Summary:

- Despite recent setbacks, I remain optimistic about Intel’s long-term goals, including cost reductions, manufacturing capacity increases, and strategic partnerships like the AWS AI chip deal.

- Intel’s Q2 FY2024 results were disappointing, with revenue and margins falling short, but the company’s aggressive transformation strategy could yield significant future value.

- A potential breakup of Intel could unlock substantial shareholder value, with individual segments possibly worth more than the current market cap.

- Despite risks and competition, I recommend buying INTC stock now, anticipating higher future valuations and potential strategic moves like divestitures or takeovers.

JHVEPhoto

My Thesis Update

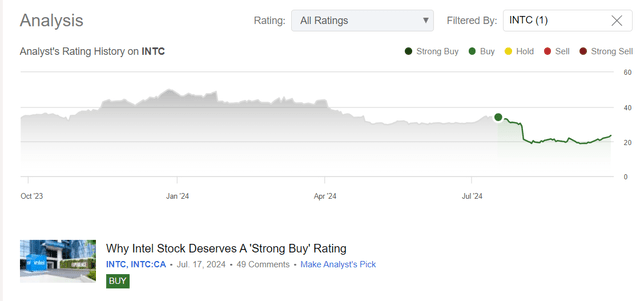

It always hurts to see bullish calls aging poorly – especially when it occurs less than a quarter from initiation, as was the case with my “Buy” rating on Intel Corporation (NASDAQ:INTC) stock:

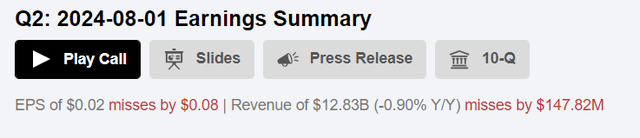

In mid-July I thought Intel’s revenue growth in key segments like CCG and DCAI was showing promising signs for future profitability, but then Q2 numbers came out and we saw a continuation of business metrics’ deterioration, as well as weak guidance (again):

Second-half trends are more challenging than we previously expected, and we are leveraging our new operating model to take decisive actions that will improve operating and capital efficiencies while accelerating our IDM 2.0 transformation.

Source: Q2 earnings press release, emphasis added by Oakoff

Nevertheless, I expect INTC stock to keep recovering in the foreseeable future – thanks to the latest news and updates about the business that I’m going to discuss below.

My Reasoning

In Q2 FY2024, Intel’s revenue was slightly down to $12.83 billion (-0.9% YoY), below the midpoint of management’s guidance and way below the Wall Street consensus. Non-GAAP gross margin was 38.7%, down big from last quarter and a year ago due to “increased cost pressures”, making the operating margin also sharply down on a QoQ and YoY basis. The company’s ongoing efforts to maintain profitability in the face of competition and structural change haven’t yet led to success as far as I see it. As a result, INTC’s non-GAAP EPS was only $0.02 compared to the forecast of $0.10, which reflects the financial challenges Intel faced in its transformation strategy.

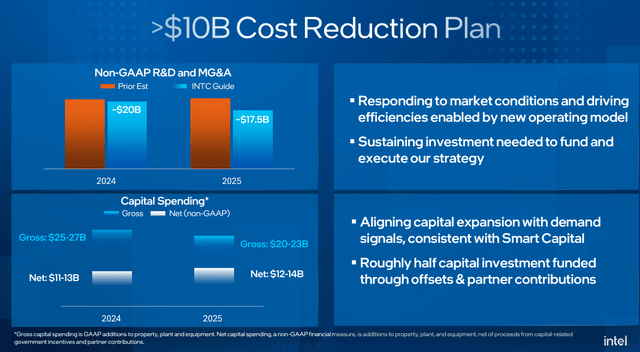

Nevertheless, Intel’s key long-term goals remain intact, such as increasing manufacturing capacity and improving the traction in the high-margin markets for AI and data centers. The company has announced a comprehensive $10 billion cost-reduction plan, which represents the largest reduction in Intel’s headcount since the massive layoffs during the dot-com bust in 2000, and shuts down unprofitable factories to improve efficiency and competitiveness.

In addition to cost control efforts, Intel is seemingly attempting other strategic moves, such as its plan to separate its foundry business and its deal on a multibillion-dollar, multi-year partnership with Amazon’s (AMZN) AWS to produce specialized AI chips, which illustrate its willingness to reposition itself for the future of the industry, relying on shifting manufacturing towards foundries rather than producing its own chips. The AWS collaboration could encourage Intel to convert its production facilities to EUV earlier, which could enable the company to win more orders and equip these foundries with the machinery to make powerful chips.

But all this comes with some huge upfront costs, which will take some time to recoup, so Intel’s aggressive strategy signaled that it could suffer through more quarters with a low or no profit as it was supposed to invest heavily in its future – hence the dip of over 25% on the Q2 earnings release.

It seems to me that the only thing the company should do in its current situation is to divest its businesses. This would theoretically free up a lot of value for the company’s shareholders, in my opinion. If management decides to make this move, INTC will easily find a demand for its parts – Qualcomm (QCOM) can take the design business it may be interested in, and Apollo Global Management (APO) can make a bid for the foundry business. Who knows? In any case, rumors (and not just rumors, but in some cases full-fledged news) in the market claim that both companies are interested in Intel’s assets. I’m just speculating here, but I hope you get the point.

As another Seeking Alpha analyst Michael Del Monte calculated in his SOTP analysis, if broken up, Intel’s business may be worth close to $722 billion in equity value.

Averaging out each segment’s closest competitors’ valuation multiples and applying them to Intel’s respective segment, we can come up with a general value for each individual component of Intel. Looking at the numbers, each value appears to be inflated relative to Intel’s current market cap of $96.5b. In all honesty, these figures threw me off given that each component has the ability to provide significantly more value as a standalone company as opposed to the conglomerate. In terms of individual market caps and valuations, these figures work out.

Of course, this is likely an optimistic view, assuming a final decision by Intel’s management and shareholders. But putting myself in the shoes of the company and looking at the overall competition in the addressable markets, I think a split is the only right move that can save individual segments from falling behind the trend. I expect to hear confirmation of my expectations (further comments or notes) in the coming months – then I’m sure the market will have no choice but to revalue the stock. Of course, I’m not expecting $720 billion – the implied value is likely to be way lower. Theoretically, however, it should be significantly higher than the current market capitalization of ~$100 billion.

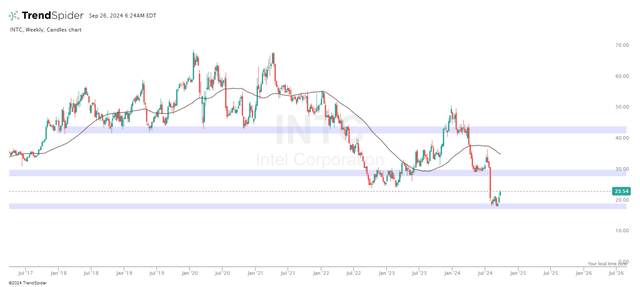

From a technical analysis point of view, INTC still seems to be trending downwards on the weekly chart and looks pretty ugly overall. On the other hand, the current recovery from $18.5 – $20 per share coincides with very strong support levels already formed in 2015-2016.

TrendSpider Software, INTC weekly, Oakoff’s notes added

The daily chart shows a much more bullish picture. Traders were obviously pleased with the news of a possible takeover and the interest from Apollo, so that INTC stock formed a clear “double bottom” with its recent price action, breaking out of a downward structure. In my opinion, the 200-day moving average is far too high for the current mean reversion to end right here.

TrendSpider Software, INTC weekly, Oakoff’s notes added

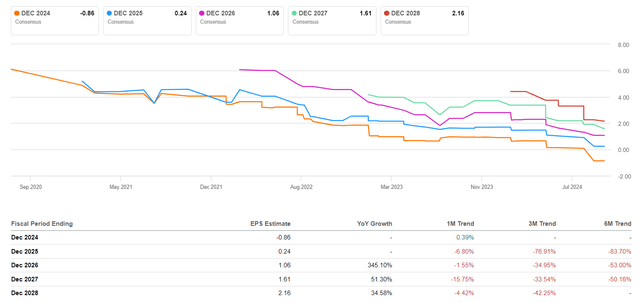

Returning to the company’s fundamental indicators, I note that a big negative for INTC is the declining earnings revisions grade (not a single Wall Street analyst has revised earnings expectations upwards for the past quarter):

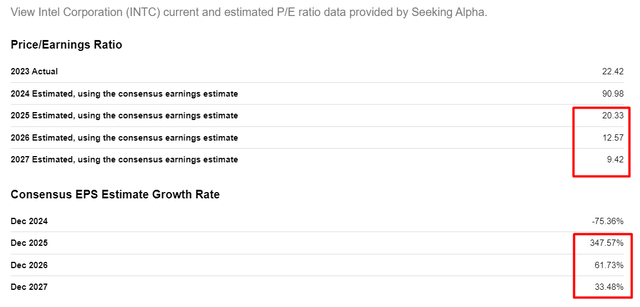

However, even against this gloomy backdrop, the company’s valuation based on TTM multiples alone appears too high – FY2025 and FY2026 price-to-earnings ratios are likely to fall significantly even after massive cuts to earnings estimates, making the stock look far more favorable than before the post-Q2 slump.

Seeking Alpha, INTC, notes added

For this reason, I still believe that INTC deserves to be averaged down into today – the value that can be unlocked over the next few years is likely to be enormous in my opinion.

Risks To My Thesis

Of course, there are a lot of risks associated with my today’s thesis update.

Although essential for regaining lost momentum, the headcount reduction planned by the management could raise operational risks and lengthen product development cycles for Intel, increasing the risk of losing market share as this has been the company’s core strength to reach the pinnacle in the industry.

Also, we can’t ignore the company’s internal weakness. As Argus Research analysts noted in their recent report (proprietary source), Intel’s Data Center business faces pressure from all sides as the company races to catch up in AI, and the client business faces pressure from Advanced Micro Devices (AMD) and others. Overall, across a number of its addressable markets, INTC is losing to competition. So unless we hear news that the company itself is ready for a split (which I hope and expect), then the stock is likely to fall further.

It should be noted that my predictions based on technical analysis are one of the most unreliable parts of my thesis. Based on subjective judgments, the conclusions of my technicals may be misleading and the outcome of INTC trading can be diametrically opposed to my calculations and “drawings”.

Your Takeaway

Despite the many risks that have actually increased since my last thesis (due to the ugly Q2 and management comments), I do not think INTC stock will fall much lower than its current levels. The events that quickly filled the media field – primarily, I am talking about potential deals with QCOM and Apollo – have breathed hope back into INTC stock. I hope that management does not let this hope fade away and that we’ll hear concrete offers to buy INTC as a whole or to split it into parts in the foreseeable future. In either case, I believe investors will likely receive more value than the company is worth today. For this reason, I recommend buying INTC and possibly averaging down here.

Good luck with your investments!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.