Moving Windows over to an ARM design won’t be easy though. Much of this push toward ARM is because Apple has seen great success in its M-series chips. Apple benefits from its tightly integrated hardware-software stack in its products, but ARM on Windows would be different.

Running Windows on ARM would require a significant amount of re-engineering and would lead to countless software bugs and incompatibilities. Apple didn’t have much trouble on this as they are the sole vendor for MacBook hardware. This is not true for machines running the Windows OS. It would be difficult for Microsoft to achieve the consistency in each successive generation unless they pick an exclusive ARM vendor and stick with them. Intel does not believe that ARM presents a serious risk to its x86 PC business.

For its part, Intel isn’t sitting still. The recent announcement of Lunar Lake at Computex in Taiwan marks a big shift to Intel’s traditional x86 approach and a direct shot at Microsoft Copilot+ qualification. Historically, ARM chips offered better power efficiency than x86 chips, allowing them to earn the dominant share in the mobile chip space. With the huge power demands of running AI, ARM-based CPUs seem poised to win. A chipset can include a power-hungry GPU and NPU while offloading some tasks to an energy efficient CPU. Intel is attacking this angle with Lunar Lake, the system on chip (“SoC”) geared toward edge AI devices.

Lunar Lake includes two types of CPU cores dubbed ‘E-cores’ (efficiency) and ‘P-cores’ (performance). Those CPU cores are co-packaged on the compute tile with an NPU and GPU. Four E-cores are threaded together, and their use is prioritized by the Thread Director before the P-cores. This leads to substantially better power efficiency relative to performance compared to prior generations.

The superior SoC power efficiency is not at the expense of performance, though. According to Forbes: “These new E-cores are so performant that they are effectively on par with earlier Raptor Cove performance cores found in Intel’s 13th and 14th Gen desktop CPUs.”

Intel is flexing some engineering muscle here. The E-cores offer substantially better energy efficiency, and if current gen E-cores do indeed match older P-cores, the Lunar Lake chipset will make it even more difficult for ARM to permeate the Windows market.

Intel Investor Relations

The battle for the next generation of AI powered computers is shaping up to be a fight between ARM and x86. The x86 moat in Windows has been far too difficult to disrupt to date, but the emergence of AI embedded directly into the Windows operating system may be a strong enough disruptive force.

Reasons for Optimism

There are still reasons for optimism for Intel investors. While 2024 has been a challenging year, the path forward could be brighter.

For one, all signs point to the emergence of a dominant US based foundry. The American CHIPS act is investing heavily to bolster domestic manufacturing capacity and Intel already has the leading American foundry business. American companies need a reliable domestic partner for leading edge chip manufacturing to de-risk supply chains. The looming threat from China will continue drumming up fear and uncertainty for TSMC. While Intel is behind on the leading edge, the company offers leading advanced packaging technology and is a leader in silicon photonics. Optical I/O is a promising solution to address the I/O requirements of commercial AI. The company recently announced the first fully integrated Optical I/O Chiplet.

Further, the boom in custom silicon suggests strong demand for Intel’s foundry business moving forward. While TSMC is undoubtedly the market leader in leading edge nodes, not all use cases require leading edge technology. Chiplet technology and other heterogenous architectures can combine leading and lagging edge chips onto the same die, so Intel can still capture demand now while it isn’t the technology leader.

Intel was a market leader for years and certainly still has the capability to reemerge better than before. The chip industry moves fast and Intel was asleep at the wheel during some major shifts, but the company is responding with agility and force to the blossoming AI industry.

Investor Takeaway: Further Uncertainty Ahead

Much of what has propelled TSMC to dominance in the foundry model is the forever node strategy. Semianalysis refers to TSMC’s use of lagging edge nodes as cash cows as the “forever node” strategy. Foundries depreciate equipment over the course of five to seven years, after which they remain entirely operational but have a much more compelling cost profile than leading edge nodes. The cash generated from these lagging edge nodes is used to invest in further leading edge advancements. On the other hand, Intel regularly demises older node leaving the company without the vital streams of cash that TSMC has.

Intel currently trades at a forward P/S of around 2.5 and forward non-GAAP P/E of 29. The sales multiple is slightly lower than the company’s five-year average while the earnings multiple is slightly higher. Compared to TSMC’s forward P/S of 9.5 and forward non-GAAP P/E of 29, Intel looks to present a reasonable valuation currently. Intel is currently guiding for a gross margin of around 40% in the upcoming quarter, well below TSMC’s gross margin which exceeds 50%. This explains the huge difference in sales multiples between the two companies, but the market looks to be discounting Intel quite heavily at current levels. It appears most of the downside is priced in, so I no longer recommend selling Intel. However, there is still too much uncertainty in the medium term to warrant long-term investment at this time.

While Intel’s early move into high-NA EUV is promising for leapfrogging TSMC, it will bring hefty depreciation costs over time and is certain to be a headwind on earnings growth in the future. The inordinately high Capex requirements of operating a leading edge foundry make success difficult, but CHIPS act funding can help ease that burden. Meanwhile, Intel was the first recipient of a High-NA EUV machine and maintains leadership positions in advanced packaging and silicon photonics.

Overall, the path forward remains uncertain and Intel sits at a perilous crossroads with its x86 market positioning. Regardless, I believe long-term success is likely with the IDM 2.0 strategy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.