Summary:

- It just so happened that Intel’s management had to scale back its expectations after the Q1 2024 results – which of course confirmed Intel’s status as a “laggard” for many.

- Despite missing expectations regarding future guidance, overall, we can’t say that Q1 results were that terrible.

- I believe Gaudi 3 may have a competitive advantage in the long run, especially for enterprise AI applications where efficiency and cost-effectiveness are critical.

- Intel aims to become the second-largest external foundry company by 2030, driven by AI opportunities and a strong pipeline of 20A and 18A-based products.

- I’d not write Intel off prematurely. My DCF model in different scenarios shows an undervaluation of about 18%, which is quite a lot and deserves an upgrade to ‘Buy’.

JHVEPhoto

Introduction

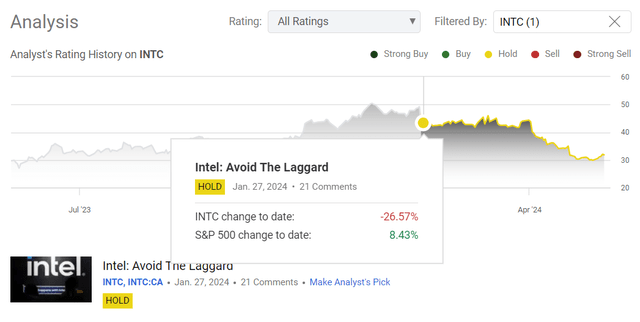

I initiated coverage of Intel Corporation (NASDAQ:INTC) stock back in late January 2024, when the stock was trading at $43.71. My thesis was simple: investors should continue to avoid the obvious laggard because at the time it seemed to me that Intel was just talking about its plans while other companies like NVIDIA Corporation (NVDA) or Advanced Micro Devices, Inc. (AMD) were simply doing their jobs and continuing to capture market share. It just so happened that Intel’s management had to scale back its expectations after the Q1 2024 results – which of course confirmed Intel’s status as a “laggard” for many market participants, and Intel stock fell by more than 26% from the publication price of my “neutral” call:

Seeking Alpha, my coverage of INTC stock

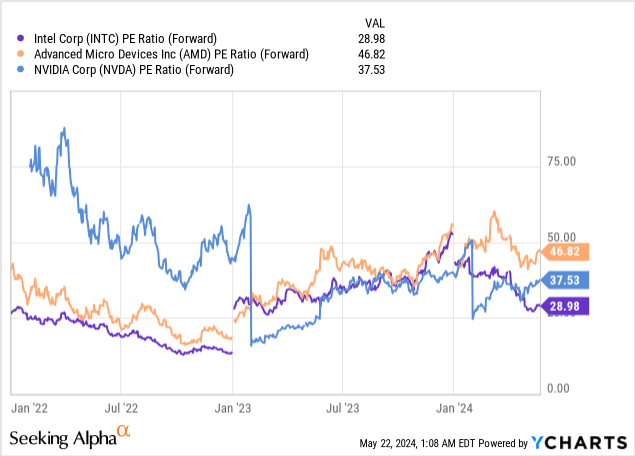

But is the market really fair to Intel today when the stock is down more than 36% YTD while NVDA and AMD are both up 91% and 13% respectively, over the same period? I suggest looking into this topic in more detail.

Q1 FY2024 Financials And Developments

In 1Q FY2024, Intel reported $12.7 billion in revenue (+9% YoY), which was a 17% sequential decline from 4Q FY2023. This figure met the midpoint of management’s guidance range but fell short of the $12.78 billion consensus estimate. Non-GAAP net earnings were $0.18 per share, compared to a loss of $0.04 a year earlier, beating both management’s and consensus forecasts of $0.13 per share:

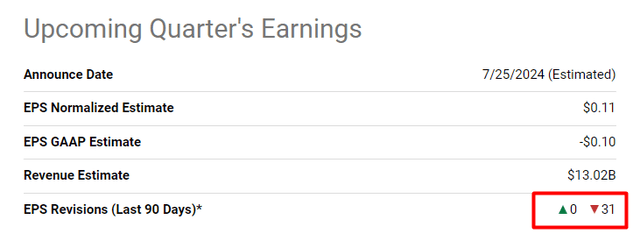

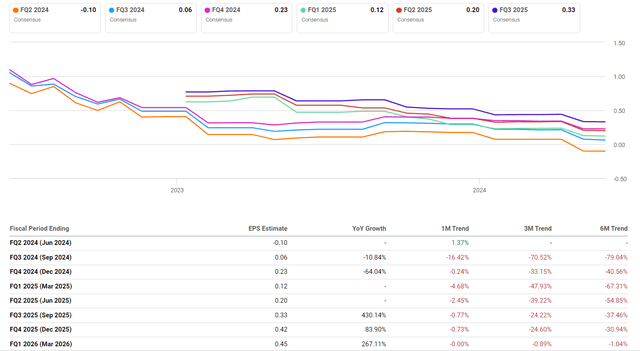

Overall, we can’t say that Q1 results were terrible. But what the market clearly didn’t like was Intel missing its quarterly revenue guidance for the 2nd consecutive quarter (largely due to losses in foundry operations and skepticism about its AI efforts). In addition, the company’s guidance for the second quarter did not meet Wall Street estimates, resulting in a flurry of negative revisions to second-quarter EPS estimates:

Seeking Alpha, the author’s notes

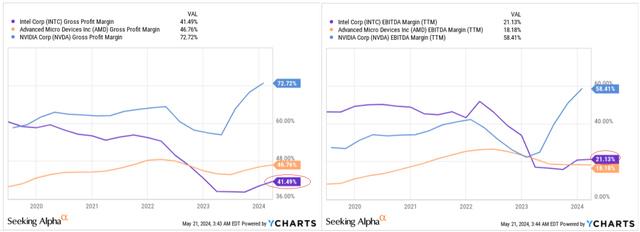

During the earnings call, CEO Pat Gelsinger highlighted “successful expense management and steady progress on long-term priorities.” However, one worrying fact remains: Intel has yet to make a significant impact on its financials based on the booming AI trend. Despite all its efforts, Intel’s gross profit margin lags behind those of its direct competitors – AMD and NVIDIA – which continue to operate more efficiently from what I can see today:

Although Intel’s EBITDA margin is slightly ahead of AMD’s currently, it’s more cyclical, as shown in the chart above. This introduces additional risk, making forecasting more challenging and resulting in a discount on the stock’s valuation.

However, past results are not always a good indicator of the future. Especially when it comes to cyclical industries such as semiconductors for PCs or other end markets. On the earnings call, Intel said it expects 1Q 2024 to be the cycle bottom, with sequential revenue growth strengthening through 2025. The key growth drivers should include an enterprise refresh cycle, AI PCs, data center recovery, and cyclical recovery in Altera, Mobileye, and NEX businesses.

We continue to see Q1 as the bottom and we expect sequential revenue growth to strengthen throughout the year and into 2025, underpinned by, one, the beginnings of an enterprise refresh cycle and growing momentum for AIPCs.

Among the latest significant corporate events, we can note Intel’s first Intel Foundry Direct Connect event that attracted 300 partners and customers, with Microsoft Corporation (MSFT) becoming its 5th customer for the 18A process node (due in 2025). Intel also introduced the 14A process node (15% higher performance per watt vs. 18A), utilizing High NA EUV technology, and launched its next-generation Gaudi 3 accelerator. In mid-April, Forbes wrote that the company’s internal tests showed that Gaudi 3 Llama 2 (13B parameters) trains up to 1.7 times faster than Nvidia’s H100 and GPT-3 (175B parameters) up to 1.4 times faster. The inference speeds also sound impressive: Llama2 7B is 1.1 times faster and Llama2 70B is up to 1.7 times faster than Nvidia’s offerings. Particularly noteworthy is the Falcon 180B model, which is up to 4 times faster. Of course, these results are information from ‘internal company tests’ – what company is going to publicly criticize its own developments? But even if all that is half-true, I believe Gaudi 3 may have a competitive advantage in the long run, especially for enterprise AI applications where efficiency and cost-effectiveness are critical. So Intel may not be efficient in terms of financials yet, but it’s still too big and significant a player in the market to ignore its potential to influence the market at this stage.

Intel aims to become the second-largest external foundry company by 2030, driven by AI opportunities and a strong pipeline of 20A and 18A-based products. The company also restated its segments, now revealing foundry revenue and profit/loss separately and disaggregating Altera from the Data Center unit. The company is also aggressively expanding its global fabrication facilities, with significant investments in Israel, Ohio, and Arizona, partly funded by government grants and the CHIPS Act. All of this could have a fairly positive impact on margins in the foreseeable future, in my view.

All of what we’re doing in terms of re-segmenting the business is to drive better decision-making, that better decision-making will translate into significant cost improvements for us, which should also be a meaningful driver for gross margins over time as well. And, of course, as Pat mentioned, we were happy to get the CHIPS announcement out. And, of course, that coupled with what we expect from the EU and the investment tax credit will also be major tailwinds on gross margins over a long-term basis.

Source: David Zinsner (Intel’s CFO)

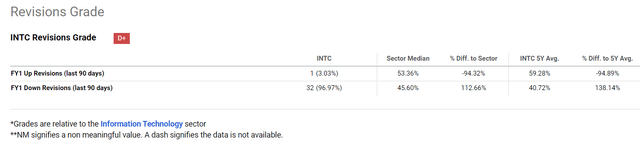

According to David Zinsner, this year was initially going to be a year of high start-up costs for the company (more noticeable in Q2 than Q1). That has put a little bit of pressure on gross margins. But as revenues increase, they are likely to come through nicely in Q3 and Q4, which should lift gross margins from their current levels. That is, to summarize the COF and the entire narrative that ran through all of management’s comments on the earnings call, investors should expect more positive margin data in 2H 2024 than in 1H. However, the market remains in a kind of after-shock mood after lowering expectations for Q2 and continuing to massively revise EPS estimates downwards for the coming quarters:

Seeking Alpha, INTC Seeking Alpha, INTC

I think these expectations look like an overreaction. Why?

In the last 2 quarters of FY2024, Intel is going to earn a total of $0.81 in EPS, according to Seeking Alpha’s consensus data – that’s only 15.7% more than in the second half of 2023. The same consensus data tells us that INTC’s sales in H2 FY2024 should exceed $30 billion – almost 4.55% higher than last year. Since we know gross margins should come higher, I think INTC’s operating leverage should theoretically provide a stronger boost than currently expected.

For this reason, I expect the recent multiple pessimistic EPS revisions to be too pessimistic in the medium term. The pressure on the stock today is disproportionately greater than that on its direct competitors – of course, there’s a reason for this, but to write off one of the flagships of the semiconductor industry is an unwise idea in my view.

But how do my above words match with Intel’s valuation? It’s time for an update.

Intel Stock’s Valuation Update

In my previous article, I looked at valuation using multiples. In view of the recent significant fall in the stock price, I now propose to examine the fair value of the company using DCF modeling – this approach is intended to assess whether the extent of the sell-off was really justified.

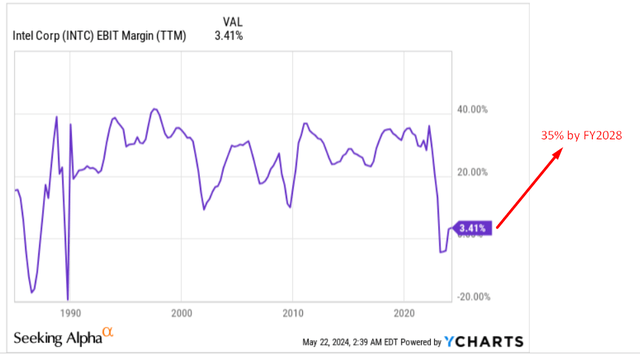

In many ways, the valuation of Intel should take into account its cyclical specifics. If I look at the long-term indicators for the EBIT margin over time, it becomes clear in which direction and up to what approximate limit Intel’s margin expansion can take place in the coming years. My expectation is shown in the following chart:

I overlooked mentioning revenue. My suggestion is to rely on consensus forecasts, as they draw from the extensive experience of Wall Street analysts who closely track the sector on a daily basis, offering a better chance than mine at accurately predicting trends in EPS and revenues. An important note here: I will not use the 22% sales growth forecast for the 2028 financial year, as this consensus comes from the forecast of only one analyst, which is probably not representative. Therefore, I will take the FY2027 forecast (8.48%) and reduce the growth rate to 7%

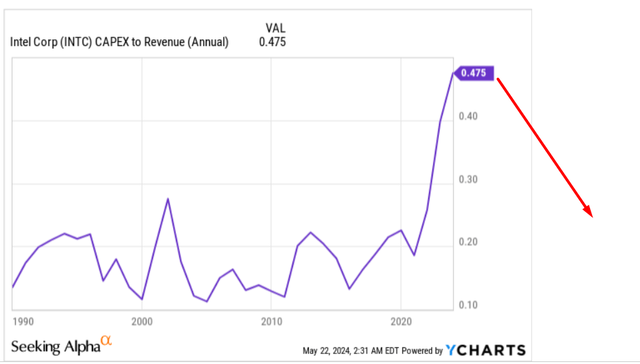

Assuming almost constant depreciation as a percentage of sales in the next forecast years, I still see the possibility for INTC to reduce CAPEX as a percentage of sales (at least to 0.25 by FY2028) – this is also due to the cyclical nature of the business. As investments are starting to pay off and new investment cycles no longer require the same volume of money injections for projects, Intel’s revenue growth should make this forecast very likely.

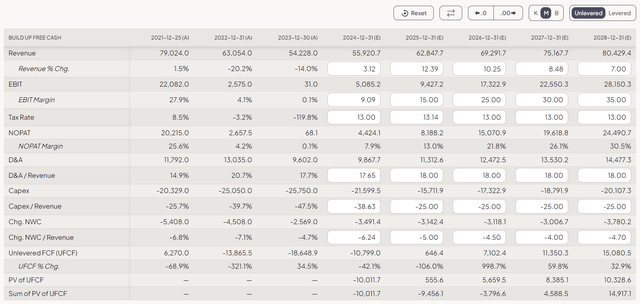

So, here is what my free cash flows to firm (FCFF) forecast looks like at this stage:

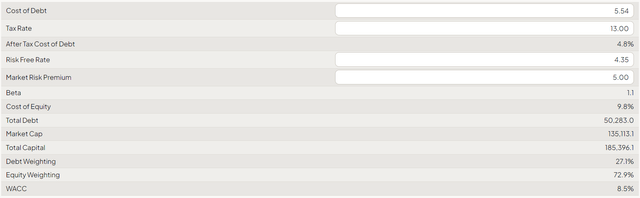

I estimate that INTC’s cost of debt is in the region of ~5.54% – that’s the yield-to-maturity of its liquid corporate bonds. Assuming a risk-free rate of 4.35% and a market risk premium of 5%, this gives a WACC of 7.9%. That looks like a low figure, but that is thanks to Intel’s capital structure.

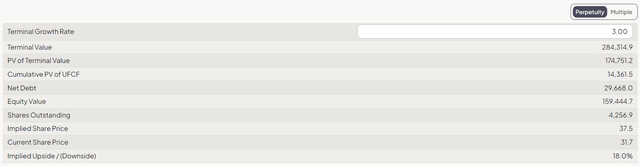

If FCFF rises by only 3% in perpetuity, this results in a fair value per share of around $37.5, which is around 18% above the current share price.

So I believe my DCF model clearly shows that INTC is not only oversold today but also undervalued.

Risks To Consider

I think the key risk for Intel lies in the competitiveness of its peer AMD, which has gained significant CPU market share in both the PC and data center segments. If Intel fails to maintain its dominance in the CPU market, it will be difficult to regain market hope. Despite Intel laying out its plans for multiple product strategies since the start of 2023, investors should still approach these announcements with caution, even though they offer clear milestones for assessing the company’s future performance. As I wrote in my previous article, the company must actually prove that it deserves to be among the industry leaders and that it is really ready to move with the times (and not just tell everyone about it).

Moreover, Intel, like other chipmakers, faces the risk of a potential economic downturn, which could lead to lower demand for semiconductors, inventory buildup, and cyclical order declines. Today’s structural difficulties in end markets such as PCs are already exerting strong pressure on INTC – if the cycle does not reverse as expected, we will most likely see a further decline in the stock price.

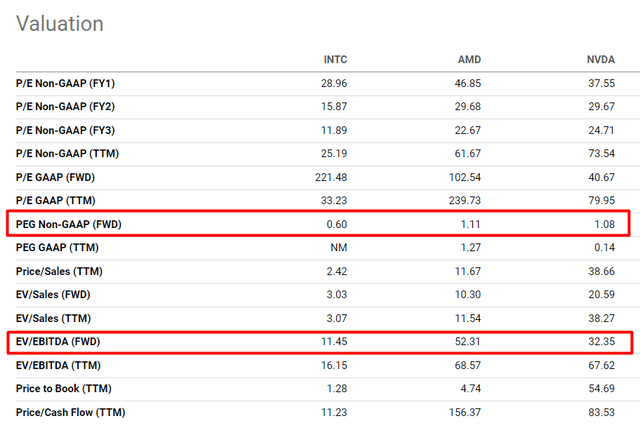

Another risk is the valuation of the company. I wrote above that it is undervalued intrinsically, but this conclusion can be challenged if we look at how EV/EBITDA has changed in recent weeks:

TrendSpider Software, INTC stock, the author’s notes

Based on the dynamics of EV/EBITDA, we can see that the multiple has risen significantly in recent weeks despite the fall in the stock price. This means that, in fact, the actual EBITDA on a TTM basis became disproportionately smaller compared to the enterprise value after its decline – as a result, the multiple increased despite the stock price’s dip. So this way the downward movement of INTC can be more than explained by the latest fundamental data. However, we’re discussing TTM data, not forward data. In my opinion, the future plays a much more crucial role in determining the fair value today. Comparing Intel’s forecasted EV/EBITDA with its successful peers reveals a significant disparity of 2-3 times, which actually makes INTC look cheap indeed. Moreover, pay attention to the PEG ratio – it’s trading at a huge discount to both NVDA and AMD:

Seeking Alpha, the author’s notes

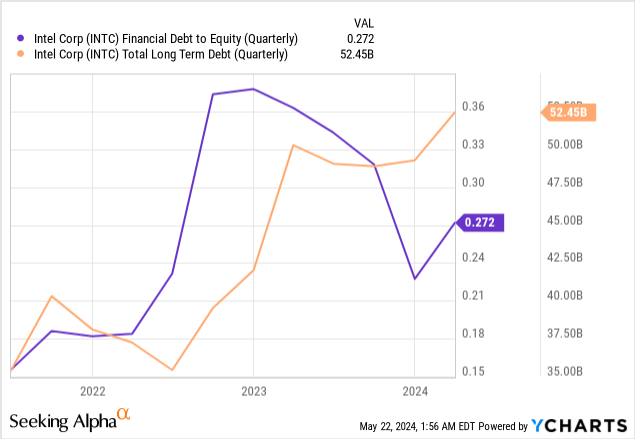

Another risk that can’t be avoided is the growing debt on the company’s balance sheet. Although the debt-to-equity ratio is still quite low, the rising debt itself is a cause for concern, in my view.

The Bottom Line

After Intel’s stock took another dive following the Q1 2024 results, it confirmed what many already suspected (myself included): Intel was lagging behind. Although Intel was able to reach the midpoint of its sales forecast, sales targets were missed for the second quarter in a row and the outlook was not exactly rosy, adding to the negative sentiment. However, I think the sharp sell-off we saw in INTC stock price was an overreaction. In reality, things are not that bad. Yes, the company is well behind its peers, but it still has projects that can provide an additional boost to sales and margins in the future. For example, Intel’s new products like the Gaudi 3 accelerator hint at a possible comeback in the AI space. Therefore, I would not write Intel off prematurely.

My DCF model in different scenarios shows an undervaluation of about 18%, which is quite a lot and deserves an upgrade to ‘Buy’.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!