Summary:

- Intel announced a 15% workforce reduction and the suspension of its dividend, aiming to cut costs and manage its $48 billion debt load, reflecting significant financial strain.

- Intel’s 1.0 PDK for the 18A process node has been completed, showing progress in its ambitious “five nodes in four years” plan to regain technological leadership by 2025.

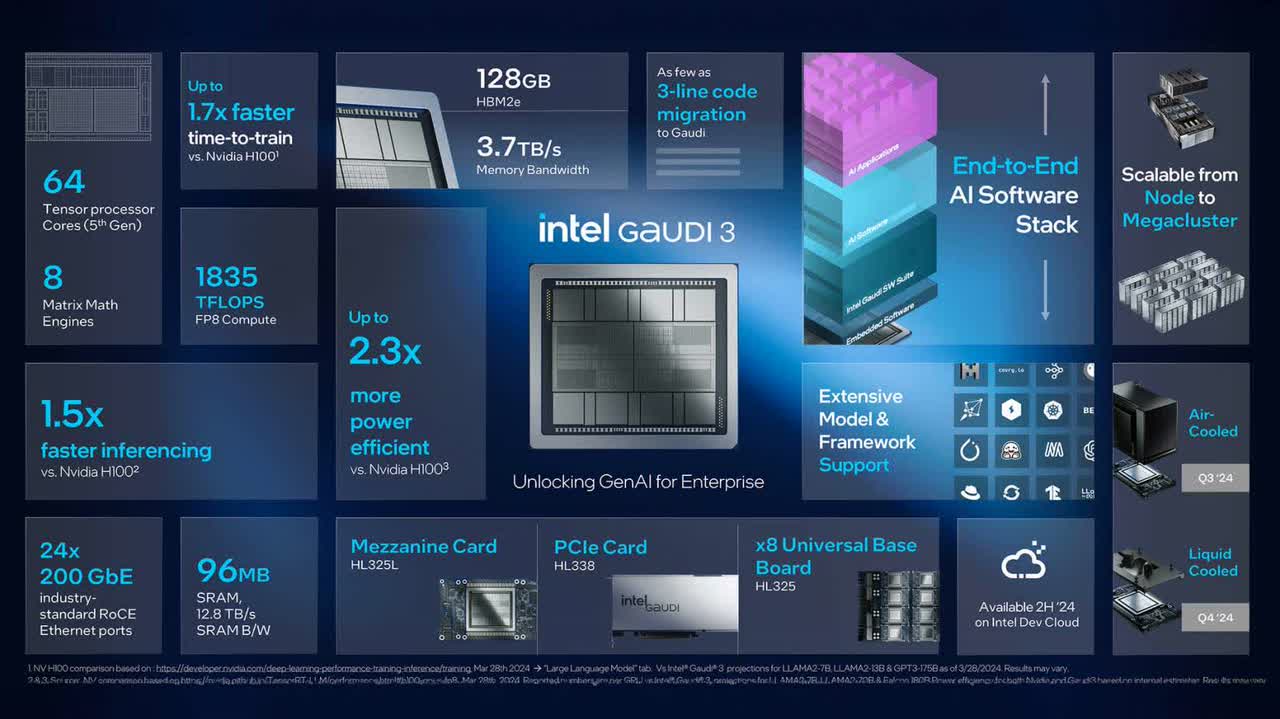

- Intel’s Gaudi 3 AI accelerator offers up to 1.7x faster AI model training than Nvidia’s H100, positioning it as a strong competitor.

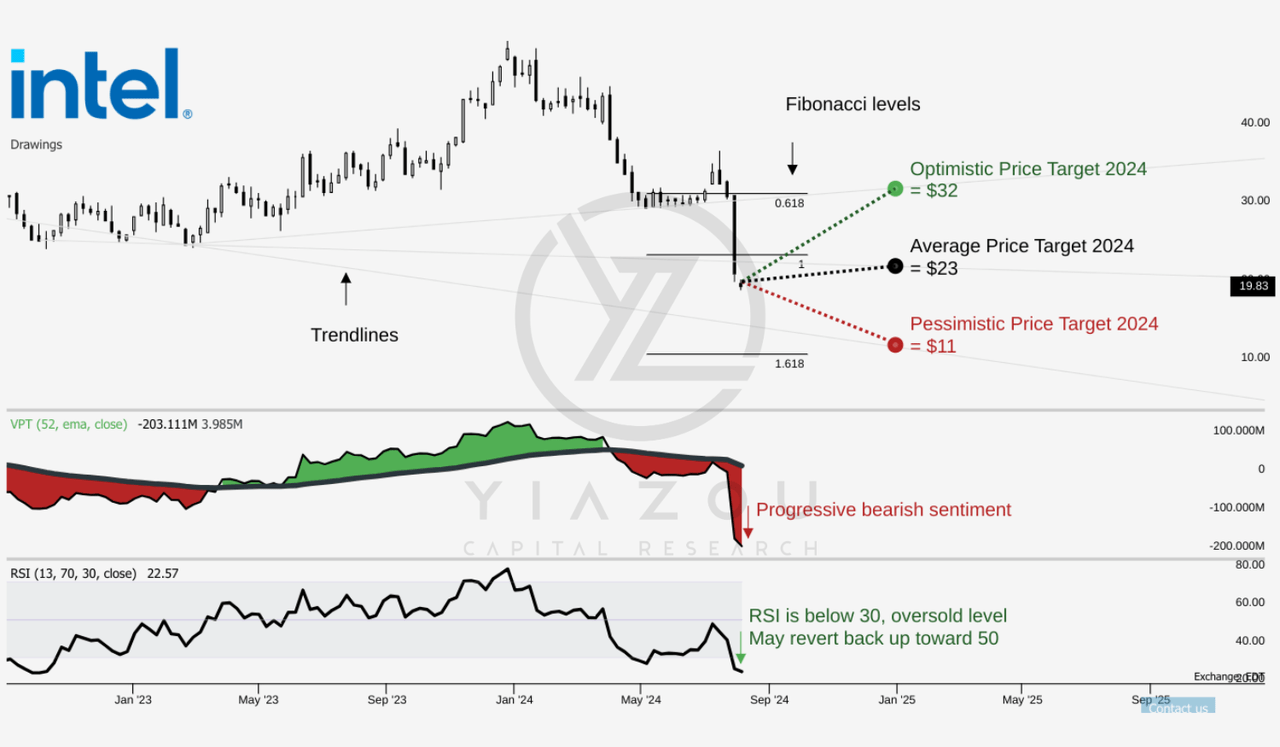

- Technical analysis indicates Intel’s stock is in oversold territory, with an RSI of 22.83 suggesting potential upside.

- Key price targets are $23 (Fibonacci level 1) and $32 (0.618 Fibonacci), with a pessimistic target of $11, aligning with short-term trendlines.

Ignatiev

Investment Thesis

In our previous coverage for Intel Corporation (NASDAQ:INTC), we indicated the range between $31 and $25 as the ideal entry range for creating new and increasing existing long positions, following DCA to bring down the positional average near $25, the book value per share.

Following the recent drop, I have doubled down on Intel, recognizing that its shares trade below book value, offering a unique entry point for long-term investors. However, I maintain no oversized position as it is a speculative buy due to the higher risk associated with Intel’s execution challenges. From a technical perspective, Intel has entered oversold territory, suggesting substantial upside potential following a bottoming out.

Intel’s financial health remains fragile, highlighted by significant debt loads and ongoing CapEx needs, highlighted by a $48 billion debt profile. The company announced a 15% employee layoff and the suspension of its dividend, reflecting cost-cutting efforts. Operational missteps, such as the transfer of Meteor Lake production and associated gross margin misses, exacerbate concerns.

While Intel’s process roadmap shows promise, with the 1.0 PDK for 18A completed, analysts remain cautious, maintaining underweight and underperform ratings. The success of Intel’s turnaround hinges on solid operational execution and the viability of its new process technologies.

Fibonacci Levels Indicate Potential Upside Amid Oversold Conditions

INTC’s average price in 2024 is $23, aligning with the Fibonacci level and suggesting a moderate trend continuation. The optimistic target of $32 corresponds to the 0.618 Fibonacci level, indicating a potential solid trial upward retracement, while the pessimistic target of $11 matches the 1.618 level, signaling possible deeper corrections.

These targets are in line with short-term price trendlines. The Relative Strength Index (RSI) at 22.83 signals an oversold condition, and no bullish or bearish divergence exists. The downward trend in the RSI suggests weakening momentum, pointing towards a bottom-form action, which may present a long setup opportunity.

Additionally, the volume Price Trend (VPT) line shows a downward trend, with the VPT line at -193 million, reflecting a massive long-term drawdown. The moving average of the VPT line is 4.37 million indicates potential short-selling opportunities. However, the short setup requires a reverse hit near the moving average, marking a potential peak and reinforcing bearish sentiment. With a 49% chance of a positive return based on 38 years of monthly seasonality data for August, there is an equal likelihood of gains or losses.

Intel’s Q2 2024: Flat Revenues and Expanding Losses Signal Deep Troubles Ahead

Intel’s second-quarter 2024 financial performance spelled out some alarming trends. Intel posted revenues of $12.8 billion, down from $12.9 billion in the same quarter a year ago-essentially flat, which exhibits shallow growth in the face of savage competition and sloppy operations. Gross margin slid to 35.4% from 35.8% year over year, continuing to spell trouble for profitability.

Operating losses expanded massively to $1.96 billion from $1.02 billion in Q2, 2023, adding to the financial pressure. GAAP net income turned negative, with the company reporting a loss of $1.61 billion, compared to a net income of $1.48 billion in the previous year. On a non-GAAP basis, Intel’s net income fell sharply to $83 million from $547 million.

In response to the financial challenges, Intel recently announced a $10 billion cost reduction plan to resize and refocus the company’s operations. These efforts include significant headcount reductions, R&D and marketing expense cuts, and lowering capital expenditures. While these are very important actions to improve profitability and liquidity, they also contain potential risks to Intel’s innovation capacity and long-term growth. The decision to suspend the dividend starting in Q4 2024 further points to financial strain and may erode investor confidence, resulting in stock price volatility.

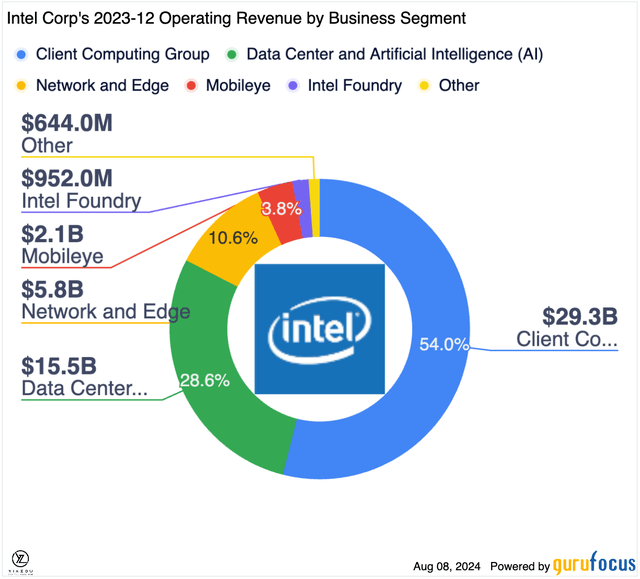

Finally, Intel’s revenue structure indicates dependence on Client Computing Group (CCG), which is still the prime revenue driver, with revenues amounting to $7.4 billion for Q2 2024. However, such overdependence risks leaving Intel highly exposed if the market condition of this segment worsens. Revenue from the Data Center and AI (DCAI) segment, considered the most critical for future growth, had declined by 3% to $3.0 billion, demonstrating significant competitive pressure from AMD (AMD) and Nvidia (NVDA) Thus, if Intel does not regain its lost market share in the data center space, it could be hit very hard financially.

Intel’s Tech Roadmap: Delays, Supply Chain Risks, and Fierce Competition Threaten Recovery

Intel’s technology roadmap faces critical execution risks. The 18A process, essential for future competitiveness, is scheduled for production in 2025, with high volume expected only in 2026. Any delays or technical issues in this rollout could derail Intel’s recovery plans and exacerbate market share losses to the competitors.

Its advanced capabilities, Lunar Lake CPU, are not expected to drive significant margin improvement due to high manufacturing costs and competition from AMD’s Zen 5 processors. Delays in the release have already missed crucial market windows, potentially impacting sales volumes.

Furthermore, Intel is prone to disruptions in the global supply of products, mainly because of likely geopolitical tensions between the US and China. Intel component availability, cost, and production schedules would be subject to drastic changes, which further adds to the challenges Intel will face regarding operational stability and market competitiveness.

Moreover, the company’s increasing dependency on external foundries like TSMC (TSM) for its critical components further raises the risk of supply chain disruption and the pricing power of suppliers. Intel offers real competition for big companies like AMD and Nvidia, precisely in the case of the data center and AI segments. With AMD’s superior Zen architecture and Nvidia’s dominance in AI accelerators, the threats to Intel’s market position are high.

At an accelerating pace, the semiconductor industry is evolving, and hence, the shift is getting higher toward AI and data-centric computing. That the old focus of Intel had been on the PC-centric markets is a major relative disadvantage right now from taking advantage of this gestating shift.

Intel lags in AI and GPU technology, but competitors move quickly. Suppose Intel cannot innovate or capture significant market share in fast-emerging, high-growth areas such as AI and data-centric computing. In that case, it may remain at a competitive disadvantage over the long term and continue on a downward death spiral.

Due to significant debt loads and ongoing capital expenditure needs, Intel’s financial health remains fragile. Operating with a $48 billion debt profile, the company relies heavily on liquidity generated from operational efficiency and strategic investments. The cost of refinancing this substantial debt is large and could pose a great financial liability, mainly if there are credit downgrades and challenges in securing funds.

The transition in management will challenge Intel’s turnaround strategy. Immediate cost-reduction steps, including significant headcount reductions and the suspension of dividend payments, pose obvious challenges to employee morale and may result in a loss of talent, which is detrimental to overall operations and innovation.

Additionally, the organizational restructuring, specifically the identified separation of the Intel Foundry business, adds complexity to Intel’s operations. Ensuring seamless integration and management among divisions is crucial for achieving the desired cost savings and operational improvements.

Finally, inflation, interest rate rises, and a potential global recession of uncertainty would have tangible implications for consumer and enterprise technology spending. Slowing or contracting demand for PCs and data center equipment would directly affect Intel’s revenues. Because of its extensive global operations, the firm could also face exchange rate and trade policy risks to international sales and profitability.

Can Intel’s Gaudi Compete with Nvidia’s H200?

Intel pitches its Gaudi 3 AI accelerator as a competitor to the Nvidia H200 GPU. The chips have the same purpose-processing the intensive computation involved in AI workloads-but they do these tasks differently.

Intel’s Gaudi 3 AI accelerator competes closely with Nvidia’s H200, offering substantial performance improvements, particularly in AI model training. The Gaudi 3 shows a 1.4x to 1.7x faster training performance on models like GPT-3 compared to Nvidia’s H100, positioning it as a strong contender in the AI hardware market. However, the H200 still holds advantages in memory capacity and bandwidth. Gaudi 3’s cost efficiency and competitive performance make it an attractive alternative, although Nvidia’s established ecosystem and software integration remain competitive solid edges.

The Gaudi 3 accelerator also brings a significant price/performance advantage over Nvidia’s H100 and upcoming H200 GPUs. The Gaudi 3 baseboard, priced at $125,000, offers 14.68 petaflops at BFP16 precision, translating to $8,515 per petaflop. In comparison, Nvidia’s H100 baseboard costs $200,000 with 8 petaflops, or $25,000 per petaflop. Despite the competitive performance and cost benefits, Intel must address challenges in production scalability and ecosystem development to leverage Gaudi 3’s potential in the AI market effectively.

Nvidia’s dominance in the AI accelerator market means that many data centers and AI researchers default to using Nvidia GPUs. Intel must demonstrate Gaudi 3’s technical capabilities and convince potential customers of its long-term viability and performance benefits. This entails proving Gaudi 3’s superiority in real-world applications and establishing confidence in Intel’s commitment to ongoing support and innovation.

Takeaway

Intel’s ambitious roadmap and strategic initiatives provide a potential pathway to recovery and regaining technological leadership. Still, major execution risks must be overcome, in addition to fierce competition from Nvidia and AMD. The availability of undervaluation at current levels makes for a very compelling opportunity for long-term investors. Still, it depends on whether or not Intel can deliver on technology, drive operational efficiency, and navigate the market dynamics effectively. If Intel realizes these goals, it will have a correspondingly strong possibility of recovery and further development of its position in the competitive landscape of semiconductors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC, AMD, NVDA, TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.