Summary:

- Intel’s shares have been volatile, but Q3 results showed progress in cost reduction and potential for recovery, boosting investor optimism.

- New AI CPUs and Gaudi 3 AI accelerator launches could drive growth in Intel’s Client Computing and Data Center businesses.

- Intel’s foundry business has growth catalysts, including a custom AI chip deal with Amazon and a $3 billion grant under the Chips and Science Act.

- Despite past underperformance, Intel remains a BUY for me, though risks remain.

JHVEPhoto

Intel’s (NASDAQ:INTC) shares have been on a rollercoaster in recent quarters. After the management delivered a disappointing earnings report for Q2 in August in which they outlined an updated strategy, released disappointing guidance, and announced the elimination of dividend payments, Intel lost a quarter of its market cap. Once the Q3 results came in a couple of weeks ago, Intel’s shares rose on optimism that the restructuring plan could help the company return to its former glory. At this point, Intel is still trading below its pre-Q2 levels, but I believe the company has everything going for it to finally achieve its long-term goals.

Potential Recovery On The Horizon

I have been pretty bullish on Intel in the past, but since the release of my latest article on the company in May, the company’s shares have depreciated by ~20% and underperformed against the S&P 500 Index. The bulk of the depreciation occurred after the release of the Q2 earnings report in August, in which the management announced a poor outlook and warned about the upcoming elimination of dividend payments in order to secure enough resources to execute the transformation plan. While this has disappointed the market, the good news is that the potential recovery of the business and its shares could be on the horizon.

The latest Q3 earnings report, which was released in late October, showed that while the revenues decreased by 6.2% Y/Y to $13.28 billion, they were above expectations by $240 million. At the same time, the management announced significant progress on its cost reduction plan, which also pleased the market. Going forward, it’s safe to assume that Intel has plenty of opportunities to ensure that it achieves its goals and returns to growth in the foreseeable future.

In Q4, Intel’s Client Computing Group business can regain its momentum thanks to the potential boost in sales caused by the company’s recently launched CPUs. Just recently, Intel launched its flagship AI CPUs under the names Lunar Lake and Arrow Lake, which should help the company strengthen its position in the CPU market and achieve a long-term goal of shipping over 100 million AI CPUs by the end of next year.

In addition to that, the anticipated release of Intel’s Gaudi 3 AI accelerator last month should also help the company’s data center business retain its momentum. Earlier Intel highlighted that Gaudi 3 is faster in comparison to Nvidia’s (NVDA) H100 GPUs. While Nvidia has released more advanced chips recently, the fact that the demand for AI chips remains high while supply is still limited creates an opportunity for Gaudi 3 to nevertheless boost Intel’s sales in Q4 and beyond.

Intel’s foundry business also has a chance to recover in the foreseeable future. Earlier this year, the company launched the Intel 18A Process Designer Kit and has received positive feedback. Intel’s upcoming Panther Lake chip is expected to be manufactured mostly by the company’s own foundries and will become the first chip to feature the Intel 18A node.

In addition to that, Intel has also recently made a deal with Amazon (AMZN) to produce a custom AI chip for AWS on Intel 18A, which should help its foundry business regain its momentum in the future. Add to that the fact that Intel recently got approved for a $3 billion grant under the Chips and Science Act and it becomes obvious that the foundry business has plenty of growth catalysts going forward.

Considering all of this, investors could be optimistic about Intel’s future, especially since the guidance for Q4 was better than expected. It’s also safe to assume that at the current price, there’s an upside to Intel’s shares. My latest article on the company, which was published in May, showed that Intel’s fair value is $34.72 per share. However, considering the drastic outlook given by the management in August, that model is mostly irrelevant today and needs to be rebuilt under new assumptions to better reflect Intel’s current state of affairs.

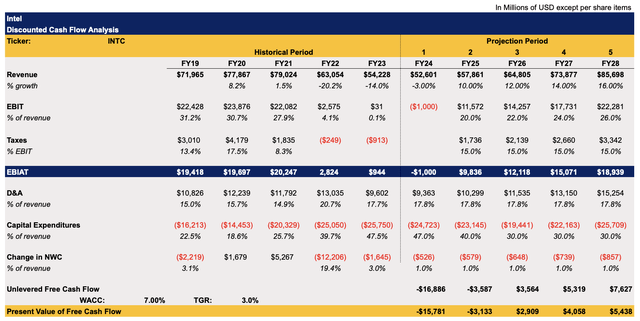

Below is the updated model, which expects Intel’s revenues to decline and the business to become unprofitable this year. This closely correlates with the overall street expectations. In FY25 and beyond, Intel is expected to return to growth thanks to the favorable macro environment. I expect the business to grow at a double-digit rate in the upcoming years as the demand for chips and foundry services is not expected to significantly slow down anytime soon.

The tax rate in the model stands at 15%, which is the corporate rate that is expected to be implemented under the Trump administration. The CapEx in the model for FY24 is nearly $25 billion, and ~$23 billion for FY25, which is in-line with the management’s expectations for gross capital expenditures. The terminal growth rate is 3%, which is the rate typically used in DCF models as it closely correlates with historical inflation and GDP growth rate. The WACC in the model is 7%, which is the market’s average cost of capital rate.

Intel’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

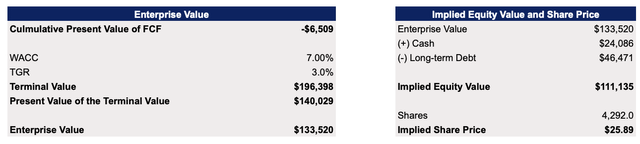

This updated model under the new assumptions shows that Intel’s current enterprise value is $133.5 billion, which is almost in-line with Seeking Alpha’s assumptions of $135.52 billion. My model also shows that Intel’s fair value is $25.89 per share, which is below the previous calculations, but slightly above the current market price.

Intel’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

Although my previous BUY call didn’t play out as expected, Intel nevertheless could be a good investment at the current price. The company recently received over 30 upward revenue revisions, which could be considered as a bullish signal. If the management utilizes most of the growth opportunities described earlier in this article, then recovery indeed could be on the horizon.

Major Risks To Consider

One of the biggest issues with Intel is that it has a track record of underperformance. The company lost its dominant position in the foundry field to TSMC (TSM) a long time ago, and its leadership position in the CPU market is not as solid as before. TSMC will likely continue to have a technological edge in the foundry business for a while and Intel will continue to play the catch-up game, which could limit the upside of its foundry business. At the same time, AMD (AMD) recently gained an additional share of the x86 CPU market at Intel’s expense and could retain its momentum in the following quarters.

The fact that Intel shocked the market with a drastic outlook in August shows that the recovery of its position in the chip design and chip production markets is not going to be smooth due to its cash-incentive growth strategy. Due to such a strategy, Intel will also stop paying dividends starting in Q4, and this could make its stock uninvestable for some investors.

The Bottom Line

Intel is certainly going to fight an uphill battle in the upcoming quarters to achieve its long-term goals. Given the company’s history of underperformance, the risk of the management not delivering on their promises is certainly decent. However, the fact that Intel didn’t raise debt in the last year and has all the chances to become free cash flow positive in the foreseeable future indicates that the worst for the company could be behind it. That’s why I’m optimistic about Intel’s future and stick with my BUY rating for now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.