Summary:

- Intel is leading in the semiconductor industry with its Advanced Packaging technology and Gaudi2 chips.

- Advanced Packaging drives Intel’s global domination in the chip race, enhancing performance and flexibility.

- Intel is expanding its global footprint, securing partnerships, and committing to cost cuts while challenging NVIDIA’s dominance in AI inference with Gaudi2.

Andy/iStock via Getty Images

Investment Thesis

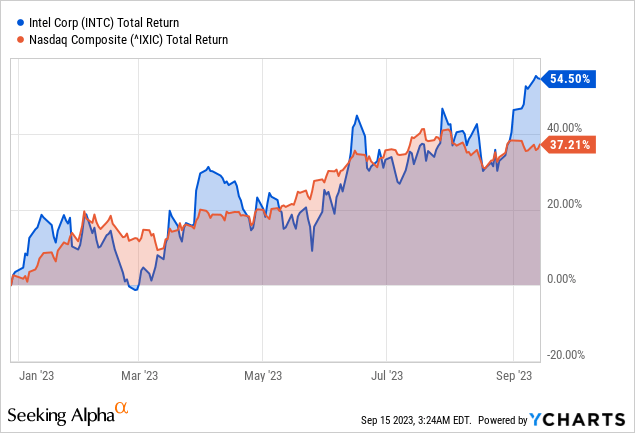

Since I suggested that a bottom could be in back in December, Intel Corporation (NASDAQ:INTC) has returned nearly 55% to investors, but the bull run is not over yet. In a pioneering shift, Intel implements its groundbreaking strategy with Advanced Packaging technology and formidable Gaudi2 chips, paving the way for more potent devices and positioning the giant for a comeback in the next two years.

Advanced Packaging Drives Global Domination in the Chip Race

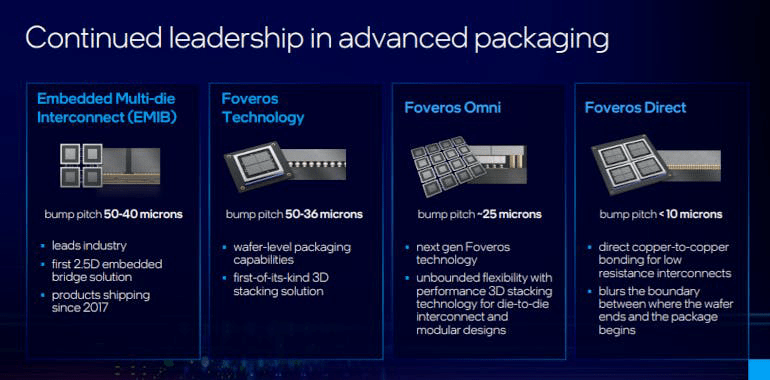

Intel’s grip on advanced packaging technologies is a key long-term growth driver. Advanced packaging enhances product-level performance by optimizing the interface between the processor and motherboard. Intel’s Foveros packaging technology, based on 3D stacking, enables logic-on-logic integration. This innovation allows designers to mix and match various technology IP blocks, memory, and I/O elements, fostering flexibility in device form factors.

In simple terms, imagine you’re trying to fit many people into a room. Traditionally, you might ask each person to stand side by side, shoulder to shoulder. This is how computer chips used to be arranged. However, as we wanted to fit more people (or components) into the room (or chip package), this method started to run out of space.

Now, Intel is thinking outside the box. Instead of just arranging these components side by side, they’ve come up with ways to stack them on top of each other, like bunk beds, using a technology called “Foveros“. They’ve also developed ways to connect multiple groups of these components side by side more efficiently, which they call “EMIB”.

As computer components get smaller, and we want to fit more into devices, we need more than just making them smaller. That’s where these Advanced Packaging methods come into play. It allows Intel to fit more components into the same space, giving us more powerful devices without them being bigger. Intel has been at the forefront of this innovative approach and aims to push the boundaries further. I view this method as a game-changer, and it gives Intel an edge over its competitors.

Intel

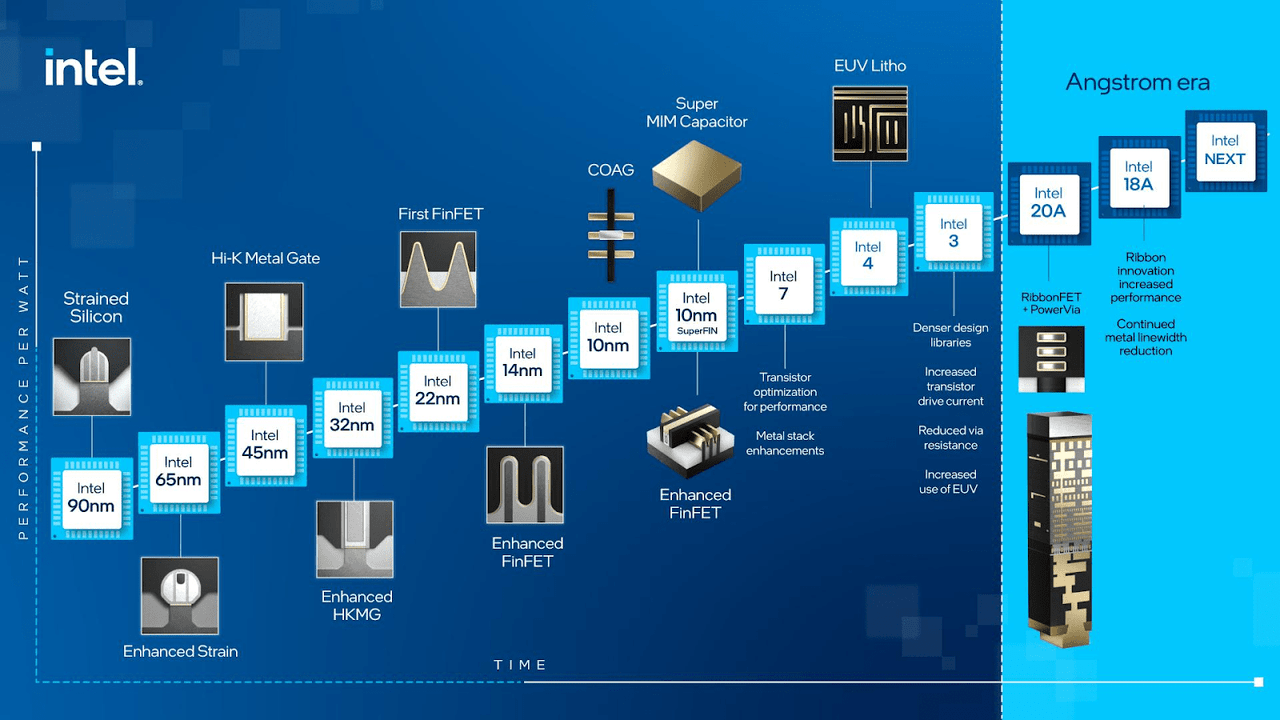

Therefore, Intel’s approach to achieving competitive growth focuses on its Advanced Packaging strategy. Intel’s leadership in manufacturing, particularly in developing FinFET and SuperFin transistors, has allowed them to achieve smaller, faster, and more power-efficient transistors. This radical design improvement ensures Intel’s processors remain at the forefront of performance.

Additionally, Intel’s Embedded Multi-Die Interconnect Bridge (EMIB) and Foveros technologies combine to offer interconnection capabilities for different chiplets, essentially delivering the performance of a single chip. The company’s relentless pursuit of innovation in packaging technologies results in increased computing power and reduced power consumption. Intel’s hybrid architecture, exemplified by its “Lakefield” processor, which combines a hybrid CPU with Foveros 3D packaging technology, showcases its design, form factor, and user experience flexibility.

In pursuit of rapid growth, Intel is not limiting its innovations to the United States. The company is expanding its manufacturing capabilities globally, with a new facility in Malaysia specializing in advanced 3D chip packaging, part of a $7 billion expansion in the region. This move underscores its commitment to regaining its leadership in semiconductor manufacturing. The advanced chip packaging market was $44.3B in 2022, projected to grow 10.6% annually, reaching $78.6B by 2028.

Lastly, Intel has secured commitments from prominent partners like Amazon, Cisco, and the US government to utilize its advanced packaging technology. This external collaboration and Intel’s global production footprint position the company to attract diverse customers for manufacturing and packaging services.

Intel’s EUV Lithography: Pioneering Speed, Power, and Precision

Intel is embracing EUV lithography, a cutting-edge technology that enables the production of smaller and more intricate features on silicon, further enhancing chip performance and efficiency. New process nodes, following RibbonFET and PowerVia in Intel 20A and Intel 18A, will lead to further power, speed, and density improvements.

Finally, Intel is on track with its process and product roadmaps, focusing on advancing semiconductor technology. Key milestones include the completion of Intel 4, the progress in Intel 3, and the development of Intel 20A, which incorporates advanced technologies like RibbonFET and PowerVia. These technological advancements are crucial for maintaining leadership in performance and power efficiency.

Gaudi2: Intel’s AI Powerhouse Challenging NVIDIA’s Dominance

Gaudi2 is a game changer for Intel against its efforts to drift out NVIDIA (NVDA) regarding AI Inference Performance. Think of Gaudi2 as a super-charged engine that makes specific computer tasks (like AI) run faster and more efficiently.

Intel focuses on two distinct markets for AI processing: Dedicated AI infrastructure (where Gaudi2 is a contender) and more casual AI usage alongside traditional CPU workloads, where Intel’s Xeon processors play a strategic role.

Gaudi2 achieves 78.58 inferences per second for server queries and 84.08 inferences per second for offline samples. Surprisingly, Gaudi2 outperforms NVIDIA’s A100 by a significant margin, with 2.4x higher performance for server queries and 2x higher performance for offline samples.

While NVIDIA’s H100 holds a slight advantage of 1.09x in server performance and 1.28x in offline performance compared to Gaudi2, Intel remains highly competitive. Gaudi2’s submission achieved an impressive 99.9% accuracy on the new FP8 data type, indicating its ability to maintain high precision while delivering rapid AI inference.

Additionally, Intel is actively working on improving performance. Thus, adding FP8 precision quantization to Gaudi2 will deliver a significant performance boost, potentially surpassing NVIDIA’s H100 in training tasks. Gaudi2’s inference performance on GPT-J models is notable, as it demonstrated impressive performance in vision-language models, outperforming NVIDIA’s H100 for multimodal transformer BridgeTower models, showcasing its capability in this AI domain.

Benchmark tests have indicated that Gaudi2, mainly used with Optimum Habana, can outperform counterparts, such as the A100 and H100. While these numbers and performance metrics indicate Intel’s competitive position in the AI hardware market, it is essential to acknowledge that outpacing NVIDIA is a long-term game.

intel.com

Therefore, Intel positions Gaudi2 as a cost-effective alternative to NVIDIA’s AI hardware, claiming that the price of Gaudi2 systems is roughly equivalent to NVIDIA’s previous-generation 100 systems, potentially attracting cost-conscious buyers.

Favorably, Intel commits to releasing Gaudi2 software updates every six to eight weeks. These updates enhance performance and expand model coverage in benchmarks like MLPerf. Finally, Intel’s roadmap indicates exploring newer manufacturing nodes, potentially including the 5nm Gaudi3, reflecting its commitment to staying technologically competitive.

Habana® Gaudi®2 accelerators (intel.com)

NVIDIA’s Rising Dominance in AI Performance and Innovations Threatens Market Share

Intel faces several fundamental downsides that may adversely impact its long-term prospects. First and foremost, continued dominance in benchmark performance is a significant threat. NVIDIA consistently outperforms its competitors, including Intel, in AI inferencing, a growing and critical market. This performance gap can erode market share and hinder its ability to compete effectively.

Furthermore, the introduction of the Grace Hopper Superchip presents a formidable challenge. It offers superior performance, with results beating offerings by up to 17%. The Superchip’s design, with higher networking speeds and efficient power management, could disrupt Intel’s server configurations and significantly reduce the cost of inference processing, making Intel’s CPUs less attractive for AI workloads.

NVIDIA’s advancements in software, such as TensorRT for LLMs, are another concern for Intel. These software improvements can double inference processing performance and may give NVIDIA a substantial advantage in the AI market. While the software is open source, Intel and other competitors must catch up and implement similar optimizations, which may take time and resources.

Lastly, NVIDIA’s continuous improvement in its edge AI Jetson platform poses a future threat, potentially expanding into areas where Intel has a presence.

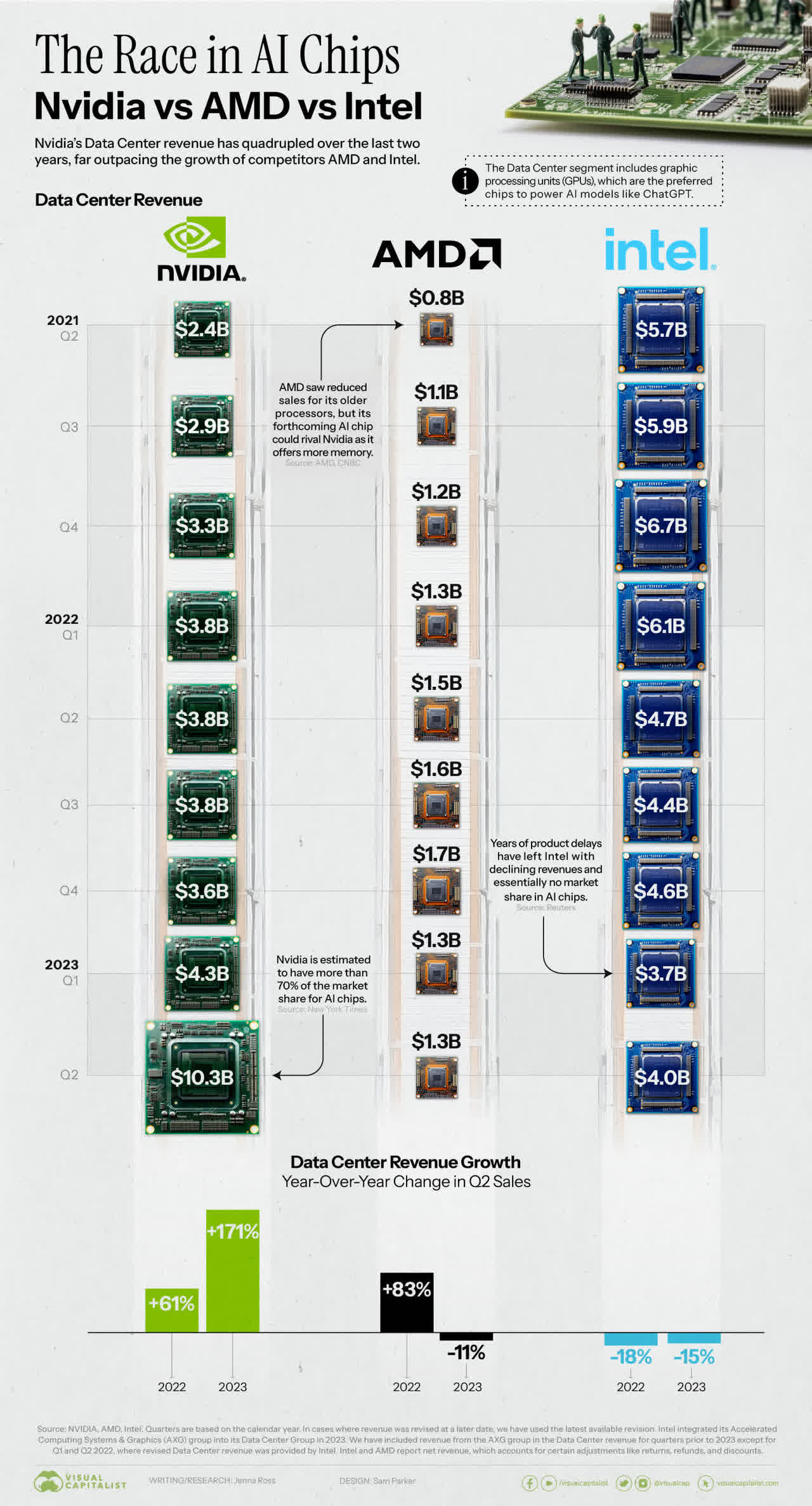

NVIDIA vs. AMD vs. Intel: Comparing AI Chip Sales (visualcapitalist.com)

Takeaway

In conclusion, Intel is charging ahead in the semiconductor industry with its revolutionary Advanced Packaging technology and formidable Gaudi2 chips. Its fundamentals are strengthening with its focus on expanding global manufacturing capabilities and securing partnerships with industry giants, positioning Intel for exponential growth in the advanced chip packaging market.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.