Summary:

- I believe the longer term bull case on Intel’s outperformance requires Intel to close its technological gap with TSMC.

- But TSMC’s CEO has very unambiguously stated an informed opinion that they will remain a step ahead of Intel and I find this narrative more credible.

- Intel is facing inventory-correction and demand related headwinds in at least 36% of its business heading into FY24.

- Given the lackluster outlook, the stock seems expensive with little margin of safety for value buys.

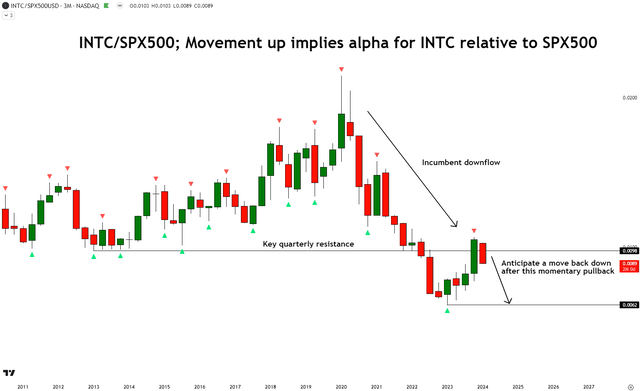

- Technical analysis also suggests negative alpha ahead for Intel vs the S&P500.

FotografiaBasica/iStock via Getty Images

Thesis

I am bearish on Intel (NASDAQ:INTC) due to 3 key reasons:

- Despite efforts to catch up, Intel may remain well behind TSMC in foundry technology

- There are many business headwinds heading into FY24

- Valuations seem steep with lower margin of safety

Despite efforts to catch up, Intel may remain well behind TSMC in foundry technology

As it has for many decades already, the world continues to move toward smaller, faster computing with greater memory. This is the essence of many technological developments and new product upgrades. And at the backbone of it all is the semiconductor chip. This is why there is high stakes for whoever can make the chips smaller, faster in compute and with higher storage captures a lot of the value. Taiwan Semiconductor Manufacturing Company (TSM) is currently the leader.

The longer term case for Intel hinges upon its ability to close the gap in foundry technology leadership it has with industry leader TSMC. This is the strategic imperative that management is focusing on in its communications with investors as well, as evidenced by CEO Patrick Gelsinger’s opening remarks in the Q4 FY24 earnings call:

Q4 was the culmination of a year of tremendous progress towards our IDM 2.0 transformation. We consistently executed on our plan to reestablish process leadership, further build out our capacity and foundry plans.

IDM stands for integrated device manufacturer

A key milestone in Intel’s journey into the design and manufacture of more advanced semiconductor chips is Intel 18A, which is expected to have manufacturing readiness in H2 FY24. This is the key product that CEO Gelsinger is relying on to regain process leadership vs TSMC.

This is Intel’s claim. The question is of course whether they can achieve it. Analysts asked TSMC about it:

Given we are hearing a lot of competitive messaging from your U.S. IDM competitor/customer in the last few months, Intel seems to think that they will be getting into technology or process technology leadership in 2025. Just wanted to hear what does TSMC think of Intel’s claim?

– JPMorgan analyst Gokul Hariharan in TSMC’s Q3 FY23 earnings call

And TSMC CEO Wei’s answer made a strong claim with no space left for ambiguity:

Let me answer your question with a very simple answer, is that no, but what I will state a little bit long. Actually, we do not underestimate any of our competitors or take them lightly…. Having said that, our internal assessment shows that our N3P, now I repeat again, N3P technology, demonstrated comparable PPA to 18A, my competitors’ technology, but with an earlier time to market, better technology, maturity and much better cost.

In fact, let me repeat again, our 2-nanometer technology without backside power is more advanced than both N3P and 18A, and will be semiconductor industry’s most advanced technology when it is introduced in 2025.

– TSMC CEO Wei in the Q3 FY23 earnings call, Author’s bolded highlights

PPA stands for power, performance and area, which are the most important metrics for judging the quality of a semiconductor manufacturing process

N3P refers to TSMC’s advanced 3nm semiconductor chip technology, which is scheduled for 2024 production.

N2P refers to TSMC’s 2nm technology without backside power which is expected to be released by TSMC in 2026; around year after Intel’s 18A

The takeaway here is that TSMC strongly believes the chip they will be producing in 2024 (N3P) is overall more advanced than the chip Intel expects to manufacture in H2 FY24. And in the pipeline, due for release in 2026, TSMC has a more advanced chip (N2P) to extend its technological lead again.

So which narrative may be the truth? Intel’s claim of being able to close the technological gap or TSMC’s assertion that it would remain a step ahead? I give the edge to TSMC here as their CEO firmly emphasized and repeated his claim in definite terms. Also given that TSMC is the incumbent technological leader, I think the onus of proving otherwise is on Intel.

The implications of this belief that Intel won’t be able to catch up to TSMC over the next few years undermines the longer term bullish, outperforming case for Intel.

There are many business headwinds heading into FY24

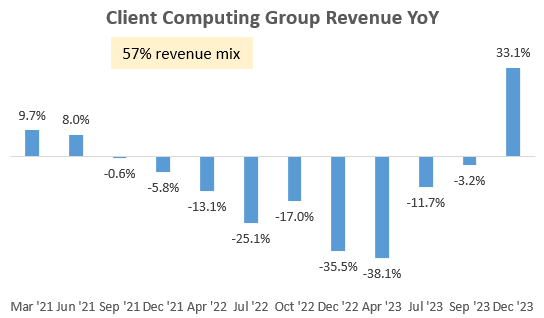

Moving onto considerations of the medium-term outlook, I note that Intel’s Client Computing Group (57% of overall revenues) is seeing a growth rebound as customer inventory levels have normalized:

Client Computing Group Revenue YoY (Company Filings, Author’s Analysis)

The commentary in the Q4 FY24 earnings call was also healthy here as management noted a stable share position and strength in gaming and commercial segments.

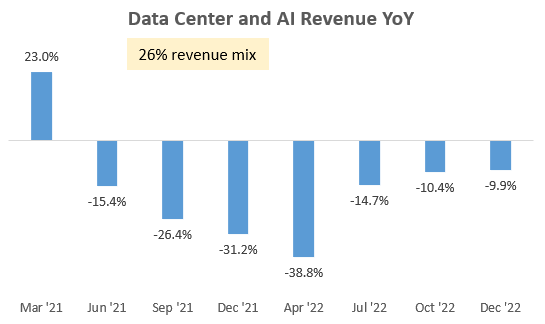

However, this segment is the silver lining. The other 2 segments that make up 36% of the business continue to see headwinds:

Data Center and AI Revenue YoY (Company Filings, Author’s Analysis)

In the Data Center and AI segment, Intel is facing a “material inventory correction” in the programmable solutions group, specifically in field-programmable gate arrays (FPGA). FPGAs are the building blocks of programmable semiconductor chips. Management expects this headwind to continue in H1 FY24. Moreover, competitive pressures were also mentioned, which I recognize may increase the risks of market share loss for Intel. Key competitors here are Advanced Micro Devices (AMD), NVIDIA (NVDA) and ARM Holdings (ARM).

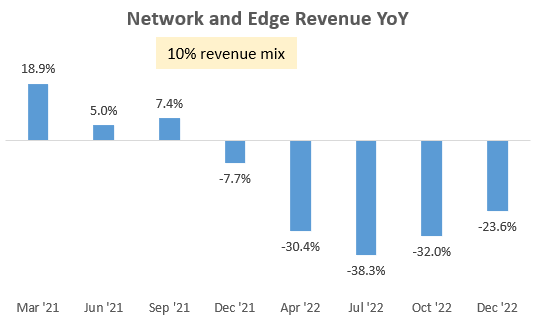

Network and Edge Revenue YoY (Company Filings, Author’s Analysis)

Intel’s Network and Edge segment has been suffering from weak telecommunication market demand and elevated customer inventory levels. Management suggested that this is expected to “remain weak” throughout the year.

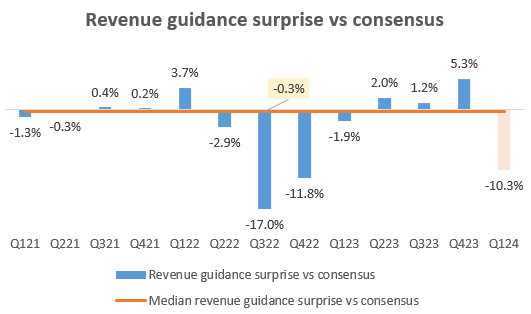

Overall, the lackluster outlook led to a large disappointment in the Q1 FY24 revenue guidance of $12.7 billion at the midpoint of the range; 10.3% lower than what consensus was expecting:

Revenue Guidance Surprise vs Consensus (Capital IQ, Author’s Analysis)

Valuations seem steep with lower margin of safety

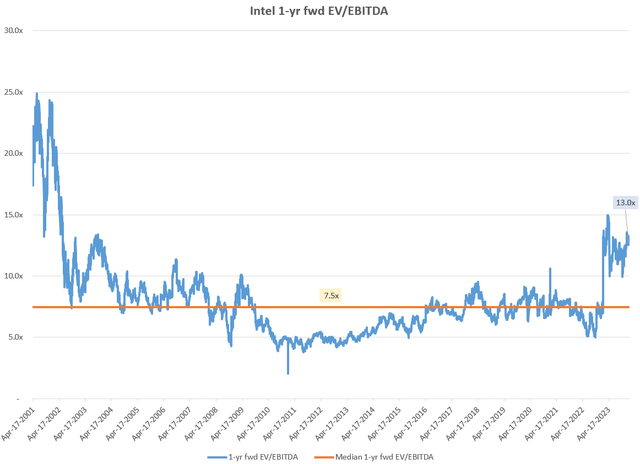

From a 1-yr fwd EV/EBITDA perspective, Intel is trading at 13.0x; 74.1% above its longer term the median of 7.5x. Of course, some premium above the longer term average is acceptable given the strong AI and high performance computing demand contributing to a positive longer term outlook for semiconductors. However, given Intel’s position and operating momentum, I believe it is trading too highly with low margin of safety for value buys.

Intel 1-yr fwd EV/EBITDA (Capital IQ, Author’s Analysis)

Technical Analysis

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do, utilizing principles of Flow, Location and Trap.

Intel vs SPX500 Relative Technical Analysis (TradingView, Author’s Analysis)

On the quarterly chart of INTC vs the S&P500 (SPY) (SPX), I note that the ratio prices have been in an incumbent downflow and there is a bearish reaction occurring now at the key resistance level. I anticipate a move back down to the local lows, which means negative alpha for Intel vs the S&P500.

Key Risk and Monitorable

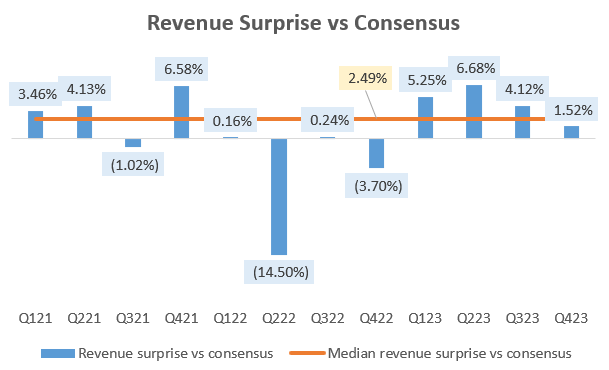

Despite the lower guidance in Q1 FY24, I note that Intel has generally posted revenue (median of 2.49%) surprises since Patrick Gelsinger joined as CEO in February 2021:

Revenue Surprise vs Consensus (Capital IQ, Author’s Analysis)

Hence, closer towards the quarters, if I believe the company is unlikely to show more disappointments in guidance and outlook, I recognize the potential for a rally in the stock. Given that Dell (DELL), Lenovo (OTCPK:LNVGY) (OTCPK:LNVGF) and HP (HPQ) make up 40% of overall revenues for Intel, I would be tracking the outlook and commentary for these companies to get leading signals on Intel’s performance.

Also, Intel’s Foundry Day is on February 21 2024. This is a key monitorable as well; I hope the company gives more clarity and justifications on their ability to close the technological gap with TSMC. Positive messaging here for Intel would pave the way for a more constructive longer term outlook for Intel.

Takeaway

I think the longer term bull case on Intel requires assumptions about it being able to close the foundry technological gap it has with TSMC. Intel’s management has suggested that this is possible by 2025 after the release of its 18A chip. However, I am skeptical of this claim as TSMC’s CEO has stated in very strong unambiguous terms that based on their internal assessments, their products and pipeline will remain a step ahead of Intel.

From an operating momentum perspective, Intel has a lot of headwinds relating mostly to inventory correction at customer levels in more than 36% of the business. Management expects this to continue at least into H1 FY24, which led to a 10% disappointment in their revenue guidance vs consensus expectations.

Looking at valuations, Intel is trading 74% higher than its longer term 1-yr fwd EV/EBITDA, which I think is excessive. Technical analysis also suggests negative alpha potential ahead vs the S&P500.

Hence, I rate Intel a ‘Sell’.

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to around a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.