Summary:

- Intel continues to lag behind some competitors in crucial businesses like data center AI, GPUs, machine learning, and more.

- With newer, more powerful data centers Nvidia is gaining significant market share due to its advanced CPU, generative AI, and machine learning capabilities.

- Unfortunately, Intel’s more powerful data center chips will be out in 2025 and could be much less capable than Nvidia’s offerings by then.

- There’s a high probability Intel could underperform in future years, and the company doesn’t deserve to trade at a premium multiple.

- Intel’s stock is a sell at or above $30, should decline due to multiple compression and lower EPS, and likely has minimal upside potential in the coming years.

da-kuk

Intel (NASDAQ:INTC) has powered the data centers for years. Unfortunately, these were the data centers of the past. Today’s increasingly complex server systems are running on generative AI Nvidia (NVDA) GPUs. Intel uses its CPUs, which is a lagging business.

Instead of simply retrieving data, companies can generate most of the data using AI. Nvidia is the leader in the growing AI data center space, which requires its high-powered GPUs to function correctly. Despite a challenging economy, Nvidia’s data center sales increased by 14% YoY last quarter, while Intel’s dropped by a staggering 38% in its last quarter. Moreover, Intel lost a record 66 cents per share “GAAP.”

Intel promises the Falcon Shores AI data center chip in 2025. However, by then, Intel will likely continue to lag behind AI industry leaders like Nvidia, AMD (AMD), Alphabet (GOOG) (GOOGL), Microsoft (MSFT), and others. Moreover, Nvidia is well ahead of Intel in machine learning, and AMD’s competitiveness will likely persist. Intel will likely face significant growth difficulties and profitability problems as the company advances in the coming years.

Current consensus EPS projections imply Intel will grow revenues at low double digits, increasing EPS by around 30% YoY through 2027. Provided the intense competition, Intel’s continuous delays and blunders, decreasing market share, worsening profitability, and other factors, Intel’s revenues may only grow by about 5% YoY, and the company could have minimal EPS of 10% or fewer as it advances through this remarkably challenging period. Intel’s stock could be trading around 30 times forward EPS estimates, providing little upside potential and a significant probability for more downside in the coming months. Therefore, at or above $30, Intel is a sell.

Intel’s Last Quarter – Simply Awful

While Intel “beat” its estimates, its revenues declined by a staggering 36% YoY to only $11.72B in Q1. The colossal disappointment came from Intel’s data center and AI business, which showed revenues shrink by 38% YoY to just $3.72B. On the other hand, Nvidia’s data center and AI segment revenues are exploding, coming in at $4.28B last quarter (a 14% YoY gain). Nvidia also guided to a more than 50%-plus revenue increase over the consensus estimate, illustrating its AI-capable data center segment should continue expanding rapidly in the coming quarters and years.

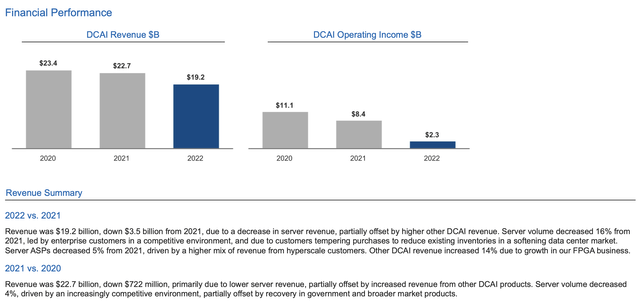

DCAI revenues (intc.com)

We see Intel’s data center/AI revenues falling off a cliff recently, and the unit’s operating income is barely in the black. Therefore, we could see further deterioration in this segment while Intel’s competitors pick up Intel’s lost market share. Nvidia is crushing the data center business, and Intel may need more ammunition to fire back soon. Therefore, Nvidia and other leading data center companies with significant AI capabilities should continue eating Intel’s server business, leading to further revenue declines as the company advances.

Intel’s Next Quarter – May Be Worse Than Expected

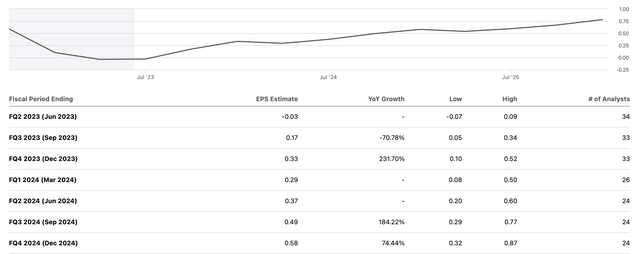

Consensus estimates are minus 3 cents for Q2 2023 and 17 cents for the third quarter. Moreover, quarterly EPS growth should remain minimal in the coming years.

EPS estimates (quarterly)

EPS estimates (SeekingAlpha.com)

Consensus estimates illustrate very modest growth in the coming quarters. Moreover, many analysts have lowered estimates, and the company’s lower-end EPS estimates amount to fewer than $1 in 2024. Intel will have a challenging time returning to prior profitability levels and may provide limited EPS growth in the coming quarters. This dynamic should lead to multiple compression and a lower stock price as we advance.

Intel vs. AMD Desktop CPUs

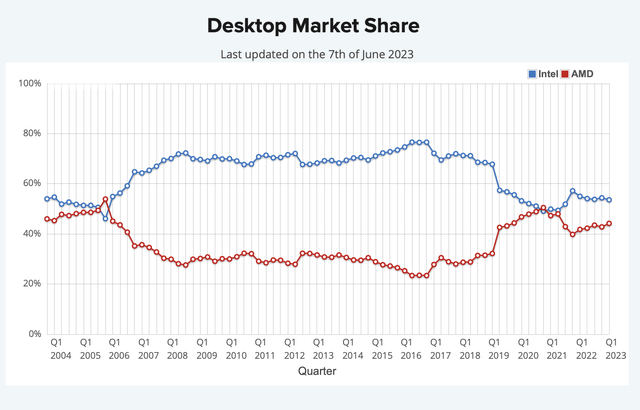

Desktop CPUs (cpubenchmark.net )

Intel used to be a tremendous market leader in desktop CPUs. However, AMD has made spectacular gains in recent years. AMD’s desktop CPU market share is up about 44%, a significant rise from the 20% benchmark several years ago. This trend of improving market share for AMD should continue as its technology gains favor over Intel. Considering all CPUs, AMDs market share is around 35% vs. Intel’s 63%. AMD also made significant improvements in the general CPU space, doubling its market share from 17.5% to 35% in the last seven years. Provided this trajectory, AMD could continue gaining market share from Intel in the critical CPU segment in future years. While Intel should have some speedier PC chips coming out in 2024, they may not be the game-changer the company needs.

The Bottom Line: Could Be A Value Trap

Just because a stock looks cheap does not make it inexpensive. Much of the valuation concerns future revenue growth and earnings growth projections. Unfortunately for Intel, we may not see much growth from the company in the next few years. I don’t expect the 30%-plus EPS growth that some analysts envision. Instead, Intel could provide modest 10%-15% EPS growth in a base-case scenario and may provide stagnant or declining earnings in a worse-case outcome.

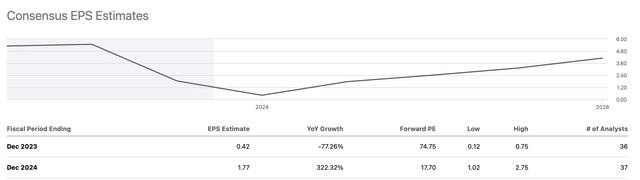

EPS – Lower Than Future Estimates

EPS estimates (SeekingAlpha.com)

Consensus estimates are for only about 42 cents this year, representing a whopping 77% EPS decline YoY. Next year, the consensus estimate is $1.77. However, due to Intel’s poor execution history, increased competition, shrinking market share, and other elements, the company’s revenues and earnings should come in lower than expected. Next year’s EPS may come in at about $1.05 (my estimate), and we may see limited EPS growth of approximately 5%-15% through 2025 and future years.

Here’s what Intel’s financials could look like in future years:

| Year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

| Revenue Bs | $50 | $52 | $55 | $57 | $59 | $62 |

| Revenue growth | -21% | 4% | 6% | 4% | 4% | 5% |

| EPS | $0.33 | $1.05 | $1.21 | $1.37 | $1.54 | $1.70 |

| EPS growth | -82% | 220% | 15% | 14% | 12% | 10% |

| Forward P/E | 30 | 15 | 14 | 13 | 14 | 13 |

| Stock price | $31 | $18 | $19 | $20 | $24 | $30 |

Source: The Financial Prophet

Why should Intel’s stock trade at a 30-times forward P/E multiple?

Even though Intel used to produce significantly higher EPS several years ago, Intel will still need to return to a similar level of profitability before seeing its stock appreciate considerably. However, returning to prior profitability could prove highly challenging due to lost market share and other factors. The company’s revenue streams are decreasing, and significant capex, R&D, and SG&A expenses are squeezing its profitability. Most importantly, Intel is losing the AI battle, which is the company’s future.

Therefore, Intel could underperform expectations in the coming years. This dynamic should lead to lower-than-expected revenue growth, worsening profitability, and a lower-than-anticipated stock price as the company advances. Moreover, there’s significant uncertainty surrounding Intel and its future revenue growth and earnings potential. Provided Intel’s limited growth prospects, its stock doesn’t deserve to trade at a premium multiple. Intel’s stock should trade closer to a “value” company valuation (12-15x EPS). Furthermore, cutting its dividend doesn’t instill confidence in Intel’s value potential. Therefore, Intel’s price could stagnate or move lower on worse-than-anticipated revenue and earnings growth coupled with multiple compression and a worsening sentiment in general.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, QCOM, TSLA, PLTR, AMZN, MTCH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!