Summary:

- Intel’s shares have underperformed recently, but there are reasons to believe that the company will return to growth in 2024.

- Intel’s client computing business has been improving, and federal subsidies could boost its foundry business.

- The launch of Intel’s Gaudi 3 AI accelerator and the reorganization of its foundry business are positive signs for future growth.

hapabapa

While Intel’s (NASDAQ:INTC) (NEOE:INTC:CA) shares have depreciated in recent months on weaker guidance and rising competition, the company nevertheless started the year on a relatively high note and there are reasons to believe that its business will once again return to growth in 2024 after underperforming in 2023. Despite all the challenges that Intel faces, its client computing business has been greatly improving in recent months, while the upcoming federal subsidies could boost its foundry business and scale the overall operations without the need for the company to fully finance its projects. Therefore, I remain optimistic about Intel’s future and believe that its stock is undervalued at the current price.

It’s Not As Bad As It Looks

Nearly two months ago I wrote a bullish article on Intel in which I noted that the management has everything going for it to properly execute the IDM 2.0 strategy and transform the company. Unfortunately, the timing of that article wasn’t great as the shares have greatly underperformed against the broader market since that time primarily due to the mixed macro data and weaker-than-expected outlook for the upcoming quarters. Despite this, I still believe that Intel is a good investment at the current price as there is every reason to believe that 2023 was the low point for the company, and the improvement of the overall business in 2024 and beyond is more than realistic.

If we take a look at Intel’s latest earnings results for Q1 which were released in late April and were not covered in my previous article, we’ll see that the company had a relatively good start to the year. During the first quarter, Intel’s revenues increased by 8.5% Y/Y to $12.7 billion and were below expectations only by $80 million. At the same time, the non-GAPP EPS was $0.18, above the expectations by $0.04, which indicates that the company is moving in the right direction as its bottom-line performance was decent in the first few months of the year.

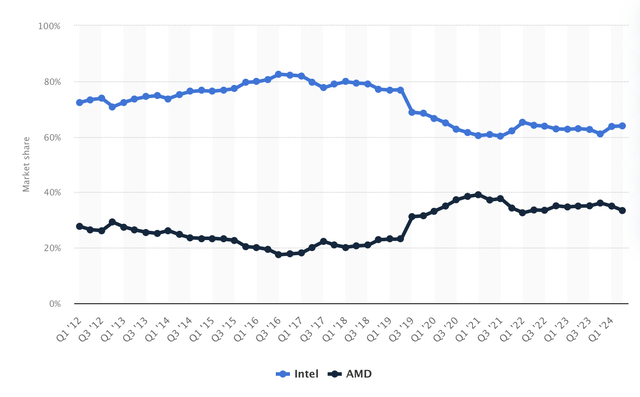

At the same time, Intel has great momentum in the PC market going for it, which could help the business exceed expectations in the second half of the year. In the first half of the year, Intel managed to improve its position in the PC CPU market by taking some share of the market from AMD (AMD) and capturing over 63% of the market.

Intel’s CPU Market Share (Statista)

The improvement was possibly mostly thanks to the rising demand for Intel’s AI CPUs from the Ultra series that were revealed last December. By the end of March, Intel had already shipped over 5 million of such CPUs, which helped its client computing business to grow revenues in Q1 by an impressive 30% Y/Y to $7.5 billion. Considering that Intel expects to exceed its target of shipping 40 million units by the end of the year, it’s likely that the client computing business will continue to show great results and boost the performance of the overall business in 2024.

At the same time, the launch of Intel’s Gaudi® 3 AI accelerator in Q3, which appears to be more powerful than NVIDIA’s (NVDA) flagship H100 GPU, should also help the company improve the performance of its data center business, which underperformed in Q1. Given that Nvidia has recently reported another blowout quarter, it’s safe to assume that the demand for AI GPUs is not slowing down and Intel has more than enough opportunities to improve its performance in the data center market by the end of the year as well.

On top of all of that, it seems that Intel has been relatively successfully reorganizing its foundry business under its IDM 2.0 vision. The latest earnings report stated that Intel is engaged with almost every foundry client in the industry, while its pipeline includes almost 50 customer test chips right now. Considering that the semiconductor industry is expected to grow by 10% thanks to the AI boom, Intel’s foundry business has a chance of improving its performance in the second half of the year as well. Add to all of this the fact that the company could scale its overall operations without the need to fully finance its projects thanks to federal grants under the CHIPS Act, and it becomes obvious that everything is not as bad as it might look.

What’s Next For Intel’s Shares?

All of those developments indicate that 2023 indeed could’ve been the low point for the company, and we could expect an improvement in the overall business in 2024 and beyond. The Q1 results were already decent and the growth of the top-line and bottom-line was a good start. While the Q2 outlook was slightly below expectations, as the street expected the company to generate $13.59 billion, while the management guided for the revenue to be in the range of $12.5 billion to $13.5 billion, it’s still possible for Intel to grow its sales and profits at a decent rate this year.

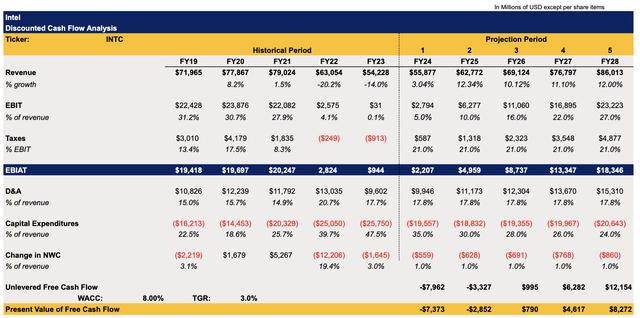

With that in mind, I made a new DCF model that better correlates with the new expectations. The revenue and earnings assumptions in the model for the following years closely correlate with the street expectations. The model also assumes a tax rate of 21%, while CapEx for FY24 closely correlates with the management’s earlier predictions of net CapEx spending to be in the mid-30s as a percent of revenue. Other assumptions in the model closely correlate with Intel’s historical performance. The terminal growth rate in the model is 3%, while WACC is 8%.

Intel’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

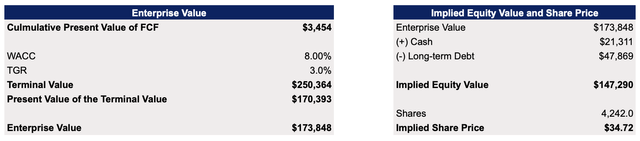

The model shows that Intel’s enterprise value is $173.8 billion, while its fair value is $34.72 per share, which represents an upside of ~16% from the current market price.

Intel’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

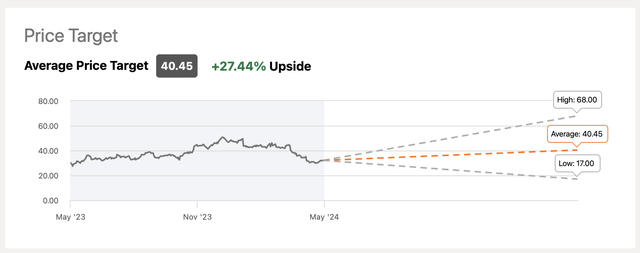

The street believes that the upside could be even greater, as the consensus price target currently is ~$40 per share. Considering that the current broader market P/E is ~27x, while Intel’s forward P/E is ~28x, it’s safe to say that Intel at the very least is not overvalued and the amount of growth catalysts described earlier in this article indeed creates an additional upside to its shares. That’s why I remain bullish about Intel’s future at this stage.

Intel’s Consensus Price Target (Seeking Alpha)

Major Risks To Consider

Despite having great opportunities to create additional value, there are still risks to Intel’s growth story in the CPU, GPU, and foundry businesses. One of the biggest disadvantages of Intel in recent years was the inability to properly execute its strategy on time, which constantly resulted in delays, underperformance, and the loss of market share. The same thing could happen again if Intel fails to properly execute its IDM 2.0 vision in the upcoming years.

In the CPU market, there’s a risk that Nvidia will break the Intel-AMD duopoly in the foreseeable future. Last year, there were rumors that Nvidia began to design its own CPUs that would be able to run Microsoft’s (MSFT) Windows OS. If Nvidia indeed becomes a CPU supplier in the future, it would have a very real chance of disrupting Intel’s dominance in the PC field.

In the GPU market, Intel might fail to gain traction with its own AI chip. While Gaudi 3 appears to be more powerful than H100 GPUs, Nvidia is already on track to release a much better version of its flagship chip H200 in the second half of the year, which could undermine Intel’s efforts to take some portion of the GPU market.

In the foundry business, TSMC (TSM) is expected to remain the most technologically advanced manufacturer for years to come, while its physical expansion across the globe will help it to decrease some of the geopolitical risks that haunted its business in recent decades. Even though Intel appears to be making progress in the foundry business, it would be immature to say that it will be able to undermine TSMC’s dominance anytime soon.

The Bottom Line

Despite all the challenges that Intel currently faces, the company’s stock appears to be a decent investment right now, especially since there is every reason to believe that growth opportunities outweigh the risks at the current price. As such, I remain optimistic about Intel’s future and continue to hold a long position in the company.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.