Summary:

- Intel delivered very disappointing 2Q FY2024 results across all financial metrics, with a further deteriorating outlook for the coming quarters, indicating a potential value trap.

- Its Client Computing Group (“CCG”) revenue, which accounts for 58% of total revenue, was significantly impacted by an export license restriction in China, dropping to single-digit growth.

- The company forecasts an accelerated YoY revenue decline in 3Q, with further contraction in gross margin to 38%, reaching historical new low.

- Management has initiated an aggressive cost-cutting plan, including reductions in operating expenses and capex, and plans to suspend the dividend in 4Q, to boost liquidity as the company faces increased credit risk.

- Management anticipates achieving profitability and FCF breakeven in FY2025.

hapabapa

Investment Thesis

Intel (NASDAQ:NASDAQ:INTC) delivered very disappointing 2Q FY2024 results, with nearly all financial metrics falling short of market estimates. Despite its goal of catching up with other semi players amid the current AI boom, INTC seems to be moving in the opposite direction. The company not only missed revenue and EPS consensus but also issued a weak outlook for 3Q and beyond. Additionally, the management announced a 15% reduction in workforce, cuts to infrastructure investment spending, and plans to suspend its dividend starting in 4Q FY2024, which justified the post-earnings selloff.

Despite the stock’s already low valuation before the 2Q earnings, it further dropped over 30%, reflecting significant doubts about the viability of their restructuring roadmap. Although I do not anticipate a clear path to a turnaround until FY2026 or later, I believe the selloff has already priced in this narrative. As I mentioned, this is a long-term turnaround story that could be very bumpy. I downgraded my buy rating to hold on INTC due to my concern about a potential value trap.

2Q FY2024 Takeaway

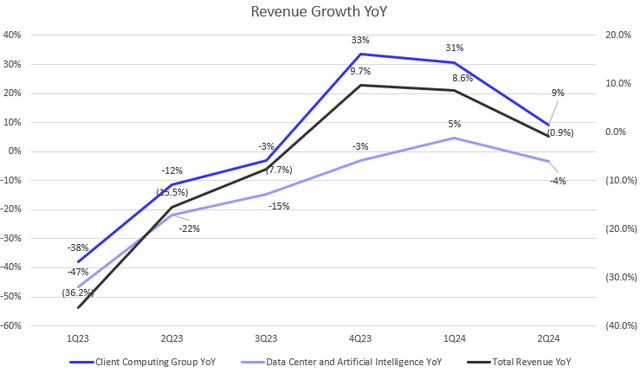

INTC had a big miss on both revenue and non-GAAP EPS estimates in 2Q, indicating a dollar decline in revenue and flat earnings growth on a YoY basis. In other words, the company returned to “0 growth” territory again. In addition, the company guided an accelerated revenue decline YoY and negative growth in EPS in 3Q, reflecting a further deterioration in its fundamentals. The management admitted that the recovery is slower than expected. Particularly, the company’s Client Computing Group (“CCG”) revenue (58% of total revenue) was largely impacted by an export license restriction in China. As shown in the chart, the segment growth significantly decelerated to 9% YoY in 2Q FY2024, down from 31% YoY in the previous quarter.

The company provides a gloomier 3Q outlook, expecting -8% YoY growth in total revenue, considering the midpoint of the revenue guidance range. The growth rate is expected to be the slowest since 2Q FY2023. Despite a -4% YoY growth in Data Center and Artificial Intelligence (“DCAI”), the company expects sequential modest improvements in 2H FY2025, which may indicate a low to mid-single digit QoQ growth sequentially. This also implies a potential negative growth YoY on CCG segment in 3Q FY2024.

Aggressive Cost-Cutting Plan to Offset Revenue Decline

The company model

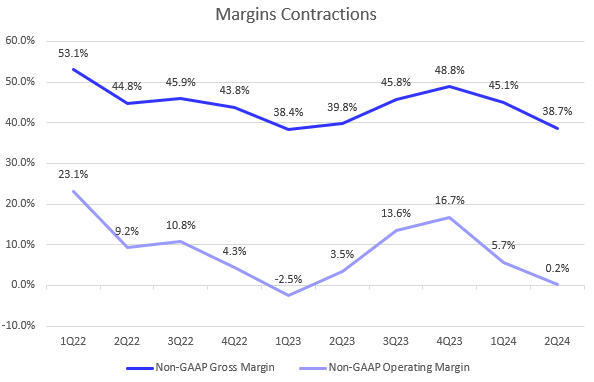

The disappointing revenue outlook coincided with the management’s decision to initiate a cost cutting plan before 2Q earnings release. In the 2Q earnings call, they announced “reductions across OpEx, CapEx, and cost of sales total well over $10 billion in direct savings in 2025”. The chart shows that INTC margins contracted significantly to 38.7% in 2Q FY2024, approaching the lowest level in the company’s history. This margin is less than half of NVIDIA’s (NVDA) 79% and 27% below Advanced Micro Devices’ (AMD) gross margin from the latest quarter. Before the pandemic era, INTC had maintained a 60% gross margin trajectory, highlighting the tremendous competitive disadvantage the company currently faces at the moment.

The management attributed the gross margin decline to an unfavorable product mix and more competitive pricing than previously expected due to the accelerated ramp of their AI PC products. Consequently, they have guided for an even lower QoQ gross margin in 3Q FY2024, down to 38%, which would mark a new historical low. The company’s heavy reliance on external wafers for ramping AI PC products is expected to continue pressuring gross margins in the coming quarters. Therefore, I believe the company’s gross margin will continue below 40% and show no inflection in the near-term.

50% Reduction in Capital Investment and Dividend Suspension to Boost Liquidity

In addition, Moody’s downgraded INTC’s senior unsecured rating to Baa1 from A3, reflecting an increase in its credit risk. In response, the company is trimming capital investments in 2H FY2024 to approximately $12 billion, representing a 50% YoY decline from FY2023. Looking ahead, they expect a modest YoY increase in capex, with projections ranging from $12 billion to $14 billion in FY2025. Furthermore, INTC plans to suspend its dividend payments starting in 4Q FY2024. The management believe these measures will help reduce leverage and achieve FCF breakeven in FY2025.

What About FY2025 and Beyond?

INTC’s long-term goal is to restore its gross margin to the previous level of 60% by 2030, with a target of reaching a 40% operating margin as well. In contrast, NVDA’s gross margin is currently close to 80%. In the near term, INTC is pursuing an aggressive cost-cutting plan to achieve breakeven profitability by FY2025. While the company has guided for approximately $20 billion in operating expenses for FY2024, they expect a 12.5% YoY decline to $17.5 billion in FY2025, which is significantly below the previous market consensus of $21 billion. This suggests that the company’s margin contraction may not bottom out until the next fiscal year.

Valuation

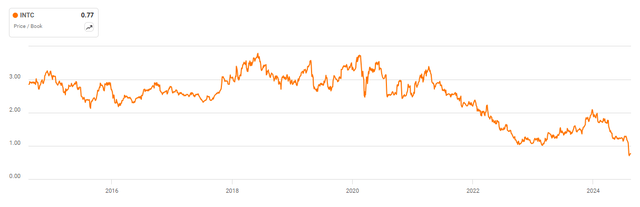

Given the possibility of its non-GAAP EPS turning negative again in the coming quarter, I believe that using the P/E multiple may not accurately reflect its valuation. Following the recent 30% price drop, INTC is currently trading at 0.77x P/B TTM, which is 65% below its 5-year average. Typically, a multiple below 1x signals a strong buy. However, investors should be cautious of a potential value trap, as continued deterioration in the company’s fundamentals could justify the low valuation. As indicated by Seeking Alpha’s valuation section, INTC’s forward multiples are higher than the TTM basis, suggesting that its financial metrics are expected to worsen. Therefore, being simply bullish on a stock because it appears very cheap is not a reliable investment strategy, because it can be cheap for a decade. Instead, we need to assess whether the company can improve its competitiveness in the industry, which investors may have overlooked. However, based on 2Q earnings, I don’t see INTC as being in that position at the moment. Therefore, I’m neutral on the stock and prefer to wait on the sidelines to gauge potential inflection points in the coming quarters, guided by management’s comments.

Conclusion

In summary. INTC’s 2Q FY2024 results reveal that its turnaround plan seems to be heading in the wrong direction, marked by a significant slowdown in CCG revenue and significant margin contractions, leading to a negative earnings trajectory. The management’s outlook indicates that conditions may worsen before getting better. To address liquidity issues following a substantial decline in fundamentals and its credit downgrades, the company has aggressively cut operating costs, reduced capital spendings, and even suspend its dividend, underscoring severe operational challenges in short to mid-term. Given these concerns and the potential for a value trap, I have downgraded my rating from a buy to a hold. The stock’s 30% decline reflects skepticism about the turnaround narrative, and while long-term opportunities might still exist, it’s better to be cautious for now. When everyone questions the viability of its turnaround story, long-term opportunity may not emerge.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.