Summary:

- Intel’s shares could surge due to Qualcomm’s buyout interest, driven by Intel’s low valuation and strategic fit with Qualcomm’s product portfolio.

- Intel’s recent struggles, including weak earnings and competitive challenges, make it an attractive acquisition target, trading at a forward P/E ratio of 18.5X.

- Qualcomm stands to diversify its revenue streams by acquiring Intel’s manufacturing capabilities and expanding into new business (PC) lines.

- A merger would be transformative for Intel, but regulatory hurdles and the risk of no deal remain significant concerns for investors.

JHVEPhoto

According to a report by the widely respected Wall Street Journal, Intel (NASDAQ:INTC) has been approached by Qualcomm (QCOM) about a potential acquisition last week, which could add considerable buyout fantasy to Intel’s investment setup. Intel’s shares could therefore be on the brink of a major breakout if the chipmaker, which has fallen on hard times lately, is indeed sought out as a major buyout target by another cashed-up semiconductor company. I believe a merger between Intel and Qualcomm would make a lot of strategic sense, especially for Qualcomm, and it could put Intel back into play for investors. With Intel’s business under pressure and no real strategic solutions in sight, the timing could be right for Qualcomm to swoop in and offer Intel and its investors a new strategic alternative.

Previous rating

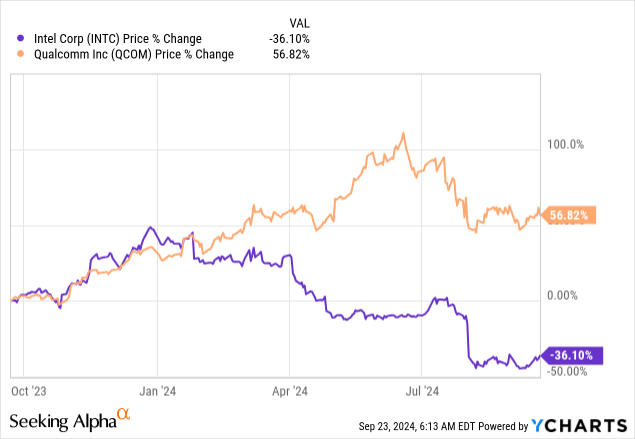

I rated shares of Intel a strong buy after the company widely disappointed investors with its second-quarter earnings sheet in August and reported an unexpected $1.6B loss: Disaster Strikes, What Now? The reason for my contrarian take was that Intel’s AI PC segment was set for strong growth going forward, and that shares were attractively priced. The market is still very much on the fence with regard to Intel, in large part because the company has lost ground to other chip rivals such as AMD (AMD) or Nvidia (NVDA). In my opinion, Qualcomm’s acquisition of Intel would make strategic sense and the risk profile for Intel is still, despite the company’s problems, attractive.

Intel/Qualcomm merger, strategic options and buyout fantasy

Intel is under considerable pressure as it is lagging AMD and Nvidia in the crucial Data Center business, which has taken off in the last year due to soaring demand for AI GPUs. Intel has been late to the party and widely disappointed investors with its Q2’24 achievements: Intel’s revenues declined 1% year-over-year in the second quarter which was an especially tough pill to swallow for investors as companies like AMD and Nvidia reported strong top line growth, especially in their Data Center segments.

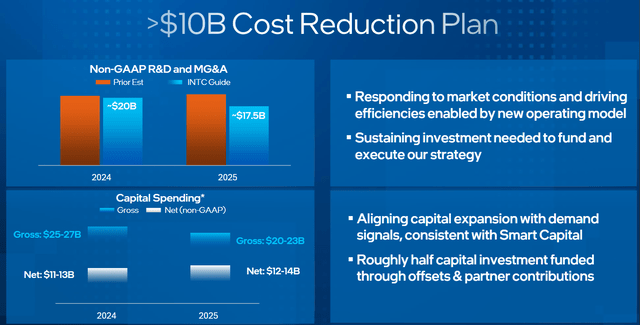

To respond to persistent sales and profitability challenges, Intel announced a new $10B cost reduction program, which also yielded the elimination of its dividend and a reduction in its capital expenditures. Obviously, Intel is now leaning on cost cuts and spending reductions, which is exactly what makes Intel attractive as a potential takeover target.

Intel

Intel’s main issue is that it has been asleep in the Data Center business, which is where especially Nvidia is crushing it right now. AMD, while also lagging Nvidia, has launched a strong GPU chip, the MI300X, which is the reason why AMD is on the brink of a major revenue and FCF boom.

But Intel’s problems could be an opportunity for a potential acquirer, like Qualcomm. An acquisition would make sense for Qualcomm, which is focused on smart phone processors, while Intel has its core competency in the manufacturing of PC processors. Qualcomm, however, has invested heavily in its own line of computer processors, dubbed Snapdragon. The Snapdragon X Series, as an example, powers Microsoft Copilot+ laptops.

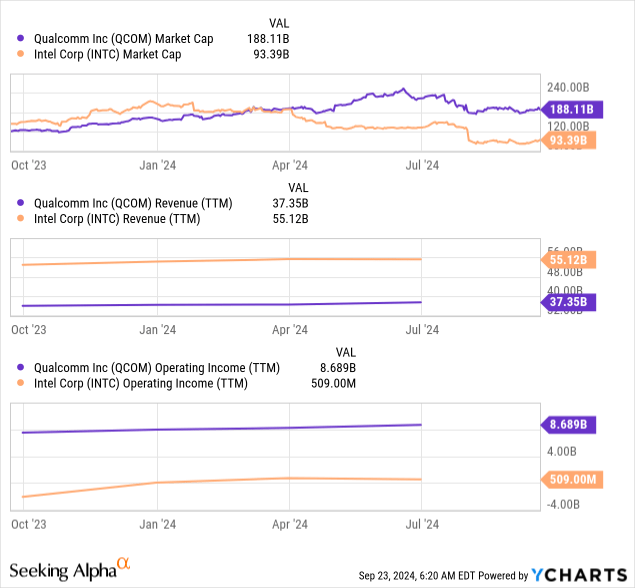

For Qualcomm, an acquisition of Intel would open up an entirely new business line, diversify its revenue streams and broaden its product portfolio. Qualcomm does not make its own chips, so the acquisition of Intel’s fab would be a major asset for the company as well. Qualcomm is currently about 2X larger than Intel, based off of market capitalization, but has 32% lower revenue volume based off of TTM revenues. On the other hand, Qualcomm is much more profitable than Intel… which is something one would expect considering that Intel is now focused on cutting costs.

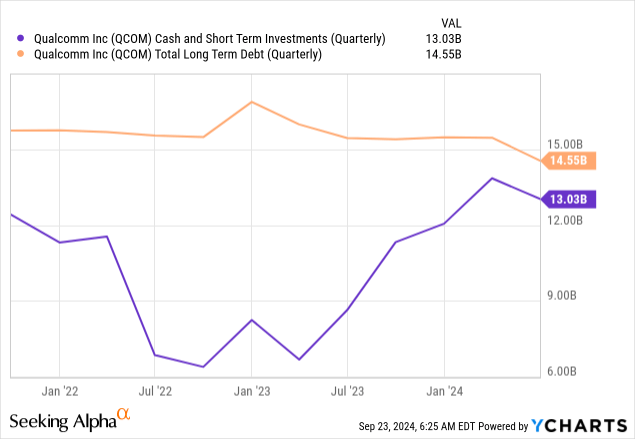

Qualcomm does have a considerable amount of cash on its balance sheet, but would likely have to raise a significant amount of debt as well to finance a potential acquisition. Qualcomm had about $13.0B in cash and investments on its balance sheet in the last quarter.

Intel’s low valuation makes it attractive for an acquirer

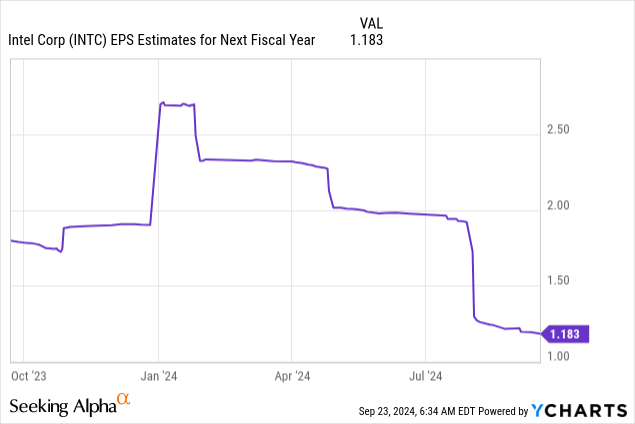

Intel’s EPS trend is very negative, as analysts updated their EPS estimates after the chipmaker’s second quarter.

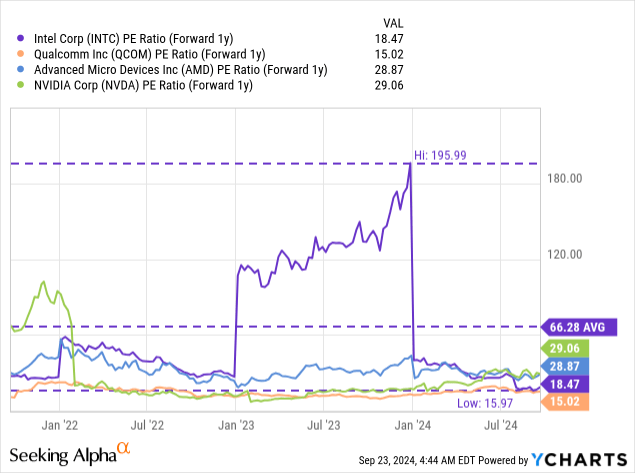

As I have stated in my last work on Intel: the chipmaker has a ton of problems, but the shares are still relatively cheap. Low valuations tend to attract potential acquirers and with Intel currently trading at a forward price-to-earnings ratio of only 18.5X, the chipmaker is an absolute bargain that practically waits to get snatched up by another chip firm. Intel’s valuation is currently also trading about 72% below its 3-year average price-to-earnings ratio, which reflects the chipmaker’s deep struggles in operating and income struggles. In comparison, Nvidia and AMD, which adapted (much) quicker to changes in market demand for generative AI products, trade at significantly higher valuation ratios.

Risks with Intel

An acquisition of Intel is only one potential outcome, as the chipmaker likely already evaluates strategic options. An acquisition would be a good outcome for investors, as shares were to benefit from a catalyst and help shift the narrative away from a multi-year restructuring and towards an immediate strategic solution to Intel’s problems. Intel’s biggest risk, as I see it, is for the company to chug along and lose more money on its core operations without fundamentally changing its strategic direction.

Another risk, related to a potential acquisition by Qualcomm, relates to securing the necessary approvals from antitrust regulators, which would likely seriously review the transaction and its impacts on competition in the semiconductor industry. What would change my mind about Intel is if the chipmaker were to fail to develop strategic solutions to its profitability problems, or if Intel failed to achieve its targeted cost savings.

Final thoughts

A merger between Intel and Qualcomm, and an official buyout offer, would be a major game-changer for Intel. A deal would make strategic sense for Qualcomm, given its complimentary product portfolios (mobile + PCs) and the fact that Intel has so far not developed any wide-reaching strategic solutions for its problems. Intel is struggling in its core Client Computing Group and has lost ground to AMD and Nvidia in the Data Center industry, which necessitates another round of deep operating cost cuts, which would likely not be enough to justify a major share price turnaround. What makes Intel attractive more than anything to Qualcomm is its strong position in the PC/laptop processor market and its low valuation based off of earnings. With a forward P/E ratio of 18.5X, I believe Intel is a true bargain and strategic alternatives, including a sale of the company, should be explored by management.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC, AMD, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.