Summary:

- Intel is embarking upon a massive turnaround plan that will require a considerable amount of time, effort, and money.

- The company plans to revitalize its operations through IDM 2.0 and IFS, which comes with questions and uncertainty.

- We view the valuation as being unattractive, given how much work still needs to be done by the company.

- The risk/reward appears to be unfavorable, and an investor’s best course of action may be to wait on the sidelines for a considerable improvement in fundamentals.

JHVEPhoto/iStock Editorial via Getty Images

Thesis

Intel (NASDAQ:INTC) is undertaking a capital-intensive endeavor that many investors are doubting. The company has become operationally unprofitable as its business has been negatively impacted by internal and external factors. While the outlook may appear bleak at this juncture, investors should keep an eye out for improvements in the fundamental story. There will likely come a time when Intel is an attractive investment relative to peers. In our opinion, that day is not today.

The Foundry Gamble and IDM 2.0

Intel has embarked upon an expensive quest to build out and improve its foundry capacity across the world in a plan known as IDM 2.0. The company is heavily playing up its strategic importance to Western supply chains in order to gain government support and receive government money. You can read the most recent updates on IDM 2.0 here.

Intel Foundry Services [IFS] is Intel’s business unit that will fabricate semiconductors for outside firms. This is a shift in direction from Intel’s primarily internal foundry operations and it remains to be seen how effectively Intel will be able to compete in this area. The foundry business is notoriously capital-intensive and there is a lot of collaboration that goes on between the foundry and its design customers. Intel lacks the robust testing/packaging/manufacturing infrastructure that exists in Taiwan, and economies of scale will be difficult to come by. The company is a competitor to many firms that are potential customers of their foundry division, which may keep them from utilizing IFS because they don’t want to fund a competitor.

Financial Difficulties

Intel is currently unprofitable on an operating basis and is experiencing a continued decline in revenue. This is generally a recipe for disaster, but due to the cyclical nature of the industry, some investors are willing to give the company the benefit of the doubt. We view the financial situation as being dismal, especially given how much investment will be required for them to catch up in design and manufacturing while also building out IFS.

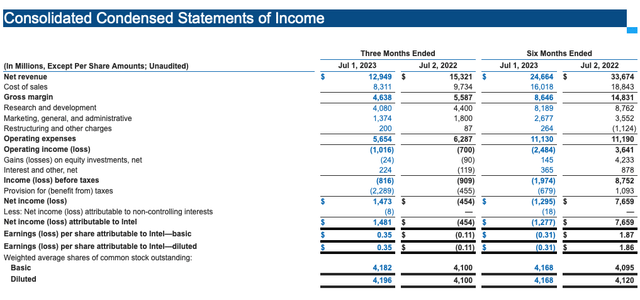

Income Statement (Intel’s Quarterly Earnings Report)

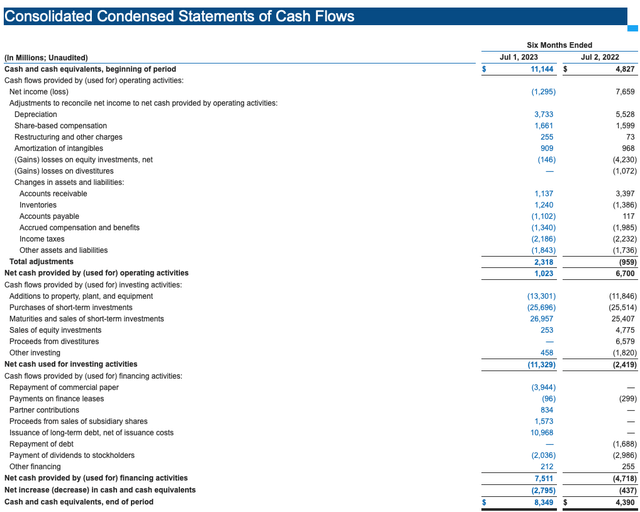

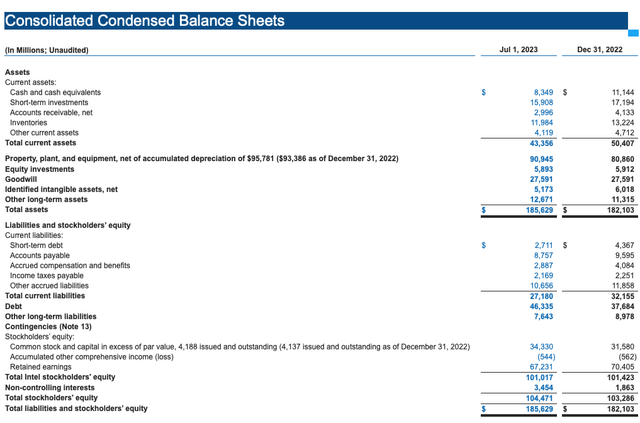

The company is facing massive capex requirements tied to its foundry buildout, with net capex increasing dramatically year over year. They have needed to increase their debt to fund these expenditures as their operating cash flows have declined considerably. Absent a meaningful turnaround in operating cash flow, the company will likely need to borrow even more money over the next couple of years. This is an unattractive prospect given where interest rates are at the moment.

Statement of Cash Flows (Intel’s Quarterly Earnings Report)

What Could Go Right

The bull case surrounding Intel relies on two things going at least partially right. The first is the company needs to improve its competitiveness on the logic front. NVIDIA (NVDA) is currently demolishing the competition but there is an appetite for an alternative to Nvidia’s GPUs in HPC, and Intel can meet the market need if they play their cards right. This will take not only time but also patience from the company.

The second thing that needs to go right is Intel needs to create and expand a financially viable foundry operation, which is no easy task given their competition in TSMC (TSM). While some investors may doubt Intel’s IFS adventure, we believe that the move is prudent and helps to future-proof the company. There is the potential for the x86 ecosystem to continue to lose popularity and for GPUs and CPUs to be replaced by ASICs/SOCs for HPC applications. Intel’s customers may opt to design their own chips instead of purchasing from Intel. This would be devastating for the company unless they can make money from fabricating the chips of their former customers. The foundry business is not an easy one, but it is one that Intel can succeed in over the long term. The battle will be long and arduous, and we believe that most investors don’t truly grasp how tough it will be. The financial rewards will likely be far out in the future even if IFS and IDM 2.0 are a success. The stock could have a prolonged period of stagnation as investors who expected a quick turnaround throw in the towel and the prolonged risk factors keep a lid on investor appetite.

What to Watch for In Q3

Intel is set to report its Q3 earnings on October 26. Some key metrics to watch out for are their profitability and cash flow. If these metrics continue to worsen it may signal that the turnaround will take even longer than expected. It could also signal that Intel may become financially challenged and need to take on more debt. On the conference call, investors should listen for progress on design and manufacturing. Bullish investors would like Intel to communicate that they have a pipeline of competitive designs and that they are taking the right steps to create useful foundry capacity. These things are the key to the fundamental thesis, and if they still appear to be behind in these areas then investors should discount their valuation for the company. It will be useful to compare the results from Intel against companies such as AMD and Nvidia to get a gauge of how far behind Intel is, and how much of their weakness is macro-related versus how much weakness is firm-specific.

Price Action and Valuation

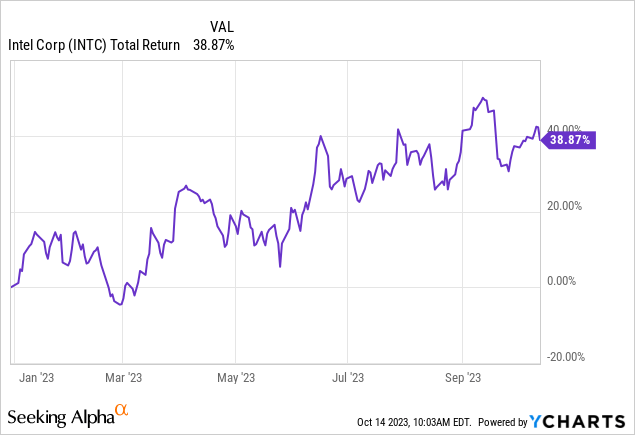

Intel has been on a nice run in 2023, with the stock returning nearly 40%. Going forward the company will need to execute well on IFS and improve its competitiveness in logic. If they can achieve this, the stock’s upward momentum appears likely to continue.

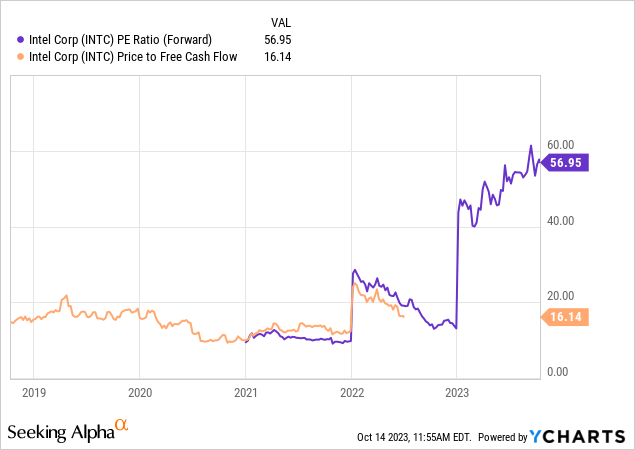

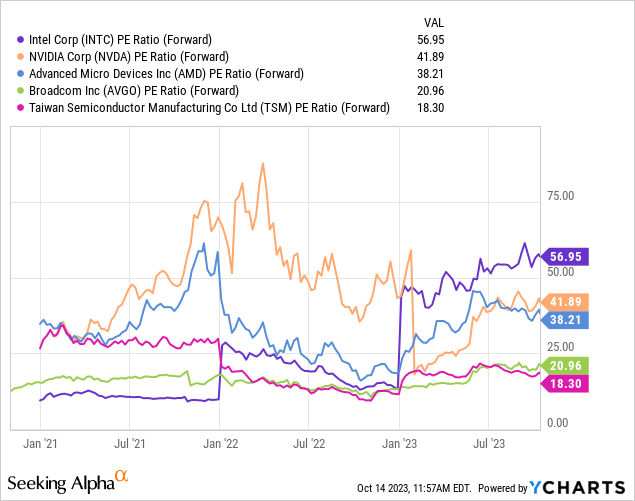

Intel is currently free cash flow negative and has a forward PE ratio of nearly 57. This is a high price to pay for a company that is experiencing a dramatic decline in revenue and profitability while also facing increasing capex requirements.

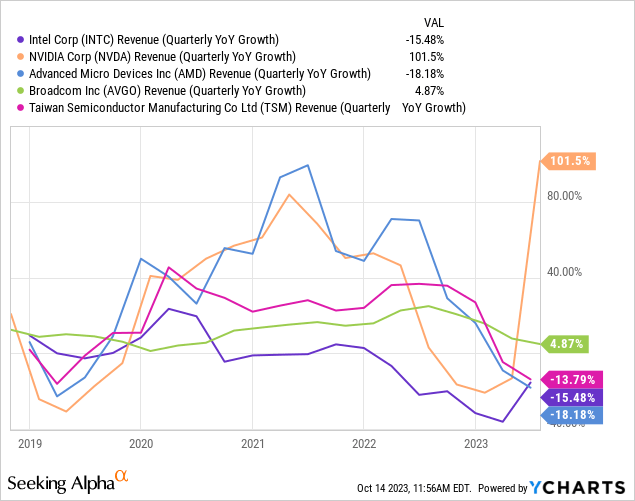

Intel isn’t the only company in the semiconductor industry experiencing a decline in revenue. That being said, Intel has faced growing problems within its business for several years now. For that reason, investors are generally more skeptical of Intel re-accelerating revenue growth than for companies such as AMD (AMD) or TSMC.

Despite the significant weakness in their business Intel is trading at the highest forward PE of any of the companies listed on the chart. This seems highly optimistic and signals that investors may be looking for a quicker turnaround from Intel than is realistically possible. It seems reasonable to expect Intel to trade at a valuation somewhere between TSMC and AMD, which at the moment would result in a much lower share price.

Intel has taken on additional debt to fund its foundry capacity buildout. Their balance sheet is still in good shape but a lot relies on how well IFS goes and how efficient their capex is going forward.

Balance Sheet (Intel’s Quarterly Earnings Report)

The fundamental thesis for Intel revolves around the company’s ability to right the ship and fix its operations. We believe that the current valuation is not compelling and would wait for the company to make considerable progress before investing. Investors don’t have to capture 100% of the move to make money and there is a lot to be said for avoiding turnaround stories until they actually make the turnaround.

Risks

Some risks to the bullish thesis are the potential for their design units to fall behind the competition and for their semiconductor sales to remain in a relative slump due to a tough macro environment.

While some investors view an adverse geopolitical event involving Taiwan as being good for Intel, the company relies heavily on Taiwan for part of its supply chain and China is a large end market. For these reasons, the net effect of a China/Taiwan conflict would likely be very negative for Intel.

The major risk to the bearish thesis is the potential for Intel to execute on its ambitious design and manufacturing goals. This would demonstrate the success of IDM 2.0 and allow Intel to not only make money from chip design but also expand into the foundry business. This would subsequently increase their earnings while helping to de-risk the business. Intel’s design and manufacturing goals are operationally challenging and we have our doubts, but they are certainly within the realm of possibility.

We view the overall risk/reward as being unattractive at this time. That being said, Intel is a company that is worth having on an investor’s watchlist.

Key Takeaway

Intel is a company that attracts many value and contrarian investors. Despite how tempting the investment may seem, we believe that staying on the sidelines is the best course of action. The company has a lot to prove and investors don’t lose a dime by waiting for the fundamental picture to improve. If they can return to operating profitability and show signs of success in design and IFS we would turn more bullish on the company. For now, we will watch and wait.

Thanks for taking the time to read this article!

Today’s question is: If you could only pick one, would you rather invest in Intel, AMD, or Nvidia at this juncture and why?

Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC, NVDA, AMD, AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

UFD Capital Value Fund, LP has long exposure to INTC, NVDA, AVGO, and AMD. UFD Capital, LLC manages a hedge fund and does not provide investment advice. Nothing contained in this article is investment advice or financial advice of any kind and investors should do their own research and consult a professional before making financial decisions. Nothing contained in this article should be interpreted as a solicitation to buy or an offer to sell securities.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.