Summary:

- After years of underperformance, there’s a risk that Intel will continue to lose its competitive advantages and won’t be able to properly revive its business anytime soon.

- The latest departure of its CEO Pat Gelsinger shows that Intel needs a new strategy if it wants to recover and avoid another lost decade.

- We believe that INTC is a sell right now.

tupungato

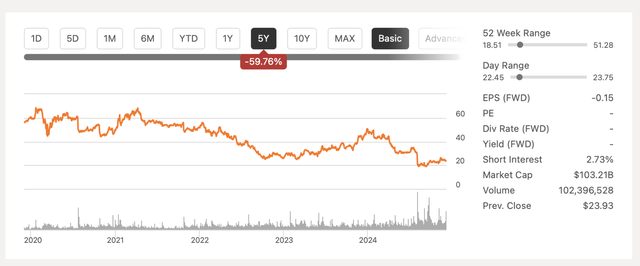

Intel’s (NASDAQ:INTC) performance this year could be characterized as a disaster. Its shares lost half of their value since the start of 2024 at a time when the stock market is reaching new highs, and there’s a possibility that the worst for the company is yet to come. Not only will Intel be unprofitable this year, but there’s also a risk that it won’t be able to become FCF positive next year as a result of rising challenges that could undermine its recovery. That is why we rate Intel as a sell since the growth story seems to be dead for now, and we also believe that there are better opportunities in the market at the moment.

Disaster In The Making

Intel shocked the market back in August when it released its weak Q2 earnings report that was accommodated by the disastrous guidance for Q3, which resulted in the major depreciation of its shares. While the market expected Intel to make $14.39 billion in revenues in Q3, the management announced that they expected to generate only between $12.5 billion and $13.5 billion in revenues. After years of underperformance, another setback indicated that the path to recovery will be longer than initially expected.

Although Intel’s Q3 earnings report, which was released in October, was not as shocking considering that the market knew that the results would not be great in the first place, we could safely say that the worst for the company is not over yet. The company already lost more than half of its value in the last few years, during a time when the stock market has been reaching new all-time highs frequently. At the same time, the latest departure of its CEO Pat Gelsinger after the confidence vote shows that Intel needs a new strategy if it wants to recover and avoid another lost decade.

Intel’s stock performance (Seeking Alpha)

One of the biggest issues that Intel faces is the inability to properly utilize its foundry business and return it to its former glory. As of today, TSMC (TSM) dominates the foundry market and Intel is nowhere near in sight. Yet, Intel’s CapEx is nearly half of its total revenues, and a significant portion of that spending is used within its fabs business, which is still lagging behind the competition. That’s why it’s no surprise that, apparently, no one knows what to do with the fabs business at this stage and whether investing in it is worth it at this stage.

Intel is also slowly losing its footing in the x86 CPU market. The latest earnings report for Q3 showed that Intel’s client business experienced a 7% Y/Y decline in revenues to $7.3 billion. In the meantime, its major competitor in the field AMD (AMD) has been taking more and more market share in recent quarters.

Intel’s data center business could also face additional hurdles in the future. In the latest earnings call, Intel’s management said that their Gaudi 3 AI chip won’t be able to meet the initial goal of generating $500 million in revenues this year. For comparison, AMD recently boosted its data center revenue for 2024 to over $5 billion in large thanks to the warm reception of its AI accelerators from the MI300X series.

At the same time, Nvidia (NVDA) is expected to ramp up its Blackwell chips in Q4 and generate $37.5 billion in revenues in the last quarter of the year, which is around as much as Intel as a whole generated in the last three quarters combined. Considering such numbers, we don’t see how Intel will be able to properly compete with its closest competitors in the data center market.

Finally, the suspension of dividends makes Intel even less attractive for some investors. In addition, even without dividend payments, we don’t see how Intel will be able to become FCF positive next year given the latest developments. We will present our calculation for this later in the article.

Risk To Our Bearish Thesis

Our bearish thesis certainly could have some flaws. There’s a possibility that Intel’s AI chips will gain traction later next year, considering that the demand for similar chips is insane right now. Nvidia’s partners believe that the demand for such chips will remain strong next year, which could be a good thing for Intel and make it possible for the company to boost its data center revenues beyond the initial expectations.

The geopolitical developments could also revive Intel’s foundry business. Earlier this year, President-elect Trump accused Taiwan of stealing the U.S. chip industry. Right now, there’s a risk that Taiwan and its chip industry could be affected by Trump’s foreign policy next year, which could be a positive thing for Intel given that TSMC is its major competitor in the foundry business. Intel already partnered with Amazon (AMZN) earlier this year to produce custom chips, while the money from the Chips Act could help revive the foundry business over time.

The Real Value of Intel

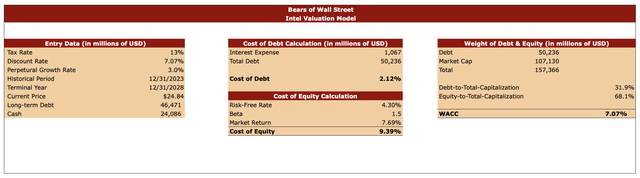

Below, we present our valuation model, which will answer the question of whether Intel is a worthy investment at the current price. For the model, we use a tax rate of 13%, which is what the management guided in the latest earnings call. The perpetual growth rate in the model is 3%, which closely aligns with the historical inflation rate and GDP growth rate. We created this model when Intel was trading at $24.84 per share, our forecast includes the period of the next five years, and the cash and long-term debt data has been taken from the latest earnings report.

The discount rate in the model is 7.07%. We figured it out by calculating Intel’s cost of debt and cost of equity. To calculate the cost of debt, we divided Intel’s TTM interest expense by its total debt at the end of Q3. For the cost of equity calculation, we used a risk-free rate of 4.3%, a beta of 1.5, and a market return rate of 7.69%. We then weighted Intel’s debt and equity to figure out its discount rate.

Intel’s valuation model (Bears of Wall Street)

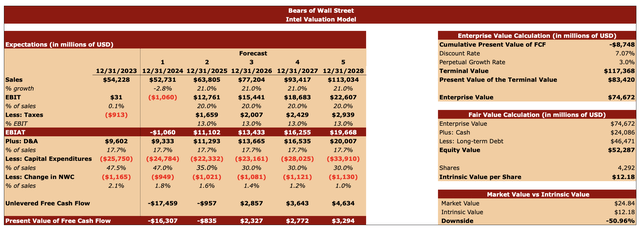

When it comes to forecasting Intel’s performance, our sales and EBIT assumptions for FY24 are mostly similar to the expectations of other analysts. The gross CapEx for FY24 is also similar to the management’s expectations of approximately $25 billion.

When it comes to FY25, the management in the latest earnings call said that they expect to become free cash flow positive. At this point, we don’t see that happening. The consensus currently is that Intel’s sales will grow at a single-digit rate next year and beyond, while the management guided for a gross CapEx of between $20 billion to $23 billion in FY25. We decided to increase Intel’s sales growth rate in our model to 21% for the following years. Considering that AMD is expected to grow its sales by 13% this year, while TSMC is expected to grow its sales by 29%, the 21% rate in our model is the average rate between those two.

It makes sense to use such a rate since Intel is likely going to be positively affected by the industry-wide demand for chips and foundry services despite its weakened position in the chips and foundry markets. Both AMD and TSMC are expected to grow above 21% in the following years, so it also makes sense to assume that Intel will be slightly lagging behind them in the following years given its latest underperformance.

The EBIT margin in FY25 and beyond in our model is 20%. This is slightly above Intel’s 5-year average rate, but there’s still a possibility that the company will achieve it thanks to the overall demand for chips and foundry services that are not expected to significantly slow down anytime soon.

Even with such optimistic assumptions, Intel is unlikely to become FCF positive in FY25. The model below shows that only in FY26 the company will become FCF positive. Considering Intel’s history of underperformance in recent years, we’re skeptical about the ability of Intel to achieve its current financial goals for the next year.

All of those assumptions helped us figure out Intel’s enterprise value, which in our scenario is $74.67 billion. The equity value is only $52.29 billion, primarily because of the high debt burden, which can’t be fully offset with the available cash resources. The calculations below show that Intel’s intrinsic value is only $12.18 per share, which is approximately 50% below the current market price. This is why we believe that Intel is a sell at this point.

Intel’s valuation model (Bears of Wall Street)

Final Thoughts

Most of Intel’s growth opportunities are simply there as a result of developments that are outside of the company’s control. It’s slowly losing its leadership position in the CPU market and is unlikely to become a leader in the AI GPU market. However, the exuberant demand both for CPUs and GPUs makes it possible for the business to expand for the time being. Intel’s foundry business is also not as advanced as TSMC’s, but the geopolitical issues nevertheless make it possible for the company to potentially improve its performance. Although this is good news for Intel, we believe that it’s a bad sign that the company needs extraordinary developments that are outside of its control to show any meaningful performance.

Currently, there’s no doubt anymore that fiscal 2024 will be a bad year for Intel in terms of performance and there are questions about its ability to execute the transformation plan and become FCF positive next year. That is why we believe that giving it a rating of sell is the best option right now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.