Summary:

- I maintain my bullish rating on Intel, believing the stock is undervalued after its massive YoY drop, presenting a buying opportunity for brave medium-term investors.

- Despite Q3 2024 challenges, Intel’s cost reduction and new product launches, like new processors for AI, could drive recovery and future growth.

- Intel’s partnership with AMD and AWS, along with ambitious restructuring, aims to regain market share and improve financial performance.

- I think that INTC will continue to make efforts, and somewhere in 2025, we might see a turnaround in the company’s fortunes, which could lead to the stock’s medium-term growth.

- My valuation calculations say that the stock is undervalued by 31% over the next 2 years as the firm emerges from its challenging period.

JHVEPhoto

My Thesis Update

In mid-July 2024, I initiated coverage of Intel Corporation (NASDAQ:INTC) (NEOE:INTC:CA) stock with a “Buy” rating. I anticipated that revenue in the company’s key segments – CCG and DCAI – would start to recover steadily in the foreseeable future, accompanied by increased profitability on a consolidated basis. Additionally, Intel had ambitious plans to expand its foundry services, which led me to expect a positive outlook from management for upcoming quarters, potentially driving nice stock price action.

However, I was mistaken, as Intel stock fell significantly, by nearly 40% since my first bullish call. This prompted me to revise my thesis. Upon reevaluation, I realized that the market’s reaction was likely overly negative, which led me to conclude in late September that Intel’s stock became undervalued and presented a buying opportunity on the dip. I called to double down on INTC, and it seems to be paying off so far:

Seeking Alpha, Oakoff’s coverage of INTC

Today, I still believe that Intel should continue to build on its current position. Recent statements from management and the overall state of the U.S. chip market suggest that Intel could have some strong catalysts to regain its market standing. Also, the current Wall Street analysts’ earnings forecasts seem too pessimistic to me, and I think it isn’t too late for investors to buy Intel stock on its protracted dip.

My Reasoning

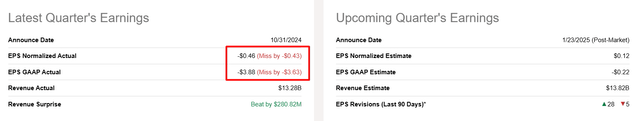

Intel’s Q3 2024 report came out in late October, depicting an organization facing a challenging transition amid massive financial challenges. As of note, INTC’s sales for the quarter were just $13.28 billion – down 6% YoY. Of course, it left much to be desired – when your peers grow by high double digits, even this slight contraction looks off. On the other hand, INTC’s revenue figure exceeded market expectations by >$280 million or 2.16%, recording a sequential increase of 3.5%. This performance came primarily from the Data Center and AI Group (DCAI), which reported a 9% YoY revenue growth on higher demand for server processors. However, the CCG incurred a 7% YoY decline due to “continued competitive pressure from peers” like Advanced Micro Devices (AMD) and Arm Holdings’ (ARM) solutions.

Going down the income statement, we see Intel’s gross margin falling precipitously to 18% from 38.7% in the same quarter a year ago, following a $3.1 billion write-off of Intel 7 processors over the past quarter. This impairment charge, along with restructuring expenses, resulted in a non-GAAP operating loss of $0.46 per share. On a GAAP basis, we saw a net loss of -$3.88, which was a massive miss to what the market expected:

However, we see that Wall Street upgraded its estimates for Q4 (84% of all analysts). Why?

Intel’s leadership still believes its aggressive cost reduction program, which calls for more than a 15% reduction in staff and a 20% reduction in capital spending, must be met regardless of the operational setbacks the firm is going through. INTC’s initiatives aim to simplify business processes and make their product more competitive on the market.

These actions are required, I suppose, but they also reveal the economic stress Intel is facing in reorienting its business model. To be honest, Intel should have thought much earlier about the initiatives that management recently announced. But better late than never, in my opinion.

In terms of its financial position, Intel has an intractable balance sheet with its net debt reaching $25.17 billion as of Q3 2024. The company had $24.1 billion in cash and equivalents, which provided some liquidity to manage its restructuring efforts. On the other hand, Intel’s free cash outflow of negative -$2.7 billion for the quarter was a real hit to investors’ confidence as amid that they stopped paying a dividend to save cash. But as the company continued to invest in its manufacturing roadmap and restructuring, I think it’s a temporary thing.

In September and October this year, Intel released its new products the Lunar Lake and Arrow Lake processors, which are going to take some market share in the AI PC market, with Intel targeting over 100 million AI PCs shipped by the end of 2025. Moreover, Intel’s partnership with AMD to create the x86 Ecosystem Advisory Group illustrates its intention to remain in the lead despite all the challenges it has been facing for years.

As vigorous competitors, Intel and AMD at the same time share a history of industry collaboration focused on platform-level advancements, the introduction of standards, and security vulnerability mitigation within the x86 ecosystem.

Source: [AMD’s press release]

However, according to Argus Research (proprietary source, October 2024), Intel’s client and data center CPU market share is at an 18-year low now (Statista’s data confirms that), showing just how pressing Intel’s strategic plans are. So I think these efforts are great, but there’s still a lot of competition out there.

As for INTC’s Foundry Services, I think they still play an important role in the IDM 2.0 roadmap and will be consolidated into an independent subsidiary to increase operational awareness and attract third-party customers. In Q3 2024, impairment and restructuring expenses cost the foundry business $5.83 billion. In spite of these challenges, Intel has won new design partnerships, such as a multi-year, multi-billion-dollar partnership with Amazon’s (AMZN) AWS to build custom AI Fabric Chips and Xeon 6 processors.

This partnership should boost Intel’s foundry operation and U.S. semiconductor manufacturing, and I believe this move could really shake up Intel, giving it a huge boost to its foundry operations.

What also gives some hope after ugly Q3 results is Intel’s management guidance: they gave an upbeat revenue forecast for Q4 2024 at $13.8 billion – a 4% sequential gain. The company estimates a non-GAAP gross margin of 39.5% and EPS of $0.12, a gain from the prior quarter’s 18%. Intel is committed to implementing its product and process roadmap for FY2024 and beyond, with the introduction of Intel 18A and Panther Lake driving future expansion. The firm plans to level the playing field and eventually regain data center CPU market share with its next-generation 20A and 18A processors. I believe these expectations may be kind of naive, but they depend on Intel’s being able to carry out its big dream plans. Anyway, what excites me is the fact that Wall Street analysts have dramatically lowered their expectations for the company’s EPS over the next few years – I believe this has set a very low base for comparison. So even a slight improvement in Intel’s performance – even not as strong as the management paints – could help exceed analysts’ consensus in Q4 and throughout fiscal 2025, serving as a strong catalyst for future stock growth.

Analysts from major investment banks are still wary of Intel’s prospects in general, with most citing the competition from AMD and ARM-based products. Analysts at Barclays (proprietary source, November 2024), for example, have worried about the viability of Intel’s core business and its ability to turn a profit. But overall, Barclays was even able to note for its clients a lot of positive moments from Q3:

Net-net, we are encouraged by INTC’s execution off the bottom and think expectations are now set more appropriately, but underlying questions around the competitiveness of the core business, process technology, and cash flow generation remain unanswered, keeping us on the sidelines.

Source: Barclays (proprietary source, November 2024)

Of course, despite some success in cost reductions and strategies, Intel faces tremendous challenges in regaining market share and profitability – the coming quarters will be of prime importance for Intel to realize its vision and provide long-term shareholder value. I believe that Intel will only be successful if it can find a way to stay ahead of the curve in an ever-evolving market. However, judging by the new partner programs and the products launched on the market recently, the company has every chance of a successful recovery, which admittedly may take several years. I remain generally optimistic and hope that this will be the case – again, the current EPS forecasts tell me that the market disagrees with me thus allowing placing an out-of-consensus bet.

But even today’s negative expectations suggest that Intel may be quite undervalued after a 31% stock price decline over the last 12 months. Yes, Seeking Alpha’s Quant Rating system assigns a “D” Valuation grade to INTC, but if we look at the next few years, we see that Intel’s earnings are expected to rise by over 75% in 2026 after the 2024/25 slump, with the P/E ratio for 2026 at 15.2x. That seems too low to me. INTC obviously operates in a cyclical industry, but a P/E ratio of 15x with earnings growth of over 75% that year seems too pessimistic.

Seeking Alpha, Oakoff’s notes added

If INTC stock trades at a multiple of at least 20x in 2026, the market cap should be around $34.4/share. That means the growth potential is over 31% over the next 2 years – and that’s assuming the current consensus is correct, which I doubt.

Risks To My Thesis

Even though I believe that Intel will eventually recover and is worth buying today, a number of reasons can undermine my bullish thesis. To begin with, the competition is a major issue: Intel’s client and data center CPU market share has declined for 18 years, according to Argus Research. This dwindling comes in large part due to the aggressive moves of rivals such as AMD and ARM which continue to dominate the market with new and optimized products. So Intel is likely to be in trouble if it doesn’t respond to these competitive pressures with its product launches and marketing strategies in a proper way. Its grand initiatives – like the Intel 18A and Panther Lake processors – look promising, but they’ll have to make real progress in terms of performance and customer acceptance if they’re going to make a difference in Intel’s market share. If they fail to deliver or are delayed, INTC’s recovery strategy will likely be compromised.

Another risk for my thesis is the assumption that the consensus could be wrong. There are research reports from major banks in which the analysts see nothing good for Intel and rate the company as a “Sell” – just look at the latest report from Goldman Sachs (proprietary source, November 2024):

Goldman Sachs (proprietary source, November 2024)

Your Takeaway

Despite the above risks, I still think that the market’s negative view of Intel Corp. is too exaggerated. I generally support the management’s efforts to restructure the business’s cost structure, even though these steps should have been taken several quarters, or even years ago. The company is currently lagging in the race to dominate the artificial intelligence market. However, I think that INTC will continue to make efforts, and somewhere in 2025, we might see a turnaround in the company’s fortunes, which could lead to medium-term growth in the stock. My valuation calculations say that the stock is undervalued by 31% over the next 2 years as the firm emerges from its challenging period.

Therefore, I reiterate my bullish rating and think that it’s not too late to buy into this long-term stock decline.

Good luck with your investments!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.