Summary:

- Intel Corporation’s Q2 2024 results were disappointing, with missed revenues, gross margins, and earnings per share, leading to a suspension of dividend payments.

- Fitch Ratings downgraded Intel’s Long-Term Issuer Default Rating to ‘BBB+’ from “A-,” citing execution risks and potential negative rating actions.

- We go over the numbers and tell you why we are not changing our outlook.

harmpeti

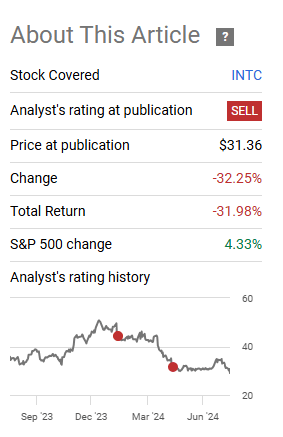

On our last coverage of Intel Corporation (NASDAQ:INTC) we got booed by the fan club. While they saw the potential of the foundry business, we saw problems galore in the current financials. We explained why the company was likely to do poorly and felt there was asymmetrical downside bias.

Currently, considering INTC is disappointing like no other time before, we see the potential for a trough under 2.0X sales. One thing that investors need to consider is that there is some severe downside risk in a recession.

Source: The AI Pie In The Sky.

Of course, INTC waited right until the results to show everyone what exactly “asymmetrical downside” means.

Seeking Alpha

We go over the results and tell you where we stand with this once revered semiconductor stock.

Q2 2024

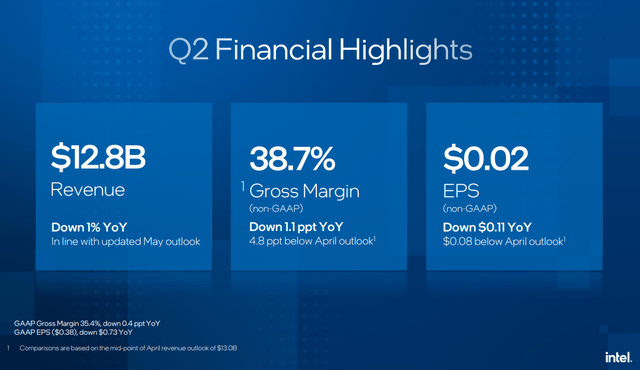

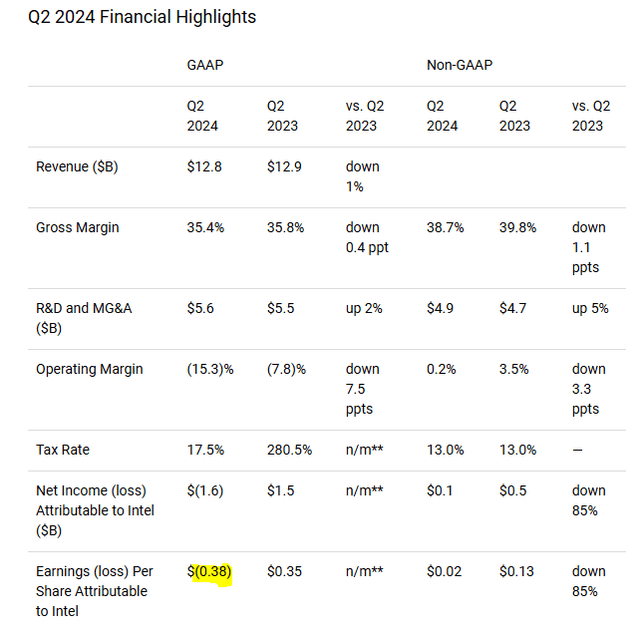

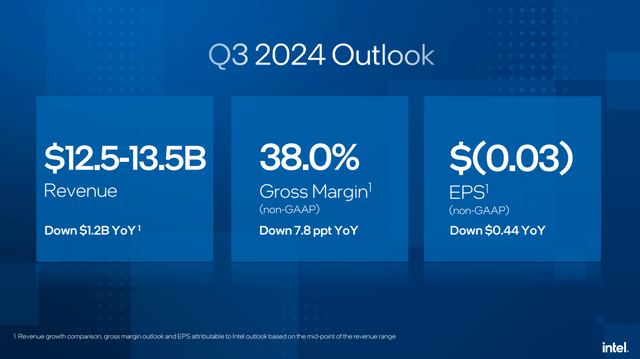

If Q1-2024 gave a new hope to investors, Q2-2024 was the equivalent of the empire striking back. INTC missed everything in sight. Revenues were down 1% year over year, and that was the closest INTC got to meeting its guidance. Gross margins were, well, gross. 4.8% drop within about 2 months (since the April outlook) is fairly dire considering there is no official recession on the map.

Earnings per share were also far below expectations. A reminder again that the number above is Non-GAAP. Actual GAAP numbers, which reflect the extent of problems here, were at negative 38 cents.

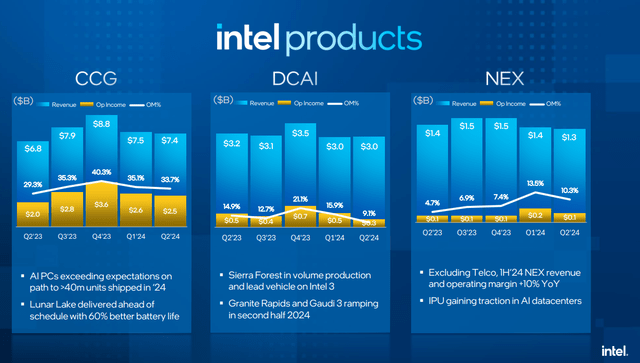

INTC aims to please and aims to play the game of Wall Street analysts like almost every other firm. So all that guidance from April likely included some major room to beat and raise, as that is how you get, Wall Street praise. So a miss of these proportions was quite a stunner. There was not a single redeeming segment. Nothing for bulls to hang on to that drives the AI growth narrative.

INTC then dropped the Q3 2024 outlook, which was again well below what any analyst had imagined. Gross margins look like they are permanently stuck below 40% and revenues will likely struggle to eclipse $13.0 billion.

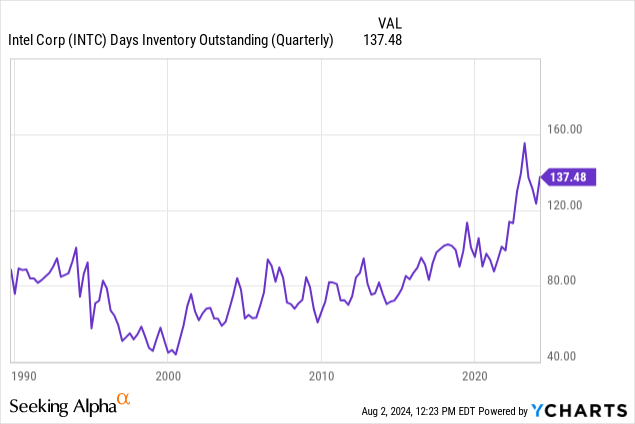

Therefore, you have losses as far as the eye can see. Why is this happening? We have mentioned this a few different times, and apparently no one else is paying attention. So here it is again. INTC cannot make money until it fixes its inventory situation.

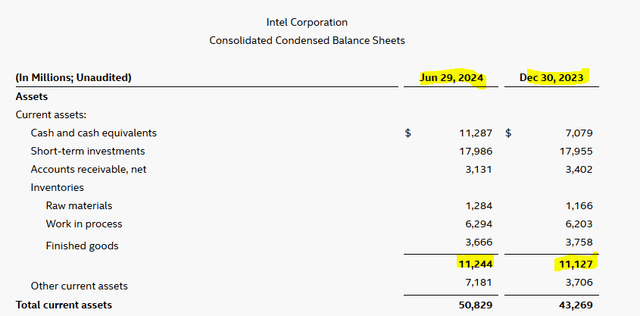

You cannot command solid gross margins when customers are drowning in your product. The supply chain is full and bloated relative to where demand is. INTC’s own inventories are full and their proverbial cup runneth over. The data below is from last quarter.

INTC just revised all sales estimates lower and their inventories are still holding fairly high over $11.2 billion.

So the result of that is those gross margins, of 38%, which look really poor, can go down even more.

Outlook & Verdict

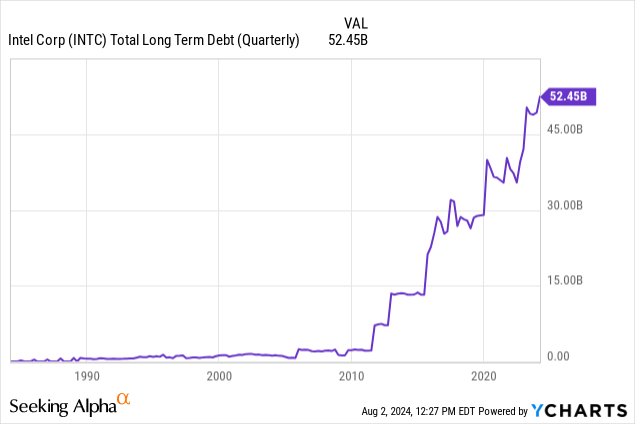

This is a crushing defeat for the bulls. Even the last fig leaf that prevented this show from getting obscene was removed as INTC stopped its dividend payment. It seems like an eternity back when we first told you that even the original dividend was not safe (See, That Dividend Will Have To Go). Things have not gone in the right direction. All of this is worsened by the mounting debt load.

That debt actually looks like an AI stock chart. Funnily enough, that number above should get worse for at least 6 more quarters, in the best-case situation. S&P Global woke up from its dream where INTC deserved an A- rating and put it on “watch.”

The CreditWatch negative placement follows Intel’s weaker-than-expected second-quarter financial performance and also reflects expected challenging business conditions in the second half of 2024. The company has outlined significant cost reductions by 2025; it plans to realign its headcount, reduce operating expenses, and make capital reductions amid weaker market demand.

Intel will also suspend its dividend (annualized at about $2.2 billion) starting in the fourth quarter to preserve liquidity and support the investments needed to execute its strategy.

While these cost-cutting measures, including significant capital expenditure reductions, could alleviate some near-term cash-flow-generation challenges, it is unclear whether these steps will be sufficient to maintain its business competitiveness and enable healthy growth.

Source: S&P.

Fitch figured that it was the right time to downgrade since the horse was in a different postal code by now.

Fitch Ratings has downgraded Intel Corporation’s Long-Term Issuer Default Rating and senior unsecured ratings to ‘BBB+’ from ‘A-‘. Fitch has also affirmed Intel’s Short-Term IDR and commercial paper rating at ‘F2’. The Rating Outlook is Stable.

The ratings and Outlook reflect Fitch’s expectation that FCF margins, adjusted for capital spending offsets, on average will be modestly positive through our forecast period (2024-2027). Additionally, Fitch expects EBITDA leverage metrics will improve but will remain outside of Fitch’s previous negative rating sensitivity through 2026. Fitch believes execution risk remains significant for Intel and that missteps could result in further negative rating actions.

Source: Fitch.

In all honestly, INTC should now be sitting at least two tiers deep into junk territory. But BBB+ is the best we can get here. Investors may quibble over whether this is a “blood in the streets” case or not. From our perspective, if the debt load was not there and if the capex requirements were not there, sure, it would be worth a punt. The stock is at $21.00 and there is strong support at $0.00, so that is the most you can lose. There could be plenty of upside in the next cycle. But as it stands, there is nothing that can change the course of this train wreck.

In two quarters, especially if a recession hits, we will see this move towards a junk rating. In 6, we might be discussing a bailout and existential risks. We continue to rate Intel Corporation stock a Sell and suggest investors use any rallies to exit.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult a professional who knows their objectives and constraints.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

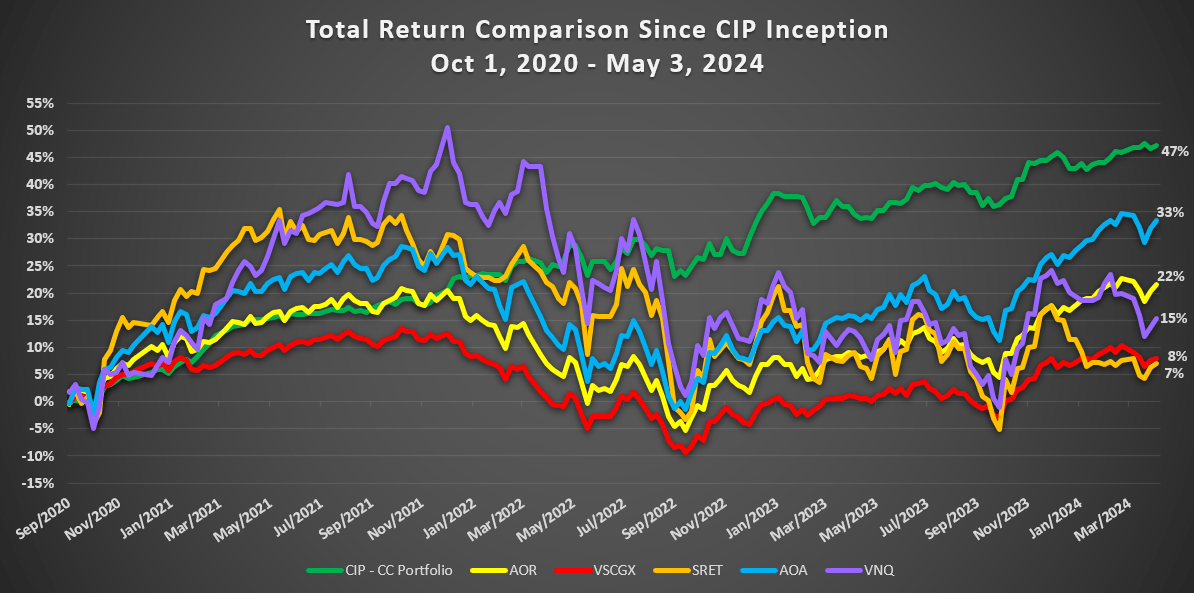

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Take advantage of the currently offered discount on annual memberships and give CIP a try. The offer comes with a 11 month money guarantee, for first time members.