Summary:

- My previous Sell rating for Intel has been spot on as Wall Street punishes the stock due to lack of a clear roadmap toward growth.

- Intel has announced several changes including layoffs, dividend cuts, and capex reduction which might have a positive impact in the near term.

- However, one of the biggest drawbacks for Intel has been the wrong long term strategy of trying to beat TSM with massive capex in high-cost regions.

- The negative FCF for Intel is unlikely to change in the near term and Wall Street could overlook the progress made by the company in AI chips.

- Intel is trading at a very low price but it will be quite a while before the management is able to turn the ship around.

JHVEPhoto/iStock Editorial via Getty Images

Intel (NASDAQ:INTC) stock has not recovered from the shock of the recent earnings where it missed in both revenue and EPS estimates. In my previous article, I mentioned that Intel is a Sell as it faces increased competition and a big capex over the next few quarters. Since the previous Sell rating, Intel stock has dropped by 55% while the S&P500 has increased by 7%. The management has announced some strong initiatives including 15% layoffs, dividend cuts, and a 20% reduction in capex for 2024. These initiatives will certainly have an impact on key metrics for Intel over the next few quarters. However, as we have seen in the last few weeks, Wall Street is not going to be swayed by these short-term efforts.

The current management has worked to improve the product pipeline and build a good roadmap for future product launches. However, I believe that one of the biggest errors is more strategic. Intel is trying to compete with TSM (TSM) by making massive capex in high-cost regions. This might seem a perfect solution due to current geopolitical tensions. But it has diverted the focus from AI chips.

The EPS estimate for the fiscal year ending Dec 2026 is $1.88 and the forward PE ratio is 10.6. This looks quite attractive and investors might want to make a value play. However, it is still advisable to wait another quarter or two to gauge the progress made by Intel in its cost-reduction efforts. By the end of 2024, it will be clear how Gaudi 3 stacks up against Nvidia (NVDA) and AMD (AMD) which can give a better view of future profitability.

Poor strategy causes big headwinds

Intel’s management has made several positive decisions. The product pipeline has improved in the last few quarters and the company is also improving on its process roadmap. However, I believe the biggest challenge for Intel is because of a wrong strategy where they are focusing on building a foundry business that will compete directly with TSM. Intel is building massive factories in regions where the labor cost is very high and it will take a long time in training new staff. On the other hand, TSM has an excellent supply chain and is able to produce the chips at a lower cost. Even the massive subsidies given by many governments to Intel might not be enough to change the economics of chip production business.

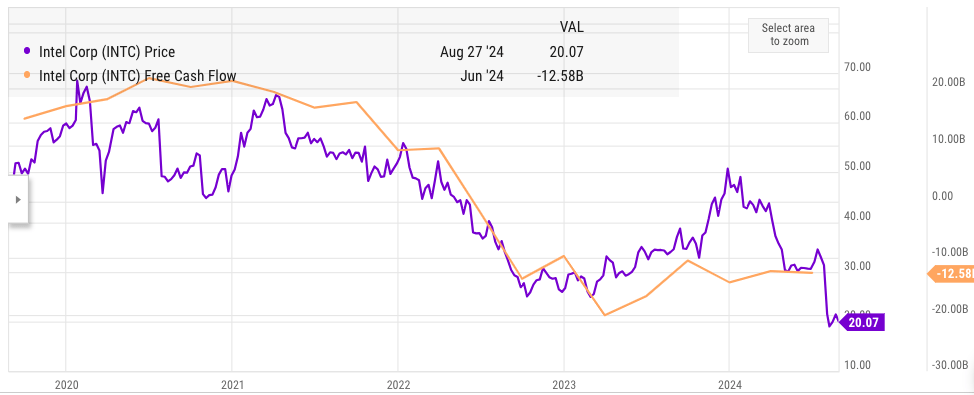

YCharts

Figure: Impact of FCF decline on stock price. Source: YCharts

Wall Street is not ready to wait another few years before these massive investments start showing results. We can see from the above chart that there is a close correlation between FCF decline and the stock price. The recent earnings miss has led to a further decline in stock price.

While AMD and Nvidia are focusing on new AI chips, Intel’s management has to focus on building huge factories for the foundry business. The recent cost-reduction efforts of Intel are promising but it is unlikely that we will see a big change in key metrics for the next few quarters.

Attractive valuation but huge headwinds

The EPS estimate for fiscal year ending Dec 2025 is $1.22. This gives Intel stock a forward PE ratio of 16.46. The EPS estimate for the fiscal year ending Dec 2026 is $1.88 and the forward PE ratio for 2026 is only 10.6. This valuation might seem very attractive but long-term investors should also note the massive challenges faced by the company.

Seeking Alpha

Figure: EPS trend for Intel in the next few years. Source: Seeking Alpha

The company would need to invest heavily to build the factories over the next few years and the results will not be visible for another 3-4 years. Intel has announced some good partnerships for foundry business but TSM is still the main choice for most of the clients. The recent capex reduction could delay the construction of these factories.

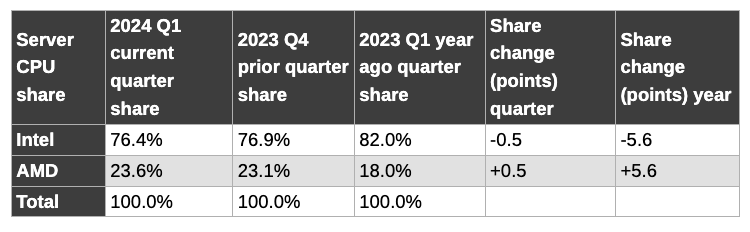

Mercury Research

Figure: Intel continues to lose market share. Source: Mercury Research, The Register

According to recent report by Mercury Research, Intel continues to lose market share to AMD in almost all segments. Despite the promises of Intel’s management over the last few quarters, we have not seen an improvement in Intel’s market share. Wall Street is unlikely to change its view of Intel until the company can at least stabilize its market share.

Risk to the thesis

Intel is currently trading at one of the lowest prices in the last decade. Some analysts have pointed to a similar bearish view on Meta (META) in 2022 when it was trading at less than $100. Since then, Meta’s stock price has jumped more than 5X and it continues to outperform other peers. It should be accepted that Intel’s price is quite low and this does not reflect the fact that the company is still the market leader in many important segments. Intel is also taking the approach of Meta by announcing a massive 15% headcount reduction. This should certainly boost earnings over the next year. Intel is also slowly improving its AI chips and Gaudi 3 looks promising.

However, despite these positives, the competition for Intel is fierce. Both Nvidia and AMD have gone all-in to improve their AI product pipeline. They have great management which has already proved their skills and Wall Street is ready to give them a much higher valuation multiple. Unless Intel delivers good results in the next few earnings, it seems unlikely that there will be a big improvement in sentiment towards the stock.

Future stock trajectory

Almost no analysts could predict the massive change in chip stocks over the last few years. Prior to the pandemic, Intel’s market cap was significantly higher than that of Nvidia and AMD while being quite close to TSM. In just a few years, the entire game has changed and Intel’s market cap has fallen to $80 billion.

The core problem is about the market share of its products and the competition it is facing. If Intel continues to lose market share, it is highly unlikely that Wall Street would be willing to turn bullish toward the stock.

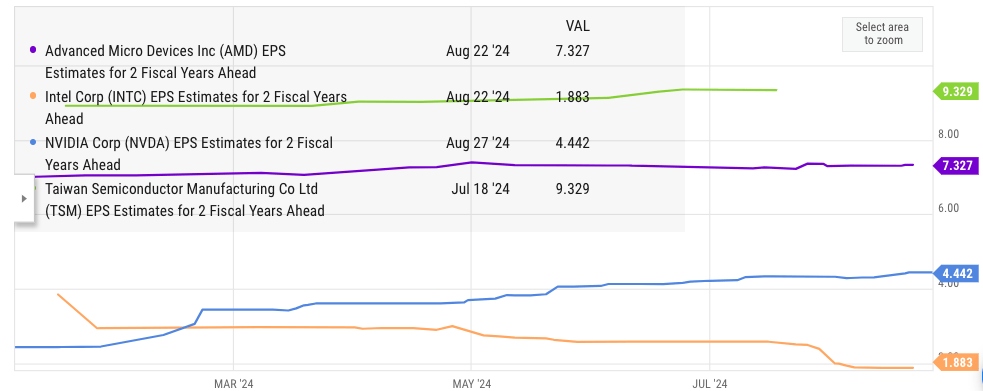

YCharts

Figure: EPS estimate of Intel and other stocks. Source: YCharts

The EPS estimate for 2 fiscal years ahead has been falling for Intel due to downward revisions as the company loses profitability. At the start of the year, Intel’s EPS estimate for 2 fiscal years ahead was $3.8 compared to $1.8 currently. This shows that there has been more than 50% reduction in forward EPS estimate and at the same time the stock has also dropped by more than 50%. Hence, there is a close correlation between how Wall Street sees the forward profitability of the company and the stock price. The management has promised a lot of improvements but it will need to deliver good earnings to change this bearish outlook.

The massive investment in the foundry business will continue to be a big drag for Intel over the next few years. The management would need to balance the resources needed in the foundry business along with improving the AI chip product pipeline. Despite the low price, I believe investors should remain on the sideline for another quarter and wait for some positive results by Gaudi 3 or other products for Intel.

Investor takeaway

My previous Sell rating for Intel has proved right as the company showed massive correction after the recent earnings. There has been no bounce back in the stock price and Wall Street is unlikely to reward Intel unless the company shows positive results. Intel is losing market share to AMD in almost every category. It also requires massive capex for the foundry business which will not deliver positive results for at least a few more years.

The stock is trading at only 10 times the EPS estimate of fiscal year ending Dec 2026. We could see some upward revisions in this estimate if the current layoffs help in big cost reductions. Intel’s Gaudi 3 could also help boost the sentiment towards the stock. However, the company faces massive challenges in its core business which makes the stock Sell at the current point.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.