Summary:

- Intel Corporation stock is too cheap for longer-term investors to ignore.

- Intel is undervalued and trading significantly below the peer group average with a market cap of roughly $93B and the stock down 55% YTD.

- While there remain no near-term catalysts at play for Intel’s Client PC, which accounts for the bulk of sales, we see green shoots for a PC TAM recovery in 2025.

- We think the AI PC moment should boost ASP, helping Intel’s top line towards the end of 2025.

- There is also a longer-term potential for the foundry business to become a secondary source after TSMC, along with CHIPS Act funding.

Jeff Rotman/DigitalVision via Getty Images

Intel Corporation (NASDAQ:INTC), down 55% YTD, is center-stage after last week’s news of closing Amazon.com, Inc.’s (AMZN) AWS as a customer for the foundry business and QUALCOMM Incorporated’s (QCOM) potential takeover. In addition, there is the news that broke out Monday about Apollo’s potential $5B investment in the company. Our latest note on INTC explains our take on the potential takeover, while this one aims to share our company-specific analysis.

INTC seems to be the underdog in the semi-industry currently, despite its over five-decade legacy of building up the industry. While the valuation looks so bad today, we don’t think INTC should be valued at this price for its midterm position in the PC Client market and longer-term position in the foundry business. Hence, we think the company is cheap, and its market cap can expand from here. We remain buy-rated on INTC for longer-term investors; we don’t see any near-term catalysts for top-line recovery, but we think the PC total addressable market, or TAM, can expand next year with Microsoft Windows End of Life and AI PC moment that should push ASP north.

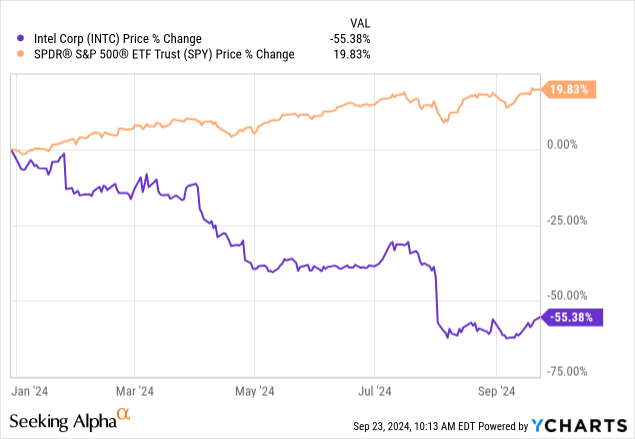

A lot of the bad news on INTC has also been priced into the stock and outlook; INTC stock is down ~55% since the start of the year, underperforming the S&P 500 by a whopping 75%. This is after the stock experienced a mini-rally on the AWS foundry news, as well as the attention from QCOM’s takeover interest and Apollo’s multi-billion dollar investment, before which INTC was down over 60% YTD. The latest sell-off was in reaction to INTC’s 2Q24 results and outlook; in a single quarter, the company reported:

- Worst-than-expected results with revenue down 1% Q/Q to $12.83B versus consensus at $12.94B,

- Softer guidance for Q3, forecasting sales to grow 1% Q/Q to the range of $12.5B to $13.5B, worse than the usual seasonality for Q3 and significantly trailing consensus at $14.4B,

- Layoffs of over 15% of its employees under the umbrella of its $10B cost-reduction plan, and

- Non-GAAP gross margin decline of 640 basis points Q/Q to 38.7% from 43.5% last quarter.

With all this in mind, it doesn’t seem surprising that the stock dipped ~35% between August 1st (after earnings) and August 7th (where the stock hovered the bottom). This tells us that investor confidence in INTC for 2H24 is weak, to say the least, but it confirms that a lot of the weakness has been priced into the stock, but there remain longer-term tailwinds intact.

YCharts

Laying out the negatives and proposing the longer-term positives

INTC’s main mid- to long-term tailwind is its Client Computing Group, but it’s also been a major weight to its top line over the past few quarters, reaching a low of $5.77B in sales during 1Q23. This quarter, 2Q24, Client sales declined 2% Q/Q but grew 9% Y/Y to $7.4B, impacted by weaker seasonal demand. It seems like the negative is spilling into 2HFY24, with management forecasting PC Client sales to be flat to down sequentially in Q3. INTC is experiencing such a drag on its PC Client sales despite the competed inventory correction cycle due to the continued slowdown in China demand.

There are no near-term catalysts to boost PC sale recovery in 2H24 or 1H25; however, the PC TAM must expand at some time next year, in our opinion, due to a couple of factors. The macro backdrop is one now that we’ve entered the rate cut period, as the cuts should enable economic expansion and, in turn, the tight belt around enterprise spend (and consumer discretionary spending, for that matter) should ease. This means seeing a reversal from the post-pandemic wave of layoffs to hiring. The economic expansion that should follow in the six months following the start of rate cuts should allow for an upgrade cycle on PCs with more hiring in 2H25. Keep in mind that INTC continues to dominate the client PC market as of 2Q24 with a 78.9% share compared to AMD with a 21.1% share.

So because of its position, it’s more likely that Intel will enjoy tailwinds from Microsoft Windows End of Life or EOL, which takes place in October 2025, and help trigger a PC refresh cycle alongside a better macro backdrop. Additionally, we’re still waiting for AI PC moment to arrive, and we anticipate it will be a 2025 event, which should also work in INTC’s favor. AI PC will be beneficial to Intel’s top line because it’ll allow for an AI price tag, i.e., a higher ASP.

The next big thing for INTC is Intel Foundry Service, which is gaining a lot of attention from government funding through the CHIPS Act and the recent announcement that INTC’s foundry business would make custom chips for Amazon. The foundry business is far from a unit that can stand alone and requires a high capex to compete with rival Taiwan Semiconductor Manufacturing Company Limited (TSM) on the advanced end; these are reasons we don’t expect the QCOM takeover talks to lead anywhere.

However, considering these factors doesn’t mean the foundry business is dead-ended; it just needs time. Foundry business sales stabilized in Q2, reporting a 1% Q/Q to $4.32B. We think INTC’s foundry business is still in its early innings but could become a secondary foundry player while TSMC still dominates first place; we’d place INTC somewhere between TSMC and GlobalFoundries Inc. (GFS) in terms of its foundry business, which is a positive for the longer-run.

Some lingering risk

There could be more downside risk for INTC on its server front, i.e., its Data Center & AI Group, which reported flat sequential growth in Q2 and a 3% Y/Y decline to $3B in sales. The reason is that AI server spend is cannibalizing compute or traditional server spend; meaning customers’ capex dollars spend is favoring AI-related investment (just check out Meta, Microsoft, or Google’s management commentary on capex spend – it all ties back to AI or AI infrastructure). This means that INTC has no real presence in the AI GPU market and can’t compete with NVIDIA Corporation (NVDA), and its CPU unit sales are now at risk. Our expectation is that INTC can still be in the game on the CPU front because you’ll always need a CPU, but then it’ll come down to whether it can offer a better product than Arm Holdings plc (ARM).

Valuation & Word on Wall Street

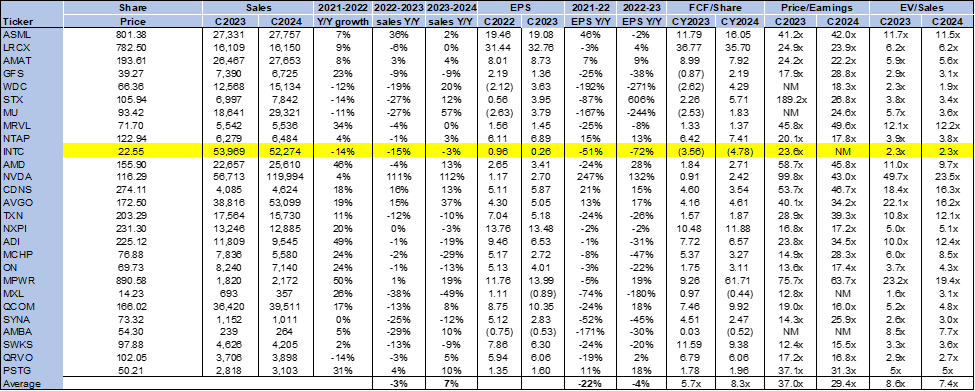

INTC isn’t fairly valued; in our opinion, the stock is undervalued at its current price. The stock is trading at an EV/Sales ratio of 2.3x C2024 compared to a peer group average of 7.4x and down from a ratio of 3.5x when we last covered the stock in early September 2023. INTC currently has a market cap of roughly $93 compared to QCOM at around $188B or Advanced Micro Devices at $253.70B. We think investors would rather not own the stock in the near term, which is understandable considering the lack of near-term catalysts and the potential downside risk. But, INTC will exist as long as the PC market does, and so we think there will be a rebound moment, eyeing into 2H25.

We also think INTC’s over $10B cost reduction plan, while painful in the near term, will help better the company’s financial performance, with CEO Pat Gelsinger emphasizing, “We must continue acting with urgency to create a more competitive cost structure and deliver the $10B in savings” in his messages to employees last week.

The following chart outlines INTC’s valuation against the peer group.

TechStockPros

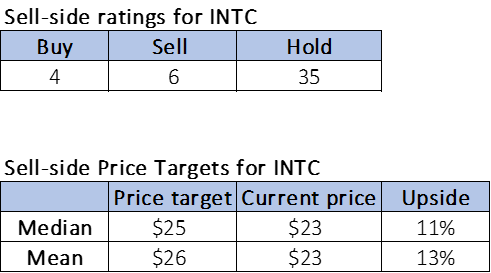

Wall Street is much more cautious about the stock than last September; of the 45 analysts covering the stock, four are buy-rated, 35 are hold-rated and six are sell-rated. This bearish shift is not a bad thing for longer-term investors; it means that the market is underestimating the company’s long-term potential. The sell-side price targets are better than they were last year, but only due to the sharp pullback YTD. The stock is priced at $23 per share with a median price target of $25 and a mean of $26 for an 11-13% potential upside. We think investors shouldn’t get too caught up with price targets for the near to midterm and focus on the longer-term market cap expansion for INTC. Part of our buy and sit-on-it sentiment for INTC has to do with our belief that INTC’s market cap will go up from here as PC TAM expands and foundry business kicks off.

The following outlines Wall Street’s sentiment on the stock.

TechStockPros

What to do with the stock

There’s a lot of buzz around what’s next for the chipmaker; we think the next chapter for INTC won’t include a takeover by QCOM for a couple of reasons we discuss in “Asking Doesn’t Mean Buying – News Of Qualcomm Potential Takeover Of Intel” and we also think the company has no near-term catalysts working in its favor. Having said this, INTC is cheaper than it should be. The company continues to enjoy a dominant position in the Client PC market and has a longer-term foundry business with government funding. We think INTC should be on the radar for longer-term investors at current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Tired of losing money? Our Tech Contrarians team of Wall Street analysts sifts through the noise in the tech industry and captures outperformers through a coveted research process. We let the work speak for itself here.