Summary:

- Intel is in the middle of a turnaround.

- The successful performance in Q4 and the growth of the PC market indicate that the recovery is on the way.

- The rising demand for AI-capable PCs and Intel’s upcoming entry into the AI GPU market could further contribute to the company’s growth.

Alexander Koerner

Intel (NASDAQ:INTC) is currently in the middle of a turnaround that can resolve most of the issues that caused a major underperformance of its business in recent years. Considering that the demand for chips is likely to continue to increase in the upcoming years while the company is on track to execute the IDM 2.0 plan and enter the AI race, it makes sense to assume that Intel’s shares still have more room for growth. That’s why I’m sticking with my BUY rating for the company’s shares for now.

Pat Gelsinger Continues To Deliver

Back in October, I wrote a bullish article about Intel in which I argued that the company is moving in the right direction under the leadership of Pat Gelsinger, who is in the middle of executing his IDM 2.0 strategy. The goal of the strategy is to revitalize the company that has been underperforming for years by focusing on the business’s strengths. Since that time, Intel’s shares have appreciated by over 20% and there are reasons to believe that they have additional room for growth in the coming months.

In part, such an optimist is caused by Intel’s successful performance in the recent quarter. The latest earnings report for Q4, which was released in late January, showed that Intel’s revenues increased by 10% Y/Y to $15.4 billion, which was above the street consensus by $230 million. At the same time, the non-GAAP EPS of $0.54 was also above the estimates by $0.09.

Going forward, there are reasons to believe that Intel has a chance to retain its momentum and exceed expectations in the following quarters as well. In part, future growth could be achieved by the recovery of the PC market, which experienced a major decline in shipments in recent years due to the high levels of inventory. In Q4, Intel’s client computing group business already generated $8.8 billion in revenues, up 33% Y/Y, which indicates that the recovery is on the way.

At the same time, the rising demand for AI PCs is likely to help Intel execute a proper turnaround. There’s an indication that AI-capable PCs will account for 18% of total PC shipments in 2024 and for 40% of all shipments in 2025. Considering that at the beginning of this year, Intel launched its latest AI-capable Core Ultra CPUs, it’s likely that the company will be one of the biggest beneficiaries of the rising demand for AI-capable PCs. On top of that, the launch of Intel’s Gaudi3 GPUs later this year could also help the company take some portion of the data center market, which is in need of new AI-capable chips.

When it comes to Intel’s foundry business, the company’s latest foundry event that was held last month gave plenty of reasons for optimism. In addition to unveiling a new foundry system for AI, Intel made a deal with Microsoft (MSFT) to manufacture custom chips on the 18A process and there’s an indication that Broadcom (AVGO) and MediaTek made similar deals as well.

In addition to all of that, Intel will finally be able to receive federal loans and subsidies to decrease its own expenses to build new fabs in the United States. Just recently, the Department of Commerce proposed the distribution of $8.5 billion in federal funding to Intel through the CHIPS and Science Act and made it possible for the company to access an additional $11 billion as federal loans. This will make it possible for Intel to accelerate the expansion of its operations without the need to fully fund the new fabs on its own.

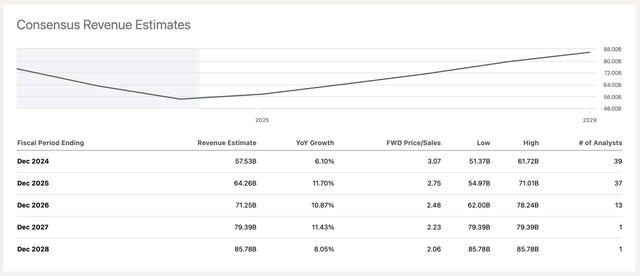

Given all of those growth catalysts, it’s safe to assume that the worst for Intel is finally behind it. There’s already an indication that Intel will once again return to growth in 2024 and beyond as Pat Gelsinger continues to execute a proper turnaround. The street expects Intel’s sales and earnings to start increasing starting this year. The revenue alone is expected to grow at 6% in 2024 and at a double-digit rate in the following years.

Intel’s Consensus Revenue Estimates (Seeking Alpha)

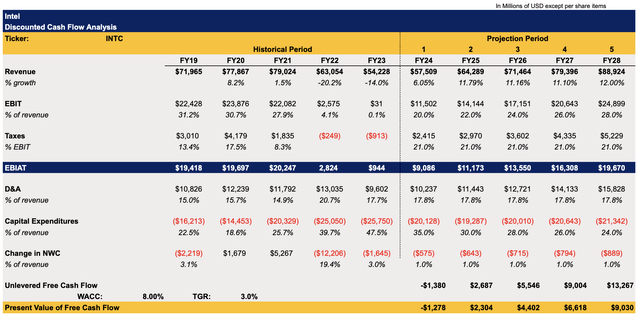

Considering this, I made a DCF model that can be seen below. The revenue assumptions in the model are mostly in-line with the street expectations. When it comes to earnings assumptions, they mostly correlate with the management’s expectations that earnings will grow faster than revenues. The tax rate in the model stands at 21%. The CapEx assumptions are also mostly in-line with the management’s expectations that spending will be in the mid-30s as a % of revenue in 2024. The assumptions for all the other metrics in the model closely correlate with Intel’s historical performance. The terminal growth rate in the model is 3%, while the WACC is 8%.

Intel’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

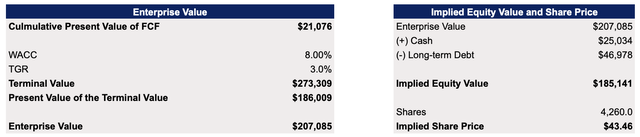

This model shows that Intel’s enterprise value is $207 billion, while its fair value is $43.46 per share, which is close to the current market price.

Intel’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

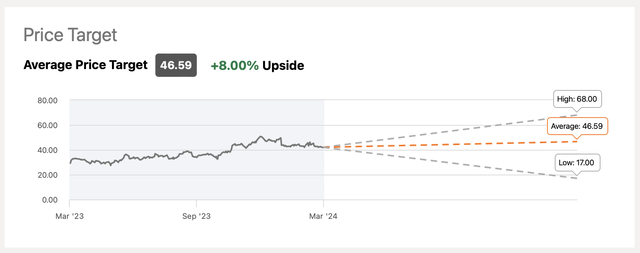

However, while it seems that Intel is fairly valued, there are reasons to believe that a faster recovery of the business caused by various growth catalysts described above could result in upward revisions of assumptions and lead to a higher valuation. That’s why the street could be right that the upside is still there and why I decided to stick with my BUY rating for now.

Intel’s Consensus Price Target (Seeking Alpha)

Major Risks To Consider

Despite all of the growth catalysts that Intel has going for it, the company nevertheless faces several challenges that could undermine its recovery. First of all, AMD (AMD) continues to capture market share from Intel in the server, desktop, and mobile CPUs. There’s a possibility that AMD will be able to retain its momentum and capture an even greater market share in the future as it might take additional time for Intel to execute a proper recovery of its PC business.

At the same time, there’s a risk that Intel won’t be able to properly penetrate the GPU market with its Gaudi3 AI chip as Nvidia (NVDA) continues to extend its lead there and is already significantly ahead of its competition. On top of that, it’s almost certain that Intel won’t be able to regain its dominant position in the foundry market anytime soon, as TSMC (TSM) is years ahead of its American-based peer in terms of technology leadership.

What’s more, is that Intel could lose as much as $1.5 billion in sales in China after Beijing banned the use of its chips in government PCs. As such, it’s important to understand that a successful turnaround is not a done deal and Intel faces more than enough challenges that could undermine its recovery.

The Bottom Line

Despite all the risks and challenges that Intel is currently facing, the company appears to be in the middle of a turnaround that can finally resolve all the issues that caused a major underperformance of its business in recent years. That’s the main reason why I continue to stick with my BUY rating since Intel is likely to create additional shareholder value in the following quarters given all the latest developments and growth catalysts that it has going for it.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.