Summary:

- Intel Corporation stock has experienced a significant recovery, outperforming its semiconductor peers since it bottomed out in May 2023.

- Interestingly, Intel outperformed while it has yet to regain process leadership, displace Nvidia as the GPU leader, nor stem AMD’s market share advances.

- While Intel’s industry outlook has improved, it didn’t look like the case in May or June 2023. So why did INTC bottom then?

- I had already presented that INTC reached peak pessimism as dip-buyers quietly accumulated. The market likely didn’t want to show its hand so early, allowing momentum buyers to chase.

- As a result, INTC is another potent reminder that stocks bottom out when you least expect it. If you want to know how to assess it, make studying price action/investor psychology a core tenet in your analysis.

hapabapa

Should semiconductor investors and analysts be surprised by Intel Corporation (NASDAQ:INTC) stock’s highly remarkable recovery, outperforming its semi peers (SOXX) (SMH) since INTC/SOXX bottomed out in late May 2023? One thing is for sure: I’m not surprised. I upgraded my rating on INTC in June 2023, reminding investors that the “rally is just getting started.” I reminded semi investors that “INTC’s bottom in May 2023 was a powerful bullish reversal, as dip buyers returned robustly to defend an initial selloff.” Let me be clear. If you referred to my June 2023 article, do you think the industry conditions were pessimistic or optimistic? Furthermore, do you recall whether the ratings on INTC were optimistic or pessimistic?

Seeking Alpha published 17 articles on INTC in June 2023. Out of the 17, there were only 6 Buy calls, as analysts/investors remained unsure/neutral (4 Hold calls) or bearish (7 Sell calls) about INTC’s prospects, even as it had already bottomed in May 2023. How did I know? If you read my introduction clearly, you should have noticed. Let me reiterate: “INTC’s bottom in May 2023 was a powerful bullish reversal, as dip buyers returned robustly to defend an initial selloff.”

Price action: Assessing buying sentiments, determining investor psychology, or tea leaves reading, depending on which side you are on (believe or don’t believe in price action). If I referred to Intel’s fundamentals, they likely didn’t tell me enough to make me want to buy. Why? I even highlighted in my June article that “IFS starts with an ‘initial negative operating margin,’ as a much larger scale is needed to improve efficiencies.” I made another Buy call in August, arguing to investors that the “King is making a comeback against all odds.”

Furthermore, the outlook had improved then, as “Intel is on track to achieve its goals and expects its margins to improve further.” In addition, I added that “PC headwinds are likely petering out, providing a much-needed boost to Intel’s recovery.” My most recent Buy call was made in October 2023, urging investors not to miss its ongoing recovery. By then, it was more apparent that the worst in INTC was likely over, as it provided “robust Q3 earnings and solid forward guidance.” However, if you waited till then, the most attractive buy levels were long over. Despite that, I maintained my Buy call, arguing that there’s “still adequate potential upside to buy its recovery thesis.”

With INTC surging toward the $51.3 level in late December 2023, re-testing its early 2022 highs, it’s timely for me to reassess whether I should continue maintaining my Buy rating. Or should it be timely for investors to consider taking a break, allowing INTC to consolidate more constructively, before returning? By now, analysts/investors have become more optimistic (why not in June 2023), based on my assessment of INTC’s ratings between December and January 5. 13 articles on INTC were rated during this period. Nine articles were assigned Buy or Strong Buy. There was only one sell rating, with the remaining three articles tagged as Hold.

I know I made you go through a lengthy recap, which I believe is necessary. I need to impress upon you the criticality of assessing investor psychology accordingly to garner the most attractive risk/reward opportunities to evaluate your thesis. If you want to buy and believe that INTC turnaround is possible, should you buy INTC now or in June 2023, when the company’s performance and industry dynamics didn’t look as good? Always remember that the market is forward-looking, and we must always anticipate as investors. We cannot wait for all the good news to arrive, as by then, the most attractive opportunities helping us to outperform potentially may not be as appealing anymore.

I referenced INTC as the “King” in my August article. That should have reminded you of how I viewed INTC’s bullish thesis. Intel was hurt by its past missteps. But that doesn’t mean it doesn’t have the talent and wherewithal to make a comeback with better execution. Shall I remind you that Intel is still assigned a best-in-class “A+” profitability grade by Seeking Alpha Quant. What does that mean? It means Intel is a fundamentally strong company. It also has a solid balance sheet with an estimated FY24 adjusted EBITDA leverage ratio of 1.85x. While it’s not as “pristine” as its pre-COVID days (well below 1x), we all know that Intel is still investing to achieve its five nodes in four years as it attempts to regain process leadership from Taiwan Semiconductor or TSMC (TSM).

In addition, Intel’s gross margin profile is also expected to bottom out in 2023 (42.8%), before recovering to 48.5% by 2025. In other words, even Wall Street analysts think that Intel’s worst in its operating performance is likely over. As the consumer and enterprise market leader, the ongoing downstream recovery is expected to lift its fortunes further. That’s why the market had already re-rated INTC, as it bottomed out in May 2023. The market isn’t going to wait until Intel management indicates a full recovery before re-rating INTC higher (again, please remember that the market is forward-looking).

However, have industry dynamics changed so significantly for INTC since May 2023 as it outperformed its semi-peers? In other words, what has changed so significantly from the fundamentals point of view that has gotten the market so interested in INTC since May 2023?

I gleaned that Nvidia (NVDA) remains the outright leader in the consumer and data center GPU segment. AMD (AMD) remains Intel’s most significant competitor as it looks to continue gaining share in the data center CPU segment. TSMC is still the foremost pure-play foundry, even though Intel has invested in Arizona and, most recently, Israel to up the ante. In addition, Intel has also received its High-NA EUV lithography system from ASML (ASML) as Intel looks to compete in the 18A process against TSMC’s 2nm process.

However, semi-investors will likely agree that there are not enough material developments to suggest that Intel is close to displacing TSMC as the leading-edge foundry leader. In addition, analysts remained lukewarm about Intel’s AI competitiveness against Nvidia. In other words, Intel’s growth potential wouldn’t have been enough to account for INTC’s resurgence and outperformance.

INTC’s “D+” valuation grade suggests the most attractive buy levels have normalized, as it was valued at a “B-” grade six months ago. When assessing potential turnaround opportunities, June 2023 seems highly unlikely if you assess its thesis based on its fundamentals then. However, the market demands investors to determine what they still cannot see (but can anticipate), and that’s where the elegance and simplicity of price action can be leveraged.

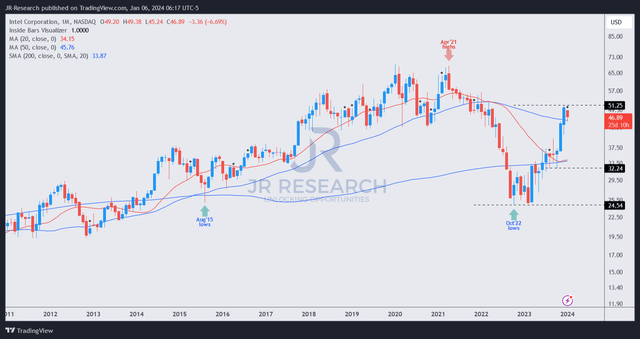

INTC price chart (monthly, long-term) (TradingView)

INTC’s October 2022 lows leading to a bear trap (false downside breakdown) was a pivotal development. It suggests that INTC’s bottom was expected to be robust, as dip-buyers impressively held the $25 support level. Do you think it’s pure coincidence that INTC consolidated at the $25 level, bolstering buying sentiments before the liftoff in March 2023? I don’t believe in coincidence in investing. I believe astute buyers accumulated quietly from October 2022 to March 2023 as INTC reached peak pessimism, as reflected in INTC’s price action.

Once INTC’s buying sentiments were lifted from its lows, momentum buyers returned, bolstering INTC’s upward recovery further, as its valuation was still attractive and its price action remained far below its all-time highs.

However, the surge over the past three months has normalized much of its hammering, just as investors and analysts have become more optimistic. Therefore, if you failed to anticipate and waited for good news to arrive first, I assessed the most attractive buy levels are over.

With INTC expected to face stiffer resistance at the current levels, the market likely needs to digest its recent surges before a more constructive and attractive buy level can be ascertained. Therefore, I move back to the sidelines from here, considering my Buy thesis has played out accordingly.

Rating: Downgraded to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, NVDA, TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!