Summary:

- I’m downgrading Intel to “Hold” due to persistent internal issues, despite previous optimism about Gaudi 3’s long-term potential.

- INTC’s Q2 report showed disappointing revenue and profitability, with significant earnings misses and competitive pressures impacting margins.

- Management’s pessimistic Q3 guidance and ongoing challenges from competitors like AMD, Nvidia, and TSMC suggest a tough road ahead for Intel.

- Despite Intel’s efforts in restructuring and new product launches, I see no immediate end to the headwinds, making it premature to upgrade to “Buy”.

hapabapa

Intro & Thesis

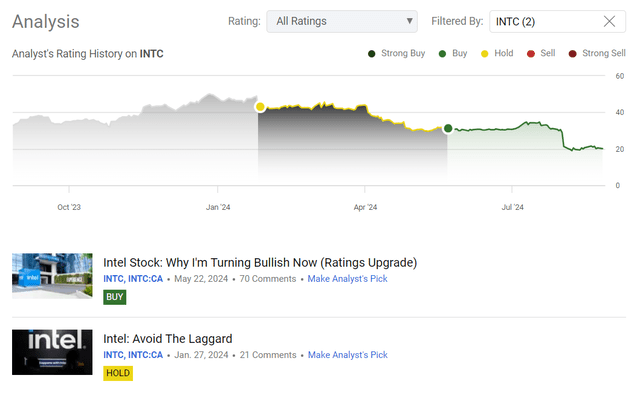

In late January 2024, I initiated coverage of Intel Corporation (NASDAQ:INTC) with a “Hold” rating and recommended avoiding the stock, as Intel’s business appeared to be an obvious laggard compared to other peers in the technology sense. After the stock price fell by 28% – this happened in late May 2024 – I decided to upgrade the stock to “Buy” as I believed that INTC’s Gaudi 3 would have a long-term competitive advantage, especially in enterprise AI applications where efficiency and cost-effectiveness are critical. My DCF model at the time showed an undervaluation of 18% – that’s how much the stock has risen since that bullish call of mine before the second quarter results were released, and INTC lost over 30% in a matter of days.

Seeking Alpha, my coverage of INTC stock

Today, I’d like to revise my rating again and downgrade it to “Hold”. From a valuation perspective, I believe INTC is no longer an unconditional “buy” for investors looking for a sufficient margin of safety. As a serial dissapointer (in my opinion), Intel seems to have enough internal problems that could potentially lead to a continuation of today’s correction.

Why Do I Think So?

As usual, I propose to start with an analysis of the latest quarterly report, which was essentially the trigger for the stock price collapse that has continued to this day.

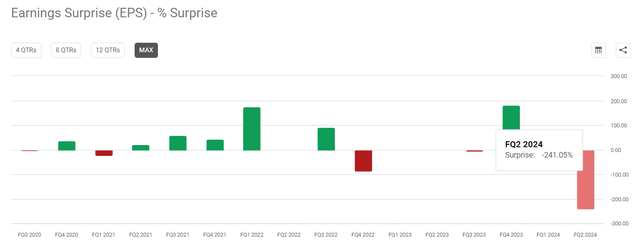

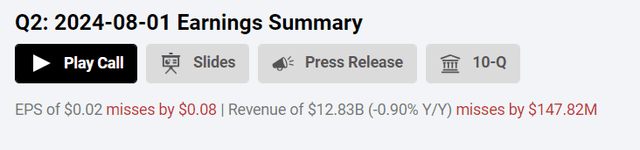

Intel’s performance in Q2 FY2024 looked quite bleak, with revenue at $12.83 billion, up 1% sequentially, down 1% YoY, and below the midpoint of management’s guidance of $12.5-$13.5 billion, and the consensus estimate of ~$12.98 billion. The non-GAAP EPS was $0.02, which was a significant drop from $0.13 a year earlier, and below the expected $0.10. Actually, what we saw recently was the most severe earnings miss in the company’s history for the past few years at least, according to Seeking Alpha:

Seeking Alpha, INTC Seeking Alpha, INTC

Clearly, Intel faced real difficulties in maintaining profitability amidst competitive pressures and strategic investments – even the CEO Pat Gelsinger described the quarter’s profitability as disappointing (during the earnings call), despite progress on product and process roadmaps:

Q2 profitability was disappointing despite continued progress on product and process roadmaps. With our new operating model firmly in place, we are accelerating actions to improve profitability and capital efficiency by more than $10 billion in 2025, which I will discuss shortly.

For the quarter, we delivered sequential revenue growth in line with our forecast despite the unexpected timing of new export control restrictions announced in May. Q2 profitability was below our expectations due in part by our decision to more quickly ramp core Ultra AI CPUs as well as other selective actions we took to better position ourselves for future quarters, which Dave will address fully in his comments.

We know from the comments that during Q2, Intel focused on its aggressive node and product roadmap, particularly in the Client and Data Center segments. However, the company acknowledged that it “faces a long road to recovery”, with intense competition from Advanced Micro Devices (AMD), Nvidia (NVDA), Apple (AAPL), and others. Apparently, huge competition has prompted Intel to move production of its latest PC processors from a low-volume/lower-cost facility in Oregon to a high-volume/much higher-cost plant in Ireland, so its gross margin missed significantly in Q2.

Intel shifted production of its latest PC processors from a low-volume (but lower-cost) facility in Oregon to its high-volume (but much higher-cost, for now) plant in Ireland. Intel thinks this was the proper long-term shift, but we fear that Intel rushed this processor (former codename Meteor Lake) to prime-time production in the face of intense competition for the artificial intelligence PC, perhaps speaking to the relative lack of competitiveness of prior-gen CPUs.

Source: Brian Colello on Morningstar (proprietary source, August 2024)

As already noted above, Intel’s restructuring actions should aim to improve profitability and capital efficiency by more than $10 billion by 2025, mainly thanks to OPEX, COGS, and CAPEX reductions. The company is also reducing its workforce by more than 15% by the end of 2024. However, Intel also faced gross margin headwinds in the second quarter due to the accelerated launch of Core Ultra AI CPUs and unexpectedly high costs in the non-core businesses, so I can’t see where they’re going to save on COGS (at least on this type of cost) in 2025. Additionally, as Argus Research analysts noted in their post-earnings report (proprietary source, August 2024), new import control restrictions impacted Intel’s revenue timing – a continuation of this impact may continue to put pressure on margins going forward.

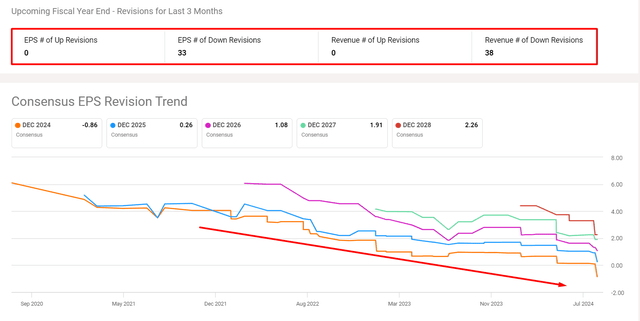

In addition to the poor earnings, the sharp fall in the stock price was a consequence of the management’s rather pessimistic guidance for Q3 2024, which now suggests a challenging second half of the year, with expectations of a 5%-12% annual revenue decline and a non-GAAP loss. Of course, such a development couldn’t help but lead to massive revisions to the forecasts for sales and earnings per share, far beyond Q3:

Seeking Alph, the author’s notes added

Despite these challenges, Intel is nearing the completion of its “five nodes in four years” project, with the Intel 20A product beginning production ramp in the second half of 2024. On the other hand, it’s far from certain that this initiative will help INTC to stand out among its peers. The company is also preparing for the release of its 18A process node, with products like “Panther Lake” and “Clearwater Forest” expected to reach mass market status in 2025. But again, the competition is still there, so there’s a risk for Intel that even if its projects reach the market, the pressure on pricing won’t disappear and Intel’s profit margin will continue to suffer.

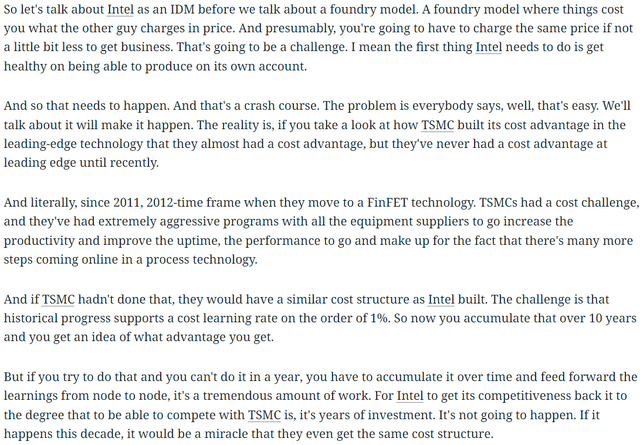

As the company focuses on expanding its Intel Foundry Services (IFS) with the goal of becoming the second-largest external foundry by 2030, I think the overall business model Intel operates has some vulnerabilities that could limit its growth and profit margins. I draw this conclusion based on the comments of a former Intel manager who shared his opinion on the Tegus platform (basically they interview experts to gather insights for institutional investors). I found a piece of that interview on X and while I have no doubts about its authenticity, I have to make a small disclaimer about how I found this material.

Tegus, shared on X by @techfund1

I’m not a great expert on the semiconductor industry, but from what I’ve understood, I can draw some brief conclusions. First, TSMC (TSM) has gained a significant cost advantage over INTC over the years. This advantage is due to its aggressive programs with equipment suppliers to increase productivity and improve performance, which Intel has struggled to keep up with. Second, TSMC has had a technological edge since switching to FinFET technology around 2011-2012, while Intel, on the other hand, hasn’t been able to make similar technological progress on this front. Third, TSMC has always been able to manage and implement new process technologies efficiently in the past, while Intel has struggled to replicate this efficiency, especially in the US.

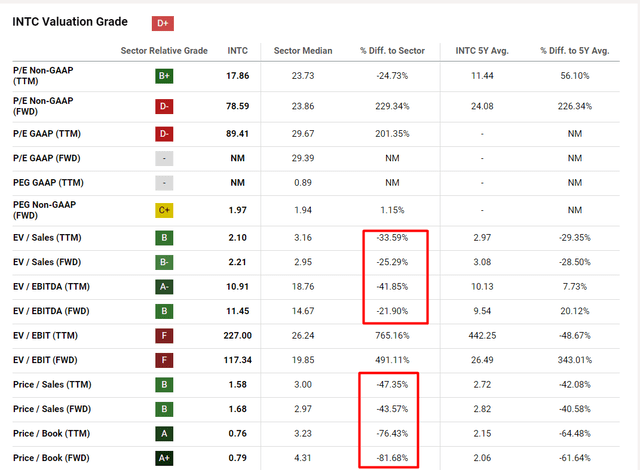

So one of the few relative strengths of INTC stock is still its discounted valuation: while most other semiconductor stocks maintain their valuation premiums that allow their stock prices to keep going higher as the financials expand, Intel’s valuation profile is becoming increasingly attractive (at least at first glance):

Seeking Alpha, INTC’s Valuation, the author’s notes added

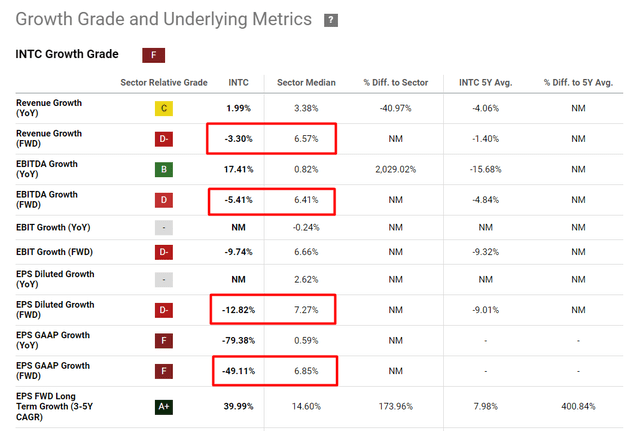

Why do I write “at first glance”? Firstly, the GAAP forward P/E of 89x doesn’t look attractive at all, and the FWD growth rates don’t bode well, which fully justifies the presence of a discount in the valuation:

Seeking Alpha, INTC’s Growth, the author’s notes added

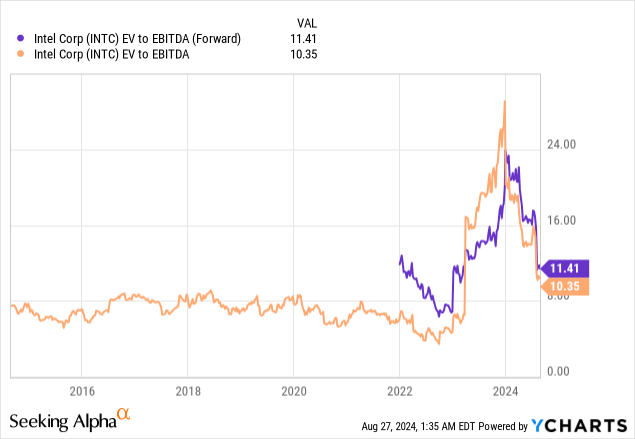

Moreover, after a sharp increase in INTC’s valuation in 2023, the stock has still not reached its historically normal EV/EBITDA levels, which should be in the range of 7-8x and not 11.4x as today:

The Bottom Line

From all of the above, I conclude that my previous “Buy” rating needs to be revised downwards. It looks like Intel still has a long road to recovery ahead of it and will have to work very hard to restore market confidence in the company’s future. However, the CEO continues to buy the dips even though his consolidated purchase price appears to be very deep underwater:

Bloomberg, shared by @OKavrak on X

Maybe he knows something we don’t?

I can’t answer that. But I think it’s only worth trying to buy any dip in the stock if we can really see or predict with some degree of certainty when the business will turn around. In Intel’s case, despite its obvious undervaluation by many criteria, I see no end to the headwinds the company is experiencing. Perhaps INTC’s new products in 2025 will radically change the current picture – then I’ll be happy to upgrade the stock back to “Buy”. But not yet.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!