Summary:

- The Company’s third-quarter earnings were poor due to ongoing restructuring, but the market’s muted reaction suggests optimism for future improvements.

- Intel Foundry’s significant losses are a major concern; divesting it could allow Intel to focus on profitable segments like Client Computing and Data Center.

- INTC’s AI accelerator Gaudi 3 and AI PC growth are promising, potentially driving future sales and profitability.

- Intel’s stock is undervalued with a favorable risk/reward ratio, and successful restructuring could lead to substantial revaluation and profit growth.

JHVEPhoto/iStock Editorial via Getty Images

Quarterly earnings for Intel Corporation (NASDAQ:INTC) last week were expectedly nasty, showing that the chip company is bogged down by an ongoing and painful restructuring.

With that said, the market did not react particularly negatively to Intel’s third quarter earnings numbers, which indicates that the market is convinced that brighter days will soon be on the horizon for the chip company.

I think that Intel will ultimately have to make a decision about selling off Intel Foundry, which had another terrible quarter in terms of operating losses. Intel’s stock, however, is dirt-cheap and has a favorable risk/reward relationship.

I also think that Intel’s positive stock price momentum is encouraging and that the stock is possibly headed for a gap close.

My Rating History

In my last piece on Intel, I pointed to the chip company’s turnaround potential related to the AI accelerator Gaudi 3, which is a lever for Intel to make up lost ground to other chip company such as Nvidia Corporation (NVDA).

Moreover, I suggested that Intel could pursue strategic measures such as a sale of Intel Foundry, which, I think, is just losing too much money.

Intel Foundry was yet again a drag on Intel’s earnings in the third quarter and, in my view, Intel might be better off concentrating exclusively on its Intel Products, which encompasses the chip company’s top three businesses.

Intel’s 3Q24 Widely Missed Profit Estimates Due To Its Ongoing Restructuring

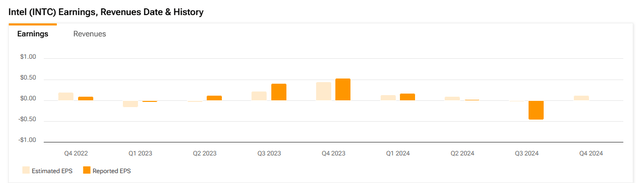

Intel’s quarterly loss in the third quarter amounted to $0.46 per share, which compared to an expected gain of $0.02 per share. It was the second consecutive quarter in which the chip company missed profit estimates by a big margin.

Earnings And Revenues (Yahoo Finance)

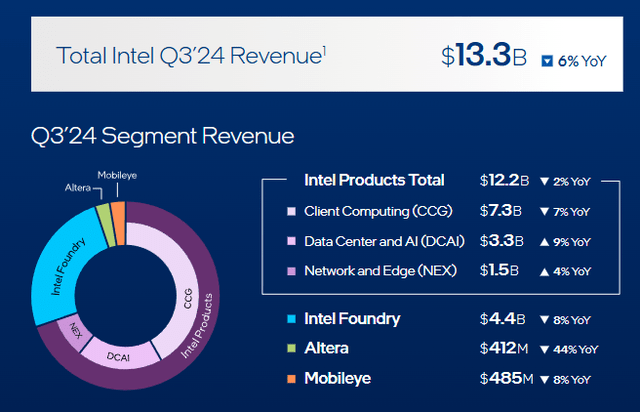

Intel produced $13.3 billion in third quarter sales, down 6% YoY. The decrease in sales was pretty much expected after the company revealed in the prior quarter a 4Q24 forecast of $12.5-13.5 billion in sales.

In 2Q24, Intel’s sales were down 1% YoY, primarily because of softer sales in Data Center and AI and Network and Edge. In the third quarter, Intel’s Data Center and AI segment roared back with 9% YoY growth and Network and Edge with 4% YoY growth.

On the flip side, Client Computer, which produces and sells processors and chipsets for desktops and laptops, saw a 7% YoY decline in revenue.

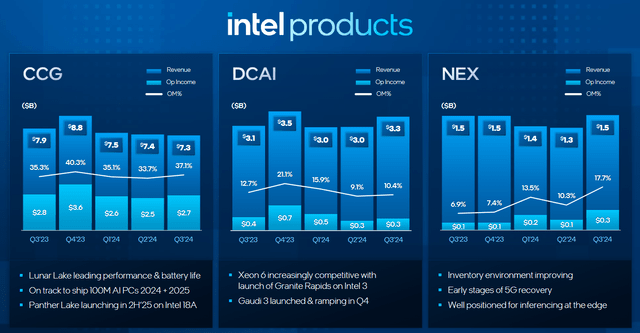

Sales for Intel Products, which encompasses Client Computing, Data Center and AI, Network and Edge decreased only 2% YoY to $12.2 billion. Client Computing also includes Intel’s new AI PC category, for which the chip company has very expectations: Intel anticipates that it could ship up to 100 million AI PCs by the end of 2025.

Growth in AI PCs, which are specifically designed to run artificial intelligence applications, could be a lever for Intel to return to growth in Client Computing.

Q3-24 Segment Revenue (Intel Corporation)

Intel Data Center and AI is another business for which investors should have high hopes. The segment is dealing primarily with data centers, as the name suggests, and providing chip solutions for the enterprise market.

The Gaudi 3 AI accelerator is the key product here that could move the needle for Intel moving forward. Sales of this chip just kicked off in 3Q24 and Intel is collaborating with IBM, for instance, to offer enterprise customers cost-effective solutions to run AI models.

Though I think the outlook for both Client Computing (due to AI PC growth) and Data Center and AI (due to Gaudi 3) is positive, the same cannot be said for Intel’s Foundry segment.

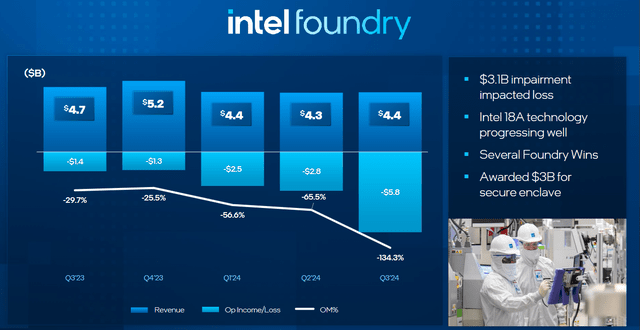

I pointed to ongoing and substantial losses in Intel Foundry in my last piece on the chip company, and the third quarter did not exactly prove me wrong.

In 3Q24, Intel Foundry produced $5.8 billion in operating losses and a negative margin of 134.3%. A negative operating profit margin in excess of 100% means that the company is losing more money than it is raking in even in terms of sales, which is obviously not a tenable situation for any company.

Intel Foundry Losses (Intel Corporation)

In the prior quarter, Intel Foundry had operating losses of $2.8 billion and a negative operating profit margin of 65.5%, so the profit situation has turned even direr here. I think that Intel may want to hire strategic advisers at this point and consider divesting Intel Foundry. Intel could primarily concentrate on its core business, which consolidates all three businesses under the ‘Intel Products’ label, and focus on consistently growing sales here.

All main businesses here are solidly profitable from an operating income angle, which Client Computing taking the lead here: This segment produced a whopping $2.7 billion in operating profits just in 3Q24.

Intel Products (Intel Corporation)

Intel Could Be Heading For A Gap Close

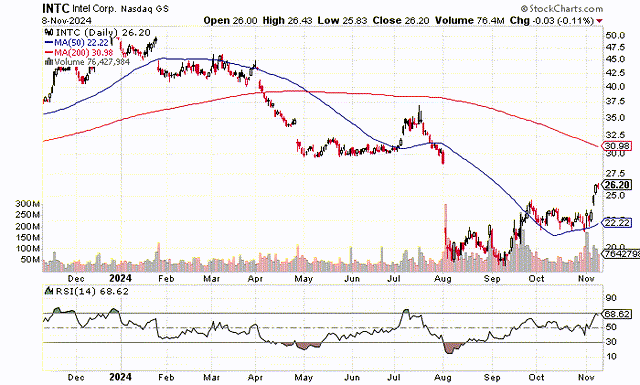

Intel shareholders have suffered enormously this year. Intel’s stock got obliterated after the company’s second quarter earnings that prepared investors for a grueling restructuring.

Intel opened up a big gap after 2Q24 earnings that has not yet been closed. But this could soon change: We have seen solid upward momentum for Intel’s stock since September, which is when Intel’s stock possibly bottomed out.

Intel also recaptured the 50-day moving average trend line, an important short-term trend indicator. In fact, I think it is entirely possible for Intel to head for a gap close ($29) in the short term, which would further solidify a bullish stock outlook.

Moving Averages (Stockcharts.com)

Intel Is Too Cheap

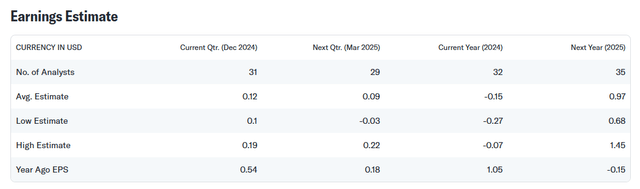

The market presently models $0.97 per share in profits for Intel for the next year. Taking into account that the chip company is anticipated to produce a loss of $0.15 per share this year thanks to its ongoing restructuring, market expectations are actually working in favor of Intel here.

Based on a present stock price of $26.20, Intel is selling for a leading profit multiple of 27x. If Intel’s restructuring is successful, however, then the chip company’s stock could revalue substantially higher.

Earnings Estimate (Yahoo Finance)

Advanced Micro Devices (AMD) is anticipated to earn $5.10 per share next year, reflecting back to us a leading profit multiple of 29.0x. Advanced Micro Devices and Intel have both missed out on upside in their data center segments due to the relatively late start of shipments of their respective H100 competitors.

In my view, Intel is poised for stronger profit growth after its restructuring, which I anticipate will be completed in the 2026. Thus, Intel could return to a position of escalating earnings strength with the scaling as its restructuring nears its completion and while Gaudi 3 AI accelerator sales start to become a substantial growth driver as well.

Why The Investment Thesis Might Be Wrong

Intel is bogged down by a painful restructuring, and investors should not be too optimistic in the near-term. I think that Intel’s best option to dig itself out of its hole is to contemplate divesting of its Foundry segment, which is by far the biggest profit drag for the company.

In terms of operating profit growth, I anticipate Foundry to remain a drag on Intel’s growth, but the outlook for Intel Products I don’t think is that bad, particularly with Gaudi 3 sales starting to scale in 4Q24.

If Intel Products sales declined again in the fourth quarter, I would certainly take a second look at my investment thesis and reevaluate Intel’s re-rating prospects.

My Conclusion

Intel’s third quarter earnings were nasty and clearly under the impression of a brutal, ongoing restructuring. With that said, the market did not react particularly negatively to the chip company’s earnings, which does suggest that Intel’s restructuring is already fully reflected in the company’s valuation.

Though Intel’s 3Q24 was terrible, the relatively positive market response, under the circumstances, is actually quite telling: I think that investors expect to deliver on its promise of $10 billion in restructuring gains in the coming quarters.

If Intel’s restructuring gains steam, investors could possibly profit from a gap close as well as a long-term re-rating of Intel’s stock. As far as I am concerned, I think the bottom for Intel is already in.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.