Summary:

- Intel reported in-line Q1 results and just below in-line guidance, with decent performance in core businesses but weakness in adjacent businesses.

- The company remains in the investment phase of its turnaround, with important successful milestones passed during the quarter. Intel is finally back (for real), which is clearly underappreciated.

- Intel’s upcoming product roadmap, including Sierra Forest and Granite Rapids, shows promise and indicates the company’s return to competitiveness. 18A launch in mid-2025 is ahead of expectations.

- The valuation only reflects the near-term, whereas Intel is currently like a start-up in leading-edge manufacturing. Profitability is completely subordinate to technology progress (and the financial opportunity that will open).

- A comparison to Tesla shows that Intel has a much improved say/do ratio. Some companies are just talking without executing. Intel (with Pat Gelsinger) is doing both.

JHVEPhoto

Investment Thesis

Intel (NASDAQ:INTC) reported in-line Q1 results and just below in-line guidance. That is, in-line compared to what Intel (for some reason clearly not analysts) had forecasted: sequential growth through the year with a more major QoQ inflection in revenue in the second half.

Looking at the results more closely, the results of the core businesses were actually very decent, with especially the PC up quite nicely, although DCAI and NEX remain near their downturn troughs (but at least didn’t sink further). The main damage was in the adjacent businesses, with Mobileye (MBLY) down 50% and Altera even down 60%.

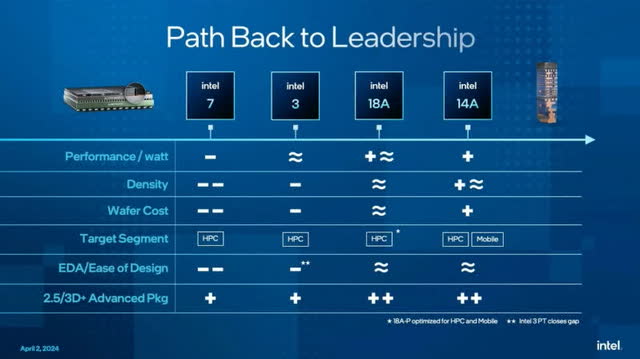

While Intel by no means reported shiny results, investors should remember that the company remains firmly in the investment phase of its turnaround, with yet again several very important milestones that have been successfully passed during the quarter. The evidence that Intel has indeed rebuilt its execution machine is now overwhelmingly mounting. With Intel 3 now in HVM (high-volume manufacturing), nearly/roughly on par with others’ N3, and the next node already starting HVM in just a few months from now, Intel is officially back.

So investors should not get distracted by this near-term noise (verging on the border of FUD) and should remain long and/or buy Intel shares. Don’t fall for the weak hand trap as in hindsight, this will have turned out to be an incredible gift in my view.

Background

The present article builds on top of the coverage of prior earnings’ results, especially the revenue walk discussed back then, will be referred to again.

In addition, while it was not an official investor meeting, Intel at the beginning of April laid out its long-term financial targets in the wake of financially (as well as operationally) splitting up the company in Products and Foundry.

Summary

The most succinct comment on Intel’s earning report was following:

Intel delivered exactly what they guided and guided for pretty much exactly what Zinsner just said at a tech conference last month. If analysts and investors were disappointed, they didn’t do their homework. As INTC has been saying, the new products roll in the second half and Intel is a second half story this year. Gelsinger is doing a great job imo–5n4y is on schedule. They delivered Sierra Forest before expectations. The strength of the company, Client, was up a whopping 31% YOY this qtr and they are rumored to be readying vastly improved products in that space this year, and they were up 9% overall in revs YOY. They guided ~10% YOY growth in 2Q. Analysts amped expectations up to the high teens, so 10% seems like a miss, but the CFO guided for growth, but not off to the races.

Q1 results

1. Revenue discussion

The results have been reported and discussed elsewhere. I will pick up the parts relevant to the thesis.

First, revenue was up 9%. Of course, last year’s Q1 was disastrous, so just a 9% uplift isn’t necessarily to write home about. Nevertheless, in the grand scheme of things, 9% is still high single-digit growth. For a company that (before the collapse) grew from ~$50B to just under $80B, that represents at best a 5% CAGR. Sure, while it might not sound appealing to take another decade to get back to where it was, if Intel continues to grow at this 10% kind of range, it will only take half a decade. In addition, note that some $5B in revenue was NAND. There’s all but likely (quite) a few other billion dollars due to Apple (AAPL) modem, Apple Mac and other exited businesses. Lastly, by definition the reason for all those inventory digestions by definition was that there was an oversupply; Intel’s customers simply bought too many chips.

Hence, as I have discussed at length before (the revenue walk in the Q4 coverage), my thesis was that the more normalized, apple-to-apples kind of peak Intel revenue was at best closer to $70B. As such, Intel would need to grow revenue only by 1.3x from the 2023 print, which would take ‘just’ three years at the current pace, far more manageable. Of course, for those are kind of following the technological side as well, three years from now the semiconductor world order will look completely, likely in favor of Intel.

In addition to this more balanced kind of view on the results, looking more closely shows that the core businesses were actually far stronger than what the 9% revenue growth suggests, with in particular the PC group carrying Intel’s results with 30% growth (although, to be fair, this is a one-time lift as the PC isn’t a long-term growing business, so obviously the other businesses will). So, what was responsible then for the just 9% growth was the collapse of both Mobileye and Altera. Together with a few other adjacent businesses, Intel spoke about a $1B hit: Mobileye got sliced in half, while Altera imploded by 60%. Complete carnage. If those had been flat, actual growth could have been in the double digits.

Note I am explicitly not using the actual growth number that a $13.7B print would have implied, because obviously those businesses that were down in Q1 would have only made the Q1’23 release even worse. Admittedly, such a realization likely wouldn’t have been on anyone’s bingo card. In any case, the whole point here is simply to look through those moving pieces (mainly the whole inventory discussion) to figure out what the underlying kind of steady-state revenue looks like (i.e. sell-through) and how that will trend over time.

Specifically, for Mobileye one can take the full-year guidance, subtract the Q1 figure and divide by three. Since Q2 will also still be partially affected, this suggests Mobileye could exit the year close to $700M quarterly revenue. For Altera, Intel has guided to $2B, in-line with its historical revenue from the last decade, but obviously far below what is was doing more recently.

Overall, and in summary, I had already proposed last quarter that a kind of high single-digit growth rate would be reasonable, and for now, that’s what Intel delivered, even despite a $1B headwind from weakness in adjacent businesses. So solid report overall.

2. Profitability discussion

For now, this section, at least as it fits in my thesis, can be kept short. Basically, for all intents and purposes, Intel is like a start-up that is creating a leading-edge semiconductor manufacturing franchise (built on top of the remains of its by now trailing edge business). As such, I believe profitability for now is basically irrelevant and subordinate to the technological imperative.

In any case, on the Product side, as the disclosures from the webinar had shown, profitability actually remains quite solid, especially since most of the Product businesses did just continue to use Foundry, subjecting them to inferior technology than if they had used TSMC (TSM). (Of course, Foundry’s financials show that it must have used quite some discounts to keep its Product manufacturing business.)

3. Guidance

For guidance, the same consideration as in Q1 applies, which even Intel didn’t seem to emphasize or even remark at all: as both Mobileye and Altera will likely remain down materially YoY, that still creates a somewhat artificial headwind.

In any case, Intel for its part, simply said that Q2 would see a quite regular seasonal trend. For completeness, Intel did admit H1 to be shaping up a bit lighter than maybe anticipated, but the Q1 result was ultimately simply within the guidance range.

With the stock down due to this so-called “miss”, in reality I think the analysts here were wrong, as they modelled super-seasonality without any catalyst warranting so. To be fair, this was the first time Intel reported the Altera results (Intel did call out the Altera weakness in the last few quarters, but the magnitude of the collapse has been quite the surprise indeed). In other words, if the magnitude of the Q2 headwind from adjacent businesses remains on the order of $0.5-1B, then analysts had been expecting quite a surge in revenue: double-digit growth on top of the artificially inflated Q2 print (of those adjacent businesses) from last year. While the PC has been quite solid more recently, Intel hadn’t provided any similar indication for either DCAI or NEX.

Beyond Q2, Dave Zinsner had already previously said he did expect super-seasonality in H2, and that remains exactly what Intel is expecting. Overall, this and the other comments here mimic the user comment from the summary section.

Net-net, as discussed previously, there would be a straightforward path back towards $60B revenue, but given the PC (and NEX?) downturn as well as lost DCAI market share, going beyond will require things like higher ASPs (possible in PC due to the AI PC, as well as in DCAI due to higher core count but relatively stable price per core), TAM increases (in principle the outlook for NEX and DCAI) and the growth of the emerging businesses (at least it has been proven the opportunity exists in all of Mobileye, Foundry and graphics/accelerators).

Business updates

1. 2024

Panther Lake is in the fab, as Intel had previously indicated. Intel 3 is in HVM, but the (bullish) surprise here was that Sierra Forest is qualified and ready to launch. Many (in my head I am referring to SemiAnalysis that many people seem to take as gospel, such as the firm’s claim that high-NA is uneconomical, which I believe has been verbally and actionably disproved by all the orders, worth billions of dollars, that ASML has been able to put on its backlog) had expected that Intel’s last year “first half” statement would mean late June. While Intel hasn’t put out an official press release yet, clearly the product is on schedule. (To be fair, since Intel hinted at Computex announcements, Sierra Forest will indeed launch in June it seems.) Granite Rapids too has been confirmed for Q3.

These are literally market share moving products. I have seen some skeptical comments by apparently AMD (AMD) bulls, someone even likening the product to Sapphire Rapids (apparently the leaker MLID, who has a mixed track record, had put out something). But those are unfounded in my opinion. Yes, these are E-cores, but there are 288 of those. AMD will only have 192, so Intel has exactly 50% more.

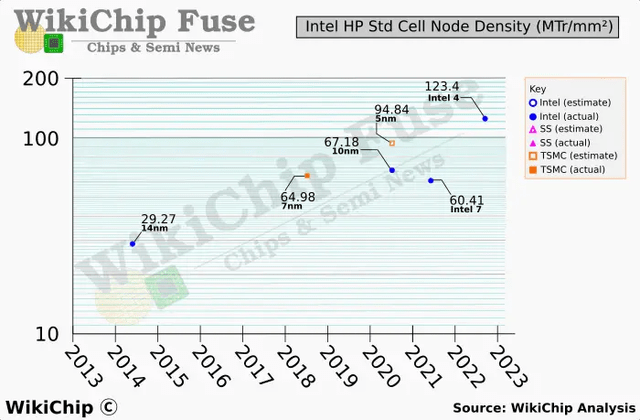

Now, to elaborate a bit here (feel free to skip), some will point out that AMD’s are fully fledged Zen 5 cores. But in reality, they’re not. They’re Zen 5c cores. Benchmarks of the Zen 4/4c generation have shown that there is quite a significant performance penalty due to the clock frequency regression. Granted, on the server side this will be less the case as those high core count chips aren’t going to clock at 5GHz, so in that regard AMD has a sensible strategy. But the chance of Zen 5 having 50% more IPC than Intel’s E-cores is slim. Although, also granted, it doesn’t need to be 50% higher because AMD also has HyperThreading. But even if it is overall 50% faster per core, then AMD will simply be on par with a more expensive product. Because, as MLID indeed might have pointed out, Intel had cancelled its planned Sierra Forest SKUs with more than 300 or even up to 512 cores – those would have been the high-end SKUs. So, okay, AMD’s high-end might be on par or at best somewhat outperform Intel’s midrange SKU. And not only will Intel have an inherently cheaper product, it will also simply have the cheapest process technology to boot, with Intel 3. Now, I think the jury is still out (as in: definitely confirmed) on whether AMD is using an N5-class or N3-class node. If it’s the latter, AMD might have a slight advantage at best, but the Intel 4 specs have shown that it is readily denser than N5 (see image below), and Intel 3 will be an additional 10% denser as well.

Moving to Granite Rapids, here the leaks have confirmed Intel will offer up to 128 cores, which is equal to AMD’s regular Zen 5 offering. Hence, this will literally be the first time Intel has been able to match AMD on core count in the data center – even in 2017 it was 28 cores vs. AMD’s 32. So by all means, Intel has a very solid 2024 product roadmap, being able to compete for the first time in half a decade, since mid-2019 when Zen 2 launched (64 cores vs. those same 28 Intel ones). As Pat Gelsinger said, with Intel 3 now in HVM, this is the first time in [almost] a decade that Intel has been producing leading-edge semiconductors. Intel is back.

Really, it seems all the ado about the financials are distracting people from the above. So let’s repeat: Intel is back.

Sure, Pat Gelsinger said exactly the same when he first returned as CEO in early 2021, but now three years later the statement is actually true. It’s not just a roadmap anymore. Not just a PowerPoint presentation. In fact, I am not aware of any other product on TSMC latest “H2 2022” N3 node shipping besides the iPhone, and here Intel is now ramping Sierra Forest within 9 months of the iPhone launch, and will already launch its second Intel 3 product a quarter later with Granite Rapids. As Pat Gelsinger (also) said: a one-two punch to regain competitiveness (if not leadership) in the data center.

This should be the clearest indication that if the stock goes down (which it indeed has), then that is simply against the fundamentals. I believe the market is wrong – having become too myopic on the near-term due to the analysts’ failure to accurately predict and/or add any value – so it is an apt opportunity to buy Intel.

To be sure, the market being wrong and sending the shares lower on the face of its only means there the opportunity for a rebound trade (which could be valid), but as argued the reason the market is wrong (in my opinion, as of course, the price of any stock is a function of both the present, as well as, future results, with the latter being definition being uncertain) is due to improving fundamentals.

For a last remark, one might remember that besides the process woes, Sapphire Rapids, besides any process consideration (which it wasn’t affected by as Ice Lake-SP on a similar 10nm-class node had already launched quarters earlier), itself was a development disaster. Moving on, just 1-2 generations, and both Emerald and Granite Rapids have been executed pretty much flawlessly. Although, one remark would be that Intel still hasn’t said anything at all about the more important Diamond Rapids, unlike Granite, which is scheduled for “shortly” after Sierra (one quarter all). This indicates it would be an (early?) 2026 product, which compares to Clearwater in mid-2025. So far, this is just a bit of a missed opportunity to fully capitalize on 18A. As Pat Gelsinger said, he is pushing the team to ramp its products very fast (but as he also said and as discussed, it takes several quarters for customers to validate these products and ramp their purchases, but if anything that should be even more of a reason to launch early).

On the PC side, Intel has been more competitive since Alder Lake in late 2021 already, already on the power consumption side it has obviously been trailing since AMD launched Zen 4, but in any case Intel hasn’t bled any meaningful share in the last two years anyway, and its position will only further improve with Arrow and Lunar Lake.

So much for 2024 line-up. Notably, though, shareholders should be ecstatic about this line-up after having been on the receiving end of the blows for the last half a decade and longer (and as mentioned Intel is even slightly beating expectations of these products’ time to market). Yet none of the analyst coverage as reported by Seeking Alpha mentioned anything about this. It just shows how far away analysts’ priorities are from what really matters for the company, in my view.

2. 2025 (and beyond)

Anyway. Intel’s comments about the 2025 (read: 18A) were even more bullish. Intel indicated that 18A would ramp in the first half, with product launch by the middle of the year already.

For comparison, TSMC’s competitive node N2 will only go into production in Q4’25. Or actually, since N2 lacks backside power delivery, arguably A16 is its real competitor, which is another year or more later: the roadmap showed N2 in mid-2025, despite TSMC’s verbal comment of a Q4’25 ramp, while the midpoint of A16 was actually in early 2027, although this might perhaps have had more to do with the lack of space on the graph. It also remains to be seen if that will be a paper announcement like N3 in December 2022 (with the first actual product being the Apple iPhone SoC in September, three quarters later).

So in one (unconfirmed) scenario, Intel will have 18A in the market in a bit over a year from now, regaining process leadership, while TSMC won’t have a competitive node until perhaps late 2027 if the iPhone, as usual, would be the first to adopt the node, although I did see a tweet that said that TSMC has apparently suggested HPC customers might be first in the future). Even if indeed another product launches first on 18A, TSMC would or might (still) be behind by around two years.

To add some concrete information besides this speculation (although the addition of PowerVia, the next major semiconductor innovation, is indeed a valid point of comparison, with regards to time to market, but ultimately only part of the complete technology), TSMC’s comments so far have indicated that N2 would improve logic transistor density by about 20-30% (at best), despite being on a generous 3-year cadence, while A16 is slated to add another piecemeal 10% in density. So in terms, of density, A16 is actually shaping to be at best around a half-node improvement over N3, despite the 4-year difference in official start of HVM.

Back to Intel, one might remember that there was some confusion regarding comments by Pat Gelsinger during the April webinar, where he indicated 18A would be mostly a 2026 (and beyond) node, which some bears were quick to use to say 18A was delayed. It is not.

Pat Gelsinger’s statements weren’t contradictory: it takes months for volume to ramp after a product launch (unless you’re Apple and have to ship 50+ million iPhones from the first quarter), resembling a cumulative normal curve. For example, Intel has shipped 5 million Meteor Lake (launch in December) units so far, and said it would double shipments QoQ. The goal had been for 40 million by the end of the year, and Intel said it will beat that goal. For example, 50 million units would be 12.5 million on average per quarter. In reality, taking the double shipment claim at face value, the split H1/H2 would be 15/35 (or however many units Intel will end up shipping in H2, it will be a lot more than H1).

3. Moore’s Law

I was planning to make this a more elaborate or thesis-weighing discussion, in that I would have to concede some of my projections for Intel process leadership might have been too high. However, I will wait with any “final” (initial, actually) conclusions until there are more details.

Concretely, Intel has revealed some initial details about Intel 3, which at least in terms of transistor density seemed underwhelming. However, after some consideration, it might be possible that Intel simply made a mistake or typo. (Note: also be sure to check out the tweets before the one in this tweet.)

The details were announced as part of a sort of teaser for press about the upcoming VLSI conference – only there the full paper will be presented. Intel made two seemingly distinct comments related to density. First, it said it delivered 10% scaling compared to Intel 4. Secondly, it said it has a 210nm “high-density standard cell”.

Now, the issue here is that Intel 4 (which only has a high-performance cell) already has a 240nm cell height. So, a 210nm cell height would yield just under 15% density scaling (assuming all else equal, as there are more factors that can influence density, including cell width). At first sight, as I tweeted, it seemed that Intel 3 would deliver very little scaling. Indeed, compared to Intel 7 too, the density would at best be around 55% higher, which is far from the 2x scaling that Bob Swan and Murthy promised in 2019. (The 3.2x scaling I referred to was an even older, never official disclosed goal. I saw some people on WCCFTech referring to this tweet, but obviously, one should be aware that 3.2x scaling was, and in general just is, an extremely ambitious target, so the more standard and fair reference point would be the 2x scaling that Moore’s Law is known for. But as mentioned, even compared to that, Intel 3 seems to fall very short.)

However, as someone pointed out, what I just laid out (based on Intel’s comments) just seems unlikely: the issue is that there would hardly be any scaling at all (perhaps 3% at best) from the Intel 3 HP to the Intel 3 HD cell. Perhaps the HP library could have cell height of 215-220nm, while as mentioned the HD one would be 210nm. This is very, very unusual because historically, there is, as the name implies, quite a noticeable difference in density between those two types of transistor cells.

Hence, unless (as the tweet concluded) Intel would indeed have significantly underachieved its targets, for now, the most plausible explanation would be that it was a typo. Or perhaps the “high-density” was just a description and actually “standard cell” refers to the high-performance cell, meaning nothing about the (actual) high-density cell has been disclosed yet.

To elaborate even more, the way in which Intel achieved the 2x density for Intel 4 was for a large part due to “fin depopulation”: the higher transistor performance was used to reduce the number of fins per transistor while maintaining (or even still improving?) performance. Obviously, this same “trick” could be applied to the high-density cell as well (especially since Intel 3 is supposed to improve performance significantly further on top of Intel 4’s increase).

In that regard, there really shouldn’t be any reason why Intel couldn’t indeed do this. In that case, I had last year (in the wake of the Intel 4 HP cell disclosure, by extrapolating this to a hypothetical Intel 4 HD cell) projected Intel 3 to quite closely match TSMC N3, both with a density around 210MT per mm2.

Still, there is one more mystery (or even three), in that case.

Intel gave itself a minus sign for Intel 3’s competitiveness on density, which contradicts my own analyst as just stated. Perhaps Intel is doing less fin depopulation for the HD cell, but that still should have results in a -~~ sign.

Secondly, looking at 18A shows a ~~ sign, despite both nodes competing against N3 (the graph doesn’t show what it is comparing against, so presumably 18A would have been compared to N2, but even that should 18A have far surpassed TSMC given the little scaling TSMC is doing at N2). This suggests quite a low density improvement for 18A (the 2019 Bob Swan target was 2x scaling, which per this slide and my interpretation of it suggests Intel has failed to achieve).

Thirdly, TSMC just announced A16 for late 2026 HVM with a whopping 1.1x scaling. Again, if 14A represented a full node shrink over 18A, then it should vastly surpass TSMC. According to my calculator, TSMC’s disclosures suggest 16A to have a density on the order of 320MT. In contrast, 18A should already be at 400MT if Intel has achieved Bob Swan’s targets.

(If not, then part of the “5 nodes in 4 years” would have been achieved by lowering the bar/target. In the end, Moore’s Law doesn’t lie, so all these trends for both Intel and TSMC will become visible on the multi-year Moore’s Law charts at some point. Although perhaps not completely since the trend nowadays is to use chiplets to increase the total chip area and hence increase transistor count in this, unsustainable, brute-force manner, in turn delaying the onset of the chip-level slowdown of Moore’s Law.)

AI business

Lastly, Intel called out $500M in AI revenue in 2024. This compares to $3.5B for AMD (with a realistic likelihood of beating this since in just one quarter it had already grown from $2B previously) and $40B for Nvidia (NVDA) (which seems a conservative estimate as Nvidia is entering the calendar year approaching an $80B run rate for its completely data center business, which does include networking).

Now, Intel specifically said Gaudi3 revenue in its press release, but then seemingly ended up using both, suggesting Gaudi2 revenue is negligible. In any case, looking close at the Gaudi2 roadmap showed that the actual (general availability) launch is planned for Q3. I saw one bull interpreting this as basically all being Q4 revenue, suggesting a $2B exit run rate by the end of the year. While I wouldn’t go that far (on the other extreme, $500M revenue in six months is obviously a $1B run rate, so the reality is somewhere in between), clearly there is some momentum finally building, albeit from a very low base.

Note though that AMD too is also ramping, so its $3.5B projection implies quite a higher exit run rate as well, so it isn’t that Intel is simply catching up with AMD in a few quarters. In any case, it seems that Gaudi3 is for some reason only the first Gaudi that is being taken seriously in the market, so the next-gen Falcon Shores (with clear leadership process technology as well?) might continue this momentum.

Risks

Before the downturn, Pat Gelsinger (in part in conjunction with his Chips Act pitch) had been saying that, in the wake of the COVID-19 tech acceleration, there would be a 10-year upcycle ahead for semiconductors, which was (widely) expected to double to $1T in size by 2030. For now, it seems many of these predictions still stand (and this $1T has quite recently been reaffirmed by Pat Gelsinger). However, clearly the downturn is already enduring much longer than expected (from H2’23 recovery to 2024 to now H2’24 into 2025). Hence, if such market growth is still baked into Intel’s forecasts (which to some extent is likely the case, even if Intel said it is being conservative), but doesn’t materialize, then Intel’s growth might be much lower.

Of course, there has been some variance in the semiconductor growth. Clearly the PC, which remains Intel’s biggest segment despite now well over a decade of trying to diversify the business, is not going to grow wildly. On the other hand, an area such as AI has seen large growth, but so far only for the likes of Nvidia. While together with Foundry and Mobileye, these remain compelling areas of growth, the risk is of course that Intel has yet to show its ability to really capitalize. To be sure, each of these three businesses have shown some proof points, but not quite yet enough to fully derisk the Intel long-term revenue growth thesis.

Tesla (TSLA) vs. Intel

One insightful comparison might be Tesla vs. Intel. To recap, Tesla reported an abysmal quarter, and even more so when compared to its official multi-year guidance for 50% average (volume) growth, which by now with negative growth it is getting “quite” far from. Nevertheless, the stock rallied in the wake of its earnings because of the robotaxi and $25k car hype.

However, what was missing in all of those discussions was… any proof whatsoever. There is simply no evidence Tesla is about to achieve autonomous driving in my opinion (current FSD is just L2+, which Mobileye beat Tesla to market to). Neither is there evidence that Tesla is capable to launch a $25k Tesla with profitable margins. Never mind to combine both.

And the whole recent Tesla earnings report changed absolutely nothing about any of that. Both of those products have been touted by bulls for years. The earnings call was just that: more talk. Yes, the principle and definition of a robotaxi is indeed that you can order one and it will autonomously pick you up and drop you off. Repeating that description doesn’t change anything about the technology challenge, so there simply wasn’t any reason for stock movements (if anything, it might go down if autonomous driving doesn’t appear, so apparently indeed the robotaxi premise has to be repeated to prevent this).

Now compare this to Intel. Intel has been soaking investors with proof points of its technology progress (test chips, tape-ins, tape-outs, foundry prepayments, start-up costs, product launches, etc.). For years. PowerVia. RibbonFET. High-NA. Sierra Forest. Granite Rapids. Clearwater Forest. Panther Lake. This is what’s called the say/do ratio. It should be close to 1 for well-executing companies, and that’s the case for post-2020 Intel.

While perhaps not all stocks are getting the same Tesla treatment of getting bid up based on promises alone, ultimately the executing of a company’s (material) promises might be quite a decent predictor for future financial performance, which will move the stock in my view (again, with some variance in P/E multiple).

Investor Takeaway

Repeating the same comments I made around three years ago, at this stage in the game, I believe the quarterly revenue and profitability results are utterly irrelevant. Intel remains a technology turnaround investment. A start-up of leading edge process technology. This indeed hasn’t changed. In that regard, Intel delivered yet another consecutive quarter with ample and meaningful proof points.

To highlight just a few, Sierra Forest has already PRQ’d in April and Granite Rapids is indeed fulfilling its promise of launching “shortly thereafter” (now specified as Q3). Solid execution. Even more significant, for 18A likewise I hadn’t put up my expectations too high for when in 2025 it would appear, so something like a fall 2025 launch seemed likely. Instead, Intel is now gearing up for HVM in H1 with launch quite early in the summer.

This isn’t just meeting the ambitious 5N4Y target, this is outright beating it by a landslide. Intel is truly back. At this point, with the 2025 18A products now in the fab, there simply aren’t any visible roadblocks left (barring any late-stage yield issues, as happened on both 14nm and 7nm). So, both process issues as well as product issues such as Sapphire Rapids have long been left behind (as indeed that was a product from prior management). If anything, it is sign of weakness that bears are referring to the past. If its past had been rosy already, it obviously wouldn’t be called a turnaround.

Overall, as a tech enthusiast, there are ample reasons to be satisfied with these developments. Intel is once again able to compete against anyone out there at the tech level. So given the fundamental nature of Moore’s Law as an economical law, it should only be a matter of time (to be sure, still measured in several year) before this new reality really starts soaking through the P&L as well, benefiting shareholders. Possible benefiting them quite a lot given the very deflated level the shares are currently at. Although this latter point is reliant on the condition Intel returns to and drives meaningful revenue growth, which to be fair is still yet another ball game than just returning its factories to profitability (with as Intel said just Foundry breakeven already doubling the company’s earnings).

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.